Not All Is What It Seems: Financial Advice On Social Media

Not All Is What It Seems: Financial Advice On Social Media

They say don't trust everything you read on the internet. But does that apply to financial advice? It depends on who you listen to.

Ellyce Fulmore, a kinesiologist, was jobless during the pandemic and used her spare time to build a presence on TikTok. She had some business experience from her side hustle as a life coach, as well as from her stint at a local financial aid office in Kelowna, B.C. where she assisted many low-income individuals.

Using the 60-second video format, she began giving financial advice to an audience of millennials and Gen-Z, covering topics such as debt management and budgeting. She picked a perfect time to do so because many people her age were also getting laid off at their jobs and struggling with money.

In the span of two years, Fulmore was able to generate a following of over 400,000 fans, and she also managed to get the attention of a few financial companies including Neo and Wealthsimple which have since partnered with her. She is now a part of the meteoric rise of "finfluencers," who create financial content on social media.

Of course, like with any sort of financial advice, people should take caution as there is always a chance that the information being given is not accurate, or worse—intended to deceive individuals and scam them of their money. That's why if there's anyone to place your trust in, it may be the "finfluencers" who are collaborating with actual financial institutions.

This is because regulators believe that the social media platforms themselves should not be responsible for reviewing bad financial advice that is given by its users, so if they are not backed by a financial institution, they may be spreading false information.

Perhaps part of the reason why financial advice is so in-demand among the younger generations is that they did not learn basic concepts in school. Unlike kids today, they had to learn about many financial-related life skills from experience. Having a resource such as TikTok, which is so easily accessible, makes it easier for young adults to get the answers they need.

READ MORE

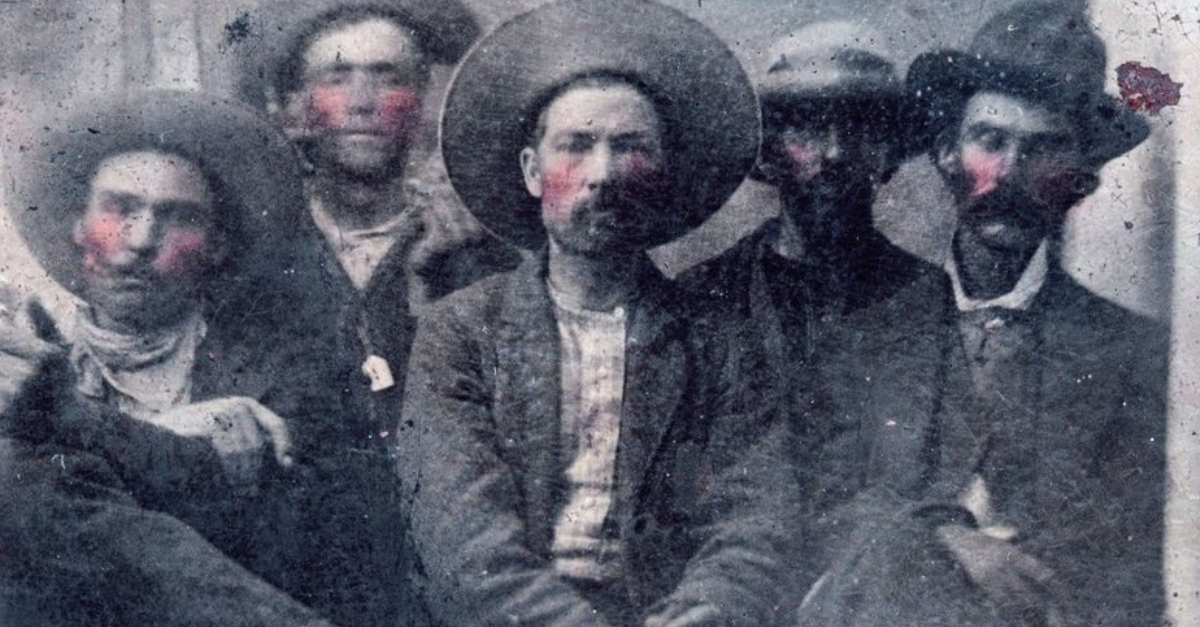

He didn’t think much of it when he bought the old photo for $10 at a flea market. But under the dust and scratches lay something remarkable—a rare glimpse of the legendary Billy the Kid. Yet what stunned historians most wasn’t the outlaw himself…it was the man sitting right next to him.

Even the most careful budgeters can end up wondering where their money went at the end of the month. Very often it's the small, recurring expenses that quietly add up over time.

Retiring at 40 isn't a pipe dream, and you don't have to be a tech genius, Wall Street bro, or pro athlete to do it. But you have to follow the habits of those who've done it before.

