Your Crypto Got Hacked: Now What?

Crypto wallets aren't the most secure assets at the best of times, but losing $14,000 to hackers is a true gut punch. Especially if you sunk all the money you had into your crypto wallet, let's explore your options to get your money back, or at least limit the damage.

First: Secure What’s Left

If there's anything left in your crypto wallet, it's time to lock it down. Withdraw the funds immediately to prevent them from being compromised. Look into a new way to store your funds that's more secure, like a real bank.

Identify How You Were Hacked

Where did the hack come from? Was it a hack from your own personal computer, or did you use a public WiFi connection and that's how your passwords were compromised? Regardless, immediately change your passwords on everything associated with your crypto accounts and wallets.

Report The Hack Immediately

Reach out to your wallet provider, crypto exchange, or custodial service to report the breach. They may offer support for investigation, or in rare cases, help freeze suspicious transfers. Act fast—crypto transactions are irreversible, and any delay gives attackers more time to obscure their tracks through mixers or swaps.

File A Police Report

Document the incident with your local law enforcement agency. Provide transaction IDs, screenshots, and all related communication. A police report not only starts a formal investigation but is also often required for insurance claims, cybercrime reporting, or tax purposes when claiming the loss on your returns.

Contact A Cybercrime Unit

You'll need to make a formal police report of the hack to a cybercrime division of your local police force. You can register the complaint online or in-person, this will help the authorities to track down your money much more quickly and (hopefully) return it to you.

Consider Blockchain Tracing Services

Hire a professional blockchain tracing service to track stolen funds across wallets and exchanges. Companies like Chainalysis, CipherBlade, and TRM Labs use forensic tools to follow crypto trails. If stolen funds reach an exchange with KYC policies, authorities might be able to identify and apprehend the perpetrator.

Check With The Exchange

If the stolen crypto moved through or originated from a centralized exchange, notify them immediately. Provide all transaction details, including wallet addresses and time stamps. Exchanges may freeze the attacker’s wallet or help recover funds if the assets remain in custody. Cooperation is time-sensitive and not guaranteed.

Evaluate If Insurance Applies

Although rare, some exchanges and high-end wallet providers include insurance coverage for hacking incidents. Review any applicable policies, including coverage offered through premium crypto credit cards, custodial services, or your own business and personal insurance. Some riders on homeowners’ or cyber policies may include theft of digital assets.

