When it comes to investing advice, you can place your trust in Warren Buffett. Hailed as one of the greatest investors of all time, Buffett knows the ins and outs of the game, and he's always been open to sharing his knowledge and expertise with others in a way that is easy to understand.

Over a decade ago, Buffett made an analogy in his letter to Berkshire Hathaway shareholders that has resonated with many people, even to this day:

"Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac’s talents didn’t extend to investing: He lost a bundle in the South Sea Bubble, explaining later, “I can calculate the movement of the stars, but not the madness of men.” If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases."

Turns out, on top of his game-changing contributions to science and physics, Newton was also a rather successful investor; that is before he was defeated by transient fluctuations in the stock market. At one point, he set aside his long-term investment plan in favor of short-term strategies with the hope that he could maximize his gains and minimize his losses in accordance with jumpy trends.

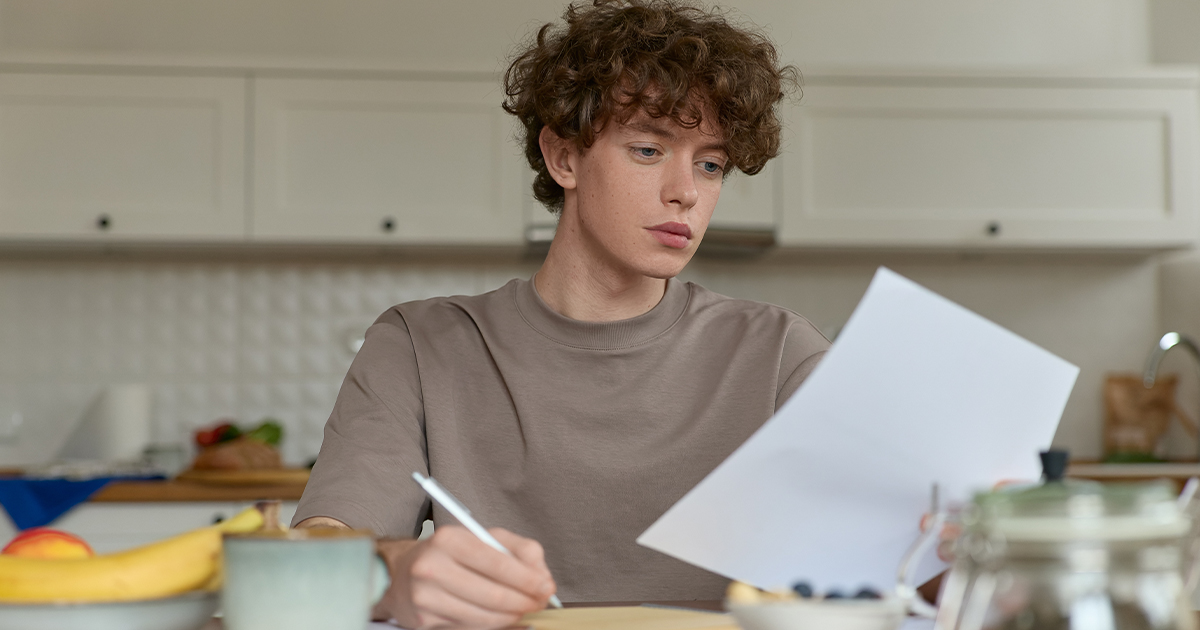

As tempting as it can be to exploit those rare opportunities, opting for Newton's approach comes with the incredibly high risk of mistiming the market and causing your long-term returns to suffer as a result.

The lesson here is summarized by Sam Ro of TKer.co: "With every trade comes not one, but two decisions. If you decide to buy, then you also have to know under what conditions you would decide to sell.

"Similarly, if you’re thinking about trimming your exposure to stocks because you think the market will go lower in the short-term, then you also have to consider under what conditions you would buy to get back to your target long-term asset allocation."

In any case, it is always best to consider all scenarios and prepare backup plans to reduce your risk and protect your long-term goals.