Don't Leave These Assets To Your Loved Ones After You're Gone

We know it's hard to consider that you might not be around one day. However, estate planning is one of the critical parts of the latter years of your life. Maybe you're at the stage where you're considering getting your affairs in order and are wondering what the best things you could leave for your loved ones are. Let's go over some of the worst assets you could leave a loved one, and why.

When Should You Start Planning Your Estate Dispersal?

But before we discuss which assets not to leave to your friends and family, let's discuss when you should start conducting estate planning. We understand that estate planning can be a difficult subject, but it's important that you tackle matters like inheritance sooner, rather than later in life.

Revisit Your Estate Dispersal Every Three To Five Years

It's a good idea to revisit your estate dispersal plan every three to five years after you create it. Relationships change, life changes, and things might differ a few years later from where they were when you first drew up your will. Big life events, or a sudden onset of illness, are also good times to revisit your estate plan.

So, What Shouldn't You Leave To Your Children Or Grandchildren?

We would all like to set our loved ones up for success once we're no longer around, but these assets that you may consider putting in your will could be more of a hassle or hindrance than their worth. Leave them out, donate them, or leave them to the state.

Timeshares

People like to leave their kids and grandkids their timeshares. These are properties in other countries that are long-term—we're talking decades or whole-life—where you agree to rent out an annual trip to a resort or vacation home. When you pass away, your kids will inherit the timeshare, along with the ever-increasing contract costs of that timeshare. Leave it up to them once you're gone.

A Note On Timeshares

Your kids may want to take one last memorial trip to the timeshare property. If they do this after they've declared their refusal to accept the contract, they may void that refusal and be forced to keep the property for the length of the contract. Let the timeshare go when you do.

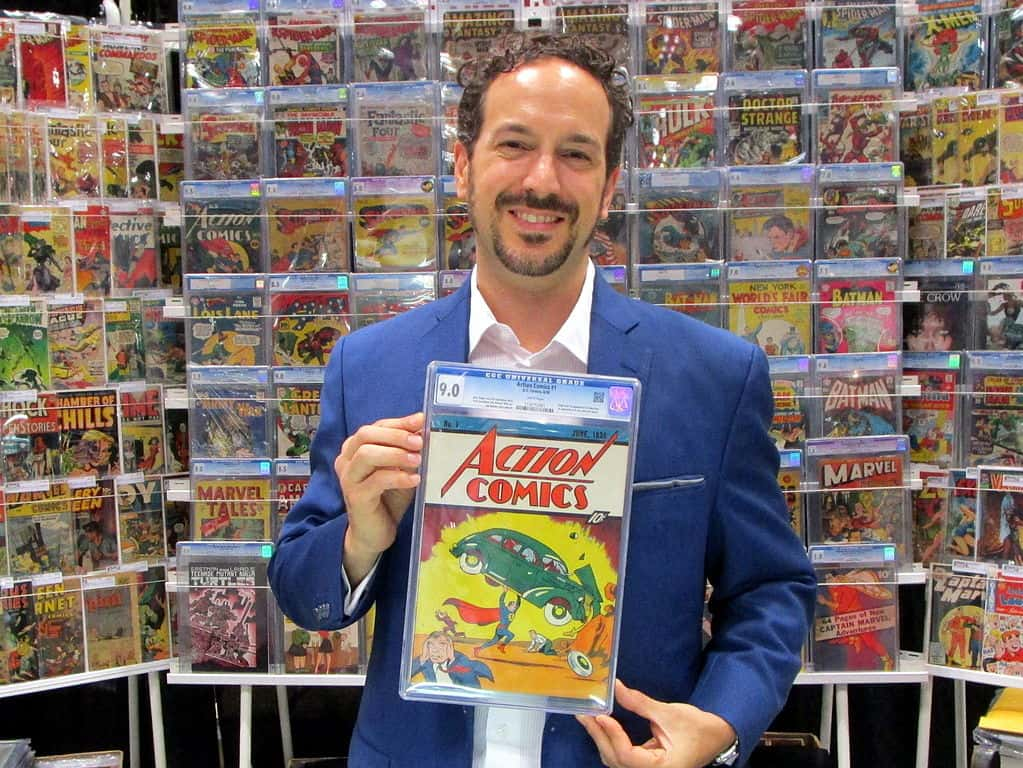

Potentially Valuable Collectibles

What's the harm in leaving the kids a valuable collectible set? Well, unfortunately, that particularly valuable item or items are subject to 28% tax when they're sold, as that's the capital gains tax rate on collectibles. There's not just the increased taxes they'll face, they could lose or damage the items and can be tough to value. It's better to cash-in on your collectibles before you go and give your heirs the cash.

