Here's What To Do If You Think Your Loved Ones Might Be At Risk Of Financial Abuse

It's hard enough to see an elderly person battle illness, either physical or mental, but if you're in a position of care to that person, taking charge of various aspects of their life, particularly their finances, can be even more challenging. Here's what to do if you think your loved ones might be at risk of financial abuse, either from a significant other or even a family friend.

Did You Know That Seniors Are The Most At-Risk Group For Financial Abuse?

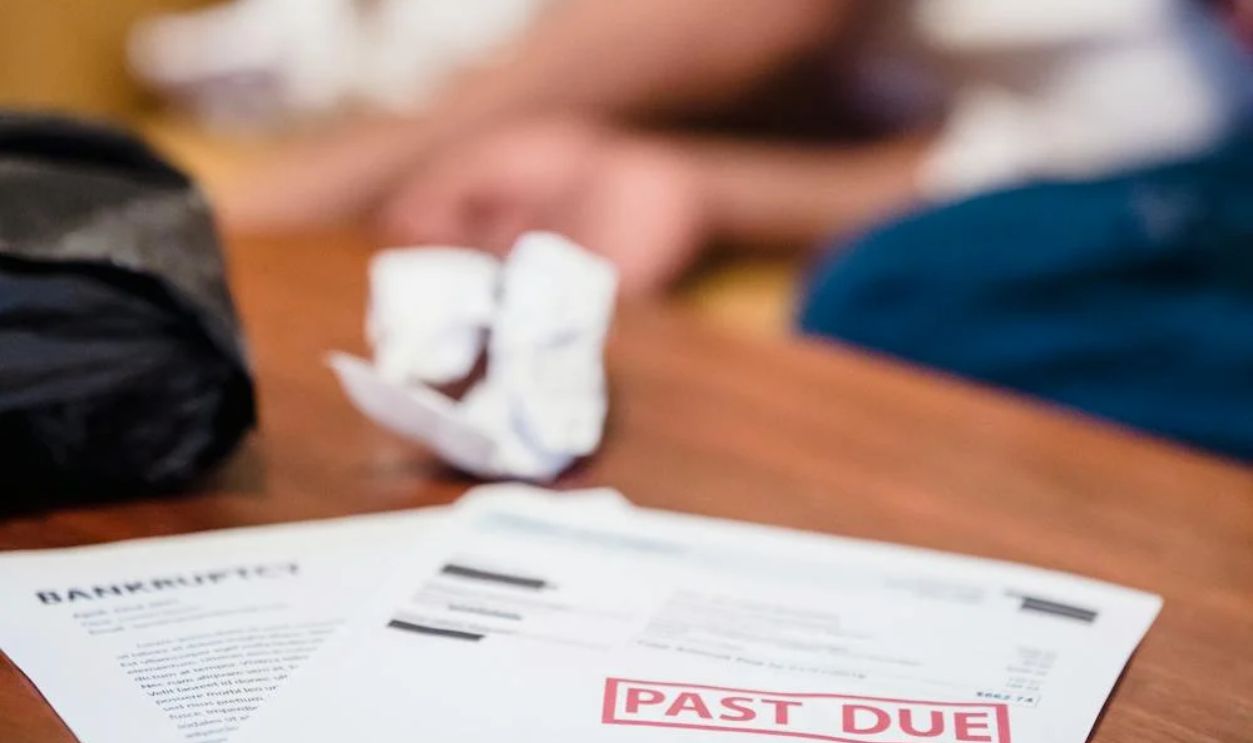

As many as one in six Americans is over the age of 65, and the Better Business Bureau reports that seniors lose more than $36 billion per year due to financial fraud. But fraud doesn't just come from scam phone calls or emails; sometimes, it's much more pernicious than that. Sometimes, it's from within their friend group or family.

The Five Forms Of Financial Abuse

There are five forms of financial abuse: coercion, which involves pressuring an elderly person to sign over money or assets; theft, which involves stealing directly or indirectly from an elderly person, either of money or material assets; fraud, which involves using deception to gain access to an elder's finances; misuse of authority, which involves abusing a conservatorship or power of attorney privilege; and exploitation, which involves using an elder's resources for personal gain.

