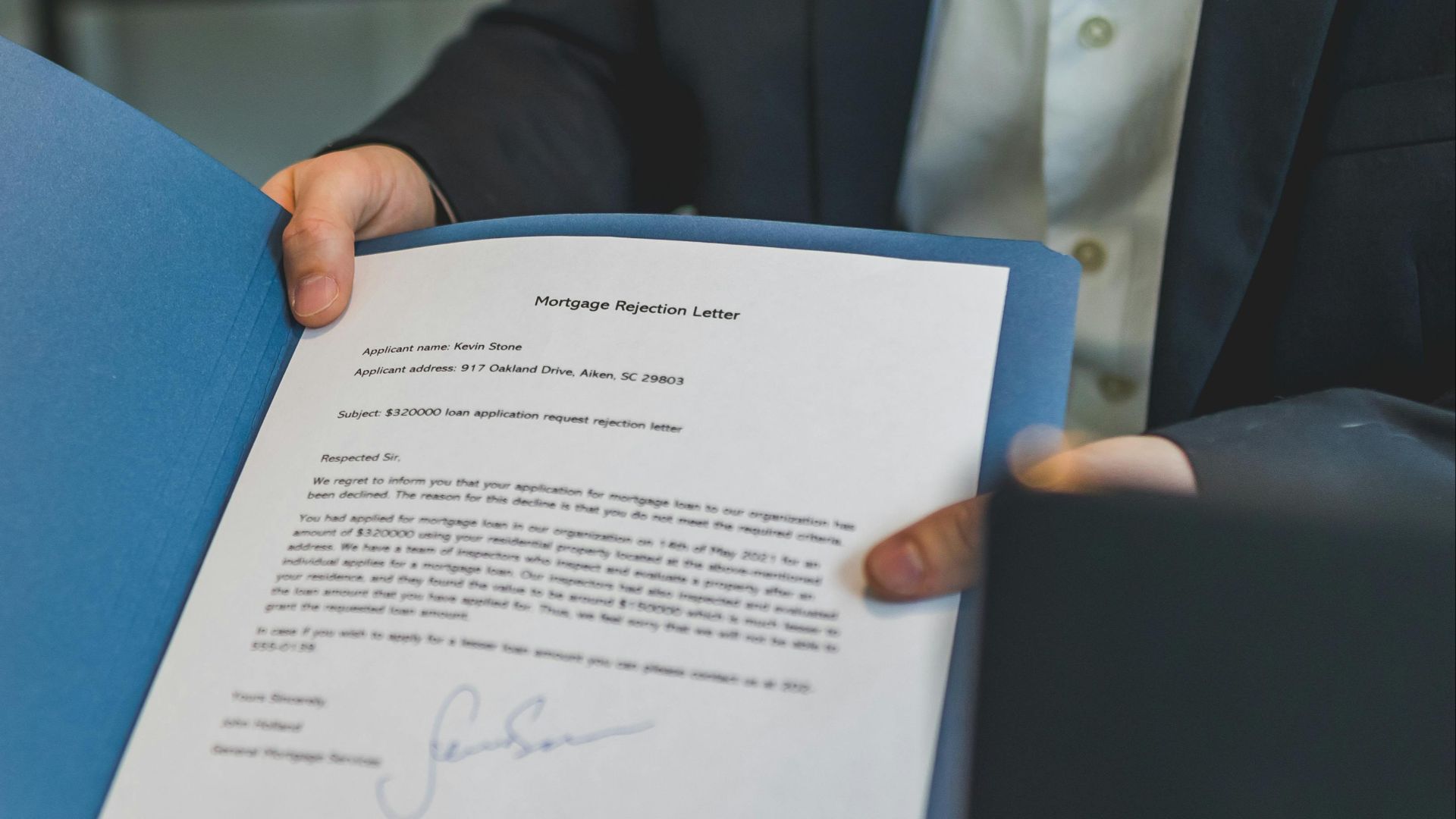

How To Improve Your Credit Score

Most people think their credit score is the be-all and end-all of loan approval. In reality, lenders are looking far beyond that number. Here are 40 of the real factors that can influence your chances, and what you can do about them.

A Long Job History Builds Trust

Lenders love consistency. If you’ve been with the same employer for at least two years, it suggests you’re financially stable and less likely to default. A longer job history can also help offset other weaknesses in your application.

Frequent Job Hopping Raises Eyebrows

Changing jobs every few months could be a red flag. Lenders may worry that unstable employment means unstable income. Gaps or rapid transitions may require extra documentation to explain.

If You Are Self-Employed, Expect Extra Paperwork

Freelancers and business owners often face more scrutiny. You’ll likely need to show tax returns, bank statements, or client invoices. The burden of proof for income consistency is higher when you're your own boss.

Income Isn’t Just Your Paycheque

Beyond wages, lenders may accept government benefits, pensions, and spousal income. This is especially true for applicants over 21. Demonstrating diverse income sources can improve your overall profile.

If You’re Under 21, You’ll Need Earned Income

Young applicants are usually required to prove they make their own money. Household income doesn’t usually count unless you’re a co-signer. Earning power is critical for younger borrowers without much credit history.

Your Credit Score Is Just The Start

That number gives a quick glance at your credit health. But lenders will always dig deeper into your full credit report. They want the full story, not just the headline.

They Check For More Than Missed Payments

Delinquencies, bankruptcies, and collections can all hurt your chances. Even if your score has since improved, these events stay on your record. Lenders see them as signs of past financial instability.

One Black Mark Can Linger

A single missed payment or default can raise questions. Some lenders weigh these issues more heavily than others. It often depends on how recent and how serious the issue was.

