California Ranks Third Place

California consistently ranks within the top five states with the highest living costs, but according to Forbes magazine, it’s currently sitting in third place behind Hawaii and Massachusetts.

With an average cost-of-living nearing $60,000 annually, it’s no wonder the state lost almost a million residents in recent years.

Statistics

The Los Angeles Times reported that people leaving California outnumbered newcomers by more than 700,000 between April 2020 and July 2022.

Between 2021 and 2022, roughly 818,000 California residents moved out of state, according to recent data from the U.S. Census Bureau.

Businesses

A report by the Hoover Institution shows that between 2018 and 2022, 352 businesses left California and moved their headquarters to a different state.

Businesses: Reasons for Leaving

The report listed high rent, high taxes, high costs of living for employees, and red tape as just a few of the reasons cited by business owners.

Current Cost of Living in California

According the Bureau of Economic Analysis, the annual average cost of living in California in 2021 was $53,082. Based on that number, it would cost $4,423 per month to live in California, with only your basic necessities.

And those are just your basic needs.

Cost of Living Breakdown

Here is the average annual per-capita cost for each major spending category:

Housing and Utilities: $9,972

Health Care: $8,501

Food and Beverages (non-restaurant): $3,865

Gas and Energy Goods: $1,039

All Other Personal Expenditures: $29,704

Housing Costs

According to Zillow, the average home price in California is $747,400.

It’s difficult to find a rental for less than $1,000/month, despite the fact the state has over 14 million housing units.

Housing Costs Breakdown

Here’s a breakdown of median monthly housing costs, according to 2021 data from the U.S. Census Bureau:

Median monthly mortgage cost: $2,548

Median studio rent: $1,360

Median one-bedroom rent: $1,525

Housing Costs Breakdown: Continued

Median two-bedroom rent: $1,797

Median three-bedroom rent: $2,001

Median four-bedroom rent: $2,399

Median five-bedroom (or more) rent: $2,649

Median gross rent: $1,750

Housing Costs by City

Home prices in California vary greatly by city. Prices range from $313,406 in Visalia to $1.4million in San Jose.

Housing Costs in Major Cities

The top 5 most expensive major cities in California are:

San Jose: $1,385,816

San Francisco: $1,096,477

Santa Cruz: $1,089,574

Santa Maria: $862,493

Los Angeles: $855,851

Terry Lucas, CC BY 3.0, Wikimedia Commons

Terry Lucas, CC BY 3.0, Wikimedia Commons

Utility Costs

Utility costs cannot be ignored, as your basic needs require heat, hydro and water. The average utility costs in California are around $380 per month.

Utility Costs Breakdown

Keep in mind, these numbers reflect basic packages and average usage, and may change based on region.

Electricity: $124

Gas: $63

Cable & Internet: $117

Water: $76

Groceries & Food

The Bureau of Economic Analysis estimates that California’s average annual non-restaurant food cost per person is $3,865. That’s $322.08 per person, per month.

The average family of four could end up spending $1,288 per month on basic needs groceries.

Grocery Prices by City

As with rent and utilities, the food costs vary by city as well.

According to HelpAdvisor, California has three of the five most expensive cities in the US for grocery shopping: Riverside San Francisco, and Los Angeles.

An average weekly grocery haul in those cities averaged around $300 in 2023.

Transportation Costs

California residents spend a lot of time in the car due to the state’s notoriously bad traffic. The size of your family and how many working adults there are can greatly affect your transportation costs as well.

As well, transportation costs can include gas, vehicle repair and maintenance, and various public transit expenses.

All of these vary based on city.

Transportation Costs Breakdown

According to MIT’s Living Wage Calculator, for the first quarter of 2023, the average annual transportation cost for one adult with no children was just over $5,000.

The average for a family with two working adults and no children rose to about $9,500, and a family with two working adults and three children shot up to just over $15,000.

Healthcare Costs

Healthcare costs vary greatly based on individual needs, and personal coverage.

According to the 2021 Bureau of Economic Analysis Personal Consumption Expenditures by State report, the average annual cost of health care per Californian is $8,501.

Childcare Costs

For families with children, childcare costs are one of the larger monthly expenses.

The age of the children, as well as the style of childcare—home-based or public classroom—reflect the cost you’ll pay.

Childcare Costs Breakdown

Here is the average monthly cost per child for each basic type of childcare.

Infant Classroom: $1,785

Toddler Classroom: $1,388

Preschooler Classroom: $990

Home-based Family Child Care: $1,269

These numbers are astronomical. The good news is, the state plans to have free universal childcare for pre-K to age four by 2025.

Taxes

Let’s not forget about taxes. State income taxes can go as high as 13.3% for those at the top of the income scale—which is the highest state income tax in the country.

Gas Prices

According to AAA, the current average price for regular gasoline in California is $4.574 per gallon (Premium is $4.949).

The National average sits at $3.145 per gallon as of February 2024.

Cities With a Low Cost of Living in California

According to the Council for Community and Economic Research’s Cost of Living Index for the 2022, the three least expensive cities in California are: Bakersfield, Stockton, and Sacramento.

Bakersfield, California

Bakersfield received a score of 109.6 on the cost-of-living index, meaning you’ll find relative affordability there. Redfin reported a median home sale price of $361,250 in early 2023.

