You Might Have Bitten Off More Than You Can Chew By Paying For Your Dog's Instagram Career

You dreamed of transforming your beloved pet into an Instagram star, with sponsorships, fame, and free perks. Instead, you’re staring at mounting credit card debt, empty promises, and stress. The truth? Recovery is entirely possible with focus and persistence.

The Dream That Went Ruff

The plan sounded simple: invest in cameras, costumes, and branding, then wait for the followers to pour in. Instead, your pet’s Instagram sits stagnant, while your financial reality has grown much heavier with each passing month.

How You Got Here

It started with one small purchase—then quickly escalated. Suddenly, you're buying outfits and a new dog bed and new toys for review videos. You now have more stuff than your dog will ever need or use and a mountain of credit card debt.

The Influencer Mirage

Influencer life really isn't all that glamorous. There's lots of work involved that you don't see behind the scenes, and then there's the constant clamoring of fans—the same isn't as true of dogs, but being in the online spotlight could still provide more stress than it's worth for them. Be considerate of your pup.

The Debt Hangover

The average APR on a credit card is between 20 and 25%. A huge figure that will turn a manageable payment into an uncontrollable financial monster. That once “affordable” $600 camera could ultimately cost hundreds more unless you intervene immediately and decisively.

First Step: Stop The Bleeding

The most urgent action? Put away those credit cards. Each new swipe makes repayment harder. Your dog doesn’t need designer accessories to shine, but you desperately need financial discipline to prevent the situation from worsening further.

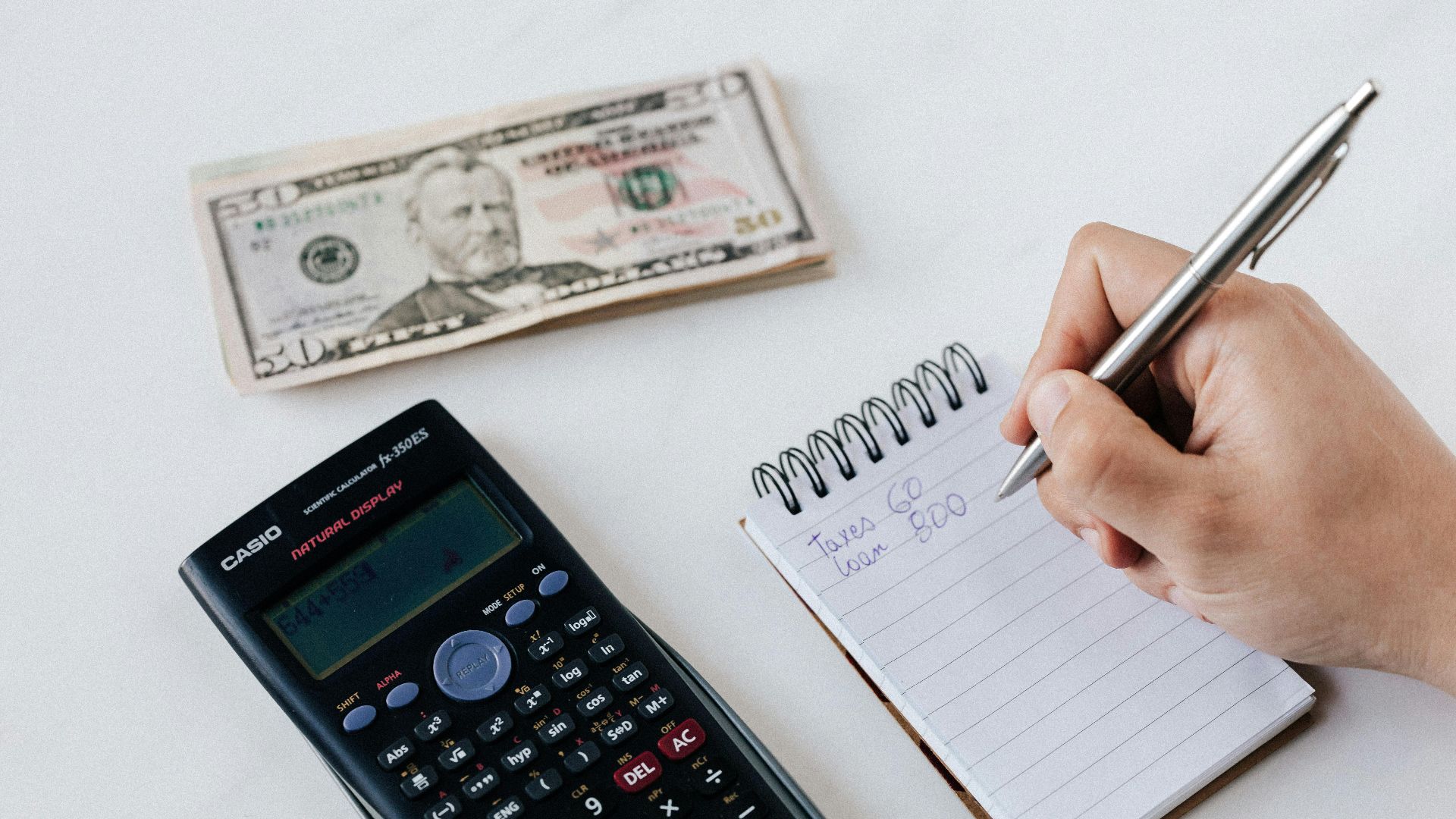

Create A Clear Debt Picture

Debt feels most overwhelming when it’s vague. List every account, balance, interest rate, and due date. Facing reality directly often reduces anxiety, because numbers—however large—are easier to manage when clearly written down and organized thoughtfully.

