How To Navigate A Recession

Recessions can strike quickly, leaving financial carnage in their wake. Like preparing for a natural disaster, there are tools and steps we can take to help mitigate the negative impact of recessions. Keep reading to discover helpful and practical information about navigating economic downturns.

What Is A Recession?

According to the National Bureau of Economic Research (NBER), a recession is defined as a significant decline in economic activity that visibly affects trade, employment, income, and industrial production. It may last for several months and is typically triggered by a domino effect in the supply chain, financial markets, or a series of impactful global events.

What Is A Recession?

Recessions are often identified only after they have ended. Because a recession is not a one-size-fits-all event, its impact can vary across investors, economies, and employees. For example, an investor who sells a financial stock and cashes out before a recession may experience different financial outcomes than someone who holds onto their stock as the markets decline.

Other Ways A Recession Can Be Triggered

In addition to a decline in economic activity, a recession can also be triggered by a prolonged period of inflation. For instance, when inflation rises, central banks often respond by raising interest rates to slow the economy and reduce inflation. This can create a ripple effect: businesses may lay off workers, consumer spending declines, and fewer jobs are created.

How Companies And Consumers Respond To Recession

When the economy is volatile, companies and shoppers are anxious, leading to significant cutbacks in spending, investing, production, and hiring. Businesses may have to get financially creative and trim resources, cut out inefficiencies, and terminate staff while freezing hiring opportunities.

Trends During Economic Downturns

During an economic downturn, economic activity slows, unemployment spikes, and the gross domestic product (GDP) typically declines for two consecutive quarters—this signals of a full-blown recession. Another common trend is that economies may take years to return to their previous peak, which can stall overall growth. Since unemployment often lingers after a recession ends, many workers may continue to feel its effects long after the broader economy begins to recover.

A Historical Look At Recessions

Since the Industrial Revolution, economies have generally experienced steady growth with relatively few periods of decline; however, recessions continue to occur periodically. For example, according to the International Monetary Fund (IMF), between 1960 and 2007, 122 recessions affected 21 advanced economies. Thankfully, while recessions still happen, their duration has generally become shorter and less frequent over time.

No picture credit in book, Wikimedia Commons

No picture credit in book, Wikimedia Commons

The Great Depression

The Great Depression lasted from 1929 to the late 1930s and was the deepest and longest-lasting downturn in the history of the Westernized world. The US economic output fell 33% and stocks plunged by 80%, leaving unemployment at a whopping 25%.

Dorothea Lange, Wikimedia Commons

Dorothea Lange, Wikimedia Commons

Recessions And Depressions

One major lesson from the Great Depression was the importance of adopting stronger fiscal and monetary policies to prevent recessions from deepening into full-scale depressions. These measures include programs like unemployment insurance, which workers contribute to, as well as the strategic lowering of interest rates to stimulate economic activity.

Lange, Dorothea, 1895-1965 (NARA record: 10582293), Wikimedia Commons

Lange, Dorothea, 1895-1965 (NARA record: 10582293), Wikimedia Commons

Recessions And Depressions

According to the IMF, routine recessions can cause GDP to drop by around 2%, while severe recessions can set the economy back by as much as 5%. The key difference between a recession and a depression is that a depression is deeper and more prolonged, with limited relief. However, economists have yet to establish a universally accepted definition for what constitutes a depression.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Recessions And Depressions

According to the NBER, an economy must undergo a widespread and intense downturn to qualify as a recession. Because these conditions are not always immediately apparent, some recessions are identified retroactively. Key indicators used to measure economic decline include nonfarm payrolls, retail sales, and industrial production.

Financial Factors Of A Recession

One of the key factors that can lead to a recession is financial instability. A clear example of this is the 2007–2008 US financial crisis. When credit is overextended—especially through risky loans—combined with an excessive expansion of the money supply and credit by the Federal Reserve, it can fuel a dangerous bubble in asset prices. Once that bubble bursts, the economy can quickly spiral into recession.

