What To Do With Your Ex's Healthcare Insurance After A Break Up

After a breakup, one partner may remain on the other’s health insurance. If your ex is asking you to pay half the premium, are you legally obligated? This common situation raises questions about financial responsibility, enforceability, and boundaries. Let’s explore the legal facts, practical steps, and key points you need to consider moving forward.

Understand What “Being on His Insurance” Means

If your ex added you to his employer-sponsored health insurance, you were likely listed as a domestic partner or dependent. That designation determines your coverage rights and responsibilities. Being included doesn’t automatically create legal or financial obligations. Before assuming any liability, understand how the plan treats partners and what it requires for ongoing eligibility.

Are You Still Eligible Post-Breakup?

Most employer plans require domestic partnerships to be current. If you’ve separated, you may no longer qualify, regardless of whether coverage continues for now. Once the insurer learns of the breakup, you could be removed. If he hasn't contacted his insurer and is keeping you on the plan, he's committing fraud. You need to let his insurer know.

Did You Sign Anything?

If you didn’t sign a written agreement to split premium costs, you’re likely under no legal obligation to pay. If it was just a verbal agreement, don't expect it to hold up in court. Even if you said you'd pay, that was then and this is now. Don't let him bully you into paying when you're not obligated to.

Are You Morally Obligated To Contribute?

Given that you're under no legal obligation to contribute, is it something you're morally obligated to do? Not really. Again, plans and people change—you may feel that when you broke up, your moral obligation ended.

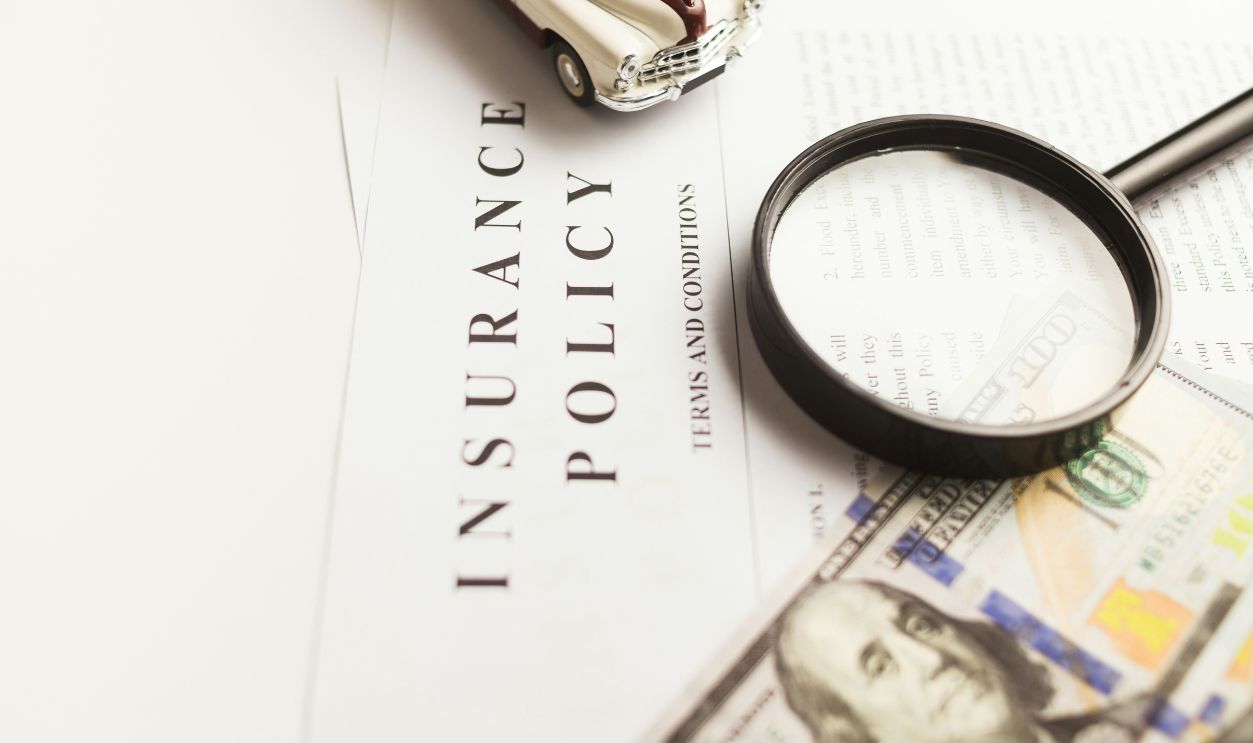

Check The Health Plan Rules

If you want ultimate clarity on this, ask your ex or his health insurance provider for the plan documents. This will clear up whatever obligations you may or may not have. If he isn't forthcoming, chances are he's trying to pull a fast one and you're not obligated to pay a cent.