Stockton, California

Stockton is the fourth most-affordable city in California, with a score of 122.6 on the cost-of-living index. Redfin gave a median home sale price of $385,000 in early 2023.

Sacramento, California

Sacramento is the third most-affordable city in California, with a cost-of-living index score of 118.7. Redfin showed a median home sale price of $439,500 in early 2023.

Income

California also has the nation’s fourth-highest level of income disparity, meaning incomes are not well balanced within the state.

This explains why California also has the highest level of poverty in the country.

Poverty

Nearly a third of California residents are living in poverty, according to the Public Policy Institute of California.

Without the recently added federal safety net programs, the poverty rate in California would climb by more than eight percentage points.

Debt

Another aspect to California’s high living costs and high poverty rates is the high levels of debt.

According to the Federal Reserve Bank of New York, Americans have created $17.3 trillion in debt. California owes close to $3 trillion of that alone.

This is due to large mortgages needed for the high housing costs.

Debt: Mortgages

Back to the housing topic, California residents are said to be carrying the most debt out of any state, driven by an average mortgage of $422,909 for home owners.

Interestingly enough, a third of the state’s homeowners do not have mortgages at all.

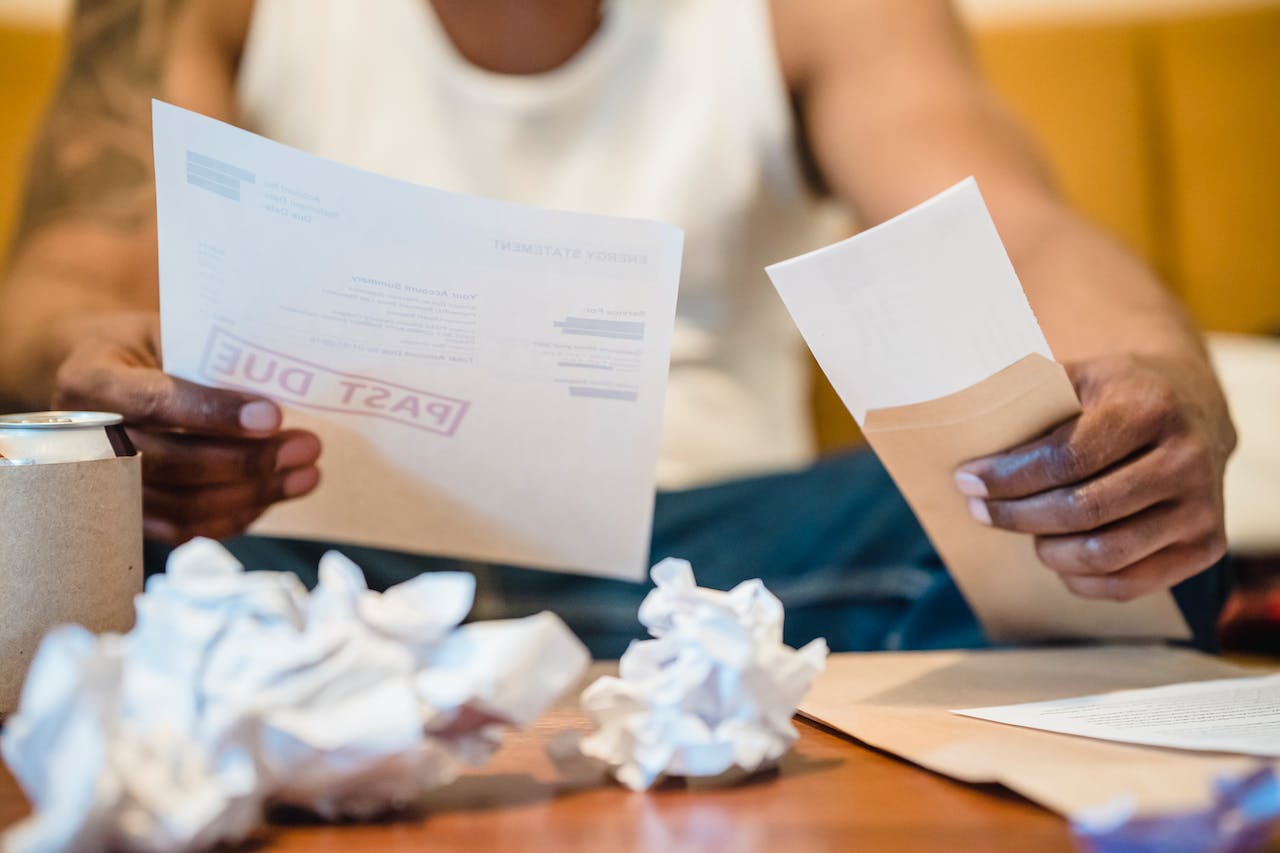

Debt: Rent

Rent is another story. With the average rent costing $1,800+ for basic apartments, it’s no surprise that a whopping 9 million renters in California are behind on their rent.

Strangely enough, the state’s bankruptcy rate is well below the national average.

Where People Are Relocating

As we now know, hundreds of thousands of people are leaving California for more affordable states.

A study by the U.S. Census Bureau suggests that the top five states people seem to be going to are Texas, Arizona, Florida, Washington and Nevada.

Final Thoughts

California’s unique combination of high living costs, high poverty, and high debt all play a part in why Americans are choosing to leave the Golden State.

With each year that passes, there are more people moving out than there are moving in.