The Middle Class Struggle

With inflation in the U.S. at a 40-year high, it seems like everybody has to cut back on something (or many things) just to be able to stay afloat.

From medicine, soda, and dog food, to warranties and insurance plans, there are several things today that even middle-class Americans can no longer afford.

Gas

A simple full tank of gas has become a luxury that many Americans are struggling to pay for. Sunny afternoon drives have now become a thing of the past.

Convenience Store Snacks

Finding higher prices in convenience stores is nothing new, but lately, those prices are climbing higher than ever.

For the high price of convenience, it might be smarter to just make the trip to the grocery store.

Medicine

Medicine is very expensive in the U.S. Even simple painkillers are pricey if you don’t have insurance.

For example, Drugs.com notes that the average cost for aspirin oral tablet costs around $10.

00 for 36 tablets—which leaves many Americans to put up with the pain.

ManzoorRph, CC BY-SA 4.0, Wikimedia Commons

ManzoorRph, CC BY-SA 4.0, Wikimedia Commons

Coffee-to-Go

Sadly, take-out coffee is also seeing a rise in cost, causing many Americans to have to skip their morning coffee on the way to work, or make their own at home.

Dog Food

Americans are known to give their pets the best of the best—especially when it comes to food.

However, premium pet food costs have risen drastically, and can currently cost anywhere from $150-$300 depending on the brand and amount needed, leaving many American pups to have to settle for store brand food.

Takeout Food

Americans are also known for enjoying take out quite a few times a week. Not only is it delicious, it is also convenient to grab dinner on the way home from work rather than cook a lavish meal every night.

But with the rising costs of takeout, a simple takeout meal on a Friday night is just not worth the hit on the wallet anymore.

Bottled Water

Who would have thought that bottled water would become a luxury that many couldn’t afford?

Bottled water, even by the case, has become so expensive that Americans are opting for reusable bottles to take along with them throughout their day instead.

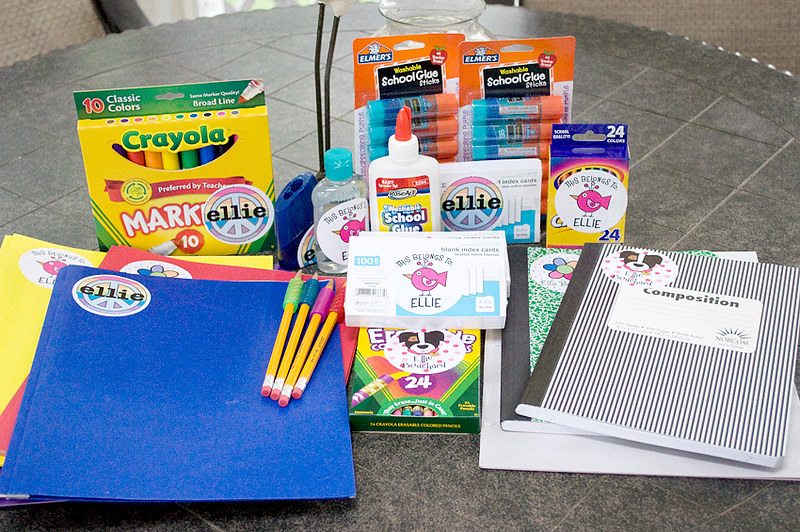

Stationary

The start of the school year has now become a challenging time for many American parents.

Simple school supplies like notebooks and pencils are steadily increasing in costs.

Backpacks and lunchboxes are even worse—many kids are having to recycle old supplies from previous years.

Sandwiches

A common work-day lunch for Americans is a classic sandwich made from local cafes. However, since the Russia-Ukraine War, the price of bakery goods has increased, turning a simple sandwich into a luxury.

Many people have to find alternatives for lunch, or pack their own.

Fast-Fashion

Fast-fashion refers to purchasing cheaper items to wear for the season, that typically only last for that one season. However, these items are no longer inexpensive.

