An Everyday Crisis

Microchips are at the center of modern life, powering cars, phones, appliances, data centers, industrial systems, and the economy as a whole. The global microchip shortage didn’t happen overnight. Instead, it unfolded through decades of manufacturing shifts, a pandemic shock, a sudden oversupply, and now a renewed shortage driven by artificial intelligence and bottomless computing demand.

Moving Offshore

Starting in the 90s, semiconductor companies moved their factories steadily away from the United States and Europe toward East Asia. Lower labor costs, government subsidies, and clustered supplier networks made Taiwan, South Korea, and China attractive locations, and a concentration of advanced fabrication capacity went on in a small number of geographic regions.

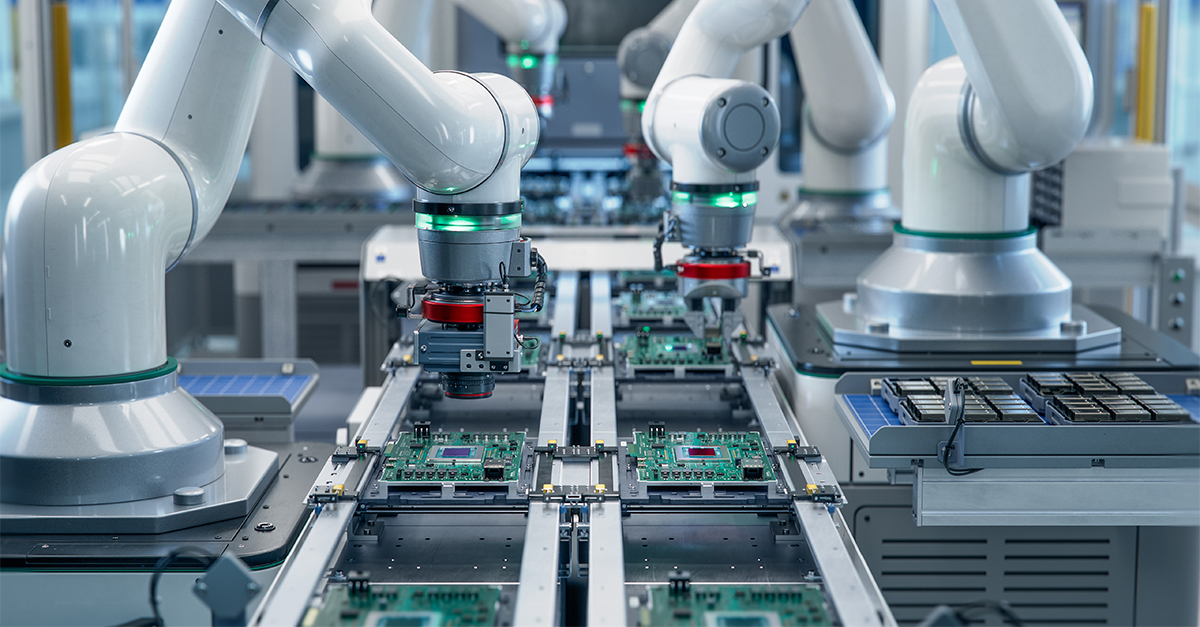

Foundry-Only Chip Makers

As chips grew in their complexity, many companies abandoned in-house manufacturing and relied on specialized foundries. Firms like TSMC and Samsung became dominant producers, while designers such as Apple, Nvidia, and Qualcomm remained squarely focused on chip design. This separation made the industry more efficient, but reduced redundancy across the global supply chain.

LIbby.Hoban, Wikimedia Commons

LIbby.Hoban, Wikimedia Commons

Semiconductor Lead Times Quietly Lengthened

Even before the pandemic restrictions, semiconductor production required long planning horizons. Advanced chips can take three to five months to manufacture, followed by testing and packaging. Because fabricators normally operate near full capacity to stay profitable, there wasn’t much excess production capability available to absorb sudden demand shocks.

University College London Faculty of Mathematical & Physical Sciences, Wikimedia Commons

University College London Faculty of Mathematical & Physical Sciences, Wikimedia Commons

Disrupted Production

In early 2020, coronavirus lockdowns forced temporary factory shutdowns across Asia. Travel restrictions led to postponements to equipment installation and maintenance. The disruptions themselves were brief, but they slowed production right when global supply chains were getting increasingly shaky. This set the stage for deeper shortages later in the year.

Albert duce, Wikimedia Commons

Albert duce, Wikimedia Commons

Demand Explosion

As people worked and studied from home through 2020 and 2021, demand surged for laptops, webcams, gaming consoles, and all the associated networking equipment. Semiconductor manufacturers dedicated production toward consumer electronics, locking in production months ahead and inadvertently starving other sectors of badly needed chips, particularly automotive manufacturers.

