The Reality Of A Lay‑off At 50+

Losing your job in your 50s hits hard. Any assumption you may have had that work was secure after decades on the job is no longer reliable. Research shows that more than half of workers over 50 experience involuntary job loss. It’s time to accept this change and start acting with intention.

Step One: Address The Emotional Impact

A lay‑off isn’t just a financial shock, but a personal one. Feelings of anger, loss, identity crisis and severe anxiety are common. Take some time to process the news before you swing into action. The sooner you move on from emotional to strategic mode, the stronger you’ll be, but it’s important not to skip the emotional mode altogether.

Take Stock Of Your Financial Position Immediately

Gather all your personal financial data: savings, retirement accounts, benefits, household expenses, debt, severance and health coverage. The moment your job ends is your “financial fuse” moment. Knowing exactly where you stand will allow you to take meaningful next steps, not engage in guesswork.

Understand Severance, Unemployment & Benefits

Find out what your former employer offers in terms of severance, unused vacation payout, and continued health benefits. Then you need to find out your eligibility for unemployment or extension programs. All of these tools will buy you time and clear your financial runway as you plan your next big move.

Reassess And Adjust Your Budget

With your income disrupted, your budget has to change fast to reflect that. Cut all non‑essential spending, delay all major purchases, and start shrinking your living costs. This isn’t just a temporary austerity measure, but a maximum effort to preserve capital and prevent long‑term damage to your net worth.

Protect Your Retirement Accounts

At 50‑plus, whatever you have in your retirement savings is of extreme importance. Avoid tapping into your retirement funds unless it is absolutely necessary. Run the numbers on the withdrawal risks, tax penalties, and potential loss of asset protection. Keeping your retirement funds intact gives you a lot more flexibility down the road as you resume your path to financial recovery.

