Needs Vs. Wants

Say it with me: Living well isn’t about splurging. You don’t NEED the newest iPhone, or a lake house, or even cable TV. 45 to 60-year-olds should know how to preserve their savings without sacrificing enjoyment. Let us help you sort through some “wants”.

Bye-Bye Steady Cashflow

Once you retire and lose that steady income, spending on unnecessary items can erode savings. Understanding which expenses to cut can create financial breathing room without sacrificing comfort. These are some common expenditures worth reevaluating if you want a sustainable and enjoyable retirement.

Expensive Jewelry

Most high-end jewelry depreciates the moment you buy it. Diamonds, for instance, have an average resale value of just 20-60% of their purchase price. It’s okay to want to pass them on to the next generation, but does it have to be worth thousands?

Luxury Watches

A Rolex may turn heads, but today’s smartphones often outperform even the fanciest watches in utility. Consider swapping for a durable, stylish watch under $500. Save the rest for experiences or investments that last longer.

Expensive Shoes

Let’s be honest, a $1,000 pair of leather loafers isn’t guaranteed to outlast a $100 option. High-priced designer shoes might look chic, but they wear out just as quickly as affordable pairs. Focus on versatile, comfortable, and durable footwear instead. Your feet—and wallet—will thank you.

Custom Suits

How much of a difference exists between a well-made, off-the-rack suit tailored locally and a fully tailored one? Hardly any. Think about how many years it’ll even be required for. With many embracing casual wardrobes, spending thousands on custom fits may be unnecessary. That brings us to…

Non-Versatile Clothing

Closets filled with single-occasion outfits are a common budget trap. A sequined gown or tropical print shirt may be eye-catching, but how often will you wear them? Stick to timeless, mix-and-match staples. You’ll save money and always have something appropriate for the occasion.

Expensive Vacations

A $10,000 luxury cruise may be tempting, but the same kind of joy can be found in affordable road trips or budget-friendly excursions. With airfare and hotel rates rising by over 10% annually, consider off-peak travel or domestic destinations. Memorable vacations don’t need extravagant price tags.

New And Expensive Vehicles

Just like jewels, brand-new cars lose 20-30% of their value within the first year. A reliable, used vehicle often provides the same benefits at half the price. Skip the bells and whistles—focus on safety and fuel efficiency instead. Leasing is also a lower-cost option for those who drive less.

Vacation Properties

Think hard before putting your money into a second home. Owning a vacation home may seem glamorous, but costs add up fast. Maintenance, insurance, property taxes, renovations, etc. can exceed your budget. Remember: buying a second home ties up capital that could earn more elsewhere.

Food Delivery

Convenience comes at a steep cost. Other than the food you’re also spending on delivery fees, service charges, and then the tip. All of this can increase meal costs by 30%. Limit DoorDash and Uber Eats for special occasions so that it feels like a treat!

Coffee Shop Coffee

A daily $5 latte adds up to $1,825 per year. That’s money that could fund a weekend getaway or boost your emergency fund. Just get a good-quality home coffee maker for just a fraction of that cost, and enjoy your coffee exactly how you like it without leaving home.

Trendy Restaurants

Trendy dining spots may serve Instagram-worthy plates, but they often come with inflated prices. A single dinner could cost upwards of $200. More if you wanna snag a drink. Find hidden gems that are cheaper and more authentic.

Unnecessary Cleaning Products

Americans spend $600 annually on cleaning supplies. For no reason, except overconsumption. Separate products for every surface sound helpful but often overlap in function. Simplify with multipurpose cleaners. Eco-friendly options are budget-friendly and reduce clutter under your sink.

Cheap Appliances

Know when to not cheap out. Budget appliances may save upfront costs, but they often break quickly, leading to frequent replacements. A $50 toaster that lasts six months is pricier over time than a $150 model that lasts for years. Prioritize quality and reliability to avoid this cycle.

Advanced Appliances

While smart refrigerators or robotic vacuums exaggerate high-tech appeal, their premium price tags rarely justify the benefits. The average "smart" appliance costs 30-50% more than standard versions. Stick to tried-and-true models unless the advanced features genuinely make your daily life easier.