Carmakers Slashed Orders At The Worst Possible Time

Early in the pandemic, automakers slashed chip orders, expecting the vehicle sales decline to go on a lot longer. When car demand bounced back faster than expected, chip foundries had already reallocated production elsewhere. Because the makers couldn’t quickly switch production, automakers found themselves at the back of the line for new chips.

Marek Ślusarczyk (Tupungato) Photo portfolio, Wikimedia Commons

Marek Ślusarczyk (Tupungato) Photo portfolio, Wikimedia Commons

Automotive Production Ground To A Halt

By 2021, missing chips forced automakers to put plants on standby worldwide. Vehicles were built without features or just left unfinished in storage lots. Industry estimates suggest millions of vehicles were never produced, which drove higher car prices and record dealer markups globally.

Governments Treat Chips As Strategic Assets

The severity of the shortage brought semiconductors into the spotlight as national security priorities. Governments launched initiatives like the U.S. CHIPS Act and European subsidy programs, with the goal of reducing dependence on Asian manufacturing and rebuilding domestic production capacity over the next decade.

The White House, Wikimedia Commons

The White House, Wikimedia Commons

U.S. Move To Reshore Chip Production

Both the Trump and Biden administrations have put priority on rebuilding U.S. semiconductor manufacturing. The Trump administration emphasized export controls and national security concerns, while the Biden administration designed incentives through the CHIPS and Science Act, committing more than $50 billion to subsidize domestic chip fabs so as not to be so reliant on Asian supply chains.

New Chip Plants Are Hard To Build

Building a leading-edge semiconductor plant can cost more than $20 billion and take five to seven years. Facilities need specialized machinery, ultra-pure water, reliable power, and skilled engineers and workers. Even with the necessary funding, workforce shortages and equipment bottlenecks frustrated expansion efforts worldwide.