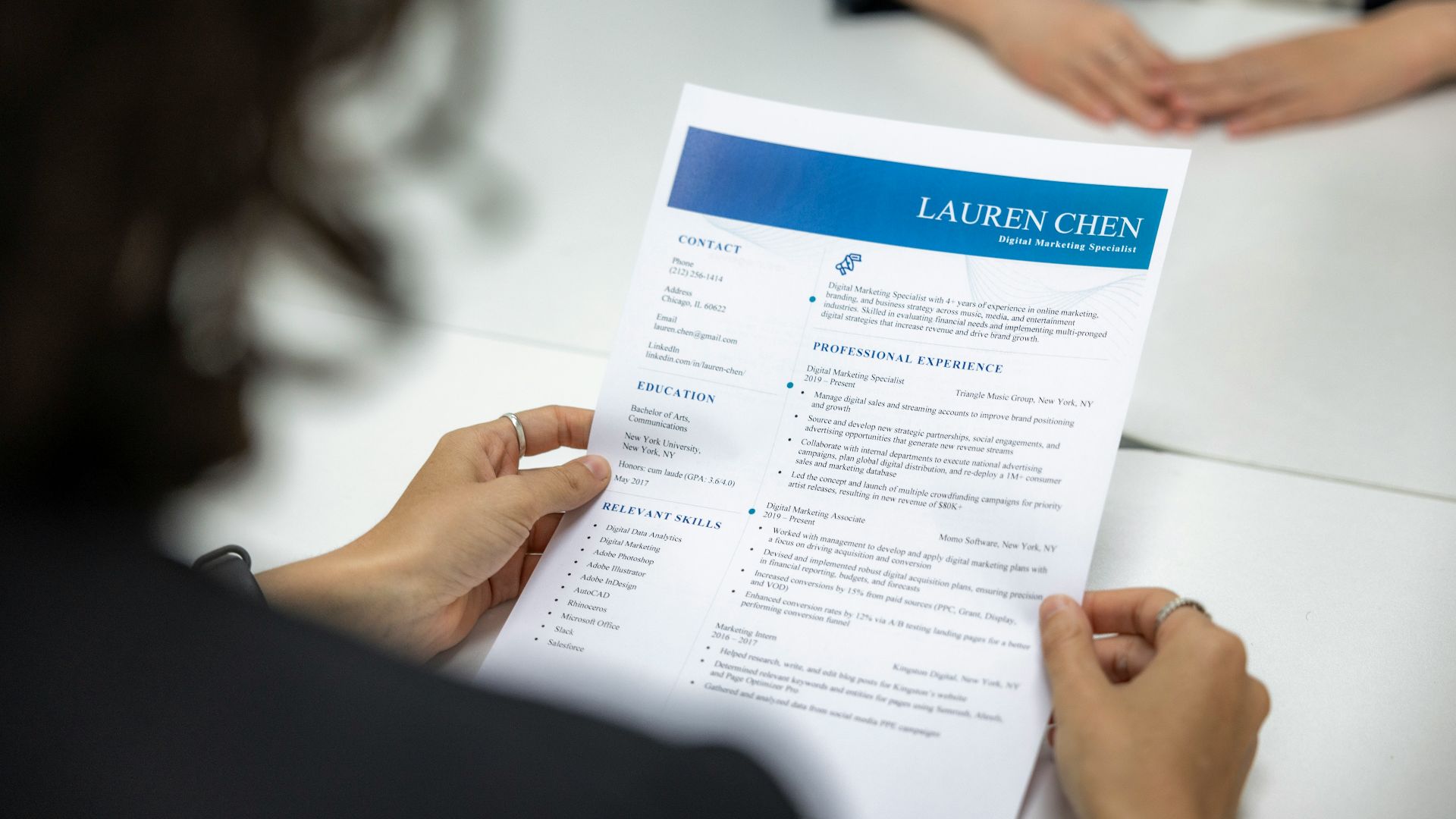

Update Your Skills And Personal Brand

The job market has changed a lot just in the past few years. Take another look at your skillset, update your resume, and revamp your online presence. Older workers often find they need to reposition themselves completely, not just update their resume. Framing your experience as a strategic asset helps you combat the ever-present age bias and complacency.

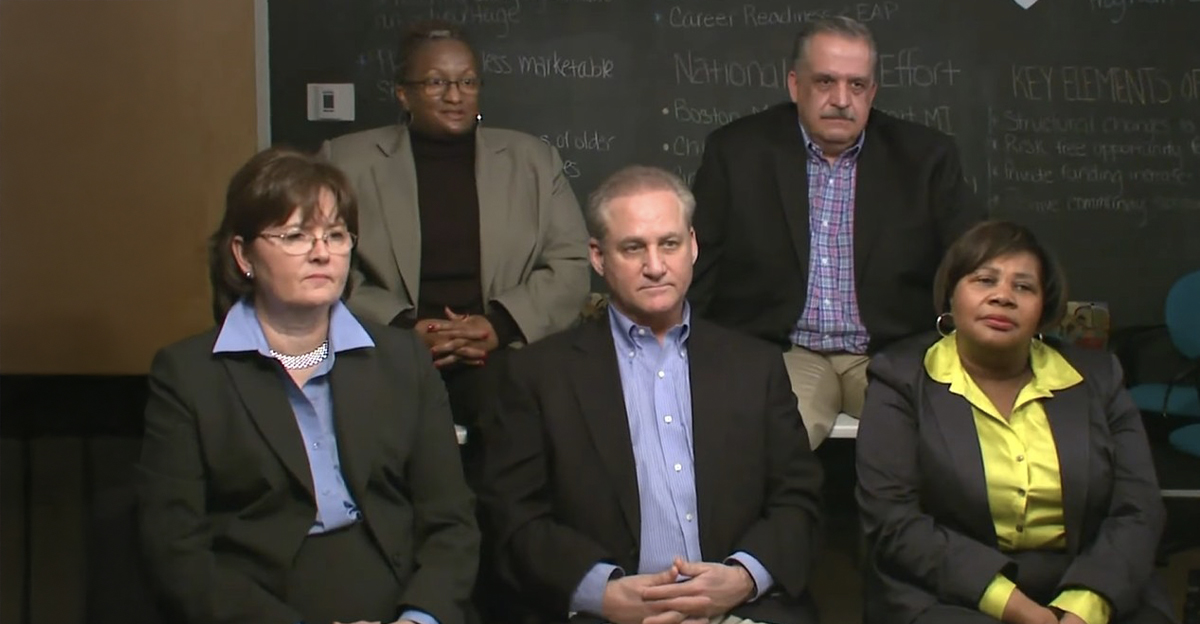

Activate Your Network With Intent

Leverage your professional and personal contacts; there are a lot of opportunities out there that are never posted publicly. At this stage of your career, signal your availability, ask for introductions, and even explore possible advisory or contract roles. Networking isn’t optional if you’re serious about finding new work, and the professional network you’ve built may be your strongest asset now.