What To Do If You Suspect Your Loved One May Be Vulnerable

It's everyone's worst nightmare: being drained of your finances and wealth by a scam. Elderly people are far more vulnerable to this, particularly as scammers become more technologically advanced and older people don't know how to navigate them. Here are some steps to better protect your loved ones from scams.

Teach Your Loved Ones About Sophisticated Scams

The first step you should take is to educate your loved ones about sophisticated scams. Sometimes, callers will call from a Blocked Number or pretend to be the government requesting documents from them. Help them understand the warning signs, teach them not to answer "Caller Unknown" calls, and teach them that the government will almost always send them a letter before calling their phone.

Never Give Out Their Personal Information Over The Phone

A good rule of thumb for them to adopt is not to give out their personal information over the phone. The government, or someone claiming to be from a bank, would ask a series of security questions before asking for any personal information. Educate your loved ones on which personal information to reveal and which to keep private.

Secure Your Loved One's Documents

While phone scams can be easily avoided, sometimes scammers and thieves take the form of people posing as a bank representative coming to your loved one's door. It's important that you secure your loved one's sensitive documents, such as their birth certificate, bank statements, and tax returns, either in a safe that you both have the combination to, or even at your home.

Set Up Alerts On Their Bank Accounts

They might not understand apps and such, but you do. You can set up bank account alerts for their accounts to come to your phone, in case there are any attempts at theft or bank fraud. The bank will act swiftly to secure the account, but be sure you're ready to lock the account remotely too.

Ensure The Funds They Need Are Liquid

It's important that, despite your loved one being in cognitive decline, that they still have access to their own money (providing they're capable of making sound decisions for the moment). These funds should be accessible easily, most commonly in a checking account.

Use A Fraud Alert Service

Different companies provide fraud monitoring apps. In addition to your banking app, fraud alert services provide an extra layer of protection against identity theft specifically. Your loved one will need to enroll in these with your help, but once they're set up, they'll be more secure against identity-related scams.

Protect Your Loved Ones' Credit

Credit companies offer "credit freezing" for those concerned about their elderly dearest falling victim to credit card fraud. It's not permanent and can be unfrozen at any time by your loved one, should they need to access their credit.

Encourage The Person To Avoid Making Quick Decisions

It's important that a person in cognitive decline not make rash financial decisions. You should actively discourage this, even if they've received a phone call or email that says something like: "You have 24 hours to respond before X happens". This is likely a scam. Encourage them to call you or another trusted person before making any deposits, sending any money, or making large purchases.

How To Secure A Power Of Attorney

In some of these matters, you'll need to act on behalf of your loved one, especially if they have a debilitating illness, such as dementia. To do this, you'll need what's called "power of attorney," which essentially gives you the power to make financial decisions (and other decisions) for your loved one. This is exercised with their written consent and knowledge. Here's how to secure power of attorney, if you think your loved one may be incapable of making sound financial decisions.

Consult With An Elder Law Attorney

The first step is for you and your loved one to consult with an elder law attorney. Ideally, your elderly loved one should have relevant papers drawn up that name you as the power of attorney before they become incapacitated. Even if they're in the early stages of dementia, it's a good idea to meet with an elder law attorney who'll walk them through what they're signing, what it means, and how it will be used.

What If They're In Mid- Or Late-Stage Dementia?

Mid- to late-stage dementia cases can make things a little more complicated. You'll need to petition a local court to act on behalf of the dementia patient. You'll need to petition the court for either a conservatorship or guardianship, which will allow you to make decisions on behalf of the afflicted person.

Your Responsibility As Power Of Attorney

As the power of attorney for your loved one, you have a responsibility to act in the best interests of the principal. This includes making decisions that align both with the principal's best interests and their wishes. If they're in the latter stages of their illness, this could mean having difficult conversations about why a course of action might not serve them well.

Where Do I Put The Assets Of A Loved One With Dementia?

When it comes to securing the assets of a loved one with dementia (outside of their accessible income), you have a few options depending on the type of financial asset you're dealing with. Let's explore your options for where to put cash or other liquid assets (not your loved one's property) for the most security.

Physical Cash: In A Safe Or A Bank Account

If your loved one has physical cash on hand in excess of a few hundred dollars, it might be a good idea to put the cash into a bank account, or, if they'd rather keep the cash physically accessible, then a fire-proof safe is an option (provided you have access to the code). Bank accounts are generally the most secure option for large amounts of cash.

