The early stages of your children's lives are the most critical for physical and mental development. With so many potentially harmful contagions in circulation, it can be scary to let your kids... well, be kids. The best thing you can do as a parent is to inform yourself of these dangers and make the necessary preparations for the worst-case scenario. Here are five common childhood illnesses you should watch out for:

#1 Respiratory syncytial virus

Respiratory syncytial virus, or RSV, is an infection of the lungs and airways. Typically, the virus doesn't cause serious illness; however, if your child is two years old or younger, or if he or she was born with a pre-existing condition that affects the heart, lungs, or immune system, there may be greater risks involved with contracting this virus. Some symptoms include runny nose, nasal congestion, cough, irritability, breathing problems, and, in severe cases, lung inflammation, and pneumonia. Ask your doctor for a drug called palivizumab (Synagis) if your child has been infected with RSV.

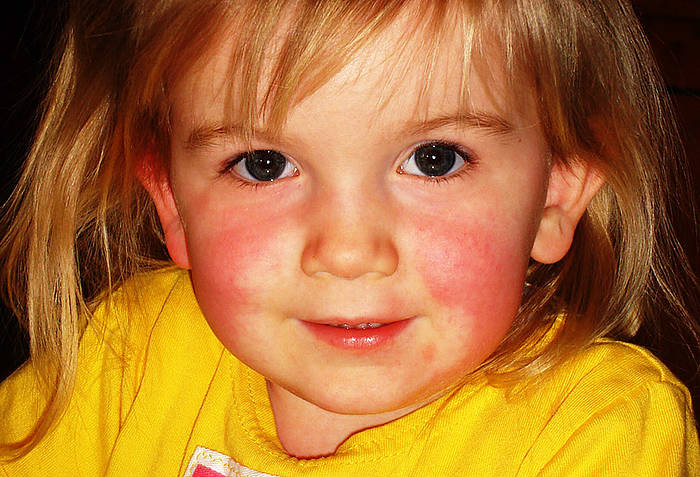

#2 Scarlet fever

Scarlet fever is a bacterial infection that is caused by group A streptococcus. Once upon a time, this illness was a death sentence, but thanks to modern antibiotics, it can be easily treated and cured. Some symptoms of scarlet fever include sore throat, a red-colored rash on the neck and face that may spread to the body, and general malaise. If your child has any of these symptoms, bring him or her to the doctor immediately to get a diagnosis. If the strep test is positive, a round of antibiotics may be prescribed.

#3 Impetigo

Impetigo is a common skin infection in younger children. It is caused by either staphylococcal bacteria or streptococcal bacteria that manage to invade an open wound, cut, scratch, or bite. The effect of impetigo can be widespread, but most of the time it manifests around the mouth, nose, and hands. Common symptoms include painful, bursting blisters as well as diaper rash. Typically, doctors will prescribe a topical or oral antibiotic to treat the issue.

#4 Whooping cough

Whooping cough affects individuals of all ages, however, infants can get seriously ill from it. It is a general bacterial infection that targets the lungs and breathing tubes and causes cold-like symptoms, including runny nose and a gradually worsening cough that has a "whooping" sound. Whooping cough is typically treated with antibiotics when caught early, but babies may need to be hospitalized for a period of time. Vaccines for whooping cough exist and should be administered at two months old for maximum effectiveness.

#5 Croup

Croup is another illness of the respiratory system. It is a viral infection that typically affects the windpipe and voice box. It starts as a sort of "barky" cough that eventually gets worse as the day goes on. Cold-like symptoms such as runny nose and fever are also common. A good treatment for croup is a 10-minute hot shower to open and clear the airways. Using a cool-mist humidifier could also help alleviate symptoms. For severe cases involving difficulty breathing or lack of appetite, seek emergency services immediately. They will likely administer a steroid to help with the inflammation.