What To Do When Your Parents Run Out Of Retirement Money

Our hope for our parents is that they live long and happy retired lives, free of the stresses and worries they had when we were children. For most, retirement is realized in relative peace and comfort. Their house is paid off, they have very little debt, and they spend much of their retirement kicking back and enjoying life. But what if that's not your parents? What if they're struggling with finances and continuously asking you for money? What can you do to help without putting yourself in the red?

How Much Is Enough To Retire?

Knowing exactly how much your parents will need to retire is a calculation they should have made for themselves from around 50, even if they didn't plan to retire until they were 65. Many financial experts will tell you you need around 70-80% of your pre-retirement income to retire comfortably.

What Contributes To Post-Retirement Financial Woes?

You may think that once you're retired, all is well and good, and you're set for the rest of your life. While this would be true in an ideal situation, life throws endless curveballs. You may think you're all set to retire in comfort, and then you're hit with something that drains your retirement savings. Let's explore what some of those things might be.

Maintaining A Large Home

If your parents still own the home you grew up in and still live there, they may fall into the all too familiar trap of maintaining a home that is too big for two people. Whether they have a mortgage or not, it still costs money to heat and maintain. If you think they're wasting their precious retirement funds, convince them to sell the home.

Travelling Too Much

But, wait, isn't retirement the time when you're supposed to travel? Yes, but not so much that you blow your retirement savings. Budgeting for an annual trip somewhere is different than taking your RV across the country twice in as many years. Travelling too much can seriously impact your parent's retirement savings.

Kostiantyn Voitenko, Shutterstock

Kostiantyn Voitenko, Shutterstock

Bad Habits

Despite the fact that smoking and other addictive substances have been proven to cause harm to your health and your wallet, your parents might still be of the generation that's going to continue smoking until the cows come home. These bad habits could cost them tens of thousands of dollars per year.

Your Parents Took Their Social Security Benefits Early

Technically, your parents likely qualified for their social security benefits at 62, despite the fact that for most people, retirement age is 65 or older. If one or both of your parents began withdrawing from their social security at 62, they could be receiving up to 25% less than they would have had they waited for 65 to roll around.

Your Parents Have A Second, Unnecessary Vehicle

Your dad may own an iconic vintage car, while your mom may have the family run-around vehicle. But, do they really need both now that they're retired? That's two sets of everything that they have to pay for every year. Having a second vehicle is nice, but it can become very expensive, let alone if both experience a problem at the same time.

Not Entering Retirement With A Budget

Even though you might think that your parents are rich enough not to have to worry about money, not having a retirement budget is one of the major pitfalls that can cause retirees to slip up and lose their hard-earned money fast.

My Parents Are Asking Me For Help With Money, What Can I Do?

Of course, every kid wants to be able to help out their parents in their hour of need, as they have done for you countless times before. But sometimes, that's not always possible, practical, or advisable. Let's explore what your options are, if you're finding that your parents are repeatedly asking you for financial support.

Understand How Much You Can Actually Help

If you have a significant other, you need to involve them in this conversation, especially if this is for a significant amount of money (basically, anything over and above what you're comfortable giving over without a second thought). If this is the first time that this has happened, then it may be a one-off. But, if this is a pattern of behavior, it could be a cry for help.

Ask Them What's Wrong

Do a little investigating. Ask your parents why they're asking you for large sums of money, knowing that you've got two kids and a home of your own to look after. They may be forthcoming, or not, about their financial situation. If they unveil some deep financial issue at the heart of their money problems, then you can begin to come up with a solution.

Create A Formal Plan Of Action

You can't act until you have a plan. Talk with your parents and your significant other (almost in an intervention-style meeting) to create a formal plan of action to tackle your parents' financial issues, whether it's gambling debts, a bad habit, or just poor financial planning. Create a formal plan of action to ensure their long-term financial success.

Get A Full Picture Of Their Finances

First, you need to get a full picture of your parents' finances. Lay it all out in one master document that you all compile together. If you need to involve their bank, then do so. See what they've got coming in from their various revenue sources, and what they've got going out. Clearly, if they're asking you for money, they've got more outgoing than incoming.

