Your Millionaire Game Plan

Everyone wants a million dollars, but the question is...how do you get it? Well, there are plenty of ways to hit that seven figure mark—at least according to ChatGPT there are. Some are smart, some are…questionable. But they can all make you rich...

Master the Money Mindset

Wealth starts in your head long before it shows up in your bank account. See money as a tool for freedom, not just something to blow. Millionaires focus on building assets, not collecting liabilities, and they’re masters of patience and long-term thinking.

The Lottery Temptation

Sure, hitting the jackpot would make you rich overnight—but your odds are about the same as being struck by lightning while holding a four-leaf clover. It’s fun to dream, but if we’re being real, then maybe your millionaire plan shouldn’t hinge on a one-in-292-million shot. Just saying. But, to paraphrase Jim Carrey in Dumb and Dumber—we are saying there’s a chance.

Define Your Millionaire Goal

Instead of vaguely wishing for wealth, pick a number and a deadline. Do you want to hit your first million in 10 years? Twenty? Work backward to figure out exactly how much to invest each month—it turns a dream into a plan.

The Viral Fame Route

One video, a million views, brand deals rolling in—sounds amazing, right? It happens…but for every viral star cashing checks, there are millions posting daily with nothing to show for it. Treat it as a fun side quest, not your main game.

Spend Less Than You Earn

The golden rule of wealth: if more flows out than in, you’ll never get ahead. Track every expense for a month—you’ll be shocked at the waste. Cut the fluff, keep what matters, and send the rest into investments.

Grow Your Earning Power

You can only cut so much—income growth has no limit. Learn in-demand skills, ask for raises, change companies strategically, or start a side hustle. Every extra dollar is fuel for your investments, and the earlier you earn more, the faster you grow.

Marrying Into Money

It’s been called the “fastest way to wealth” for centuries. History is full of people who jumped straight into riches by marrying someone loaded. Sure, it works…sometimes. But it comes with emotional fine print and isn’t exactly a strategy you can “budget” for. Love first, prenup second.

Build an Emergency Fund

Before you dive into high-growth investing, build a cushion—three to six months of expenses in a safe account. It’s not glamorous, but it keeps you from pulling money out of investments or going into debt when life throws a curveball.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Create a High Savings Rate

Want to turbocharge your millionaire timeline? Save 20–50% of your income if you can. That might sound extreme, but it’s how you compress decades of slow growth into a much shorter path to freedom.

Invest in Assets That Grow

Cash sitting idle shrinks over time thanks to inflation. Millionaires buy assets—stocks, real estate, businesses—that put their money to work. The trick isn’t finding the “perfect” investment, but sticking with solid ones for years without bailing when things get shaky.

Understand Compound Interest

Compound interest is the closest thing to financial magic. Small amounts, invested consistently, snowball over decades into huge sums. The earlier you start, the less you need to save—because your money is busy making more money.

Alex from the Rock, Adobe Stock

Alex from the Rock, Adobe Stock

Keep Lifestyle Inflation in Check

When your income jumps, the temptation to upgrade everything is real. New car, bigger house, nicer vacations. But every upgrade pushes your millionaire goal further away. Keep spending steady and invest the difference—you’ll thank yourself later.

The “One Big Idea” Gamble

Some people invent the next iPhone or launch the next Facebook and strike it rich. But ideas are cheap—execution is where the odds get brutal. If you chase this route, be ready for years of work before any payoff.

Multiple Income Streams

Millionaires rarely have just one income source. Salary, side hustle, investments, rental properties, royalties—it all adds up. If one stream dries up, you’ve still got others flowing, which makes hitting that million much easier.

Avoid Bad Debt

Credit cards with sky-high interest rates? Payday loans? Wealth killers. They drain you faster than you can save. Borrow only for things that grow in value—like a degree, a home, or a business—not to fund a lifestyle you can’t afford.

Age-Based Millionaire Math

Start at 25: invest $880 a month at 8%, and you’ll hit $1M by 55. Wait until 35? Now it’s $1,850 a month. Wait until 45? You’ll need $5,700 a month. The earlier you start, the easier the climb.

