Living a Frugal Lifestyle

Being frugal means to live below your means and prioritize things that make you happy instead of things that are trendy.

The best way to learn how to be frugal is to ask those who already are. Here are 36 things frugal people say they never do.

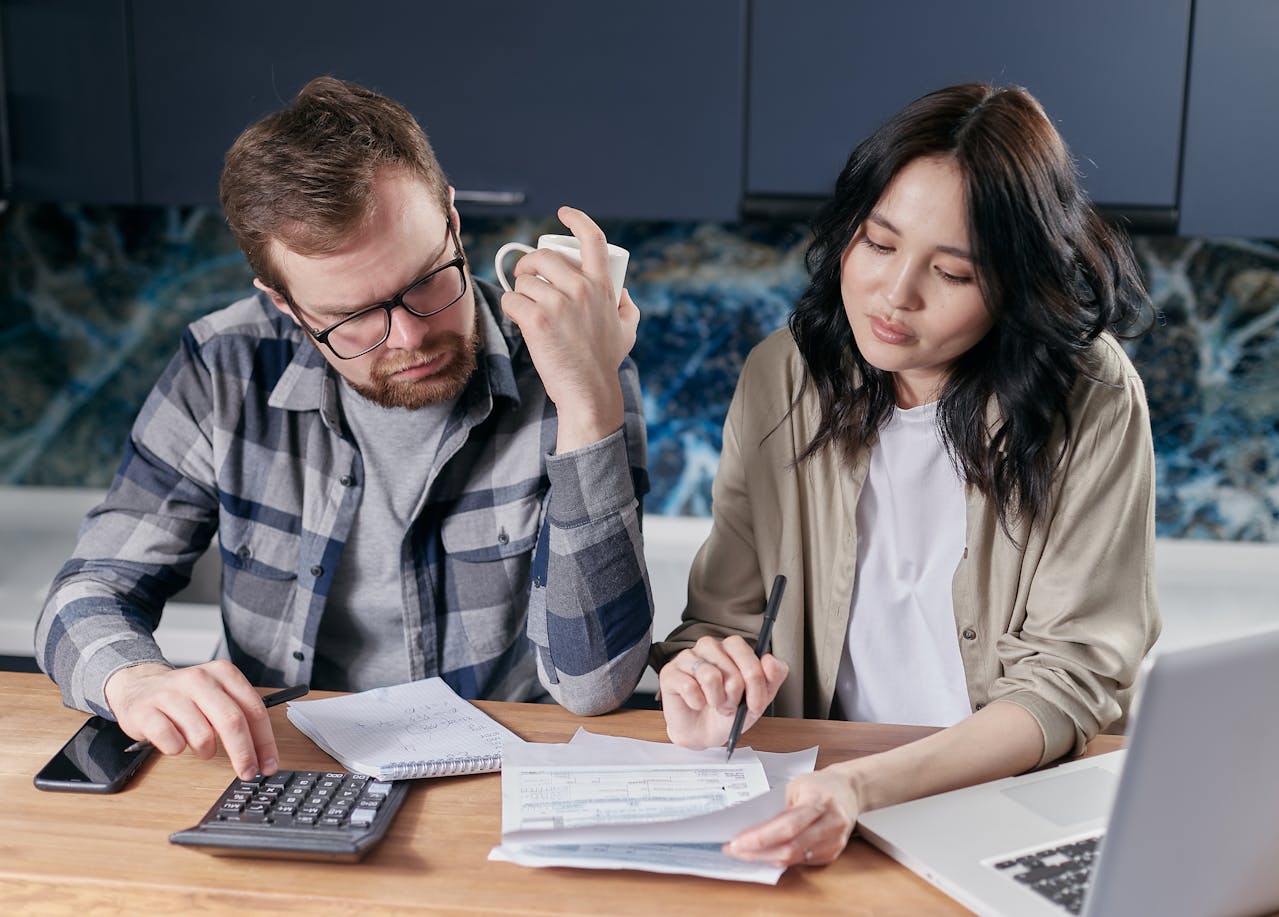

Skip Budgeting

Frugal people tend to have a plan for everything—including, and specifically, their spending. They have a plan for they money and understand exactly what they want their money to do for them.

Dine Out More Than Once Per Week

Although dining out is fun and convenient, frugal people know that they can have the same experience at home–for less.

Meal planning is a great way to plan ahead (for convenience) and also to ensure you’re eating what you enjoy.

Ignore Their Credit Score

Frugal people understand how important their credit score is in relation to interest rates and acquiring credit when needed.

They use free services to monitor their score and gain insights to their spending.

Pay Full Price

Frugal people truly understand the value of every dollar, and they aren’t willing to pay more than they feel they should.

Shopping sales and discounts is an easy way to save a few bucks.

Spend Time Doing Nothing

Frugal people usually stay busy—usually finding ways to save or make money. They avoid mindlessly shopping online when they’re bored, and prefer to seek out upcoming deals or discounts.

