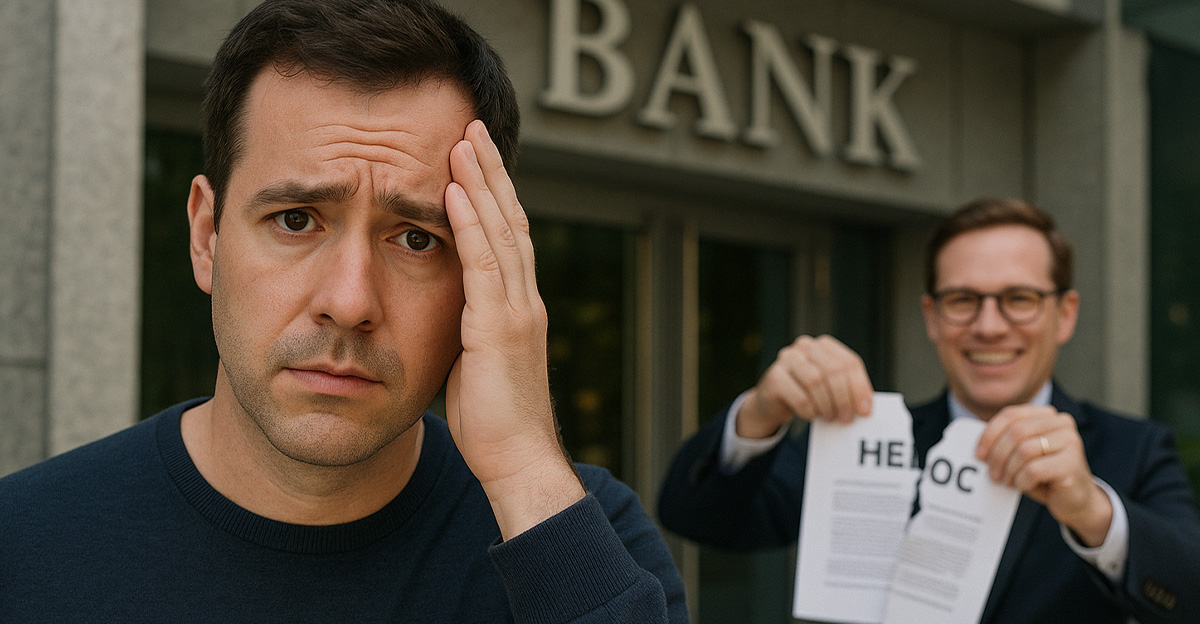

Help! My HELOC Just Became a Headache

You took out a Home Equity Line of Credit (HELOC) to transform your house into something out of a renovation show, and everything seemed great—until the Federal Reserve sent interest rates soaring. Now your HELOC feels less like a smart financial tool and more like a straitjacket. The good news is that you still have options, and by understanding them step by step, you can chart a path out of this financial squeeze.

What Exactly Is a HELOC?

A HELOC is a revolving credit line secured by your home, which means you can borrow against the equity you’ve built and use the funds as needed during a draw period, usually lasting five to ten years. Unlike a fixed loan, you pay interest only on what you use, which can be convenient when financing projects such as a home renovation.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Why Your Payment Suddenly Exploded

The sting you’re feeling comes from the fact that HELOCs usually carry variable interest rates, which means they rise and fall along with broader market rates. When benchmark interest rates increased, your lender adjusted your HELOC accordingly, which could mean that a loan balance of $50,000 that once cost you 4% is now sitting at 9% or more, nearly doubling your monthly payments overnight.

First Step: Assess The Damage

Before panicking, it’s crucial to sit down with the numbers and see exactly what you’re facing. Calculate your current balance, note the new interest rate, and compare your minimum payment with what your budget realistically allows. Knowing the full scope of the challenge will put you in a position to make informed decisions rather than reacting blindly.

Contact Your Lender Immediately

Although it may feel intimidating, your lender is usually more interested in working with you than in pursuing foreclosure. Calling them early to explain your situation can open the door to temporary hardship programs, interest-only payment extensions, or even negotiated rate adjustments that give you some breathing room.

Explore Loan Modification

In many cases, lenders offer loan modification programs that reshape the loan so you can keep paying without drowning. These modifications might involve extending your repayment period, switching from a variable rate to a fixed rate, or lowering your monthly payments so they better align with your income.