Credit History Reveals Your Patterns

Even with a good score, lenders want to see how you got there. A clean track record matters more than a sudden spike. Long-term behavior paints a more reliable picture.

Your Debt-to-Income Ratio Speaks Volumes

This ratio shows how much of your income goes toward paying off debt. Most lenders want it below 50%, while mortgage lenders may require it under 43%. It’s a key metric for assessing affordability.

High DTI May Mean You Might Be Overextended

A high ratio doesn’t just look bad, it suggests you’re relying too heavily on credit. That can scare lenders away. It may also indicate future payment difficulties.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Assets Can Be A Game-Changer

Savings, investments, and property can strengthen your application. They show you’re prepared for emergencies and manage money well. Assets can offset a lower score or higher DTI.

Liquid Cash Builds Confidence

Lenders like to see accessible funds in your bank account. It suggests you won’t miss payments due to short-term hiccups. Cash reserves provide a financial cushion.

They May Ask To See Your Bank Activity

Some lenders want to check your cash flow directly. Linking your bank account lets them assess your spending and saving habits. Consistent deposits and balanced expenses work in your favor.

Collateral Can Tip The Scales

If your loan is secured by an asset, like a car or home, the lender will assess its value. The more valuable and well-maintained the collateral, the lower the lender’s risk. This can improve your loan terms.

Not All Assets Are Equal

Newer or more valuable assets offer more security to lenders. A well-maintained home or newer car can qualify for better rates. Older or depreciating assets carry more risk.

Housing Stability Carries Weight

Whether you’re renting or owning, what matters is how stable your living situation is. Frequent moves may raise red flags. A long-term lease or homeownership reflects reliability.

Rent Doesn’t Always Show Up On Reports

Your rent payment history often isn't on your credit report. Lenders may ask for it directly to get a fuller picture. Showing on-time rent can help bolster your application.

Lenders Look For Overall Responsibility

A great score won’t help much if the rest of your application suggests poor judgment. Lenders assess the full financial ecosystem. They want to see that your habits match your numbers.

Inconsistent Applications Raise Red Flags

Even small discrepancies in your paperwork can delay or derail approval. Lenders expect accuracy and honesty. Sloppy applications suggest a lack of care or reliability.

Late Payments Hit Where It Hurts

Your payment history is one of the most important credit factors. Lenders view consistent, on-time payments as a sign of trustworthiness. Even one late payment can trigger concern.

Even Utilities Can Count In The Wrong Way

Most utility bills aren’t reported until you fall behind. At that point, they may show up as collections. That can significantly hurt your score.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Renters Can Now Get Credit For On-Time Payments

Some services let you report rent and utility payments. This can raise your score if you’re consistent. It’s especially helpful for people with thin credit files.

Credit Utilization Is Key

Using too much of your available credit lowers your score. Try to keep usage under 30%, and ideally under 10%. Low utilization shows lenders you’re not financially strained.

Closing Cards Can Backfire

Canceling a credit card reduces your available credit. This can spike your utilization ratio. It may also shorten your credit history.

Your Oldest Account Has Weight

Long credit histories suggest reliability. Closing your oldest account could lower your average age of credit. That can hurt your score even years later.

Secured Credit Cards Can Help You Rebuild

Secured cards are great for establishing or repairing credit. Your deposit becomes your limit, making it safer for the lender. On-time payments help you build trust.

Hard Inquiries Aren’t Always Harmless

Each time you apply for credit, it shows up as a hard inquiry. Too many in a short period can lower your score. Lenders may also question why you’re applying so frequently.

Rate Shopping Is An Exception

Shopping for a mortgage or auto loan within a short window usually counts as one inquiry. Credit scoring models are designed to accommodate this. Still, keep your applications tightly grouped.

You Can Check Your Own Score Without Penalty

Soft inquiries don’t affect your score. You can monitor your credit regularly without worry. This is a great way to catch issues early.

Mistakes On Your Report Can Hurt You

Credit reports aren’t always accurate. Errors can damage your score and reduce your approval chances. Reviewing your report is a vital first step.

You Have The Right To Dispute Errors

If you see a mistake, you can file a dispute with the credit bureau. Providing documentation helps your case. Resolving errors can boost your score quickly.

You Actually Have Multiple Scores

Different credit bureaus use different scoring models. Your Equifax score may differ from your TransUnion score. Some lenders use proprietary models, too.

Not All Lenders Use The Same Score

Mortgage lenders may use older FICO models, while credit cards use newer ones. Knowing which score matters helps you prepare. Ask your lender what model they rely on.

Your Partner’s Score Isn’t Yours

Spouses don’t share credit scores or reports. Unless you co-sign or open joint accounts, your partner’s activity won’t affect you. However, it may impact joint applications.

Your Bills Might Not Be Building Credit

Most utility and internet companies don’t report positive payment history. Only missed or defaulted payments usually show up. Don’t count on bills to boost your score.

Rebuilding Credit Takes Patience

Good credit doesn’t happen overnight. Responsible habits must be sustained for months or years. Small, steady improvements matter most.

Better Credit Means Better Offers

Higher scores unlock better interest rates and credit limits. Even a modest improvement can save thousands. The financial upside is worth the effort.

A Good Score Isn’t A Guarantee

Lenders evaluate more than just numbers. Debt load, employment, and housing all play a role. A complete financial picture determines the final decision.

Start Preparing Before You Apply

Waiting until the last minute is risky. Pay down debt, fix errors, and organize documents early. Preparation is the best approval strategy.

You May Also Like:

What Affects Your Credit Score The Most

Ways To Improve Your Credit Score Fast