Marek Ślusarczyk (Tupungato) Photo portfolio, Wikimedia Commons

Marek Ślusarczyk (Tupungato) Photo portfolio, Wikimedia Commons

Financial Factors Of A Recession

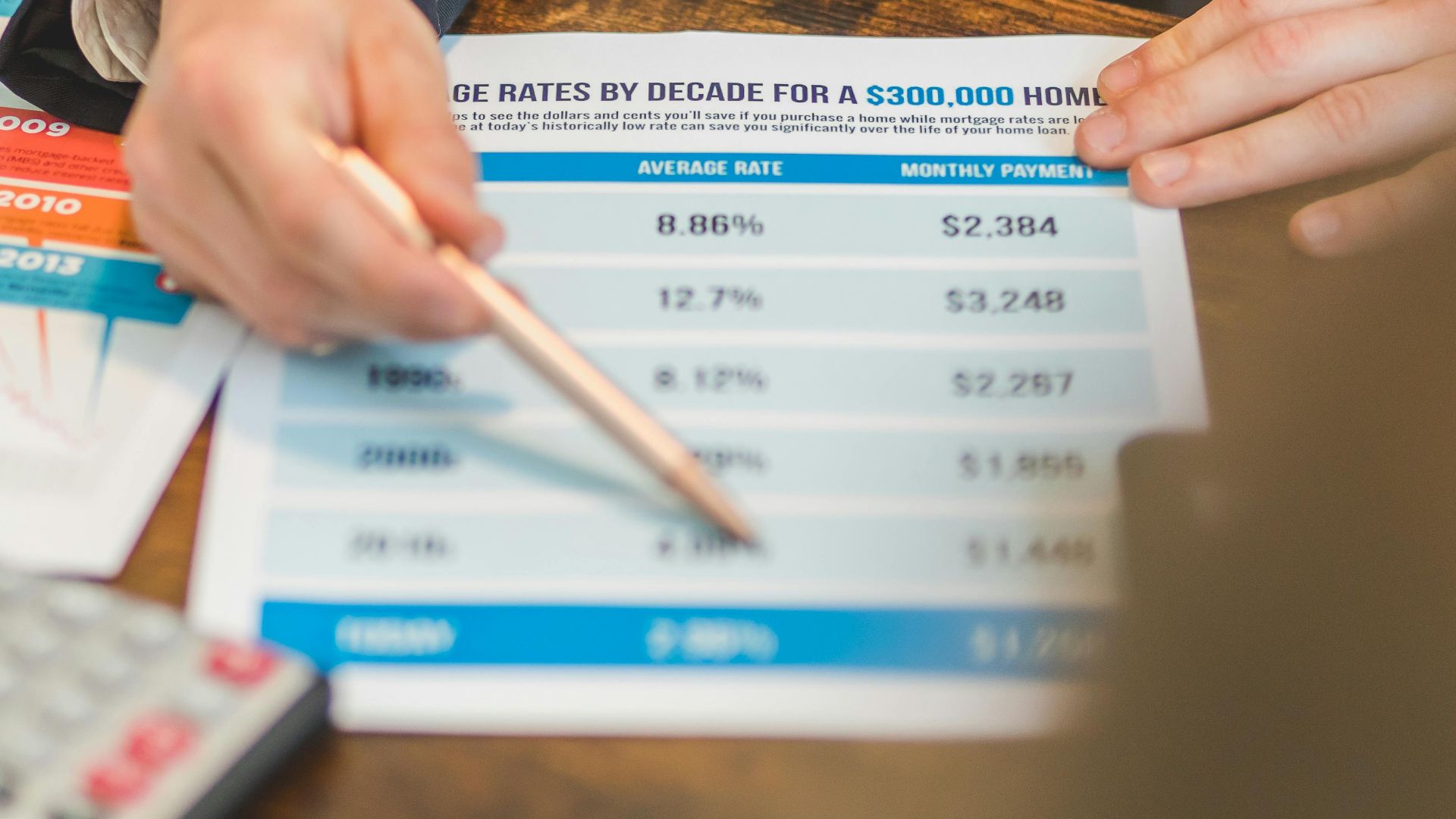

Artificially low interest rates during economic booms can distort the natural balance between businesses and consumers, encouraging excessive borrowing and misallocation of resources. Interest rate-sensitive ventures, such as buying a home or launching a long-term business expansion, can seem unusually attractive with lower interest rates. Unfortunately, when the rates rise to reflect normal market values, those previous investments are unsustainable.

Psychological Factors Of A Recession

Different economic theorists point to psychological factors as contributors to economic cycles—for example, excessive enthusiasm during booms, and deep pessimism during busts as investors attempt to recover their losses. Keynesian economics emphasizes how both psychological and economic factors can reinforce and extend the duration of recessions.

