Teaching Your Kids About Money Early Will Save Them Later In Life

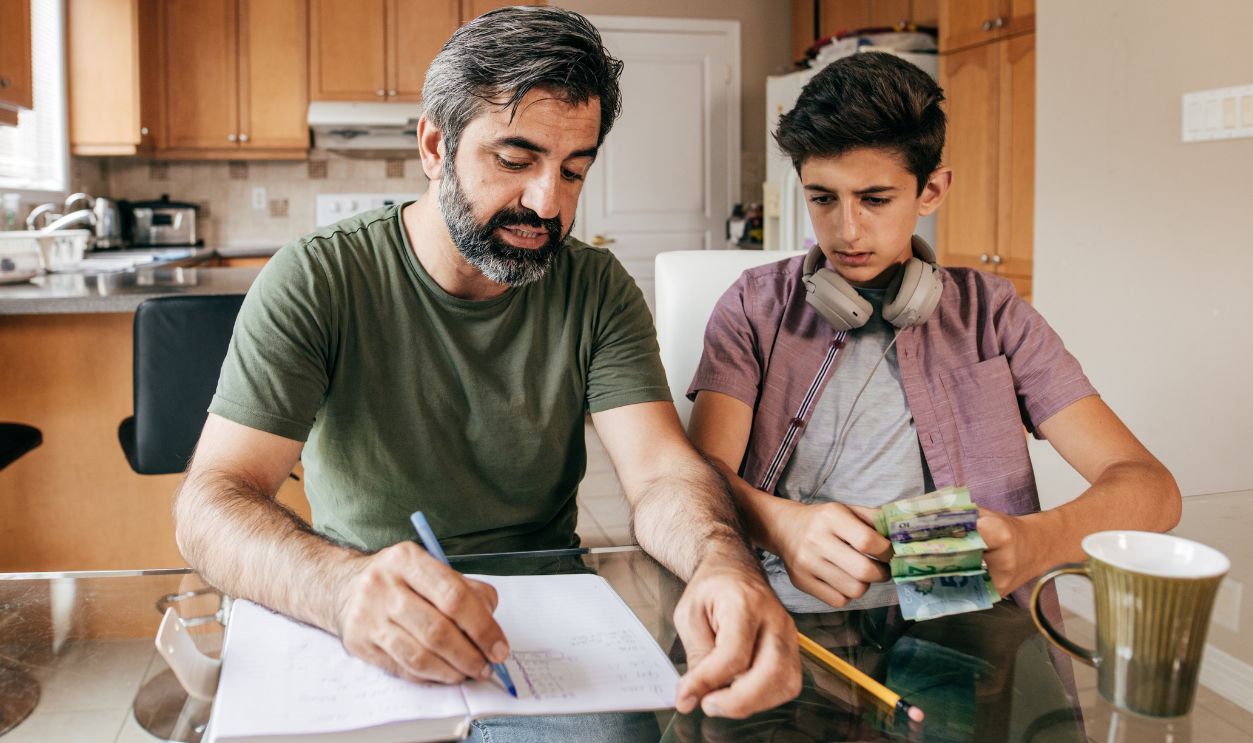

Far too many people learn financial lessons later in life. Although they can still apply these lessons, one common theme is that people wish their parents had introduced them to these financial lessons sooner rather than later. Here are some of the most valuable lessons you can teach your kids about money.

Starting A Budget As Soon As They Get Their First Steady Job

Many adults struggle with the concept of budgeting, but if kids can learn this early in life—as soon as they get their first steady job—then they'll be much better set up to deal with bigger budgets and larger numbers.

Help Them Build A Traditional Budget

Do this on paper first with the basics of economics: outgoing and incoming monies. Even if their first steady job only nets them a small amount every month, understanding how to spread that amount out over the next seven days or two weeks until they're paid again will help them keep better track of their finances later in life.

Give Them Tools To Track Their Spending

If we're talking teenagers, then they likely already have a smartphone. If so, there are many budgeting apps they can use. Or, if your kids are too young to have a smartphone, have them write out each purchase they make, what it was, the date of purchase, and how much it cost on a sheet of paper.

Tracking Their Spending Will Teach Them The Basics Of Not Spending More Than They Have

By tracking their spending, your kids will learn the basics of cash flow and how important it is to keep track of their spending so they don't spend more than they have—and then run out of money. Although, if they do end up running out of money, that could lead to a good lesson on debt...

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Help Them Understand Compound Interest

Compound interest is one of the most important financial forces they'll ever learn about—the younger they learn about and start to utilize compound interest, the better. Albert Einstein once said, "Compound interest is the eighth wonder of the world".

Why Is Compound Interest So Powerful?