Operating Businesses

You may have been a very successful business owner, but that doesn't mean everyone in your family will be. Unless you've got a family member trained up and prepared to take over the business, it's not a good idea to leave a fully-functioning business in the hands of the inexperienced. It may be better to sell the business before you pass away, leaving them with the cash from the sale instead.

Vacation Properties

Timeshares may be an administrative nightmare, but leaving a particular family member a vacation property over and above another family member could cause inter-familial strife that nobody wants. Especially when they're grieving. Who gets your summer cottage, then? Well, if everyone is on good terms, it may still be a bad idea to leave family members with an asset that they can't maintain. You don't want to leave them with an anvil.

Physical Property With Sentimental Value

Physical property that has sentimental value is another thing that could cause a fight. Who gets to keep Dad's military uniform? Or Mom's wedding ring? Even if siblings don't fight over it, trying to sell jewellery is tough and it loses its value pretty quickly once you're trying to sell it. Try to offload things of sentimental value before you leave this world, it's easier for everyone.

Tax-Deferred Bank Accounts

Unless it's a Roth IRA, leaving your loved ones with a tax-deferred bank account isn't always the best idea. If you're in a lower tax bracket than your children, rather than leaving them a bank account which will increase their overall taxable income, why don't you defer IRA withdrawals over a few years? Spreading out the taxable income will mean they never see a spike in their tax bracket.

High-Maintenance Real Estate

Real estate can be a great asset to leave to your kids, but not if it comes with exorbitant maintenance costs. It's not your fault that you bought a fixer-upper a decade ago and then illness came calling, but it's not a good idea to leave your kids with a high-maintenance real estate project that they didn't ask for, or know how to navigate. Sell, then leave them the profits.

Health Savings Account

Another income-centric suggestion to not leave to your children is your Health Savings Account. An HSA can be beneficial for a spouse, because they qualify to continue to use the money for medical expenses without incurring taxable income for that year. However, the same is not true of your children. The HSA amount would add to their taxable income for the year.

Illiquid Investments

Illiquid investments are investments that cannot be turned into cash immediately. These are things like high-interest fixed-term mortgages, long-term fixed-term bank accounts like Certificates of Deposit accounts, or things like private equity. Sell these investments and convert them to cash, or transfer them to a more liquid form, like a high-interest savings account.

Not Simplifying Your Investment Portfolio

If your investment portfolio contains complex financial instruments like derivatives or certain structured products, or anything else that's highly financially complicated, unburden your significant other/kids/grandkids of these by turning them into a simpler investment portfolio that you can then hand over with ease.

Intellectual Property Without Commercial Opportunity

Intellectual property law is complicated, but it's not always the key to generating wealth for future generations. Your ideas and intellectual property could have significant value, but if they don't have the commercial opportunity, or the persons with the knowledge to bring them to market, then they'll be wasted. Sell or license your IP before you kick the bucket.

Cryptocurrencies Or Digital Assets

Cryptocurrencies or other digital assets are reasonably speculative and difficult to keep track of at the best of times. These complicated forms of currency can be volatile. You'd be better off leaving your kids or significant other with a healthy Roth IRA investment portfolio.

Uninsured Assets

Any asset that's uninsured is a big no-no to leave to your significant other or children. Things happen. Houses burn down, cars get T-boned...but not having insurance will mean that your significant other or children won't have any recourse if the worst happens to an uninsured asset that you left them in your will.

You May Also Like:

Drawing Financial Boundaries With Family & Friends