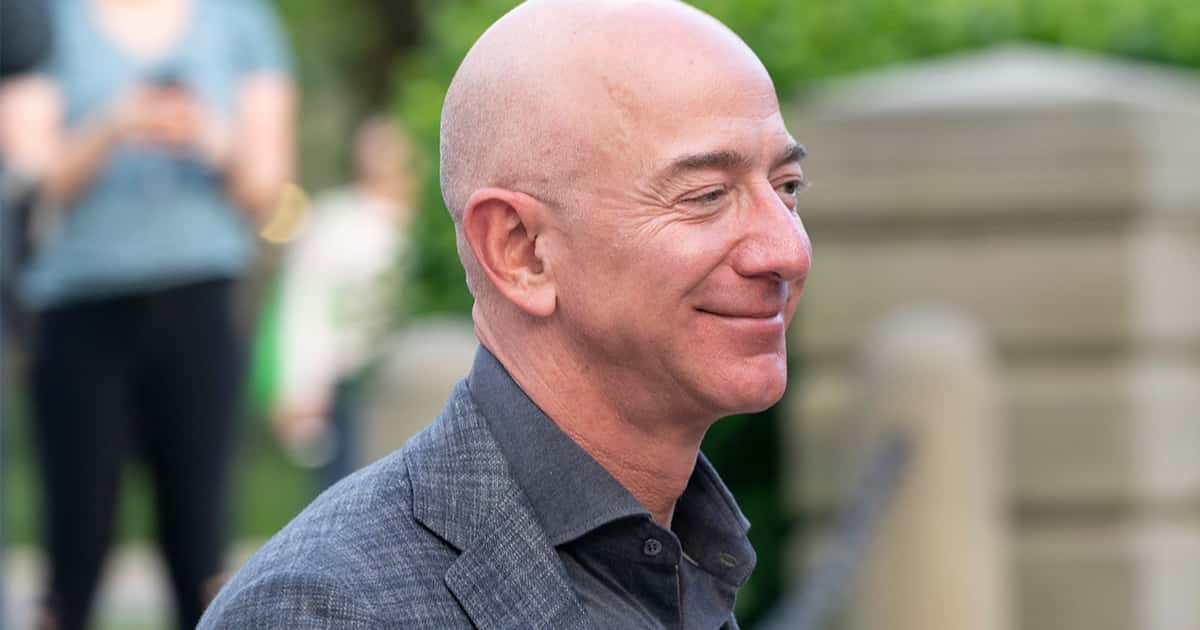

Amazon founder Jeff Bezos is still the richest man in the world. After recently selling $2.5 billion worth of Amazon shares earlier this month, he will net a total of $1.9 billion, which will bring his estimated net worth up to $192.6 billion. Such is enough to keep him at the No. 1 spot, just above LVMH's Bernard Arnault and Tesla's Elon Musk.

To put that transaction into perspective: $2.5 billion worth of Amazon shares is around 740,000 shares in total, and according to SEC documents, they ranged in price at about $3,274 and $3,485 per share last week. Currently, Bezos owns 52.5 million shares, which leaves him with a 10.4% stake in the company.

Bezos typically profits at least $1 billion from stock sales every year, and he could potentially rake in even more money should he sell again in the next few months. For reference, last year he made over $10 billion across three batches of stock sales that he made in February, August, and November.

In 2017, Bezos said he would continue his regular $1 billion stock sales annually in order to support his space exploration company, Blue Origin. Whether or not his most recent transactions will go toward funding that initiative is still unconfirmed; however, it's clear that Bezos is focused on gearing up the company's efforts to compete against other similar enterprises, such as Musk's SpaceX. Earlier this month, Blue Origin began an auction for one seat on its first commercial flight, which is supposedly set to launch on July 20 of this year.

In comparison, SpaceX is aiming to conduct the first all-civilian mission to space in history sometime in the fourth quarter of this year. Musk hopes the mission will lay the groundwork for more commercial flights to space in the future, and beyond just the billionaires who can afford to take them.

The journey will feature a four-person crew led by Jared Isaacman, the founder and CEO of Shift 4 Payments. In a recent statement, she said that the initiative will be "the realization of a lifelong dream and a step towards a future in which anyone can venture out and explore the stars."

With SpaceX seeing so much progress, Bezos is seriously looking to catch up. In fact, in an open letter to employees, he announced he would also be stepping down as CEO before the end of 2021, which shows just how committed he is to make that happen. He said the move will allow him to spend more time growing his other businesses, including Blue Origin, The Washington Post, and the Bezos Earth Fund, his $10-billion philanthropic commitment to fight climate change.