Moving away to college this September? That's great! It's going to be a really exciting time in your life. But you should be warned—not all of it is fun and games. It will likely be your first time living on your own, which means you won't have your mom there to do your laundry or your dad to organize your cables and do all the domestic handiwork for you.

To help you overcome the new challenges you'll soon face, you should definitely learn the tried-and-true college life hacks listed below. They were "invented" by people who were once in your shoes, and because they've already been there and done that, you can take their advice on faith. Don't stress out over the little things and make your life at college a whole lot easier with these college life hacks:

Don't forget to check the comment section below the article for more interesting stories!

#1 Don't fold your clothes, roll them

When in college, you're bound to go on many trips, whether they be to your hometown for the holidays or to some foreign country on a class excursion. Most college dorms or student apartments don't give you much room to begin with, so it's hard to keep around travel luggage for when you need it. That being said, when packing for a trip, you're most likely just going to have to opt for a smaller bag, like a duffle.

In order to fit your clothes, skip the fold and roll them instead. This allows you to maximize the amount of clothing you can fit into the duffle by minimizing the amount of surface area each article of clothing will take up. Anything can be rolled—shirts, pants, underwear, even socks. Once you get into the habit of rolling your clothes, you'll never pack the same way again.

#2 Microwave two things at once

As a college student, you're going to constantly be on the move. You're going to have lectures to sit in, labs to attend, homework to finish, and all sorts of social functions to be present for. That being said, you're going to want to save as much of your time as possible. One great time-saving tip is to microwave two things at once when you're meal prepping. Who says the microwave can only heat things up one at a time?

Simply place one item in the microwave on one side, and then another item on the other side that is elevated by some microwavable platform, like an inverted mug or bowl. This way, you can get two plates of food heated up in a single go. This tip is especially helpful at the common microwaves—no need to wait for another student to finish microwaving their food first; just elevate your food and heat it up with theirs.

#3 One dryer sheet, endless possibilities

If there's anything you should always have handy, it's a dryer sheet. You can use them for all sorts of freshening purposes. Got a smelly gym bag? Use a dryer sheet. Got smelly shoes? Use a dryer sheet. Does your closet seem funky? Line your clothes piles with dryer sheets. The possibilities are pretty much endless with dryer sheets!

They can even be used as air fresheners. If you have a fan or some sort of air vent system, you can place a dryer sheet or two over the vents so that the air will distribute the scent throughout your room. No need to buy $25 candles at Bath and Body Works (which probably wouldn't be allowed in your dorm in the first place)—just buy a box of dryer sheets for $5 and you're set.

#4 The food trail reward system

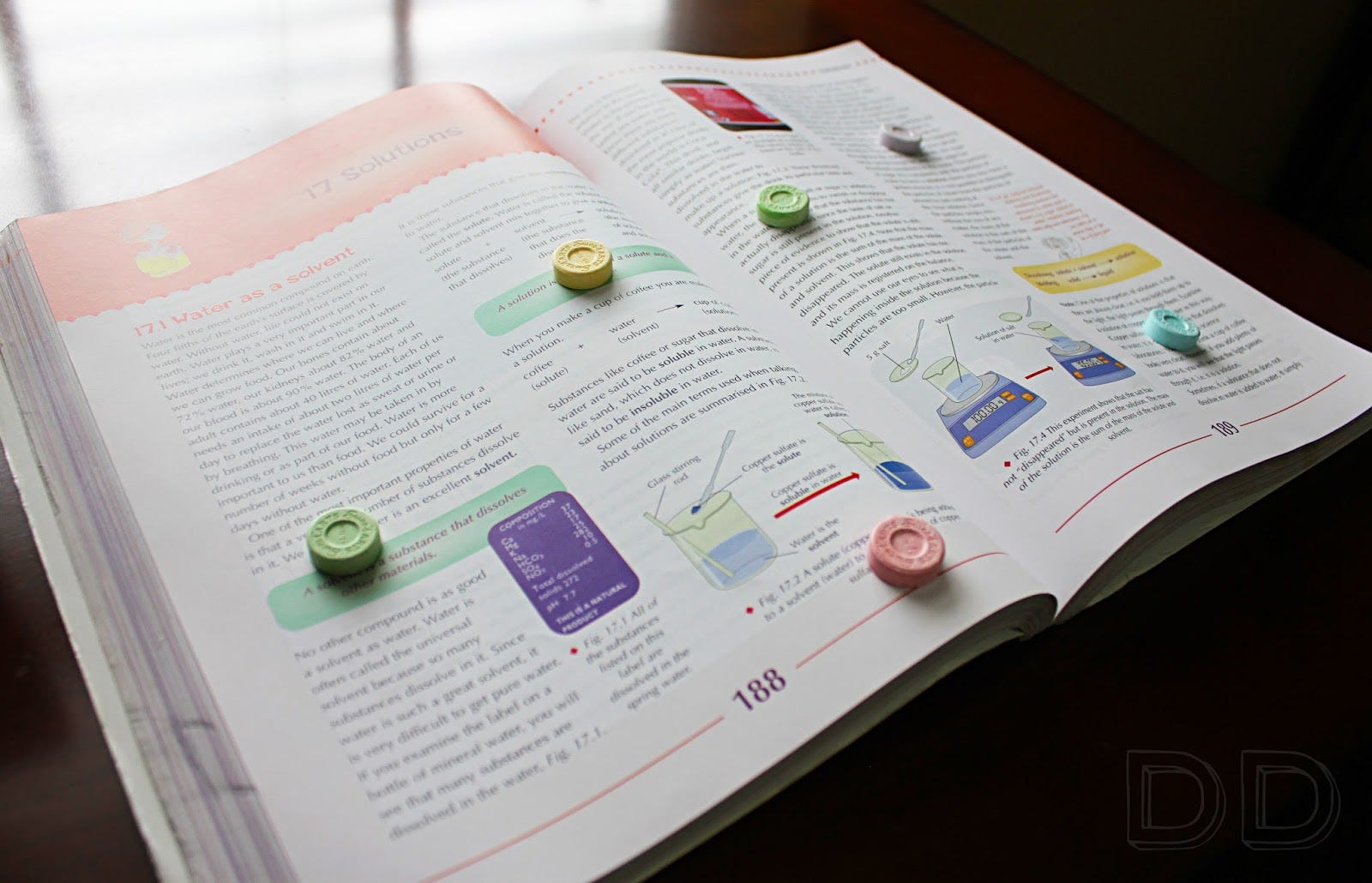

Studying for long periods of time can be draining. It's hard to keep going when there's nothing to motivate you... so why not add the motivation yourself? If you're studying from a textbook, set up a "food trail" on the page you're on. Take some treats like gummy bears or chocolates and distribute them throughout the text after a few paragraphs each.

Every time you get to the end of a block of text, you will be rewarded with a gummy bear or chocolate to eat. You know when you're finished studying once you've managed to finish all of the treats in your food trail! Just remember to take your time—really try to understand the material before eating the treats.

#5 Help your alarms help you

Do you find yourself sleeping through your alarms often? Well, that needs to change before you get to college. You don't want to be late for an important lecture, or even worse, a final exam. There are a couple of things you can do to increase the effectiveness of your alarms. One is to place them far away from your bed, ideally to a spot where you'd have to get up in order to turn it off.

Another thing you could do is amplify the alarm sound. If you're using your cellphone as an alarm (which you should always do, on top of your alarm clock), you can place it inside the glass or cone. When it rings, it will be much louder and you'll definitely have an easier time hearing it. Help your alarms help you!