We now live in the age of the 'finfluencer'. Finfluencers are internet personalities with large followings who share financial tips and career advice with everyday people. With the rise of social media platforms such as TikTok, it's easy for one's words to be received by the masses, and even easier to shroud those words in false promises. But one woman is hoping to make an honest living out of her finfluencer status, and it looks like she's well on her way to achieving that.

Tori Dunlop has amassed an impressive following of 2.8 million on TikTok by, well, talking about money. Her videos have especially caught the attention of younger Americans who are often accused of having indulgent spending habits and lazy work ethics that contribute to their financial struggles. Dunlop understands it is much more complex than that, and she aims to provide her followers with sound recommendations for improving their financial situations, based on her own experience.

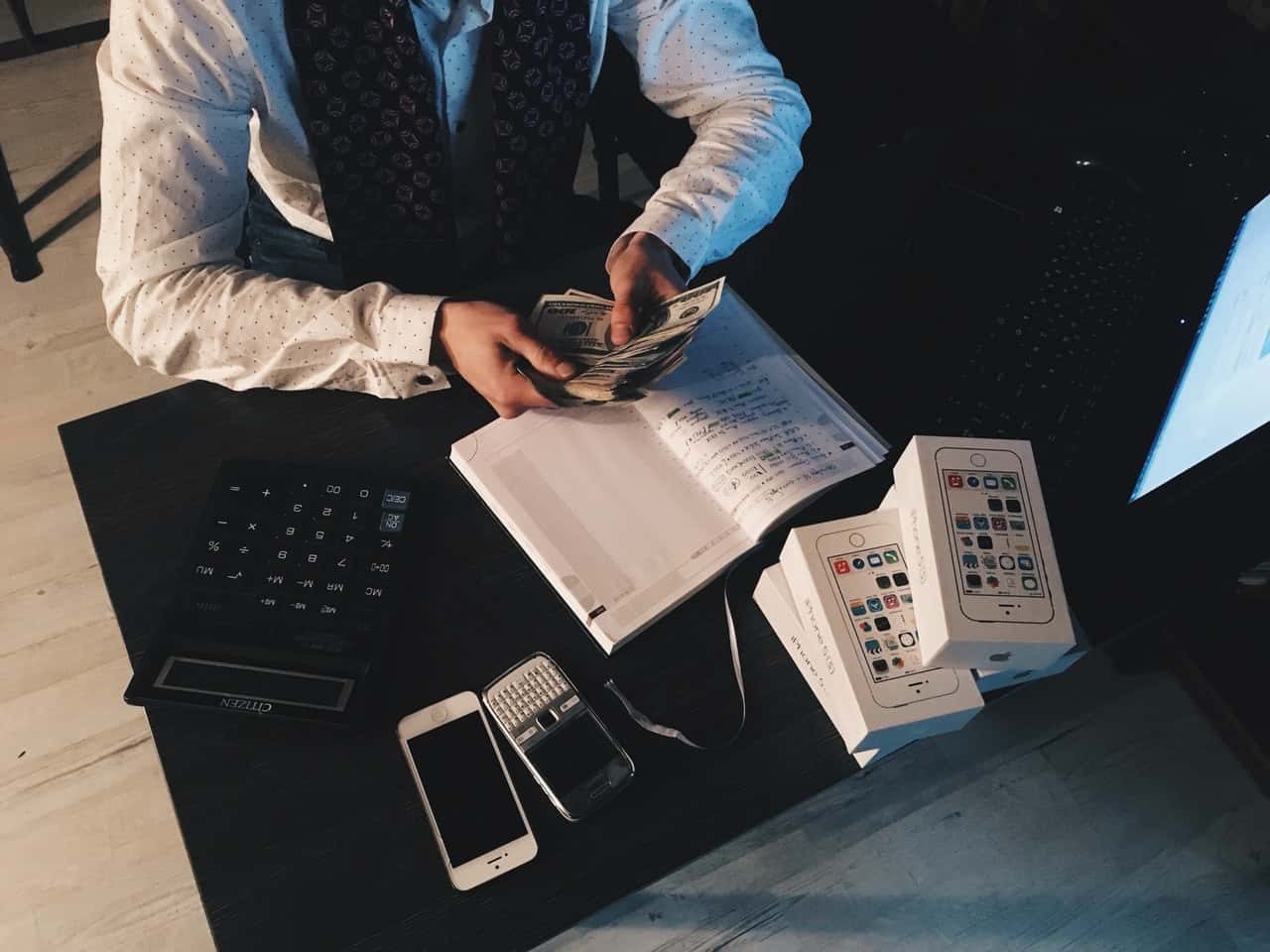

She posted her first TikTok post two years ago and has since built an entire enterprise around her channel. Corporations are paying big bucks to get access to her massive audience, with some dishing out as much as $15,000 per video. But her latest venture with an app called Treasury may be her biggest moneymaker yet.

Shutterstockm

ShutterstockmTreasury is a "nonjudgmental investing community" that provides first-time users, mainly women, with workshops and tools to help them succeed in their investment endeavors. The app hopes to help them overcome their anxiety about investing, which is often a topic that they are not so versed in.

“I was the friend every female friend came to, and I also became more committed to managing my own money. I realized I had a passion for teaching women the same thing,” Dunlap told The New York Times.

Back in 2016, while Dunlop worked for a security firm, she set herself the goal of reaching $100,000 in savings by the time she turned 25. She began documenting her journey, and readers quickly became invested. Two months before her birthday deadline, she managed to achieve her goal, and her finfluencer status began to grow from then on out.

Her story was featured on Good Morning America, and her company, Her First 100K, started to gain traction online. Her formula is simple: posts are to be entertaining, educational, and aspirational. But most important of all, every piece of advice she gives should be based on honest information, whether it be from the responsible financial habits she learned from her parents growing up or the knowledge she obtained from her previous jobs. In any case, Dunlop proves that not all self-made online experts are just about their own profits—some really do want to lend a helping hand to others.