TrickHunter, Wikimedia Commons

TrickHunter, Wikimedia Commons

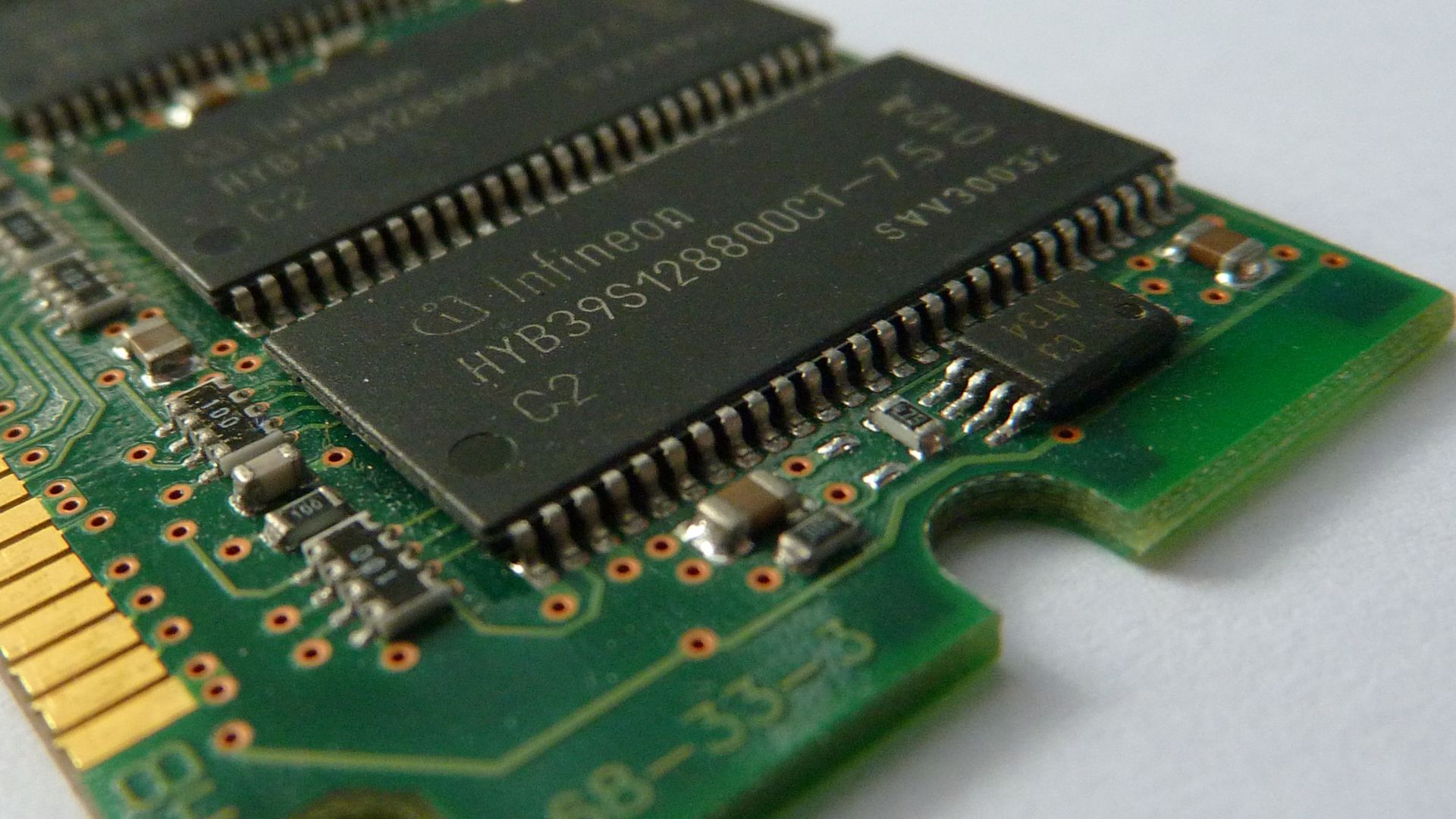

Supply Chain Complexity Adds Fragility

Microchips rely on thousands of inputs, from rare gases to precision lithography equipment. Disruptions at any step of the process can grind production to a halt. The extreme specialization of suppliers means that there aren’t any easy replacements. This makes semiconductor supply chains very sensitive to geopolitical flareups and logistical breakdowns.

Matt Howard, Wikimedia Commons

Matt Howard, Wikimedia Commons

2022: The Shortage Subsides

As consumer electronics demand slowed down, chip inventories slowly began to get back to normal. Lead times shortened, and some sectors reported improved availability. Automakers finally stabilized production, giving the impression that the chip crisis was ending after nearly three years of disruption. But it wasn’t that simple.

LIbby.Hoban, Wikimedia Commons

LIbby.Hoban, Wikimedia Commons

2023: Chip Glut

By mid-2023, the industry did a 180, from shortage to oversupply. Memory chips and consumer processors flooded the market, pushing prices into a steep downturn. Manufacturers had overproduced after misjudging post-pandemic demand, leading to falling revenues and inventory write-downs.

Blake Patterson, Wikimedia Commons

Blake Patterson, Wikimedia Commons

All Chips Are Not Equal

While memory and low-end chips were abundant, advanced processors were still constrained. Advanced nodes used for data centers and high-performance computing stayed tight. This uneven recovery masked the underlying structural shortage that would soon reemerge as new and far more aggressive demand drivers sprang up.

AI Changed The Demand Equation

The explosion of generative AI (artificial intelligence) systems in 2024 dramatically increased demand for high-performance GPUs and accelerators. Advanced chip capacity was rapidly vacuumed up by cloud providers racing to build AI infrastructure.

Lawrence Systems, Wikimedia Commons

Lawrence Systems, Wikimedia Commons

AI Chips Need The Best

AI processors require leading-edge fabrication techniques available at only a handful of plants worldwide. These chips require far more silicon area and production time than traditional processors, stretching capacity constraints and putting sharp limits on the industry’s ability to scale output quickly.

Minister-president Rutte from Nederland (+31), Wikimedia Commons

Minister-president Rutte from Nederland (+31), Wikimedia Commons

Smartphone Prices Jump

AI-driven demand is now spilling over into the consumer markets. Smartphone makers are now dealing with rising component costs as chipmakers cater more to higher-margin AI customers. Analysts expect device prices to go up in the coming years as competition for advanced chips heats up.