Certificate Of Deposit Accounts

Certificate of deposit accounts, or CDs, are a type of bank account wherein the money deposited is locked away for a specific period of time. CDs also guarantee a fixed interest rate and a fixed term for which the funds will be locked away. This is best used for funds that the senior doesn't need access to for at least a year, possibly two or more.

High-Yield Savings Accounts

A high-yield savings account, or HYSA, is another great option for your loved one to keep their cash somewhere liquid. These HYSAs will most often offer a higher interest rate than traditional certificate of deposit accounts, but may only offer them for a limited time—for example, new customers could receive 5-6% for the first three or four months that their account is open.

Why "Bank Hopping" Might Not Be Best

Some people choose to move their money from one high-yield savings account to the next, once each new promotion ends. This is a great option for those who are able to keep track of their money, but not so for the elderly. You don't want your loved one to have to deal with the hassle of having multiple bank accounts.

Money Market Accounts

A money market account is a common type of bank account that combines the best of both checking and savings accounts. They tend to have higher interest rates than traditional HYSAs, include check-writing privileges (which the older generation may be more familiar with), and include a debit card.

THICHA SATAPITANON, Shutterstock

THICHA SATAPITANON, Shutterstock

Establish A Joint Bank Account

If you are the spouse or child of someone with dementia, if you aren't yet able to get power of attorney, you could try establishing a joint bank account. This will allow you to keep an eye on transactions and look for signs of fraudulent activity, without taking over the personal finances completely. You'll still need to prove their diagnosis and inability to make sound decisions, but it's less work than getting POA.

Automate Bills If Possible

As dementia progresses, you may find that your loved one is missing bill payments. While reminding them about it may be helpful in the moment, in order to ensure it doesn't happen too often, you should try to automate as many bills as possible. You can do this in partnership with your bank, or help your loved one set this up online.

Be Thorough About Caregivers

Sometimes, betrayal can come from the people you least suspect. It's important that you are vigilant about caregivers who interact with your loved one suffering from dementia. Ensure you thoroughly vet all caregivers and the organizations that employ them.

Consider Consolidating Finances

If your loved one has their financial assets spread across multiple different bank accounts and/or investment classes, consider consolidating their finances into one or two accounts. This will make it easier for them and you to manage their money long-term.

Consider Selling Investments

If your loved one has been investing for decades and has money sitting in an investment account or automated stock market investments, several years prior to getting sick, it might be a good idea to discuss with them the prospect of cashing in on their investments. This will give them extra cash flow in their retirement, as well as making those investments less vulnerable to fraudsters.

Review Their Will

If the person made their will a number of years ago, it's a good idea to review it with them before their dementia reaches the point of no return, as they can still cognitively make changes. Or, if their will was recently changed, it's important that you determine by whom, in case a family member or friend has written themselves into the will.

Try To Be There For At-Home Repair Services

If your loved one has booked at-home repair services, such as washer-dryer repair, plumbing, gardening, or any other service that's performed inside the home, it might be worth ensuring that you are around when those services happen. You could provide a layer of security against shady businesspeople taking advantage of senior citizens, or even outright thievery of a person's valuables.

Beware The Catfish

Unfortunately, the elderly who live alone are particularly vulnerable to catfishing. That is, someone who develops a relationship with the elderly person, only to turn around and scam them out of thousands of dollars. Beware of new relationships that an elderly person forms, particularly online. Under no circumstances should the person send money to their "significant other" for visits, medical injuries, or for any other purpose.

Beware Of Those Showering Your Elderly Relative With Gifts

Even if your relative isn't active online, it's important that you're wary of those showering your elderly relative with gifts. This could be innocuous, but it might also be a ploy to get into their "good books" before working their way into their will or asking them for money in return for those "gifts". Warn them against accepting too many gifts from those with possibly sinister intentions. As the old adage goes, "If it seems too good to be true, it probably is".

Education And Communication Are Your Best Tools

The best tools that you can use to combat elder financial abuse are education and communication. Ensure that your elderly relatives are aware of various scam techniques and what to do if they think they might have been a victim to one. Try and communicate frequently with your loved one about their finances and keep a watchful eye for any suspicious activity.

You May Also Like:

Sources: , , 3