They say don't trust everything you read on the internet. But does that apply to financial advice? It depends on who you listen to.

Ellyce Fulmore, a kinesiologist, was jobless during the pandemic and used her spare time to build a presence on TikTok. She had some business experience from her side hustle as a life coach, as well as from her stint at a local financial aid office in Kelowna, B.C. where she assisted many low-income individuals.

Using the 60-second video format, she began giving financial advice to an audience of millennials and Gen-Z, covering topics such as debt management and budgeting. She picked a perfect time to do so because many people her age were also getting laid off at their jobs and struggling with money.

In the span of two years, Fulmore was able to generate a following of over 400,000 fans, and she also managed to get the attention of a few financial companies including Neo and Wealthsimple which have since partnered with her. She is now a part of the meteoric rise of "finfluencers," who create financial content on social media.

Of course, like with any sort of financial advice, people should take caution as there is always a chance that the information being given is not accurate, or worse—intended to deceive individuals and scam them of their money. That's why if there's anyone to place your trust in, it may be the "finfluencers" who are collaborating with actual financial institutions.

This is because regulators believe that the social media platforms themselves should not be responsible for reviewing bad financial advice that is given by its users, so if they are not backed by a financial institution, they may be spreading false information.

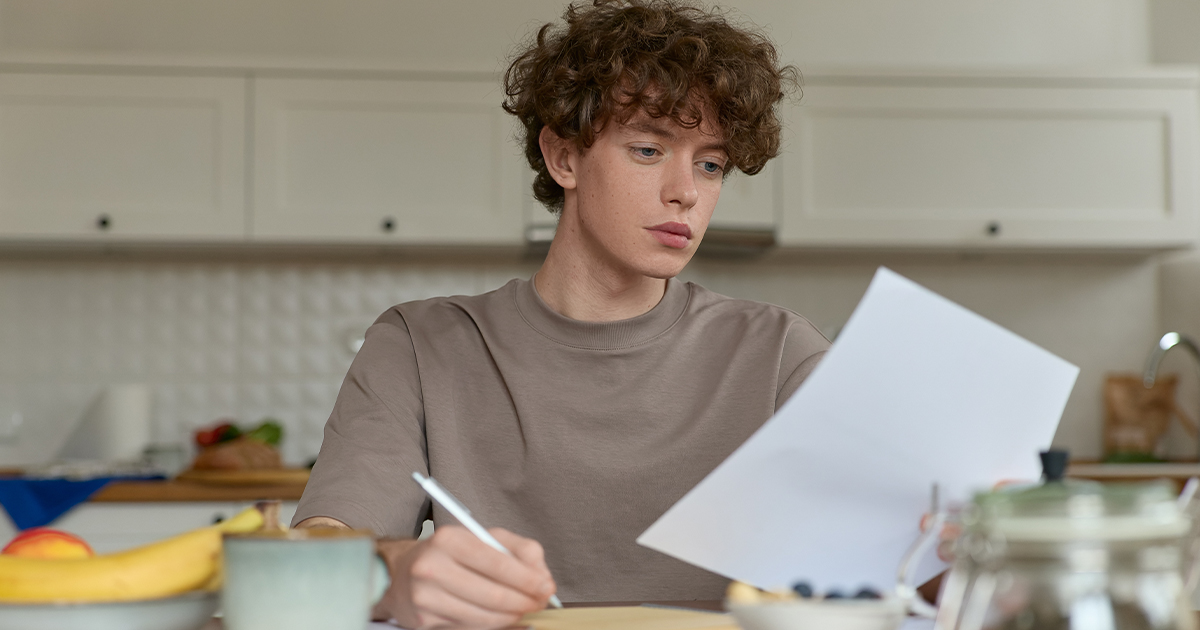

Perhaps part of the reason why financial advice is so in-demand among the younger generations is that they did not learn basic concepts in school. Unlike kids today, they had to learn about many financial-related life skills from experience. Having a resource such as TikTok, which is so easily accessible, makes it easier for young adults to get the answers they need.