Drive Everywhere

Frugal people certainly don’t drive everywhere, especially when walking, biking, or public transit is an option.

Driving can have huge costs just for gas alone, and then you can include maintenance and parking fees on top of that.

Pay Full Price for Cosmetics

Cosmetics are expensive—especially in America. Frugal people save on make-up by using discount websites, or making their own.

DIY haircuts and manicures are also a popular activity with frugal people.

Throw Away Anything That Isn’t Trash

Frugal people prefer to recycle and reuse. When donating old clothing, they take a moment to reflect on their purchasing habits so they don’t make the same mistake twice.

They also avoid over-shopping so they don’t have to toss things later.

Get Annoyed When Prices Drop

People who are extremely frugal will always find the best ways to save money and get the most bang for their buck.

When prices drop on items they’ve already bought, you can be sure they will return to the store with their receipt looking for the difference.

Pay Attention to Brand Names

Frugal people are not exactly brand loyal. They find quality items that are affordable, whether or not they have a brand name label attached.

Be Scared to Invest

Frugal people are not afraid to invest because they know it is financially beneficial to their future. They already know that their money can work for them, if they allow it.

Keep Cable

Most frugal families have already cut the costly cable packages from their budget. With the invention of various subscription services, frugal people know they can watch things more tailored to their interests—and for a fraction of the price.

Shop At The Last Minute

As previously mentioned, frugal people have a plan for their money. They know what they need, and where to buy it at the best price.

Last minute shopping and impulse buying are not options for them.

Spoil Their Children

Frugal people understand the value of every dollar, and they make sure they instill the same values in their children.

They only buy their children what is needed, and teach them how to earn the things they want.

Buy Bottled Water

Frugal people definitely don’t spend money on plastic water bottles when they know that spending the extra few bucks initially on a reusable water bottle with not only save them money in the long run—but it will also benefit the environment.

Ignore Small Health Issues

Frugal people know that ignoring small health issues will only make them bigger with time, which will end up costing them more money in the end.

Upgrade Their Phone Each Year

If it’s not broke, don’t replace it. Frugal people follow this rule in many areas of life—but especially when it comes to electronics.

Cell phone companies make a lot of their money on upgrades. They may add one or two features, and charge another few hundred bucks. Upgrading often is an unnecessary expense.

Cast Of Thousands, Shutterstock

Cast Of Thousands, Shutterstock

Delay Repairs

Much like our health, delaying repairs on your home or vehicle will only make matters worse—aka more costly.

You also run the risk of missing warranty deadlines.