Choose A Repayment Strategy

Two proven methods exist: snowball and avalanche. Snowball creates motivation by paying off smaller debts first, while avalanche saves money by eliminating high-interest accounts sooner. Choose whichever method you’ll realistically stick to long term—consistency matters most.

Pablo García Saldaña, Unsplash

Pablo García Saldaña, Unsplash

Consider A Balance Transfer

If your credit remains strong enough, explore a 0% APR balance transfer card. This tool gives temporary relief by pausing interest accrual, but comes with strict rules and possible fees. Use it carefully, and always read the fine print.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Side Hustles > Dog Hustles

When your passion project stalls, consider supplementing income through practical side hustles. Deliveries, freelancing, or gig work may not be glamorous, but extra earnings accelerate debt repayment. Replace unrealistic influencer profits with tangible, reliable income opportunities that actually pay.

Sell Off The Extras

Unused equipment and props represent tied-up money. That DSLR camera, ring light, or unopened costumes can be sold online. Decluttering both your space and financial commitments turns mistakes into partial recovery, reducing your balances faster and more effectively.

Budget Like A Pro

A budget is not a punishment—it’s a lifeline. Start by tracking income and spending honestly, then cut excess categories. Prioritize necessities, allocate toward debt, and stick to realistic goals. Every dollar redirected becomes progress toward long-term financial freedom.

Emergency Fund First (Yes, Even Now)

Even while focusing on debt, build a small emergency fund of $500–$1,000. Unexpected costs—like vet bills or car repairs—shouldn’t push you further into debt. Having a safety net prevents setbacks and gives stability as you continue repayment.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Negotiate With Creditors

Creditors prefer working with you rather than chasing payments. Call and explain your hardship; many offer lower interest rates, payment adjustments, or hardship programs. A simple conversation could provide genuine relief—often more than you’d expect without even asking.

Credit Counseling Can Help

If debt feels unmanageable, nonprofit credit counseling agencies exist to assist. They can consolidate payments, reduce interest, and provide structured plans. Professional guidance helps you stay on track while avoiding the scams that often target vulnerable consumers.

Beware Of Quick Fix Scams

Desperation can make false promises seem attractive. Be cautious—anyone claiming instant debt erasure is preying on hope. Real solutions require commitment and time. Choose trustworthy resources and verified nonprofits, not shortcuts that may deepen your financial troubles further.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

The Emotional Side Of Debt

Debt isn’t only a financial problem—it affects self-esteem, relationships, and mental health. Shame is common, but unnecessary. You took a chance, and it didn’t succeed. Learn from it, forgive yourself, and focus energy on recovery and growth.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Keep The Dog, Ditch The Debt

Your dog doesn’t care about Instagram followers. They value companionship, affection, and consistent care. While you work on removing debt, cherish their loyalty. Unlike failed influencer dreams, your relationship with your pet is priceless, enduring, and deeply rewarding.

Can You Still Try Again?

Yes, but differently. If you relaunch your pet’s social media, prioritize creativity over spending. Leverage free apps, natural lighting, and authentic storytelling. Never finance hobbies with credit cards. If it grows, wonderful—if not, enjoy the journey without pressure.

Learn From The Experience

This failed experiment wasn’t meaningless—it taught valuable lessons. Passion doesn’t replace planning, and credit isn’t risk-free money. Every financial misstep provides perspective, strengthening your ability to make wiser, more cautious decisions in the future. Growth comes from setbacks.

Small Wins Count

Debt repayment is a marathon, not a sprint. Celebrate small victories: selling unused items, hitting payment milestones, or finishing a month under budget. Recognizing progress builds momentum, making the long journey feel manageable and consistently worthwhile.

Track Your Progress

Use tools like Mint, YNAB, or spreadsheets to monitor progress. Watching balances decline and credit scores improve provides motivation. Tangible results reinforce commitment, transforming repayment from a vague struggle into a measurable challenge with visible improvement each month.

Build Credit Back Stronger

As balances shrink, your credit score improves. That growth creates long-term opportunities—better loan terms, reduced rates, and stronger financial options. Rebuilding trust with lenders also builds confidence in yourself. Discipline today creates freedom and stability tomorrow.

Imagine Life Without Debt

Picture a future free from collection calls, high interest payments, and stress. Instead, imagine vacations paid with savings, guilt-free spending, and actual financial security. That vision can motivate you to persevere, reminding you why the effort matters.

The Recovery Is Possible

Recovery won’t be immediate, but it’s absolutely achievable. Debt may weigh heavily now, but it’s not permanent. Through consistent payments, disciplined choices, and patience, you can rebuild. The failed influencer phase will fade into just one life lesson.

A Final Bark Of Wisdom

Your dog’s love endures, regardless of followers or financial missteps. Debt will pass, but lessons will remain. Focus on steady repayment, value the support of loved ones, and build a stronger future—tail wags guaranteed every step forward.

You May Also Like:

The Grocery Items That Have Been the least impacted By Inflation

I'm very good at my job, but my boss hasn't given me a raise in 5 years. Is that legal?