In simple terms, compound interest is the interest that you earn on interest you've already earned. If you invested $100 at a 5% interest rate, at the end of the first year of investment, you'll have earned $105, but in the second year, you'll have $110.25, because you earned $0.25 on the $5 in interest you earned. If your teenager understands this, you can show them compound interest calculators to help them grasp how much money they'll have by the time they're 25, 30, or even at retirement age.

Take Them To Open A Bank Account As Soon As They're Old Enough

Most banks will allow those 18 and over to open an account. It's a great idea to take your children to open their own bank account as soon as they're old enough. This will give them a sense of responsibility that their money is theirs to manage, as well as giving them independence from your finances as their parent.

Should They Open Multiple Accounts?

This depends on how confident they are about their ability to manage their money and how much they know about the different types of accounts. It's definitely easier to have just a single checking account that acts as both savings and everyday banking, but if they're serious about saving money for a big purchase, then opening up a savings account will do them the world of good.

Teach Them About Investing

Investing money doesn't have to be as complicated as many financial experts have made it seem. For kids and young adults, it could be as simple as putting money into a clear plastic jar every time they get an allowance. This could act as their "investment account" until they're old enough to open a bank account. You can "invest" this money into something they want, or wait till they're 18 and put it into an investment account.

The Best Investment Account For Kids: A Roth IRA

If you're wondering what the best type of investment account might be for your children, it's undoubtedly a Roth IRA. This type of individual retirement account allows their contributions and growth inside the account to grow tax-free. While a lesson on taxes might not be required at this stage, you can open the Roth IRA as a custodial account, which then transfers to their ownership when they turn 18.

Help Them Understand The Role Of Credit

Credit is one of those unfortunate things that we all need to do various things with our lives, like applying for a credit card or applying for a mortgage. Depending on their age, your kids may already have a grasp of credit, but it doesn't hurt to reinforce this with a lesson about borrowed money.

Borrowed Money Is The Most Important Concept

When it comes to credit, the most important concept that your kids need to learn is that credit equals borrowed money. And borrowed money is different than money that you have for yourself. Borrowed money is someone else's money that you're entrusted with, but ultimately have to pay back to them.

A Simple Lesson To Teach Them About Borrowing & Interest

One simple way of doing this is to give your kid $5, then say that when they have $5 saved up, they're to pay you back. If they miss the payment, increase the amount to $5.25, adding the $0.25 for "interest". They now have to pay you back $5.25. You can always put that money back into their savings account later, but the point is to teach them about borrowing and then paying back, plus a side lesson about interest.

Teach Them About Credit Scores

Credit, or FICO scores, won't really be important until they're in their teens and have responsibility for things like a cell phone bill. But, once they have those responsibilities, it's a great idea to teach them about credit scores—you don't need to make it overly complicated, either.

Pay Your Bills On Time & In Full

This is an excellent lesson in financial health, whether or not it's specific to their credit score, but it dovetails nicely into the lesson on credit scores. Teaching them to pay their bills in full and on time will boost their credit scores, which will make it easier for them to borrow money in the future.

Ask Them What Their Financial Goals Are

Once your child has reached the age where they're receiving an allowance (that they don't immediately spend on toys), you could start having a conversation with them about bigger financial goals. When they're teenagers, do they want to buy a car? Take a road trip with their friends? Save up for a house one day?

Start Build A Roadmap To Achieving Those Goals Through Savings

One of the keys to achieving financial success, no matter how old you are, is being able to have a plan to reach your financial goals. Start your teenagers off by helping them to visualize their financial goals, maybe with number-based visualizations, like, "If you put $10 of your weekly allowance away, by the end of summer, you'll have enough to buy yourself X thing you want". Find out the price of the item they're after and set it as a goal.

Give Them An Allowance

The age at which you start offering your children an allowance can vary depending on how comfortable you are with this concept and how much extra income you have to give to your kids as an allowance. Another lesson to incorporate is teaching them some responsibility. Making their own bed in the morning is a good early lesson.

Teach Them The Basics Of Spending Money You Have VS Money You Don't Have

One of the most important things you can teach your kids about money is the concept of being in debt. That is, they've spent money they don't have and are therefore now in debt. The less debt they have, the more financially free they'll be to spend on other things.

If You Can't Afford It, Don't Buy It

A critical lesson to help your kids avoid debt for as long as humanly possible is teaching them that if they don't have the money for an item, they don't buy it. Even if that means that you, as their parent, don't buy it for them either, despite their pleas. Teach them that if they want something, they either need to save up for it or go into debt (bad) by you paying for the item and not buying them anything else until their debt to you is repaid.

This May Sound Harsh, But...

