5 Steps To Get Yourself Out Of Debt

5 Steps To Get Yourself Out Of Debt

Once you start accumulating debt, it can be hard to get rid of. It's easy to keep putting payments off, but it's a dangerous cycle that could bring you to a point of seemingly no return. When your debt is too overwhelming, what do you do? Well, one thing's for sure—it's not going to just magically sort itself out and disappear. You're going to have to tackle the problem head-on, and here are some tips on how you can do that:

#1 Make Small Payments

A good strategy you can try when you've got a substantial debt to pay is to chip away at it little by little. Break down your large balances into smaller payments that you can handle, based on your budget. It's much easier to charge $5,000 on a credit card than it is to pay it off right away. However, if you pay incrementally, say, $200 a month, you'll eventually be able to pay off that entire amount. Yes, it will take a longer time, and yes, it will take a lot of discipline, but it is definitely achievable.

#2 Accelerate Payments

In some situations, you may be able to accelerate payments on ongoing commitments like your mortgage. If you're only paying monthly for your mortgage, you will end up paying more interest over time, which doesn't help you out in the long run. One of the easiest ways to pay off your mortgage faster is by switching from monthly payments to semi-monthly, or, bi-weekly, or even weekly payments, based on your budget and income. By doing this, you will save both time and money.

#3 Stop Impulse Spending

It's hard to pay off a debt if you keep contributing to it, and one of the biggest contributing factors to debt is impulse spending. It's a hard habit to break, but it's a necessary one to stop, or else you may never achieve your debt-free goal. You may be surprised at just how much your impulse spending adds up in the grand scheme of things. Identify the things you can switch out in your daily routine—maybe skip the Starbucks, or cut down on the groceries. These little lifestyle changes will help you tremendously.

#4 Track Your Expenses

Where does all of your money go? Track your expenses to see if the things you are spending your money on are absolutely necessary. There may be some areas in your budget that you can cut out to free up some money for savings or other more important things. Efficient tracking can also help you figure out which credit cards or loans need the most attention. Once you've figured tall of that out, you can start making a budgeting plan that suits your lifestyle.

#5 Create A Master Budget

All of the aforementioned steps tie into this last and final step—making a master budget. It can be intimidating to lay out all of your finances into a single document, but it's important to stay organized to make sure your spending plan is airtight. Figure out a budget that is realistic and manageable for you. Consulting with a financial planner may be a good idea if you are overwhelmed or unsure of where to begin. Coupled with good changes to your spending habits, following this master budget will help you accomplish your debt-free goal in no time.

Source

READ MORE

He didn’t think much of it when he bought the old photo for $10 at a flea market. But under the dust and scratches lay something remarkable—a rare glimpse of the legendary Billy the Kid. Yet what stunned historians most wasn’t the outlaw himself…it was the man sitting right next to him.

Even the most careful budgeters can end up wondering where their money went at the end of the month. Very often it's the small, recurring expenses that quietly add up over time.

Retiring at 40 isn't a pipe dream, and you don't have to be a tech genius, Wall Street bro, or pro athlete to do it. But you have to follow the habits of those who've done it before.

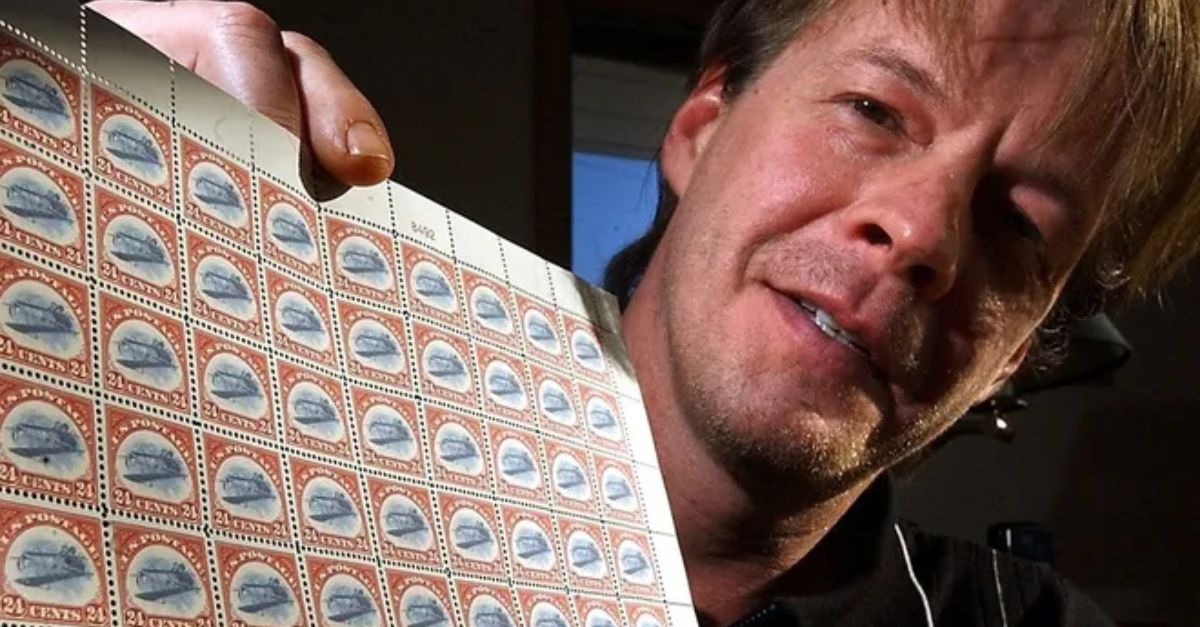

A postmark here, a printing slip there—history has a way of hiding value in plain sight. Some stamps grew from ordinary mail carriers into cultural icons, now ranking among the world’s most sought-after collectibles.

Major corporations seem so stable. That's why shocking corporate meltdowns are so compelling. Here are 10 of the worst ever.

Building wealth isn’t just for the rich or those with six-figure salaries. These ten strategies can help you grow your net worth without bringing in a huge paycheck.

Disclaimer

The information on MoneyMade.com is intended to support financial literacy and should not be considered tax or legal advice. It is not meant to serve as a forecast, research report, or investment recommendation, nor should it be taken as an offer or solicitation to buy or sell any securities or adopt any particular investment strategy. All financial, tax, and legal decisions should be made with the help of a qualified professional. We do not guarantee the accuracy, timeliness, or outcomes associated with the use of this content.

Dear reader,

It’s true what they say: money makes the world go round. In order to succeed in this life, you need to have a good grasp of key financial concepts. That’s where Moneymade comes in. Our mission is to provide you with the best financial advice and information to help you navigate this ever-changing world. Sometimes, generating wealth just requires common sense. Don’t max out your credit card if you can’t afford the interest payments. Don’t overspend on Christmas shopping. When ordering gifts on Amazon, make sure you factor in taxes and shipping costs. If you need a new car, consider a model that’s easy to repair instead of an expensive BMW or Mercedes. Sometimes you dream vacation to Hawaii or the Bahamas just isn’t in the budget, but there may be more affordable all-inclusive hotels if you know where to look.

Looking for a new home? Make sure you get a mortgage rate that works for you. That means understanding the difference between fixed and variable interest rates. Whether you’re looking to learn how to make money, save money, or invest your money, our well-researched and insightful content will set you on the path to financial success. Passionate about mortgage rates, real estate, investing, saving, or anything money-related? Looking to learn how to generate wealth? Improve your life today with Moneymade. If you have any feedback for the MoneyMade team, please reach out to [email protected]. Thanks for your help!

Warmest regards,

The Moneymade team