Its actually a smarter choice now to buy better-quality items that will last for years.

Subscription TV

Many Americans get caught up in the subscription trap, paying for apps and services that they use once or twice and then forget about—adding to their monthly bill for nothing.

However, paying for a subscription service that no one is using has become a luxury that many middle-class Americans can no longer afford.

Public Transportation

Taking the bus used to be a cheaper option to avoid gas prices and vehicle maintenance, but that’s no longer the case.

Many Americans are finding themselves cycling or walking to work whenever possible to save money.

Disposables

While disposable options are certainly more convenience, they are no longer affordable.

Many Americans are opting for reusable household items, such as cloths, sandwich bags, etc. to save money where they can.

Throwaway items have become a luxury of the past for the middle class.

Textbooks

The price of college textbooks in the U.S. is soaring, making it impossible for students to purchase their books.

Hard copy textbooks come with a price tag of $100-400.

Students are having to take out loans just to cover their textbooks—many of them rethink studying altogether.

Housing

This doesn’t just affect the middle class; however, it is serious concern.

With high interest rates and ridiculous down payments, middle class Americans can no longer afford to buy a home, leaving them to pay just as much, or more, in rent—essentially investing in someone else’s property.

Tech Upgrades

Unless their current tech is truly slow or broken, many Americans are hanging onto their old phones and laptops for as long as they can to avoid costly upgrades, and getting stuck in expensive contracts.

Alejandro Escamilla, Wikimedia Commons

Alejandro Escamilla, Wikimedia Commons

Concert Tickets

Concert tickets have risen in cost just like everything else. Years ago, a decent seat could cost maybe $100, give or take. Currently, depending on the artist, concert tickets can take you into the high hundreds—for one seat.

Soda

With the rising cost of food, many grocery items are no longer on the weekly shopping list.

Soda is one of those items that for many middle-class Americans has become a luxury that is only bought when its on sale.

Vehicles

Vehicle ownership as a whole has become a luxury that even middle-class Americans can’t afford.

From soaring gas prices, costly maintenance fees, increasing insurance rates, and even paid parking, many people are avoiding car ownership altogether.

Helgi Halldórsson, CC BY-SA 2.0, Wikimedia Commons

Helgi Halldórsson, CC BY-SA 2.0, Wikimedia Commons

Hair Care

Salon haircuts are also experiencing inflation. Just in the last 5 years, basic haircuts have doubled or even tripled depending on the location—not to mention coloring and styling.

Many middle-class Americans are resorting to DIY haircare.

Support Charitable Causes

Sadly, generosity has decreased in recent years given the increasing economic state of the world.

Many middle-class Americans find it hard to support charity when they can hardly support themselves.

Restaurant Dining

Restaurant dining has since a huge increase in prices, considering how much it now costs the suppliers to access food.

On average, the cost of a mid-range restaurant meal for one person without drinks or tip is approximately $15 to $25. Higher-end restaurants can cost $30 to $50 or more per person.

Movie Theaters

Now-a-days, the popcorn and treats at the theater will cost you more than the movie ticket itself. It is said that the movie itself is what gets you in the door, and then they get you with everything else.

Without the snacks, the experience is different—which is why a trip to the theater is no longer a luxury that middle-class Americans can enjoy.

Eyewear

Prescription glasses—and the frames—are often something that falls outside basic medical coverage, leaving many Americans to pay out of pocket just to be able to see.

Forget trendy frames, basic glasses can now be considered a luxury for some middle-class families.

Travel

Many middle-class Americans would love to take their family on a trip and give their children a different perspective of the world.

Unfortunately, travel has become so expensive that even a road trip upstate can be too much.

Extracurricular Activities

Parents want the best for their children, especially when it comes to their physical health.

However, the rising cost of extracurricular activities for kids has become “outrageous” (especially when there is more than one child), leaving many kids unable to participate.

