Barely Holding On

Money problems don’t always create chaos. Sometimes they create restraint. Inside these spaces, choices are delayed, comfort is minimized, and everything revolves around getting through the next stretch without falling further behind.

Unopened Bills

Picture walking into someone's kitchen and spotting a pile of envelopes gathering dust on the counter, many stamped with "FINAL NOTICE" in bold red letters. People deliberately avoid opening bills when they know they can't pay them, creating a psychological buffer against overwhelming anxiety.

Disconnection Notices

Those bright yellow or orange utility company warnings posted on doors or tucked behind magnets on refrigerators tell an urgent story. When you spot a disconnection notice, you're witnessing someone standing at the precipice—typically, these warnings arrive only after bills are 20 to 60 days overdue.

Disconnection Notices (Cont.)

Many utility companies offer payment plans and assistance programs, so receiving a shutoff notice usually means someone has already exhausted or avoided those options. Recent data from The Century Foundation shows that approximately 14 million American households, roughly one in twenty, face utility debt severe enough to risk disconnection.

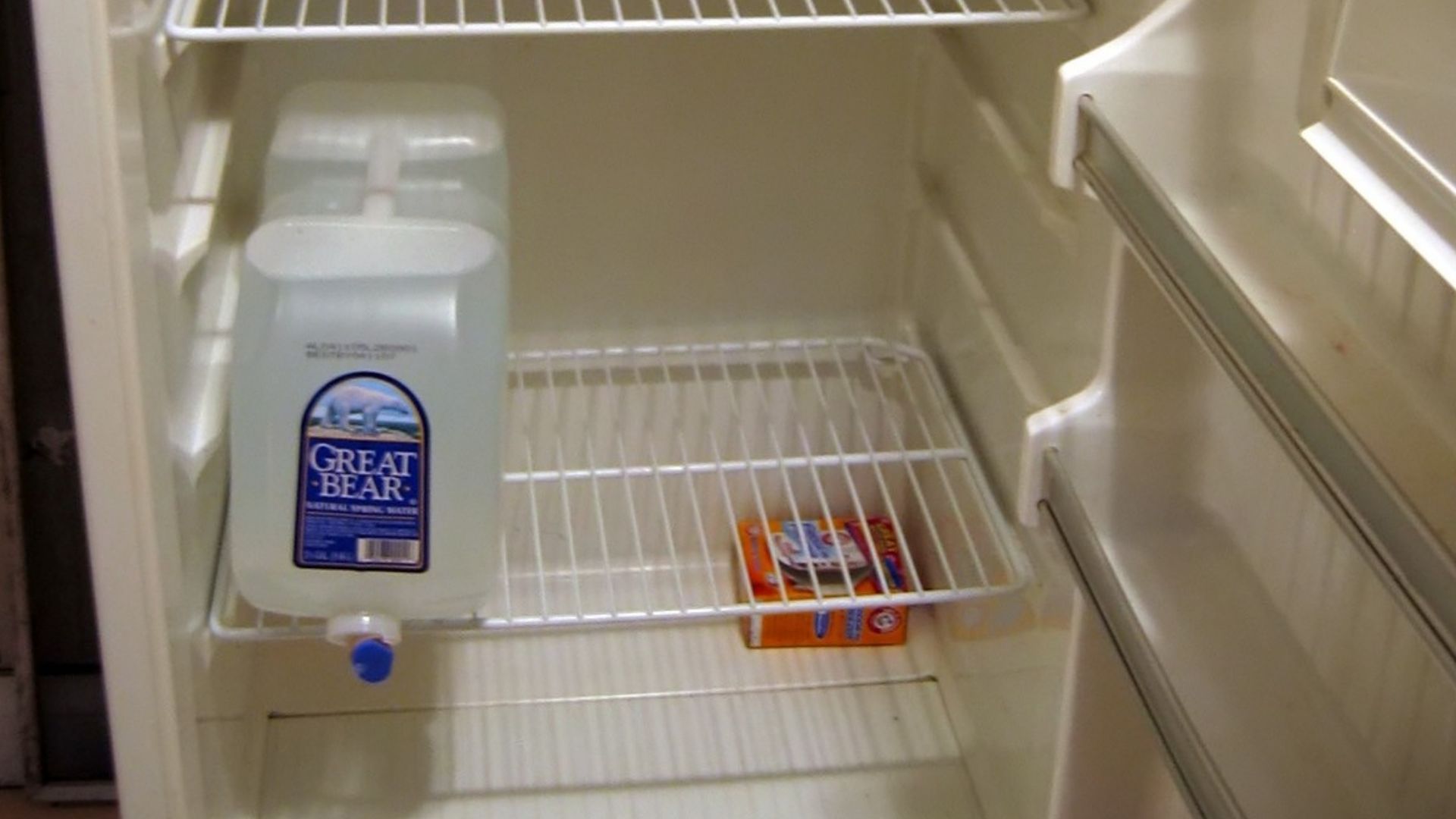

Empty Refrigerator

Unlike the stereotypical bachelor pad with takeout containers, a truly empty refrigerator in a family home signals that grocery shopping has become a luxury they can't afford. Financial counselors identify "food insecurity" as one of the most immediate indicators that someone is struggling to meet basic needs.

Payday Loan Receipts

Spot receipts from places like "Cash Money," "Quick Cash," or any storefront with "Advance" in the name, and you're looking at evidence of desperate borrowing. These aren't typical loans. Payday lenders charge an average of $15 per $100 borrowed.

Pawn Shop Tickets

Those small, pale yellow or pink tickets with item descriptions and loan amounts represent more than temporary cash solutions. They're markers of financial desperation. Pawn shops offer immediate cash in exchange for personal property, giving borrowers 30–90 days to repay with interest or lose their possessions forever.

Pawn Shop Tickets (Cont.)

When you see multiple pawn tickets, especially for sentimental items like wedding rings, musical instruments, or electronics, someone is liquidating their life piece by piece. The pawn industry has grown significantly, now a $14.5 billion business in America, with the average pawn loan hovering around $150.

Infrogmation of New Orleans, Wikimedia Commons

Infrogmation of New Orleans, Wikimedia Commons

Estate Sale Signs

Walking past a home with an "Estate Sale This Weekend" sign posted in the yard might seem like a treasure-hunting opportunity, but it often masks a financial crisis unfolding inside. While estate sales traditionally happen after someone passes away, they're increasingly being used by living homeowners desperately liquidating entire households to stay afloat.

Estate Sale Signs (Cont.)