Economic Factors Of A Recession

Beyond financial sectors and investor psychology, tangible economic shifts can facilitate a recession. For example, some economists attribute economic shocks as the sole contributor to recessions. Economic shocks can rupture supply chain operations, leaving businesses that depend on them in deep trouble.

Economic Factors Of A Recession

Essential sectors like energy and transportation can significantly impact the broader economy during economic shocks. Actions such as investors pulling out funds and companies halting hiring can simultaneously affect workers, consumers, and financial markets.

Economic Factors Of A Recession With A Financial Twist

Some economic factors are closely tied to financial markets. Interest rates, for example, indicate the cost of borrowing for businesses and reflect how people value current spending versus future savings. When central banks maintain artificially low interest rates during strong economic periods, it can distort financial markets and encourage poor decision-making by businesses and consumers. Over time, these imbalances can contribute to the onset of a recession.

Economic Factors Of A Recession With A Financial Twist

However, a boom fueled by low interest rates can only last so long. Consumers, savers, and investors eventually adjust their behavior, leading to a natural slowdown. This shift often reveals deeper issues such as worker shortages, supply chain disruptions, and rising prices for raw materials—all of which contribute to inflation. As businesses struggle to secure necessary resources and face increasing costs, some may be forced to shut down. This pressure can be enough to tip the economy into a recession.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

What Predicts A Recession?

Although no single indicator can perfectly predict a recession, an inverted yield curve has preceded 10 US recessions since 1955. While not every recession was signaled by this metric, it remains a valuable tool that helps economists narrow their focus when assessing potential pre-recession conditions.

What Predicts A Recession?

In a normal yield curve, short-term interest rates are lower than long-term rates. This is due to longer-term debt having more duration risk than short-term debt. To illustrate, a 10-year bond usually pays more than a two-year bond because it's riskier to lock in money for a longer time. This makes the yield rise with time, creating an upward-sloping yield curve.

What Predicts A Recession?

An inverted yield curve happens when long-term bonds pay less interest than short-term ones. With the rise of near-term interest rates, the economy can slip into a recession. Long-term bond yields drop below short-term ones when traders expect the economy to slow down and interest rates to be cut in the future. Investors scrutinize multiple leading indicators to forecast a recession, including the ISM Purchasing Managers Index, the Conference Board Leading Economic Index, and OECD’s Composite Lending Indicator.

The COVID-19 Pandemic Impact On The Economy

The COVID-19 outbreak serves as a clear example of an economic shock. With non-essential businesses forced to shut down during the critical stages of the pandemic, the NBER officially identified the 2020 COVID-19 downturn as a recession, which ended in April 2020. This two-month recession was triggered by a global disruption in supply chain operations, which significantly impacted domestic activity across nearly all industries.

The COVID-19 Pandemic Impact On The Economy

Fragile business models were hit especially hard during this period, and over-reliance on global supply chains left resources scarce and shortages widespread. Limited inventories only worsened the situation, further fueling the cycle of supply chain disruptions—even for essential goods.

Are Things Cheaper During A Recession?

Pricing often reflects consumer spending habits, so it's not surprising that prices tend to decline amid a recession as people cut back on spending. In response, businesses may lower prices to encourage consumer purchases. However, commodities like food and gas often see price increases—especially when demand remains high, or supply becomes limited.

How Long Do Recessions Last?

In the US, the average recession has lasted for 17 months since 1857; however, since 1980, the last six recessions have only lasted less than 10 months. There is no hard rule about how long a recession is supposed to last, but economists have charted recession trends to forecast based on previous recession data.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Don’t Co-Sign A Loan

Co-signing a loan carries inherent risks in stable economic times, but doing so during an economic downturn could significantly increase those risks. Both the borrower and the co-signer may face additional challenges, such as job loss or poor investment returns. If the borrower struggles to make timely payments, the co-signer could experience even greater financial strain than they might under normal circumstances.

Don’t Make Risky Investments

For business owners, an economic slowdown may not be the ideal time to take on risky ventures. While lower interest rates can make it tempting to expand operations or increase inventory, caution is warranted. When the market rebounds, those low interest rates may rise, potentially straining your ability to keep up with payments and impacting overall financial stability.