Podar Education Network, CC BY-SA 4.0, Wikimedia Commons

Podar Education Network, CC BY-SA 4.0, Wikimedia Commons

Funerals

Many middle-class Americans are plagued by the thought of what will happen to their families upon their departure—specifically in terms of funeral expenses.

Planning ahead is important, but also a challenge these days with the rising costs of funeral arrangements.

Warranties

Warranties are important, but in recent years the surprising additional cost on the already expensive purchase is a tough pill to swallow.

This leaves many Americans opting out of the warranties on their new TVs and tablets—which can possibly be a regretful decision later on.

Private Education

Private schooling offers certain advantages but comes at a significant cost.

With the costly gap between public and private education continuously widening, private education will soon become an option only for the wealthy.

Tim Pierce, CC BY-SA 4.0, Wikimedia Commons

Tim Pierce, CC BY-SA 4.0, Wikimedia Commons

Personal Fitness and Wellness

Personal trainers, dieticians, and public fitness centers having seen a huge increase in costs in recent years, making them a luxury that even the middle-class can no longer afford.

Comprehensive Insurance Plans

Insurance is a critical safety net, that can cost a significant amount of money.

While we all want to be sufficiently covered, some middle-class Americans are finding themselves having to make difficult decisions about which financial risks they can afford to take regarding unforeseen circumstances.

Bacon

In recent years, the price of bacon has gone up by a whopping 40%, making it a special treat among even middle-class American families.

Debt Payment

In America, debt is increasing faster than people can pay it off. With almost everything increasing in cost, even middle-class Americans are having to take on more loans than ever before.

Unfortunately, paying off those loans is proving to be even more challenging these days, especially considering the increase in cost-of-living without the increase in wage.

Emergency Savings

Much like the last point, many Americans struggle with basic living expenses, making saving money nearly impossible.

A Bankrate survey found that only around one out of four households have six months of emergency money saved, and many of them are in the higher income groups.

Fresh Produce

Without addressing grocery inflation as a whole, fresh produce is no longer a luxury that even middle-class families can afford.

With the astronomical prices of groceries these days, fresh produce is something that many Americans are struggling to afford, leaving them no choice but to opt for frozen and canned veggies and fruits.

Online Shopping

Buying online used to be the cheaper way to go, even when you factored in shipping.

However, since online shopping has become more popular, the costs have increased there as well.

Many Americans are finding even local online prices are sky rocketing, making it less affordable than before.

Makeup

With current “no makeup” trends happening, we thought maybe individuals were learning to love the skin they’re in—but perhaps its more because of the rising cost of makeup.

Medical Care

For Americans who are uninsured, medical care can be a seriously expensive cost.

Many middle-class Americans who do not have comprehensive medical care are often stuck with making decisions about which situations are dire enough to consult a doctor.

Marriage

Sadly, many Americans have reported putting off engagements and marriage plans right now simply because they have more important things to pay for—like gas, bills, and food.

Not everyone dreams of a courthouse wedding.

Spontaneous Living

Doing things spontaneously has become a luxury of the past. Most Americans find themselves having to check their budget before they splurge on something unexpectedly.

Even a trip to the beach requires a quick check of the bank account, for some Americans.

Being a Stay-at-Home-Parent

These days, most families need at least two incomes just to be able to provide the bare minimum.

Many middle-class families struggle with finding affordable daycare, but also can’t afford to stay home.

It’s a double-edged sword for many.

Eating Meat

Many Americans have reported eating less meat simply because the cost of meat has increased drastically.

While this may be a benefit to health, it is also a challenge for many people.

Living Alone

With a huge jump in housing costs, many people are being forced to take on roommates, or move in with friends and family members.

Even middle-class Americans are having to share housing costs with others just to be able to afford the rent or mortgage.

Pet Care

Grooming, training, veterinary services and doggy daycare have all gone up in price, along with everything else pet related.

Many American pet parents have been struggling to provide the necessary care for their beloved fur-babies, which has resulted in less people taking on pets, and a lot more animals being placed in shelters.