Unlike casual garage sales where people offload unwanted clutter, estate sales involve professionals cataloging and pricing everything from bedroom sets to kitchen appliances, often because creditors are circling or foreclosure looms. The professionals take a hefty commission, but families accept this because they need cash immediately.

Selling Valuables Online

What distinguishes financial distress from simple decluttering is the volume and variety. People are not just selling one old TV; they're posting everything from wedding china to children's toys, often priced well below market value with phrases like "must sell today" or "cash only, pick up now”.

Selling Valuables Online (Cont.)

The listings pile up weekly, sometimes daily, each representing another piece of their life converted to immediate cash for rent, groceries, or keeping the lights on. You'll notice they're active on multiple platforms simultaneously, casting the widest possible net, and they respond to inquiries within minutes, regardless of the hour.

Overdue Rent Notices

That official-looking paper taped to someone's door or slipped under is a pay-or-quit notice, the legal first step toward eviction. These notices usually appear after rent is five to ten days late, and they give tenants a specific timeframe to pay the full amount owed plus late fees.

Overdue Rent Notices (Cont.)

The presence of multiple notices over several months tells an even grimmer story: this person is constantly scrambling, maybe scraping together partial payments that buy them another few weeks before the cycle repeats. Some landlords are more patient than others, but the accumulation of notices means patience is wearing thin.

Broken Appliances

The washing machine has been broken for three months, so laundry gets done in the bathtub or at a friend's house when they're not home. The microwave sparks, but still technically works if you're careful. The refrigerator makes concerning noises and runs constantly, but cannot be replaced for obvious reasons.

Budget Brand Everything

There's this specific kind of sadness that comes from a home where literally everything is the cheapest possible version of itself. Not "smart shopping" cheap or "I found a great deal" cheap, but "this is genuinely all I can afford" cheap.

Extension Cords Everywhere

Notice power strips and extension cords snaking through every room, not because someone has too many devices, but because they're strategically heating or cooling only the spaces they absolutely must use. One space heater gets dragged from room to room instead of turning on the central heating.

Final Warning Letters

Credit card companies, medical billing offices, and loan servicers send these after multiple unsuccessful attempts to collect payment, usually after sixty to ninety days of silence. Unlike regular monthly statements, final notices carry real consequences.

Final Warning Letters (Cont.)

They threaten legal action, promise to report delinquencies to credit bureaus, or warn that accounts will be charged off and sold to aggressive third-party collectors. Such envelopes are usually marked "FINAL NOTICE," "URGENT," or "ACTION REQUIRED" in bold red ink.