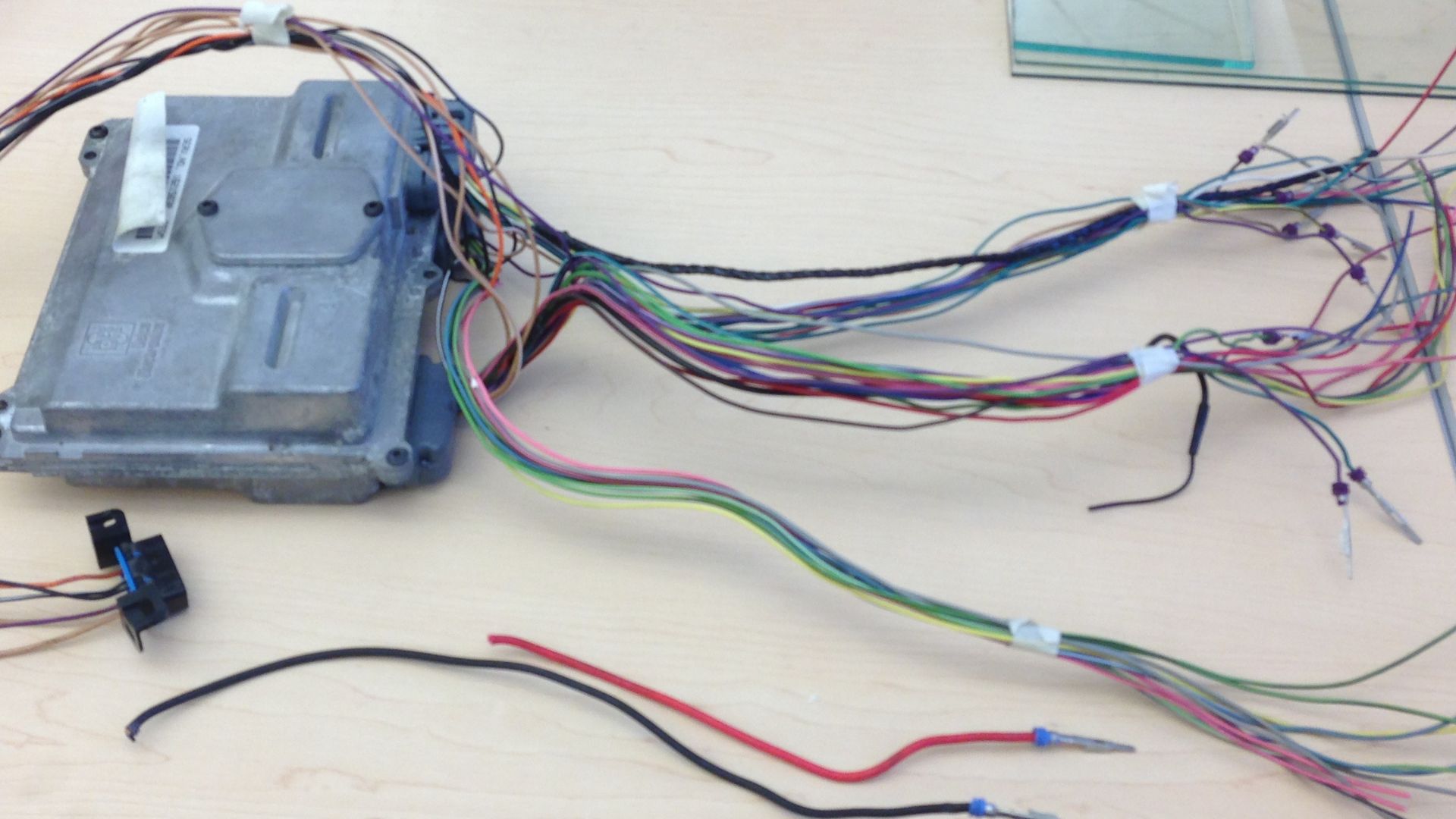

Automakers Still Vulnerable

Modern vehicles require hundreds to thousands of chips, including advanced processors for driver assistance systems. While availability has improved for basic automotive chips, competition from AI workloads threatens long-term supply stability, leaving automakers high and dry if there’s a disruption in the future.

Snewkirk7953, Wikimedia Commons

Snewkirk7953, Wikimedia Commons

Risk Of Geographic Concentration

Despite new investments, most advanced semiconductor capacity is still heavily concentrated in Taiwan and South Korea. Geopolitical tensions, natural disasters, or trade restrictions in those regions could set off a whole new global shortage.

Oskar Alexanderson, Wikimedia Commons

Oskar Alexanderson, Wikimedia Commons

India Tries To Build A Domestic Chip Industry

In the early 2020s India launched the India Semiconductor Mission, offering to cover up to 50% of fabrication project costs to attract global chipmakers. Backed by tens of billions in incentives, partnerships with firms like Tata Group and Micron focus on fabrication, packaging, and testing, with the goal of cutting their dependence on imports and joining the global microchip supply chain.

DisplayEcosystem, Wikimedia Commons

DisplayEcosystem, Wikimedia Commons

New Era Of Instability

Microchip shortages are about a system built for efficiency, not resilience. Government pandemic measures threw the lid off its fragility, the 2023 glut showed its volatility, and the current voracious AI demand is stretching limits again. Until production catches up, shortages will likely be a part of our lives in one way or another for the foreseeable future.

You May Also Like: