What Do You Do After You Blow Through An Inheritance & Are On The Brink Of Financial Ruin?

We've all made bad money decisions in our lives, whether buying that brand-new watch instead of paying off a credit card, or paying for dinner for a friend that didn't repay you after they promised they would. But few things match up to being given the gift of an inheritance, only to have nothing left a couple of years later. Here's what to do if you are on the brink of financial ruin after making terrible decisions with an inheritance.

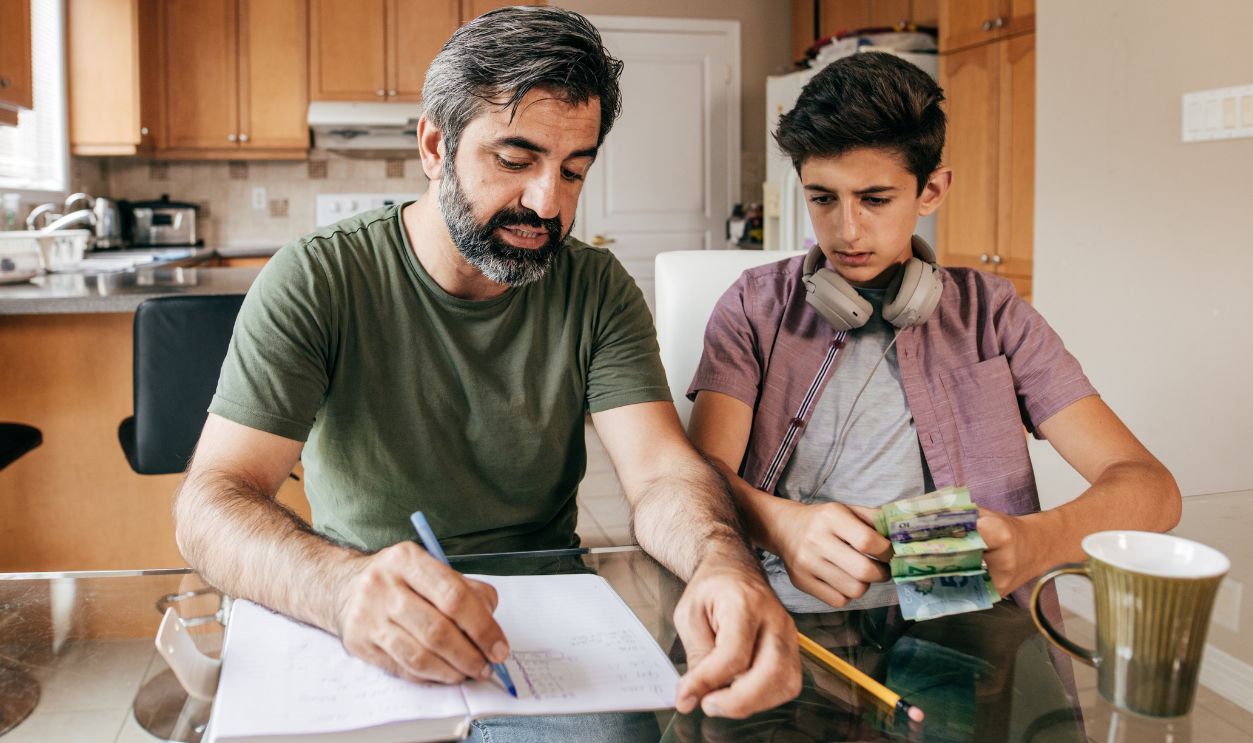

What To Do If You Receive A Large Inheritance

We could all use a helping hand sometimes; even a few extra hundred dollars a month would help most of us significantly. But what happens if a family member passes away unexpectedly, and you're suddenly in line to receive a large inheritance, say, over $50,000? What do you do now?

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Slow Down

You may be tempted to go out and make a big purchase after receiving a large inheritance, but that's not advisable. You should slow down and take your time with these next steps to avoid making rash decisions.

Assess Your Financial Situation

One of the first things you can do is assess your financial situation. Do you have a large debt that you could pay off right away? How much is left on your mortgage or student loans? Do you have any large purchases that you could make with some of this inheritance that would enhance your quality of life? Take the time to assess your financial situation. You can simply write out how much inheritance you've received and your current financial situation on paper or in an Excel spreadsheet.

Consult With A Professional

Once you've written this out, consult with a professional financial advisor. They will be able to help you set up a financial vision for what to do with your inheritance once the check or direct deposit lands in your bank account. Ensure this person has the heart of a teacher, rather than telling you what to do with your money.

Work Out Any Tax Implications

This inheritance may well put you in a larger income tax bracket, unless your state law prohibits any taxes on inheritance monies. If there are to be tax implications, discuss this with your financial advisor. Work out how you can use this money to better your tax situation down the road.

Pay Off Your Existing Debts

Using some of your inheritance to pay off any existing debt is a great way to build wealth in the future—even if it takes a good chunk of that inheritance to do so. By paying off your existing debt (with the possible exception of your mortgage), you'll be well on your way to a debt-free life, which can only mean one thing: financial growth.

Bank The Rest Until You Have A Plan

Once you've paid off any existing debt, it's important that you not touch the rest of your inheritance unless you have a specific purpose for it. It's very easy to spend money that you have, because you can see it in your bank account. We recommend parking the rest of your inheritance in an accessible savings account, like a money market fund, where it will grow in interest over time.

How People Waste Their Inheritances

Unfortunately, not everyone is so careful with their inheritance monies and over 70% of inheritances disappear by the second generation. Here are a few ways that people burn through an inheritance in no time at all.

Sitting On The Cash Long-Term

While you might not be spending your money like a person possessed, sitting on the cash long-term will mean that it will be spent eventually. Sitting on the money long-term is a wasteful strategy, it just takes longer for you to realize it.

Buying An Asset That You Can't Maintain

Lots of people will use some of their inheritance money to purchase high-cost assets, such as homes, cars, boats or other "toys" that they can't maintain for the long-term. While a home is an appreciating asset, everything else depreciates in value. Ensure you don't buy an asset with your inheritance that you can't maintain.

Holding Onto Inherited Property You Can't Afford

Sometimes our inheritance will come in the form of an inherited property. This can be wonderful if you've been searching for a home, but owning a home comes with significant costs that you might not be anticipating, especially if you've rented for much of your life, or owned a smaller property. Holding onto an inherited property that you can't afford will ultimately cost you more in the long run than selling it.

Not Diversifying Your Investments

If you're going to invest a portion of your inheritance, it's a bad idea to put it all in one place, like in a single stock or a piece of property. It's almost always best to diversify your investments so that if one part of your portfolio takes a dive, you're not losing (or at risk of losing) all of your inheritance.

Not Speaking To A Financial Planner

You can do all the research you want online, but there's no substitute for solid financial advice from a financial planner. Get yourself a good one and they'll make your money work for you. If you don't, you may find yourself facing down the barrel of financial ruin.

What To Do If You've Blown It All Already

But what do you do if you're already there? Like if you've been spending and spending your inheritance for a couple of years, and you turn around one day and your bank account has gone from $60,000 to $600 in no time, and suddenly you can't afford to make your all-too-large mortgage payments? Here's some advice to help you out.

It's Time To Go Back Into Survival Mode

You might not be able to believe that you're back to where you are, with no money in your accounts and having wasted so much wealth. But, there's no point in dwelling on that now. It's time to go into survival mode and get through the next month, wherein you'll come up with a plan to get yourself back on track.

Speak To Your Lender

It is imperative that you speak to your mortgage lender as soon as possible. The bank or mortgage lender can (and will) take steps to foreclose on your property, but you might be able to delay this with a simple conversation. Ask them if they'd consider a small mortgage interest loan to get you through the next month of payments.

Go Back To Basics

Once you've got a moratorium of sorts from your bank, it's time to go back to basics. We mean survival basics: food, water, shelter, etc. Go to your local food bank (to avoid touching your $600) and get yourself enough food and water for a week. You'll use that week well, don't worry.

Cut Out All Unnecessary Expenses

It's time to stop paying your unnecessary expenses immediately. Cut off Netflix, Hulu, Amazon Prime, etc. Close your account on Amazon to avoid the temptation—be ruthless with this. You may only save an extra $100 next month from doing this, but this is an emergency situation, every penny counts.

Find Work

If you've made the unfortunate mistake of quitting your job because you thought you wouldn't need it again, well, it's time to get back on that work train. You could look into working for your old company, particularly if you parted on good terms. Or, you could take a part-time job at a local grocery store or any other position that's hiring. You just need to find work and get an income stream going.

Look Online To Cut Out Your Car Expenses

Given that we're going "scorched earth" on our expenses until we get back on our feet, there are plenty of opportunities for online work, particularly if you're familiar with the space already. Check online job postings and apply to everything you think you'd be good at! If you find online work, you can significantly reduce your car-related expenses.

Sell Your Car

Unless you or your family needs your car right now, it might be a good time to consider selling it. We know it has sentimental value and maybe it's in really good shape—it could also be the reason you're in this mess to begin with! Sell the car and recoup whatever you can for it.

Eat Meagerly

Even Warren Buffett—the man who could afford absolutely anything he wants—advocates for eating meagerly, even if that means eating the same things over and over again. They're predictable expenses and most meals can be made far cheaper at home than going out. Absolutely no eating out whatsoever.

Start Working Again

Once you get yourself a job, you can start to breathe a little easier, but you're not out of the woods just yet. It's time to start working again and making money. Even if it's minimum wage, you have to make lifestyle sacrifices in the short-term. Once you get a steady paycheck, you can start to rebuild what you lost.

Use The Car Money To Build An Emergency Fund

Once the sale of your car is complete, you can use that money to rebuild your emergency fund. Now that you've learned the really tough lesson about inheritances, we hope that you'll be more careful with the emergency fund this time around. Start by saving $1,000.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Where To Store Your Emergency Fund?

You know that storing your emergency fund in a checking account is a terrible idea, so consider putting the emergency fund money into something a little less enticing, like a redeemable Certificate of Deposit account (you'll have to actually go into your bank to withdraw the funds). If it stays in there, it earns 4-6% interest.

Pay Off Your Debts

If you've accrued debts as a result of losing almost all of your inheritance money (despite at one point being debt-free), you'll need to pay those off as the next step to rebuilding your personal wealth. Start with highest-interest debt first, then use the capital gained from that debt pay-off to move onto the next highest-interest debt item. This is known as the debt snowball method. You should do this for all your debts with the exception of your mortgage.

Grow Your Emergency Fund

Once you've got $1,000 saved up, it becomes easier to save up a fully funded emergency fund of three to six months' worth of expenses. You'll be able to funnel more money into the three- to six-month emergency fund once you've paid off all your debts.

Once You're Debt Free & Have A Fully Funded Emergency Fund...

Then, and only then, can you start looking at purchasing things like a car, or starting to save again for your retirement. In general, becoming debt-free and rebuilding that fully funded account can take a couple of years, but once you get back to that place, even if you aren't as wealthy as you were when you had your inheritance, you're still starting from a financial "Ground Zero".

Invest In Your Retirement (Again)

Once you've got yourself relatively financially stable, it's time to start re-investing in your own retirement, particularly if you didn't do this when you received your inheritance. Open a Roth IRA account and begin monthly contributions that are automated.

Invest In Your Children's Education

Another automatic investment you can make if you've got kids is to invest in a 529 Plan. This is a form of education savings account that the government matches your contributions to. Speak with your bank about opening a 529 Plan and setting up monthly payments to that as well.

Invest In The Stock Market

We understand if you're super risk-averse after your last experience, particularly if the stock market was what burned your inheritance down the last time, but this time will be different. You'll be smarter about it. Build up an amount in a savings account that you're willing to invest in the stock market. Once you have this amount, invest with the help of an investment advisor.

Kaptan Ravi Thakkar, CC BY-SA 4.0, Wikimedia Commons

Kaptan Ravi Thakkar, CC BY-SA 4.0, Wikimedia Commons

Choose Diverse Stock Portfolios

We've already talked about the importance of investment diversity above, so we won't rehash it, but it's important that you choose a diverse stock portfolio this time around. Try out low-risk investments like money market funds or low-risk ETFs.

Congrats On Making It Back From The Brink. Learn Your Lesson!

Congratulations on getting yourself into and out of debt; now you're back in good financial health and can start re-saving for retirement again and putting money aside for your kids' college fund. Having been to the brink of financial ruin, we trust you've learned your lesson and won't put yourself in that situation ever again.

You May Also Like:

Sources: , , ,