You Have Options

Leaving work completely is no longer the only choice, and for many there is a better choice than full-retirement.

From supplemental income to boredom relief, there are many reasons why people are now choosing semi-retirement over full-retirement.

Semi-Retirement Defined

Semi-retirement is a situation in which you’re still working but you’ve cut back on your hours and possibly transitioned to a less-stressful job.

Semi-Retirement Age

According to Aviva, more than 44% of 55–64-year-olds plan to move into semi-retirement before they reach 65.

Semi-Retirement Statistics

According to data from the U.

S. Bureau of Labor Statistics, the labor force made up of people aged 75 years and older is expected to grow by 96.5% by 2030.

Senior Satisfaction

According to a 2023 Pew Research Center survey, senior workers are the group who most enjoy working.

Job Satisfaction

Furthermore, two-thirds of workers ages 65 and older said they were extremely or very satisfied with their job overall, a higher percentage than their younger counterparts.

Why People Choose Semi-Retirement

Many people choose semi-retirement to allow them to draw on their pension savings while continuing to work part-time.

Semi-retirement as a Transition

Semi-retirement is also a good way to transition from full-time work to full-time retirement, allowing for freedom but continuing with social engagement and structure.

Semi-Retirement to Reduce Stress

Some people choose semi-retirement as a way of reducing stress.

Taking less hours, or switching to a more fulfilling job, even if it pays less, can be beneficial for many people during the transition process to full retirement.

Semi-Retirement Usage of Skills

Many people use semi-retirement as a way to continue using their skills without the pressure of having to perform strenuous work full-time.

This is particularly true for people who work in trades.

Semi-Retirement as a New Beginning

Some people use their retirement as an opportunity to start a business, sometimes called a passion project. Individuals can give up the drawn-out career they’ve spent decades doing and instead start something they’ve always wanted to do.

Semi-Retirement to Curb Boredom

There are many people who continue working after retirement simply because working is all they ever knew.

Boredom creeps in and before they know it they’re looking for jobs to do. This is when semi-retirement can be a great option.

Semi-Retirement as a Financial Need

Others choose semi-retirement because they simply have no choice, they need the money. Not everyone is equipped with a full savings account, or a good company-provided pension plan.

Semi-Retirement to Keep Benefits

Sometimes, people lose their comprehensive benefits packages upon retirement, or they become reduced. To avoid losing health insurance, some people will continue to work only as much and as long as they need to continue to receive the necessary insurance.

Social Security Benefits

According to Investopia, for a person with median earnings who worked steadily and retired at age 65, Social Security benefits replace about 37% of their past earnings as of 2022.

Self-Employed Workers

Workers with Social Security as their only retirement income—such as self-employed individuals who did not have a company pension plan—often have no choice but to continue working into retirement.

Delaying Social Security

Earning some money after retiring also allows many to delay taking Social Security to get a higher benefit later on, to reduce withdrawals from retirement accounts, and to continue to save for later on.

Delaying Social Security: Tip

According to Investopedia, delaying your Social Security payments beyond age 65 will permanently increase your Social Security benefit. You'll reach the maximum benefit if you delay starting your payments until age 70.

Jobs for the Semi-Retired

With a few exceptions, almost any type of job can be turned into a part-time position. The goal though is to choose something low-stress, less-hours, and one that will still keep you active and social.

Shifting to Part Time

Some people continue to do the same job they’ve always done, just with half the hours instead, which makes the transition to full-retirement so much easier.