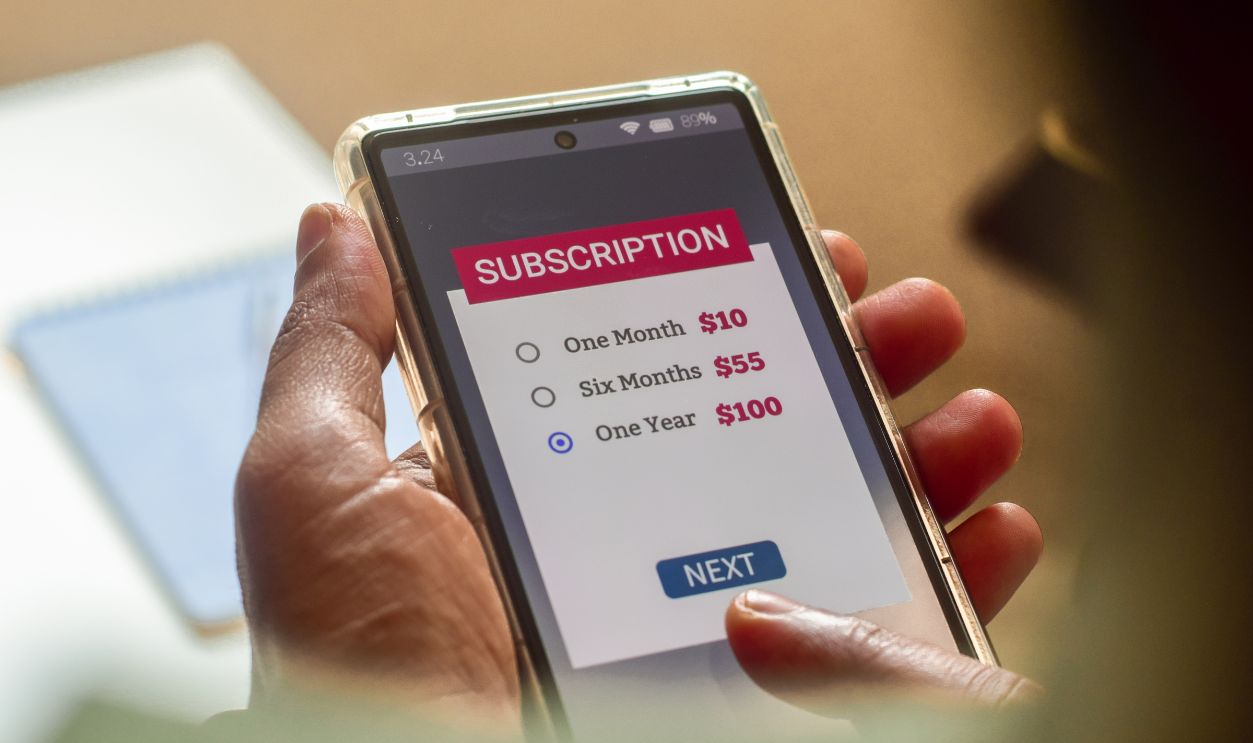

Figure Out How To Help Them Get Back In The Green

Once you've got a full picture of their finances, you should be able to see where they're falling down. There could be a very simple explanation, like perhaps they've got some subscriptions taking money out of their account that they'd forgotten about. If it's something simple, it may be a case of cutting off those subscriptions and away they go, happily off into the retirement sunset.

Create A New Budget

Regardless of the cause, you'll need to create a brand-new budget that reflects their current financial situation, rather than any retirement budget they may have made previously. Of course, if they've never budgeted during the latter years, this may be why they're in this mess to begin with.

Pay Off Debts ASAP

If your parents still have debts, it's imperative that they pay them off as soon as possible. Try using the debt snowball method, which is a method of debt repayment where debts are smallest to largest, attacking the smallest amount first. Once that's paid off, move on to the larger debt and so on and so forth until all debts are paid off.

Create Some Ground Rules For Your Help

If your parents still need your help financially, you need to lay some ground rules for that support. You'll need greater transparency; they need to stop putting purchases on credit cards, and there will be a clear limit for what you're able to provide financially while they get themselves back on their feet. Also, be clear that there will be consequences for abusing your generosity.

Suradech Prapairat, Shutterstock

Suradech Prapairat, Shutterstock

Is Permanent Life Insurance An Option?

Life insurance can offer a solution to some retirees' financial woes, but as they get older, the cost and difficulty of insuring an older adult increases significantly. Permanent life insurance makes payments to parents throughout the course of their life, in lieu of money given to them by their children. Upon the parents' passing, that money is replenished to the children by the insurance company. It's a relatively quick fix, but can be expensive and cumbersome.

Understand Any Tax Implications

There may be tax implications for you helping out your elderly parents, although not for most of us. The limitation on not incurring any taxes from financial gifts is $12 million over the course of a lifetime. You can also give non-taxable "gifts" of up to $17,000 per person, or $34,000 for a married couple. You may also be able to claim your parents as dependents on your tax returns, but to do so, your situation must meet strict criteria.

Helping Your Parents Is Admirable, But There Has To Be An End In Sight

While it's admirable to help your parents out when they need help, there has to be an end in sight to your support, and your parents need to be able to re-establish self-sufficiency. Whether you're loaning them $1,000 or $5,000, there has to be an end in sight to your generosity. Ensure that your parents acknowledge that there's an end in sight to your assistance with their financial woes.

You May Also Like:

The 50 Most Profitable Companies On The Planet

The Quiet Billionaires Who Live Below Their Means

These Activities Used To Be Just Fun For Kids, Now They Can Make You Rich