A slow economic squeeze

The standard American dream is undergoing a silent, radical transformation, and before markets react, household finances often reveal economic trouble. Somehow, everyday decisions now carry more weight, and small missteps feel riskier than before.

Why Do So Many Families Feel Stretched?

Many households report feeling financially squeezed because routine expenses now absorb a larger share of income. Housing, food, insurance, and utilities compete with savings and leisure. Even stable earners notice less flexibility, which creates persistent anxiety that daily finances are becoming harder to control over time.

Everyday Costs Stop Feeling Predictable

When prices fluctuate week to week, families struggle to plan. Groceries and utilities no longer follow familiar patterns, forcing constant adjustments. Budgeting becomes reactive rather than strategic, which leaves people unsure whether next month will demand sacrifice or unexpected borrowing.

Prices That Rose Quickly And Never Came Back Down

Inflation slowed, but many prices stayed elevated. Businesses rarely reverse increases tied to supply or energy costs. Families experience this as a permanent loss of purchasing power, especially for essentials, where cutting back is difficult without lowering the quality of life for millions nationwide today.

And Paychecks That Quietly Fell Behind Real Expenses

Over the years, pay increases failed to match rising living costs. Although wages grew nominally, inflation-adjusted income often stagnated. This gradual mismatch went unnoticed until households realized that raises no longer improved comfort, only prevented further erosion of their financial footing.

The Narrowing Gap Between Stability And Struggle

As expenses climb and income lags, stability becomes fragile. Small disruptions like car repairs or medical bills carry outsized consequences. Families now sense they are one setback away from trouble, changing how they spend and emotionally approach everyday decisions in modern American life.

Savings No Longer Feel Like A Safety Net

For many families, savings were depleted during periods of high inflation and economic disruption. What remains often earns little interest compared to rising costs. As balances shrink, savings feel less like protection and more like a temporary buffer that disappears faster than expected.

Credit Cards Have Become Tools For Survival

Credit cards are increasingly used for groceries, gas, and utility bills rather than emergencies. High interest rates mean balances linger and grow. This turns short-term relief into long-term strain, locking families into monthly payments that reduce future financial flexibility.

The Compounding Weight Of High-Interest Debt

Rising interest rates magnify the cost of carrying debt. Minimum payments increase while progress slows. Over time, interest consumes income that could have supported savings or necessities, and this creates a cycle where families work harder simply to stay in the same place financially.