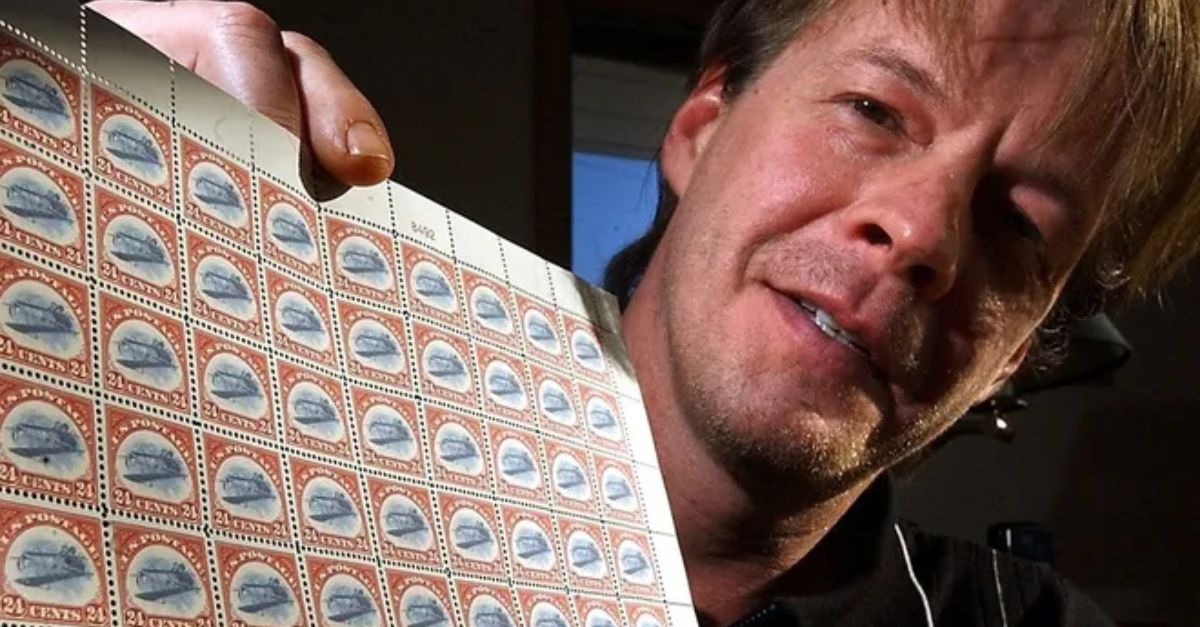

A postmark here, a printing slip there—history has a way of hiding value in plain sight. Some stamps grew from ordinary mail carriers into cultural icons, now ranking among the world’s most sought-after collectibles.

Major corporations seem so stable. That's why shocking corporate meltdowns are so compelling. Here are 10 of the worst ever.

Building wealth isn’t just for the rich or those with six-figure salaries. These ten strategies can help you grow your net worth without bringing in a huge paycheck.

Disclaimer

The information on MoneyMade.com is intended to support financial literacy and should not be considered tax or legal advice. It is not meant to serve as a forecast, research report, or investment recommendation, nor should it be taken as an offer or solicitation to buy or sell any securities or adopt any particular investment strategy. All financial, tax, and legal decisions should be made with the help of a qualified professional. We do not guarantee the accuracy, timeliness, or outcomes associated with the use of this content.

Dear reader,

It’s true what they say: money makes the world go round. In order to succeed in this life, you need to have a good grasp of key financial concepts. That’s where Moneymade comes in. Our mission is to provide you with the best financial advice and information to help you navigate this ever-changing world. Sometimes, generating wealth just requires common sense. Don’t max out your credit card if you can’t afford the interest payments. Don’t overspend on Christmas shopping. When ordering gifts on Amazon, make sure you factor in taxes and shipping costs. If you need a new car, consider a model that’s easy to repair instead of an expensive BMW or Mercedes. Sometimes you dream vacation to Hawaii or the Bahamas just isn’t in the budget, but there may be more affordable all-inclusive hotels if you know where to look.

Looking for a new home? Make sure you get a mortgage rate that works for you. That means understanding the difference between fixed and variable interest rates. Whether you’re looking to learn how to make money, save money, or invest your money, our well-researched and insightful content will set you on the path to financial success. Passionate about mortgage rates, real estate, investing, saving, or anything money-related? Looking to learn how to generate wealth? Improve your life today with Moneymade. If you have any feedback for the MoneyMade team, please reach out to [email protected]. Thanks for your help!

Warmest regards,

The Moneymade team