Consider Alternative Income Streams

A full‑time job might not materialize right away. Explore consulting, part‑time work, board positions, or gig roles. Any one of these can replenish income, keep your skills active, and open new pathways. Just giving you an excuse to get out of bed in the morning is really more than enough reason to pursue these options. Each new dollar you earn eases the pressure on your savings and gives you more flexibility.

Reevaluate Your Career Path And Timing

Your lay‑off may force you to make a big change in whatever career trajectory or timeline you had mapped out for yourself. Maybe you put off retirement, change fields, downshift roles, or relocate. The goal here is to not overthink or over-react, but to maintain stability while staying realistic. The earlier you adapt, the more power you regain.

Manage Debt And Deferred Expenses

If you’re carrying significant debts, refinancing or restructuring might be the best way to go. Get in touch with your creditors early, explain to them what’s going on, and explore payment relief options. In the meantime, don’t add any new high‑interest debt. Keeping your debt under control is a saving grace; it protects your flexibility and credit.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Preserve Health Insurance And Benefits

Health coverage often changes with a job loss. Look into COBRA health coverage extensions, spousal coverage, or marketplace plans. Medical costs are one major bugbear that can derail financial plans if ignored. Nailing down a reasonable health insurance arrangement keeps one of the biggest risks off the table as you begin the rebuilding process.

Revisit Your Social Security And Pension Options

If you have a pension or defined benefit plan and are approaching Social Security eligibility, now is the time to review your options. Understand how your lay‑off might affect benefits and whether you need to shift your strategy. Putting time in planning now helps you avoid regret later.

Rebuild Your Emergency Fund And Cash Buffer

If you’ve emptied your savings, start building up a new cushion. Aim for 6‑12 months of expenses if you can. In uncertain times, liquid access to funds is critical to avoiding early withdrawals from protected accounts. This acts as a safety net for you and your family as you reestablish income.

Communicate With Your Partner Or Family

Financial stress after 50 casts a pall of negativity over the entire household. Have open, honest conversations with your spouse or family about what changes need to made, what’s realistic, and what you plan to do differently. When everyone in the family is on the same page, it reduces stress and incorrect assumptions.

Protect Your Assets And Update Legal Documents

Make sure your estate documents, wills, beneficiary designations, and power of attorney forms are all up‑to‑date. A lay‑off could necessitate changing your plans for retirement, guardianship or legacy. Maintaining legal clarity will prevent any unpleasant surprises.

Look At Downsizing Or Simplifying Your Lifestyle

If the financial outlook is tough, figure out if you can reduce housing costs, move to a lower‑cost area, sell unused assets, or even explore semi-retirement. Lifestyle flexibility is another possible strength you can bring to bear in order to adapt without losing dignity.

Make A Reintegration Plan With Milestones

Set clear actionable goals for yourself: update your resume by a specific target date, apply to X number of roles weekly, solicit X number of contacts monthly, and target your income by quarter. Tracking your progress gives you momentum and focus; more importantly, it discourages you from getting down and feeling sorry for yourself. This plan, and the winner’s attitude that goes with it, is your path out of this crisis.

Maintain Your Mental Health And Stay Grounded

Job loss in your 50s can erode your self‑worth and identity. Keep up a daily career routine, set non‑work goals as well, and try to get some exercise and fresh air each day. Seek support from friends, peers, or professionals. A stable mental state improves decision‑making and resilience.

Stay Flexible And Embrace The Opportunity

While it certainly doesn’t feel like an opportunity at the present time, you may discover a new direction, more meaningful work, or a lifestyle you hadn’t considered. At 50+, you bring experience, maturity, and opportunity as assets to any organization. Keep the doors open, stay responsive, and build forward.

You May Also Like:

Smart Side Gigs For Homebodies And Retirees

We have $1M in retirement accounts and $3K/month in expenses. Are we good to retire now?

I'm 67 with $700K in the bank but with a hefty mortgage. Can I finally retire?