Don’t Make Risky Investments

A better approach for business owners is to monitor interest rates closely as the economy begins to stabilize. Rising rates can signal tightening financial conditions. It's also wise to look for positive shifts in leading economic indicators specific to your industry before making decisions to scale or revamp operations.

Don’t Get An Adjustable-Rate Mortgage (ARM)

Taking out an adjustable-rate mortgage in a downturn will be more costly once the recession ends. Those lower interest rates you were quoted will likely rise once the market swings back up, and since an adjustable-rate mortgage can fluctuate, a fixed-rate mortgage may be the better long-term deal.

Don’t Get An Adjustable-Rate Mortgage (ARM)

One caveat to securing a lower interest rate on a fixed-rate mortgage amid economic decline is that credit requirements often become more stringent, making it harder for some borrowers to qualify. While a recession can present an opportunity to lock in a favorable rate, it's important to be cautious about taking on new debt until there are clear, reliable signs that the economy is on the path to recovery.

Don’t Take Your Job For Granted

In a recession, finding employment can become more challenging as businesses look to reduce expenses to protect their bottom line. This often results in layoffs, making the job market more competitive. For those considering a career change, it’s especially important to evaluate all options carefully and weigh the potential risks and rewards.

Don’t Take Your Job For Granted

You may want to hold off on submitting your letter of resignation—especially if you're approaching retirement. Retiring in the middle of an economic slump can negatively affect both your income and the value of your retirement portfolio, just as you begin to rely on it more. If possible, it may be wise to hold onto your job for another year or until the economy shows clearer signs of stability.

How To Protect Your Investments During A Recession

There’s no one-size-fits-all strategy to perfectly prepare your investments for a recession. Depending on your individual circumstances, adjusting your investment approach during a downturn may or may not lead to better returns. For example, if you have a longer investment horizon, allowing your assets time to recover from short-term losses, it may be beneficial to stay the course and avoid making knee-jerk changes to your portfolio.

How To Protect Your Investments During A Recession

During a recession, consider assets that tend to retain or increase in value, such as gold and US Treasuries. High-risk stocks and high-yield bonds often lose value in economic downturns. Instead, investing in well-established companies with strong cash flow and reliable dividends can offer greater stability, as they tend to perform more consistently during recessions.

Tips On Making Your Life Recession-Proof

Practicing strong financial hygiene is a valuable habit that can help mitigate unexpected financial challenges, including recessions. Building an emergency fund with enough cash to cover three to 12 months of expenses is ideal. Consider placing this money in a high-yield, Federal Deposit Insurance Corp (FDIC)-insured account, where it can retain its value while earning interest.

Tips On Making Your Life Recession-Proof

Emergency funds are especially valuable because they reduce your reliance on borrowing to cover essential expenses. During a recession, credit can become harder to access, so it’s important to keep a tight budget and closely monitor your spending. Use your emergency fund only for true emergencies and aim to preserve as much of it as possible.

Live Within Your Means

Spending is a normal part of daily life, but sticking to your means can help you avoid unnecessary debt—especially during a recession. Debt can pile up fast if it’s not paid off right away. That expensive tank of gas becomes even more expensive when you’re paying 29.99% interest by putting it on a credit card.

Live Within Your Means

Another strategy to try if you're in a dual-income household is to try living off just one spouse’s income. During good times, this lets you save a lot more. And if things take a turn—like one of you losing a job—you’ll already be used to managing on a single income. You might have to pause your savings, but your everyday lifestyle can stay the same.

Vodafone x Rankin everyone.connected, Pexels

Vodafone x Rankin everyone.connected, Pexels

Have Additional Income

Diversifying your sources of income can help you through a recession. In addition to your full-time job, you may consider consulting on the side, driving Uber on the weekends, or selling collectibles on eBay. The more streams of income you can generate, the better, so if you happen to lose one source of income, you still have others backed up.

Keep Your Credit Score High

As previously mentioned, lenders tighten their purse strings during a recession with stricter criteria for borrowers, so those with high credit scores are often approved for mortgages, credit cards, or other types of loans. To maintain a high credit rating, you will need to pay your bills on time and keep your ratio of debt-to-credit available low. This will help to keep your credit score high and signal to lenders that you are trustworthy to repay loans. Keeping your credit score between 740 and 850 is optimal.

You May Also Like:

Preparing For A Possible 2025 Recession

Recession-Proof Jobs For All Skill Levels