Consider Refinancing The HELOC

If your credit remains strong and your home has retained or gained value, you may be able to refinance your HELOC into a fixed-rate home equity loan or even roll it into a new mortgage through a cash-out refinance. While refinancing usually comes with closing costs, the stability of a locked-in rate can protect you from future spikes and give you peace of mind.

Tap Into A Balance Transfer (With Caution)

Another short-term strategy could involve moving a portion of your HELOC balance to a credit card with a 0% introductory APR balance transfer offer, giving you a year or more of interest relief. While this can buy time, it also comes with transfer fees, the risk of high post-promo rates, and the shift from secured debt to unsecured debt, making it a move that must be executed carefully.

Check If You Qualify For Assistance Programs

Federal, state, and local programs may offer relief if you meet income or hardship criteria. The Homeowner Assistance Fund (HAF), for instance, was designed to help homeowners facing pandemic-related financial challenges, and various nonprofit housing agencies continue to provide aid and counseling for those caught in today’s high-rate squeeze.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Downsizing Expenses May Bridge The Gap

Sometimes the most immediate solution is simply to free up cash flow by tightening your household budget. Canceling unused subscriptions, negotiating lower rates on insurance or cell phone plans, trimming discretionary spending, and even picking up extra freelance or gig work can collectively close the gap between what you owe and what you can pay.

Cast of Thousands, Shutterstock

Cast of Thousands, Shutterstock

Should You Sell?

While selling your home is hardly anyone’s first choice, it can be a financially responsible move if payments have become entirely unmanageable. By selling in a still-strong housing market, you could pay off the HELOC balance in full and walk away with equity, which is far better than risking foreclosure and damage to your financial future.

Beware Of The Minimum Payment Trap

Some HELOCs allow interest-only payments, which at first glance may look like a lifeline because they lower what you owe each month. But relying on this option without a long-term plan means you will make no progress on the principal, and years later you could still owe nearly the same amount—or even more if rates climb again.

Don’t Ignore Tax Implications

One silver lining is that HELOC interest is sometimes tax-deductible, but only if the borrowed funds were used to buy, build, or substantially improve your home. Since you used your HELOC to renovate, you likely qualify for this deduction, which can ease the net cost of borrowing if you take advantage of it during tax season.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Watch Out For Predatory Solutions

In times of stress, it’s easy to fall for offers that sound too good to be true. Unfortunately, predatory companies promise miracle fixes for a fee but often deliver nothing. The best path forward is to stick with reputable lenders, government-backed programs, or nonprofit credit counselors who are legally obligated to work in your best interest.

Can You Lock In A Fixed Rate?

Some HELOC agreements actually contain a conversion option that allows you to shift part or all of your balance to a fixed rate without refinancing entirely. If you’ve never read the fine print on your loan paperwork, now is the time—it could contain a built-in safeguard you didn’t realize you had.

Talk To A HUD-Approved Housing Counselor

HUD-approved housing counselors are trained to help homeowners in financial distress by reviewing your loan documents, outlining your options, and even communicating directly with your lender on your behalf. Having this kind of advocate in your corner can remove much of the stress and uncertainty of navigating the process alone.

Consider A Personal Loan

If your credit profile is still strong, another alternative is to take out a personal loan at a lower fixed rate than your current HELOC. This can consolidate some of your balance into a predictable monthly payment, but you must be careful to compare rates and terms to ensure you aren’t simply trading one financial headache for another.

Protect Your Credit Score

Throughout this process, protecting your credit score should remain a priority. Even if you can’t make the full HELOC payment, continuing to pay something each month and avoiding late fees will soften the blow to your credit and help you preserve eligibility for refinancing or other relief options later.

Keep An Eye On The Fed

Although rates feel crushing now, monetary policy shifts are cyclical, and most economists agree that interest rates won’t rise forever. By monitoring Federal Reserve signals, you can make strategic decisions about whether to refinance now, wait for stabilization, or take temporary measures until the pressure eases.

The Bottom Line: You Have A Path Forward

Rising HELOC payments can be stressful, but they don’t mean financial doom. Between contacting your lender, exploring refinancing or loan modifications, tapping into assistance programs, and considering long-term moves such as selling, you have multiple ways to take control of the situation. Acting sooner rather than later ensures that your renovated home remains a source of pride and comfort rather than a financial anchor.