It is far better that they learn this lesson with you as their teacher earlier in life than when they really need money for a mortgage or a car loan and the banks all turn them away. It's a simple lesson, but far too many adults go into mountains of debt buying things they can't afford.

Help Them Understand The Importance Of Saving

Another great lesson they'll need to learn sooner rather than later is how to save. Show them things that cost money, and then do a breakdown of how much that item costs and how much they have in their allowance. Write it all out on paper and then have them do the math (with your help) as to how much they'll need to save if they want that particular item.

As They Get Older, Introduce Them To Longer-Term Savings Goals

Of course, when they're children, it's all about immediate gratification. The older they get, the more important it is that they understand the concept of patience and thinking long-term. Introduce them gently to longer-term savings goals as they get older. Maybe they want a new bicycle—it's the perfect time to say, "OK, how much does that cost? And how much do you have?" And then do the exercise of working out how much they'll need to save.

Talk About Needs VS Wants

In the financial world, needs and wants are critical to differentiate between, especially when your kids are younger. Everything is a need. That new toy? They need that. NEED IT. For survival, I tell you. But, as they get older, one of the most important lessons they'll learn is the difference between a need and a want. They NEED food, water, shelter, love, affection, and so on. They WANT that new bike or video game, etc.

And If They Want It, Then They Can Probably Help Pay For It

If your child is at an age where they're earning money, either from an allowance or a part-time job, then it's important to teach them that they can pay for some of the things they want. Even if it's a large purchase, you might be willing to pay a quarter or half of the overall cost, but they've gotta cover the rest. It's important that they learn to pay for the things they want and not become dependent.

VioletaStoimenova, Getty Images

VioletaStoimenova, Getty Images

Teach Them About The Importance Of An Emergency Fund

While, obviously, you're going to be covering any emergencies they may have until they're, say, 16 and have a driver's license, you can use those times to teach a lesson on the importance of saving for a rainy day.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Talk To Them About Setting Aside A Little Money In A Savings Account For That Emergency Fund

Even if they're just earning a small allowance of $10-$20 per week, you can explain that it's important that they not spend all of that money right away and save a little for when their summer job mowing lawn gets rained off for a week straight and they make no money, or when their car breaks down and they need to pay for a certain repair. Open a high-yield savings account and have them contribute (or you contribute their money for them) regularly.

Teach Them To Work Out How To Make Money

Once they're teenagers, one of the most important things they can do is to start making their own money. There are plenty of ways for teenagers to make money, no matter what they're good at or what their interests are. Teach them how to work out to make money for themselves, and you may just create a little entrepreneur!

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

The Best First Jobs For Young Earners

If they're entrepreneurial and want to earn their own money rather than working for someone else, there are all kinds of options for young teenagers looking to earn some extra pocket money to put towards that new bike or guitar, etc. Here are some of the best first jobs for teenagers.

Babysitting

Whether they've got little siblings or not, babysitting is another great way to earn money off an evening after school or on the weekends. They could start out by babysitting the neighbor's young kids for an hourly rate, then expand the business further afield if successful.

Mowing Lawns

The age-old way to make money: mow lawns in your neighborhood. Even if they need to borrow the family lawnmower, that's fine! Just ensure they know the expectation that they'll pay for the gas, oil, and maintenance of the lawnmower. There's probably enough work to keep them busy all summer long! Many of the biggest lawn mowing companies you know started out as teenage businesses.

Aigars Reinholds, Getty Images

Aigars Reinholds, Getty Images

Dog Walking

If they're strong enough to walk your own dogs by themselves, then they're likely okay to handle another person's dog too! Start putting up fliers offering dog walking services and watch all the families who don't have time to give their dog the exercise it needs line up for a dog walk. They usually take no more than an hour, so they could get at least two or three in a day, with more opportunity on the weekends.

Car Washing

They just need a sponge, a bucket, and some soapy water to start offering to wash all of your neighbors' cars. They can do this on the weekends or in the evenings after school, it's a simple and easy way to make some good cash. They could even expand the business to include interior cleaning in time.

monkeybusinessimages, Getty Images

monkeybusinessimages, Getty Images

The Food Service Industry

Of course, there are plenty of opportunities to work for someone else if they haven't yet developed the entrepreneurial spirit. The food service industry is one of the most common options for flexible, part-time work. This can be a great option once they're about 14/15/16.

What's One Lesson You Taught Your Children About Money?

What's the one lesson you drilled into your kids about money when they were growing up? How has it helped them become more financially responsible as adults? Let us know in the comments below!

You May Also Like:

Red Flags That An Investment Might Be Riskier Than It Seems

10 Hidden Expenses That Are Draining Your Wallet Every Month