Borrowed Items

Look closely, and you'll notice things that don't quite belong. It could be a neighbor's vacuum cleaner that's been "borrowed" for two months, a sibling's old pots and pans filling the kitchen, a coworker's hand-me-down winter coat hanging by the door.

Borrowed Items (Cont.)

These aren't casual temporary loans between friends; they're indefinite arrangements born from not being able to afford basic necessities. The person keeps promising to return items "soon," but everyone knows there's no timeline because purchasing replacements isn't financially possible. Sometimes they even borrow groceries.

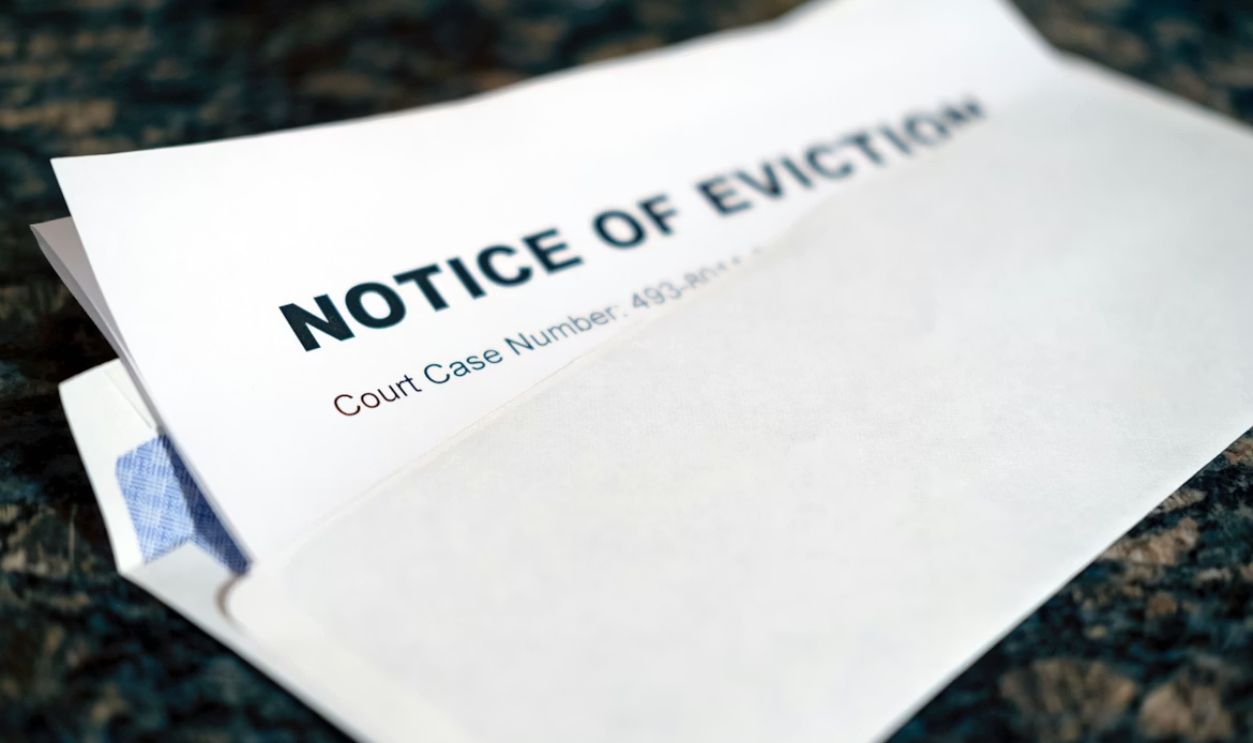

Eviction Papers

The last legal stage before homelessness is symbolized by those formal court documents, which are tacked to a bulletin board or strewn across a table with case numbers and hearing dates. Several attempts have already failed by the time eviction papers are sent. The legal system is now engaged.

Return Labels Everywhere

Return labels piling up are a quiet sign of money stress. People buy items hoping they’ll work, then panic when the charge hits. Sending things back becomes damage control, delaying reality, juggling balances, and stretching a budget that’s already running on fumes.

Collection Letters

Letters from agencies with names like "National Recovery Systems" or "Accelerated Bureau of Collections" aren't from the original creditor anymore. The debt has been sold, often for pennies on the dollar, to companies whose entire business model involves harassment and intimidation.

Expired Food

Opening someone's pantry reveals a telling pattern: cans of soup expired in 2023, boxes of pasta from last year, condiment bottles with dates long past. This isn't about forgetting to check dates or being careless. When groceries become unaffordable, people buy what they can when they can.