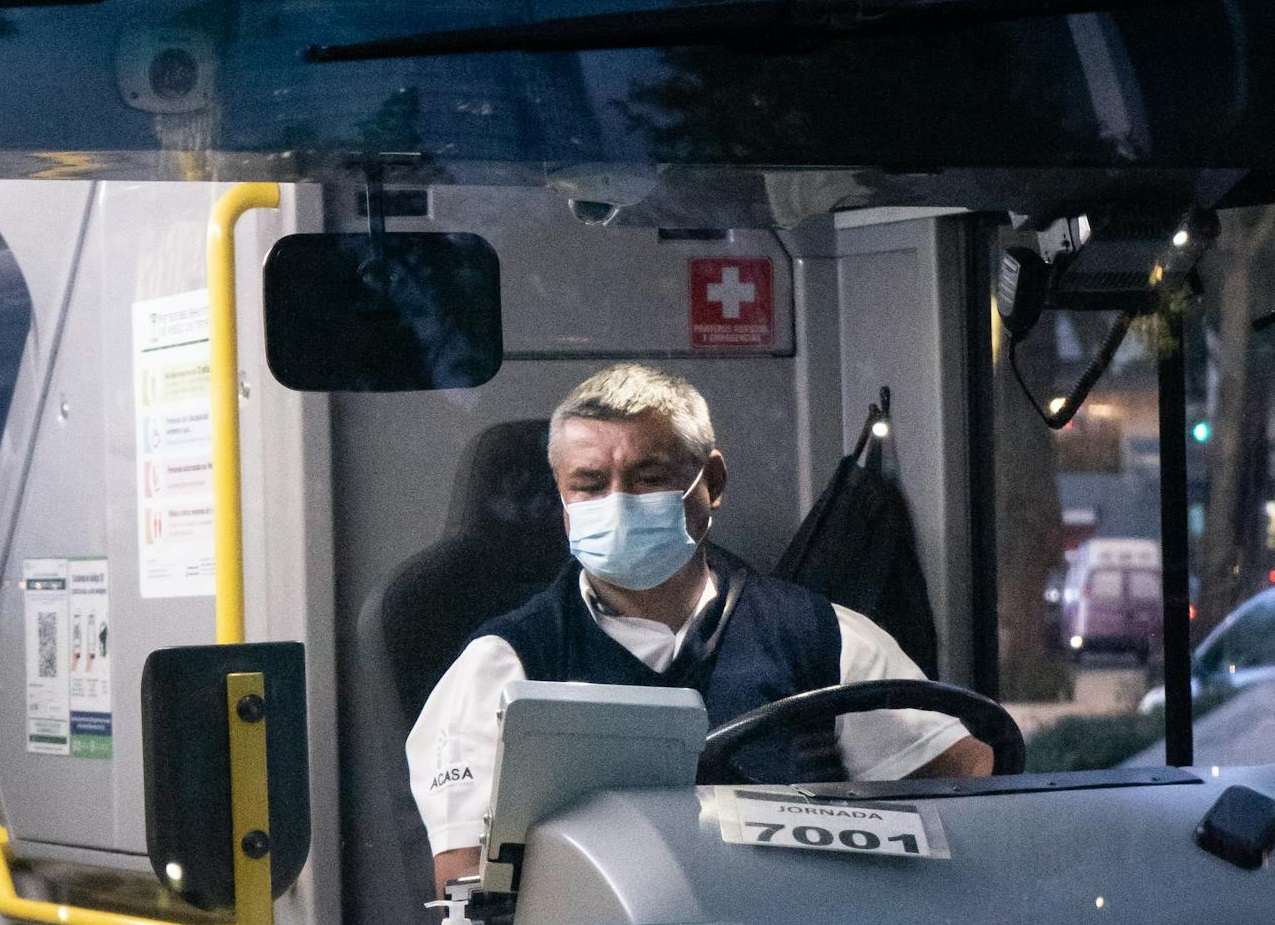

Low-Stress Options

Low-stress options for seniors include jobs like being a greeter in a retail store, working for a nonprofit organization or a church, working in home health care, or driving a bus.

Become a Consultant

Another great option for semi-retirement is to become a consultant where you can use your years of experience and expertise to assist others.

This also avoids working for one particular employer, reducing stress and hours of work.

Seasonal Work

Instead of working all year, consider seasonal jobs like a golf course during the summer or a ski resort in the winter.

A coaching position on a sports team is another common semi-retirement job that appeals to many.

Beware of the Caveats

Semi-retirement may sound appealing to a lot of people, but there are some things to make note of too, that need to be factored into your choice.

Income Tax

Working while receiving a retirement income can put you in a higher tax bracket. But according to Investopedia, tinkering with your work hours or 401(k) withdrawals are two ways to avoid that trap.

Social Security Reductions

Investopedia also explains that, “anyone who receives Social Security benefits before full retirement age, continues working, and earned more than $21,240 in 2023 will see their monthly benefits reduced by $1 for every $2 over the limit until they reach full retirement age”.

Social Security Reductions Cont’d

During the year they reach full retirement age, their benefits would be reduced by $1 for every $3 over a limit of $56,520 in 2023.

However, that money would be credited back to them after they reach full retirement age.

Healthcare Plans

Retirees who are eligible for Medicare while still working may also have the option of a company-provided healthcare plan. However, some insurance plans will pay less (or nothing) for services if the policyholder is eligible for Medicare.

Insurance Providers

It is always best to check with your insurance provider about how Medicare eligibility affects your coverage and how it will deal with Medicare should you choose to enroll.

Consider Your Health & Wellness

Before you choose the semi-retired life, consider your health and wellness. While an extra income may sound appealing, if its going to be too much for you it wont benefit you in the long run.