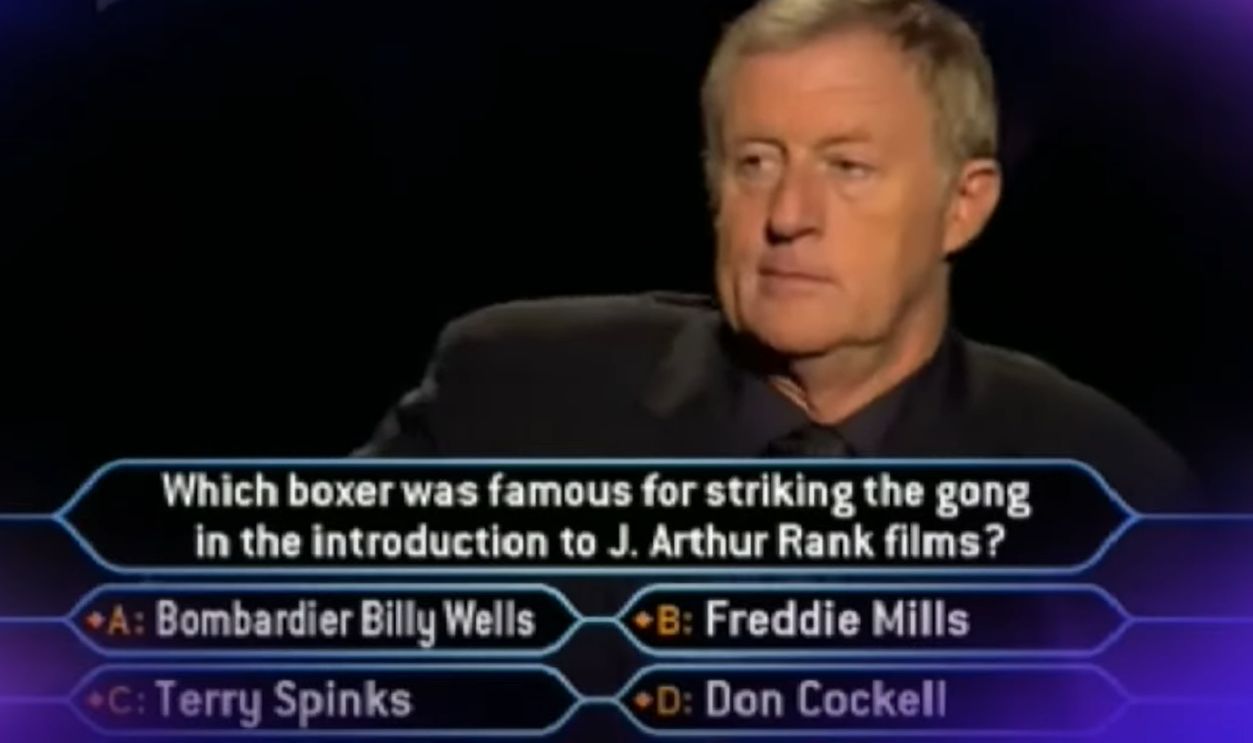

The Game Show Jackpot

Winning Who Wants to Be a Millionaire? sounds like a solid plan…until you realize you have to get on the show, keep your cool under bright lights, and answer every question right. Not impossible—just not something to bank on.

Who Wants to be a Millionaire Chris's Final Answer - 11th February 2014, Den_chik_366

Who Wants to be a Millionaire Chris's Final Answer - 11th February 2014, Den_chik_366

Live Below Your Means—Always

Even when you can afford more, you don’t have to spend more. Many millionaires still live in modest homes and drive reliable, paid-off cars. They know the real luxury is freedom, not a higher car payment.

Reinvest Your Profits

Every dollar your investments earn should go right back into more investments. This is how compounding snowballs—your money makes money, and that money makes more money. The cycle just keeps getting bigger.

Track Your Net Worth

Your net worth—what you own minus what you owe—is the real scoreboard. Track it regularly, and you’ll spot progress and problems early. Watching the number grow is motivating, even in small increments.

Use Tax-Advantaged Accounts

Max out accounts like 401(k)s and IRAs to grow wealth faster and dodge unnecessary taxes. If your employer offers a match, take it—it’s free money toward your million-dollar goal.

The Inheritance Wild Card

Some people become millionaires overnight thanks to inheritance. But since you can’t control timing, amount, or whether it happens at all, it’s a bonus—not a plan. Hoping for it isn’t the same as preparing for it.

Miracle Schemes & Fast Cash Fantasies

From magical “double your money” offers to risky crypto moonshots, there’s no shortage of shortcuts promising riches. Yes, you might hit big—but most people lose big. Millionaires prefer long-term certainty to short-term hype.

Start a High-ROI Side Hustle

Not all side hustles are worth it, but some can seriously accelerate your path to $1M. Look for low-overhead, high-margin work—consulting, freelancing, or selling digital products that keep paying you without eating all your time.

Monetize Your Expertise

Turn your skills into cash. Online courses, coaching, e-books, or consulting let you scale what you know into something profitable. It’s one of the fastest ways to create a new income stream without starting from scratch.

Avoid Get-Rich-Quick Traps

If it sounds too good to be true, it usually is. The people getting rich in these schemes are usually the ones selling them—not the ones buying in. Millionaires prefer boring but reliable over flashy but risky.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Time Your Big Purchases

Cars, appliances, even tech gear go on predictable sale cycles. Waiting a few months can save thousands—money better put into investments where it can grow instead of depreciate in your driveway.

Track and Celebrate Milestones

The road to $1M is long—celebrate $50k, $100k, $250k along the way. These checkpoints keep you motivated and give you a reason to stay on track when the end goal feels far away.

Stick to the Plan When It Gets Boring

Wealth building isn’t flashy. It’s slow, steady, and sometimes a little dull. But the boring stuff—saving, investing, repeating—is exactly what works. Millionaires know discipline beats excitement every time.

Your Millionaire Blueprint

It all comes down to this: earn more, spend less, invest the difference, avoid bad debt, and stay patient. Mix in a little fun along the way, but let the real magic come from time, consistency, and smart choices.

You Might Also Like:

Millionaires Who Made Their Fortunes Later In Life

Tricks for Recognizing Stealth Wealth: The Subtle Clues Someone Could Be A Millionaire