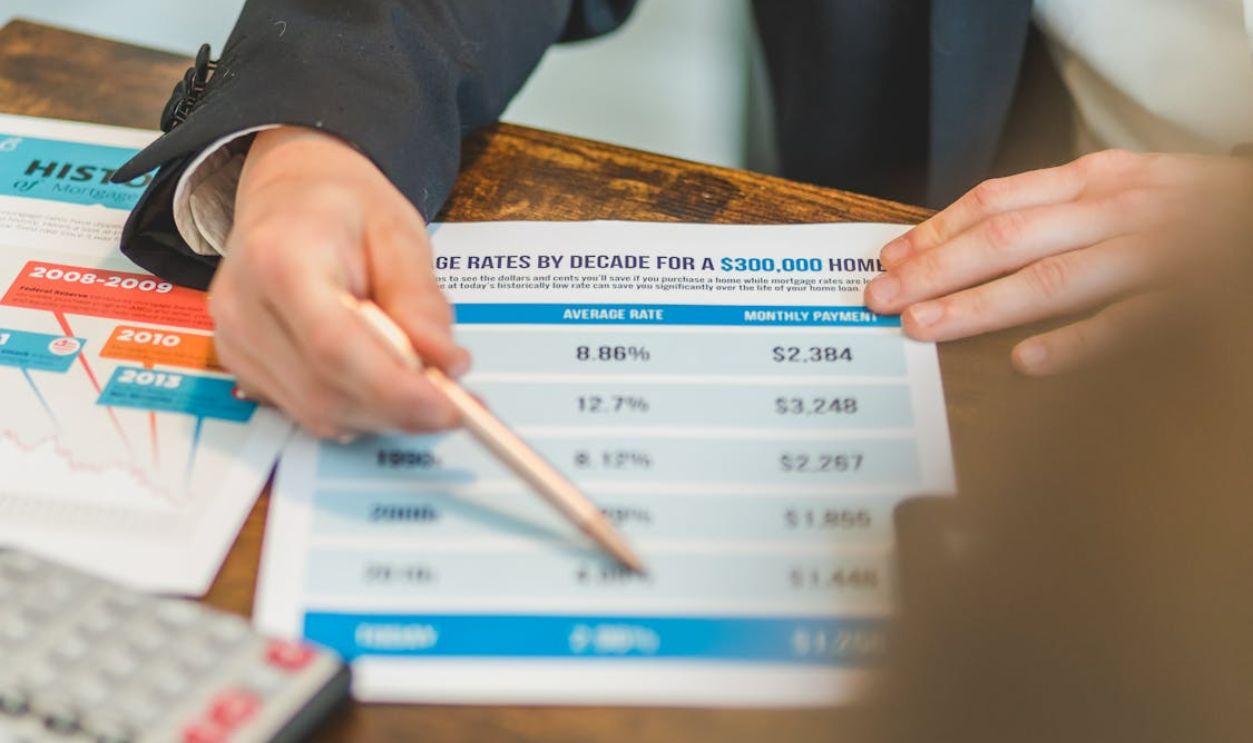

Housing Costs That Consume More Than Income

Housing now takes a historically large share of household budgets. Rent increases, higher mortgage rates, property taxes, and insurance all contribute. When shelter dominates spending, families are forced to cut elsewhere, reducing overall financial resilience and long-term planning options.

Renting Feels Unstable, And Owning Feels Out Of Reach

Renters face frequent increases and limited security, while prospective buyers confront high prices and borrowing costs. This dual pressure leaves many feeling stuck, unable to settle or build equity. The result is delayed stability and growing frustration across age groups and income levels.

Strong Job Numbers With Weak Job Security

Headline employment figures often mask instability beneath the surface. Many positions offer limited benefits or short-term contracts. Even full-time workers are worried about layoffs or restructuring. As a result, families remain cautious despite seemingly positive labor market statistics nationwide.

ANTONI SHKRABA production, Pexels

ANTONI SHKRABA production, Pexels

The Rise Of Side Hustles And Chronic Exhaustion

More Americans take on extra work to offset higher costs. Side income helps, but it reduces rest and family time. Constant hustle leads to burnout, making financial survival feel like a marathon without recovery, mainly for working parents and younger households.

The Emotional Toll Of Living Without A Financial Cushion

When there is little margin for error, stress becomes constant. Financial worry affects sleep, relationships, and health. Over time, this pressure shapes behavior, encouraging risk avoidance and limiting optimism about the future.

How Financial Pressure Is Reshaping Family Choices

Economic strain influences decisions about marriage, children, education, and relocation. Families delay commitments or choose less costly paths. These adjustments reflect caution rather than preference, and show how finances quietly steer life choices across generations in today’s economy.

Middle-Income Households Feel The Greatest Squeeze

Middle-income families often earn too much for assistance but lack significant assets. They face full exposure to rising prices, taxes, and interest rates. Without meaningful buffers, even modest disruptions strain budgets that already feel tightly balanced month to month.

Vodafone x Rankin everyone.connected, Pexels

Vodafone x Rankin everyone.connected, Pexels

Cautious Consumers Begin To Pull Back

As uncertainty grows, families reduce discretionary spending. Dining out, travel, and major purchases are delayed. This shift reflects self-preservation rather than pessimism, but when repeated across millions of households, it quietly slows economic activity and business confidence nationwide.

Subtle Spending Shifts That Signal Bigger Trouble

Early warning signs appear in small choices, like switching brands or postponing repairs. These adjustments reveal stress before crises emerge. When such behavior becomes widespread, it often signals deeper financial pressure building beneath the surface.

How Minor Setbacks Become Full Financial Emergencies

With limited savings and high debt, routine setbacks escalate quickly. A medical bill or car repair can trigger borrowing or missed payments. Families experience these moments as crises, even though the underlying expenses are common and unavoidable.

Rising Delinquencies And What They Reveal Beneath The Surface

Increases in late payments often reflect strain rather than irresponsibility. As costs rise faster than income, more households fall behind despite steady work. These patterns suggest financial systems absorbing stress that families can no longer manage alone.

Economic Crises Often Begin At Home

Economic downturns usually take shape in household budgets before markets react. When families cut spending, miss payments, or delay decisions, broader demand weakens. These personal adjustments accumulate quietly, turning individual stress into an economy-wide slowdown without dramatic warning signs.

The Feedback Loop That Turns Strain Into Systemic Risk

Household strain reduces spending, which pressures businesses to cut costs or jobs. That, in turn, weakens incomes further. This feedback loop can accelerate quickly by changing manageable stress into widespread instability once confidence and cash flow erode simultaneously.

Lessons From Past Downturns That Still Apply Today

Previous recessions show that prolonged household stress often precedes sharper declines. Rising debt and cautious consumers were present before earlier crises. These patterns matter because they highlight vulnerability building long before official indicators confirm trouble.

Timing Matters More Than Forecasts

Predicting exact moments of crisis is difficult, but pressure accumulates gradually. What matters is how long families can absorb strain. Once buffers disappear, even minor shocks can trigger rapid change, making timing dependent on resilience rather than headlines.

What The Coming Months May Mean For Families

If costs stay high and incomes lag, families may continue cutting back and delaying plans. Stability will depend on job security and inflation trends. The period ahead may test adaptability more than optimism for many American households.