National Cancer Institute, Unsplash

National Cancer Institute, Unsplash

Were You Officially Registered As Domestic Partners?

The policy documents will also tell you if you were registered as domestic partners. Some insurance companies require you to register as such, if that's your situation. If you've been misrepresenting your relationship status, this could lead to retroactive termination of the policy.

Know The Rules About Fraud

Do not stay on your ex's plan after you've broken up. It's considered insurance fraud and is punishable by fines, reimbursement, or even prison time. This could impact both you and your ex financially. It’s important to avoid misrepresentation, even if you didn’t intend to mislead.

Who’s The Policyholder?

Your ex is the primary policyholder—the one receiving the insurance through work and managing the account. Unless you both agreed in writing to split costs, he’s financially responsible by default. The policyholder is responsible for payments—if that's not you, then you've no need to worry.

"I'll Take You To Court!"

If your ex threatens to take you to court over the matter, let him try. Courts require documented proof of wrongdoing to issue judgements, especially in insurance fraud cases. If it's not in writing, it's generally not admissible as evidence.

Verbal Agreements: Are They Enforceable?

In general, verbal agreements aren't enforceable by law. You likely entered into a verbal agreement with your ex that you'd pay for part of the insurance, but that agreement is understood (commonly and by law) to have ended when you broke up, unless you have a written agreement to the contrary.

Emotional Pressure ≠ Legal Obligation

Your ex may use guilt or emotional appeals to influence you. But emotions don’t create legal responsibilities. You’re allowed to set boundaries, especially if no agreement exists. Focus on what the law requires—not what someone hopes you’ll do out of obligation or past intimacy.

Consider the Ethical Angle

If you’re still receiving coverage, contributing to the cost may feel fair, even if not legally required. This is a personal choice, not a legal duty. If you’re inclined to help, do so with full understanding of the arrangement and the temporary nature of the situation.

Should You Get Your Own Coverage?

It’s wise to find your own insurance after a breakup. Consider coverage through your employer, the ACA marketplace, or Medicaid. Being on your own plan avoids future complications and protects you from losing coverage suddenly. Independence here provides peace of mind and long-term stability.

COBRA Doesn’t Apply Here

COBRA lets you stay on an ex-spouse’s plan after divorce, but it usually doesn’t apply to domestic partners. If you're not legally married, don’t expect COBRA protections. That makes it more urgent to get your own insurance before your ex—or his employer—removes you from the plan.

Tingey Injury Law Firm, Unsplash

Tingey Injury Law Firm, Unsplash

What To Say To Your Ex

Set a respectful but clear boundary. You might say: “Since we’re no longer together and never agreed to share costs in writing, I’m not comfortable paying the premium. I’ll be making other coverage plans.”

This keeps communication firm and focused without escalating conflict.

When To Consult A Lawyer

Speak to a lawyer if your ex claims you’re legally obligated or threatens action. An attorney can review any documents, advise on your rights, and help resolve disputes. One consultation can clarify whether there’s any risk—or confirm you have no legal duties at all.

Tingey Injury Law Firm, Unsplash

Tingey Injury Law Firm, Unsplash

The Risk of Staying on His Plan

Remaining on a plan when you’re no longer eligible can backfire. If the insurer discovers the issue, they might cancel coverage retroactively and deny claims. That could leave you responsible for medical bills you thought were covered. Avoid this by securing your own valid plan.

Document Everything

Keep a record of all communications, especially if things become contentious. Save texts or emails where your ex makes demands or outlines expectations. If you make a payment, log it. A documented paper trail protects you if the situation escalates or legal advice becomes necessary.

You Don't Owe Them Anything

Unless you signed a formal agreement, you’re likely not legally obligated to pay your ex’s insurance premium. Make a clean break by finding your own coverage and setting financial boundaries. Legal clarity and personal independence will serve you far better than lingering attachments or informal promises.

You May Also Like:

America's Biggest—And Most Despicable Class-Action Lawsuits

Managed Vs. Self-Directed Investment Portfolios: Which Is Right For You?