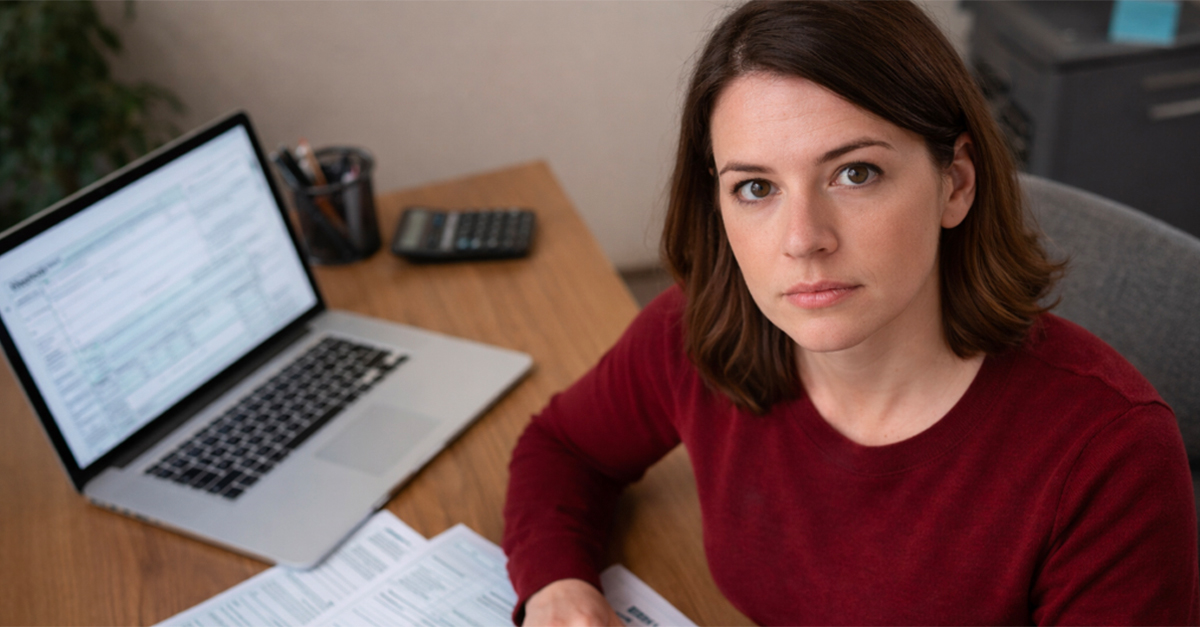

Alert Your Tax Professional

Contact a CPA or tax professional experienced in digital assets. Crypto tax rules are complex and changing. Your loss might qualify for a write-off depending on how the assets were used and how the theft occurred. Proper classification—whether as investment loss or theft—is crucial for tax treatment.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Understand IRS Deduction Rules

Since the Tax Cuts and Jobs Act of 2017, personal theft losses are only deductible in federally declared disaster zones. However, if your crypto was held as an investment or business asset, it may qualify for a capital loss deduction. Knowing the difference is essential for proper tax reporting.

Was This A Capital Asset?

If the stolen crypto was part of your investment portfolio—not used for daily purchases—you may classify it as a capital asset. This allows you to potentially offset gains or reduce taxable income. Holding period, cost basis, and loss documentation all influence how the IRS will treat the claim.

Capital Loss Vs. Theft Loss

Capital losses are easier to deduct and apply to offsetting capital gains or reducing taxable income by up to $3,000 annually. Theft losses require proving criminal intent and may be subject to stricter limitations. Understanding which classification fits your situation determines how much you can recover via taxes.

Gather Documentation

Maintain a thorough paper trail: wallet addresses, screenshots of balances, transaction hashes, blockchain explorer links, and police or cybercrime reports. You’ll need all of this for tax filings, insurance claims, or legal pursuits. The better your records, the more likely professionals can help recover or deduct the loss.

Consider Amending Past Returns

If the loss occurred in a prior tax year and wasn’t claimed, you may be eligible to file an amended return. The IRS typically allows amendments within three years. Work with a tax expert to evaluate the benefit of amending and ensure documentation supports any retroactive claim or deduction.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Be Cautious With Recovery Services

Unfortunately, the crypto recovery industry is filled with scams preying on victims. Avoid services that ask for upfront fees, guarantee results, or use pressure tactics. Only work with firms that are publicly verifiable, have good reviews, and use real investigators—not “black-hat” hackers promising miracle solutions.

Legal Action May Be an Option

If a person or company is directly responsible—such as a rogue employee, known scammer, or negligent platform—you may be able to pursue a civil or class-action lawsuit. Consult a lawyer who specializes in cryptocurrency or fintech. Legal recourse is complex but potentially valuable, especially in high-value losses.

Prepare For Emotional Fallout

Beyond financial loss, crypto hacks are deeply personal. The feeling of violation, stress, and helplessness can be overwhelming. Don’t ignore mental health. Speak with professionals, join support forums, and remind yourself that cyber theft victims are growing in number. You’re not alone—and your experience can educate others.

Learn & Harden Future Security

Use this painful lesson to transform your security practices. Invest in a hardware wallet, never store seed phrases online, and enable two-factor authentication everywhere. Avoid downloading unknown apps and use cold storage for long-term holdings. Regularly review your security hygiene and update it as threats evolve.

Don't Fall Victim To The Next Crypto Scam

Thousands fall victim to crypto theft each year, and while recovery is rare, you're not helpless. With proper steps, you may reclaim some losses via tax law, law enforcement, or improved cybersecurity. Turn this incident into a learning experience that protects your future crypto endeavors and possibly helps others.

You May Also Like:

Self-Directed Or Managed Investment Portfolios: Which Is Right For You?

Common Crypto Investing Mistakes To Avoid

Crypto Crash Course: Here Are The 12 Biggest Crypto Currencies