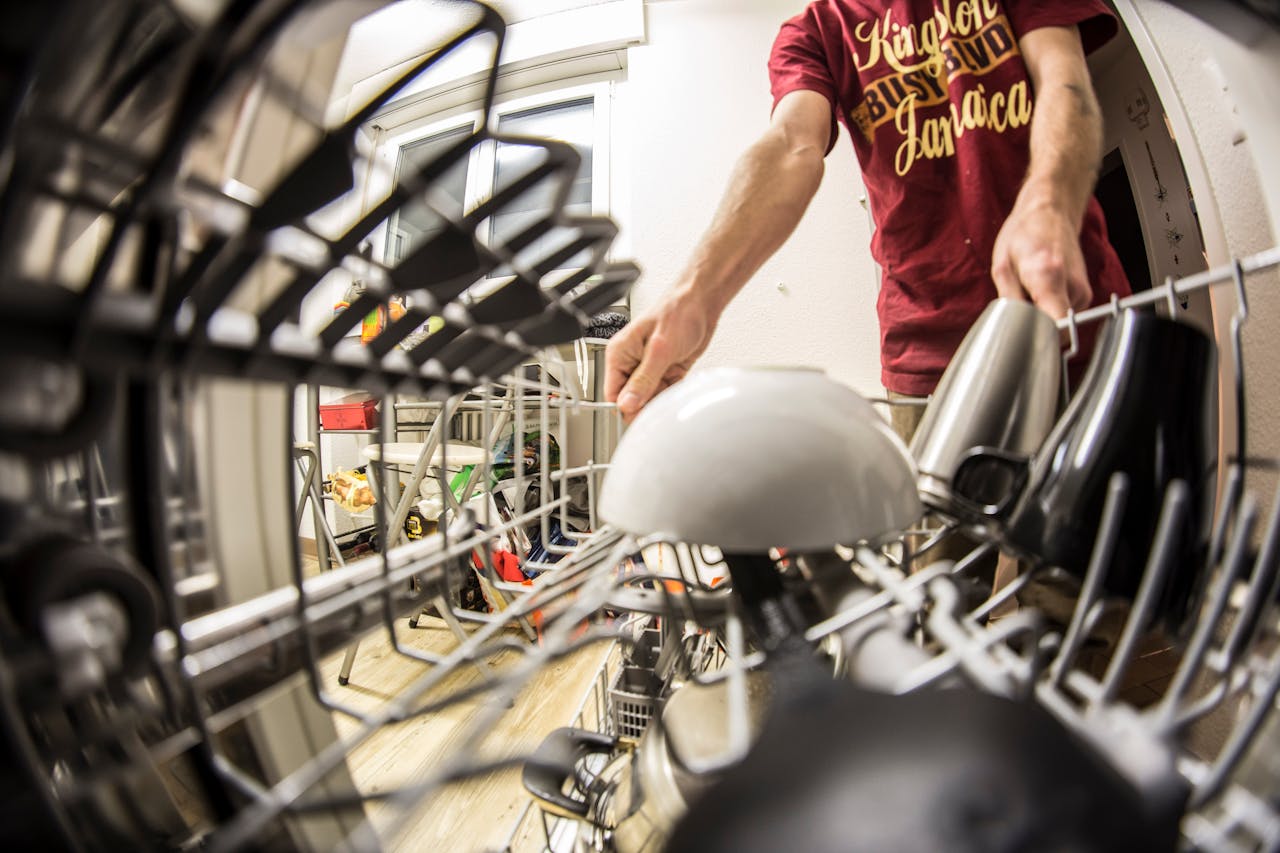

Start a 1/2 Full Dishwasher

Frugal people know that starting a 1/2 full dishwasher is just a waste of energy, and water. You should try your best to make sure that your dishwasher is full no matter what.

Buy Something Just Because It’s On Sale

Frugal people love sales—but not when the item is not needed. They know that just because the price is enticing does not mean that they should buy the item.

Save your money for what you need, not what is convenient to buy.

Borrow Money

Frugal people avoid debt at all costs—especially credit cards. Debt can get out of hand real quick, and unpaid debt can be impossible to pay off.

Frugal people pay with the money they have, avoiding incurring unnecessary debt.

Spend Emotionally

A lot of people find themselves buying something special when they’re feeling down, hoping it will make them feel better.

But frugal people know that the storm will pass and that purchase may later be regretted.

Have Empty Freezers

Frugal people avoid empty freezers for two reasons: keeping a freezer at freezing temperatures when nothing is in it is a huge energy waster, and also because stocking up on food sales and freezing the food for later is a great way to save money.

Window Shop

Window shopping means browsing without buying. Frugal people don’t waste their time doing this. As previously mentioned now many times, frugal people shop with a purpose.

This avoids impulse buying.

Buy Too Much House

Frugal people only buy a house that is comfortable enough to fit their needs. Buying a too-big home will only add to your expenses as utility costs, property taxes, and mortgages will be significantly higher.

Spend Money Every Day

People who are truly frugal are really big fans of no-spend days. They focus more on spending time than money.

Leaving your wallet at home when you go out may help curb the desire to spend money every day.

Buy Expensive Coffee Daily

Frugal people are also huge fans of home brewed coffee.

Buying expensive coffee (like Starbucks) every day adds up super quickly, and really isn’t the best way for anyone to spend their money.

Throw Away Left Overs

Made too much dinner? Don’t toss it—package it up for tomorrow. Frugal people are great at finding creative ways to reinvent leftovers, saving them a ton of money on groceries.

Pay Someone When They Could DIY

Frugal people definitely don’t pay someone for a service they can easily do themselves.

Now-a-days, social media platforms (like YouTube) offer step-by-step instructions for almost any task, from automotive and household, to tech and even schooling.

Pay Bank Fees

Frugal people shop around for the best place to save their money that won’t accumulate unnecessary fees each month.

Pay Late Fees

Frugal people avoid any fees, really. But late fees are definitely something they avoid. Because frugal people are always focused on their finances, they don’t often miss payments—especially if it’ll cost them more in the long run.

Buy Convenience Foods

Frugal people skip the convenience stores and head straight to the bulk food stores. Instead of paying $10 for a small tin of nuts, get a whole bag full from the bulk food store for a fraction of the price.

Use a Tupperware container and they’ll even stay fresh for longer.

Ignore Clearance Racks

When frugal people need something, they go the store and typically head straight for the clearance racks first—always checking for a deal before paying full price.

Skip Free Events

Frugal people prioritize free events over paid ones. Why pay full price at the theater when your town is offering movie-in-the-park for free?

There are tons of free concerts, festivals, walks and so much more.

Buy Big Ticket Items Without Comparing

Frugal people will never buy a big-ticket item (like an appliance) without shopping around first to compare prices.

Not only do these items range in price based on brand and model, but you’ll also find varying warranties and delivery fees. Always compare big ticket items before buying.

Try To Live Someone Else’s Life

The key to being able to save money is to not focus on everybody else. You don’t know what other people’s true financial situation is.

Frugal people know to stay in their own lane and focus on their own happiness—being thankful for what they have.