High-Interest Debt

Carrying high-interest debt is one of the costliest financial mistakes. Credit card interest rates average 20%, eroding your savings with every month unpaid. So, tackle these debts aggressively. Consolidation or balance transfers to lower-interest accounts can help you pay them off faster.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Extended Warranties

Most extended warranties cover unlikely events or overlap with existing protections like manufacturer warranties. Consumer Reports found that less than 20% of buyers ever use these warranties. Instead, set aside savings for repairs—this "self-insurance" plan is often cheaper and more effective.

Timeshares

Timeshares often come with hidden fees and poor resale value. The average annual maintenance cost is over $1,000, and exit fees are exorbitant. Instead of locking into a long-term contract, use vacation rentals. That kind of flexibility and lower costs make them a smarter choice.

Fancy Festival Decorations

Seasonal decor is fun, but do you need a full new set each year? Billions are spent on holiday decorations, annually, in the US. And a bunch of it goes unused after one season. Reuse old favorites, get sturdy ornaments that’ll last you years, go thrifting, shop sales, get crafty.

Premium Booze

A $200 bottle of whiskey may impress guests, but funnily enough, studies show blind tastings often can’t distinguish premium spirits from budget options. Prioritize taste over branding. Mid-range wines and liquors can be just as enjoyable if you know how to make a drink.

Expensive Food Subscriptions

Meal kits and specialty snack boxes charge premium prices for convenience. A subscription can cost up to $15 per meal. That’s double what you’d spend cooking from scratch. YouTube (and even TikTok) has a million recipes that you can pick from to recreate gourmet dishes at home.

Trendy Diet Plans Or Supplements

Be it detox teas or expensive meal plans, trendy diets rarely deliver lasting results. The US diet industry is worth $72 billion right now. But can we agree that simple habits like balanced eating and regular exercise are just as (or more) effective?

Cheap Furniture

Furniture, like appliances, is not something to cheap out on. Especially when it comes to sofas, wardrobes, dining tables, or anything that will be in constant use. For example, a sturdy $1,000 sofa can last decades, while a $300 one may fall apart in three years.

Expensive Flooring

Hardwood or premium tile floors add elegance, but costs can skyrocket, especially with installation. Consider laminate or engineered wood as alternatives. These options are durable, stylish, and, more often than not, indistinguishable from higher-end materials at a glance.

Extensive Home Renovations

Think long and hard before you spend on renovations of any kind. While certain upgrades add resale value, extravagant renovations rarely offer a good return on investment. Stick to necessary repairs or modest updates. Your savings are better spent elsewhere.

Magazine Or Newspaper Subscriptions

Print subscriptions are becoming outdated as digital content grows. Many newspapers offer free online access or ad-supported apps. Consider canceling subscriptions and relying on free alternatives. Save the environment—and also your wallet.

Mike van Schoonderwalt, Pexels

Mike van Schoonderwalt, Pexels

High-End Beauty Products

Getting a ton of fancy products does not promise great skin. You’d expect pricey skincare lines to work miracles but they might just deliver results similar to drugstore brands. Get what your dermatologist recommends instead of hopping on online bandwagons.

Elective Cosmetic Procedures

Do you know the prices for these treatments? A facelift can cost over $10,000, with additional risks and recovery time. Instead, explore non-invasive treatments or simply embrace your natural beauty. Confidence often outshines expensive procedures.

Gym Memberships

Most gym memberships go unused, with nearly 67% of members attending less than once a month. Walking outdoors, YouTube workouts, Zumba or community fitness classes are affordable alternatives that you may consider.

Fancy Outdoor Gear

High-end camping or hiking gear is tempting, but do you need a $500 tent for occasional weekend trips? Most probably not. Borrow, rent, or buy used gear instead. You’ll enjoy the same adventures without the hefty price tag.

Expensive Sporting Equipment

The same goes for sporting equipment. Top-tier golf clubs or bicycles can cost thousands, but mid-range options often perform just as well. It’s kinder to your budget and the planet. For casual use, you can also consider second-hand equipment.

Private Golf Club Memberships

Private clubs charge initiation fees up to $50,000, plus monthly dues. Now that’s an expensive hobby. There are public courses or pay-as-you-go memberships that offer comparable experiences without the long-term financial commitment.

Centre for Ageing Better, Pexels

Centre for Ageing Better, Pexels

Home Phone

Nearly 70% of US households have cut the cord. If you haven’t, what are you waiting for and why? Ditch the outdated bill—smartphones work just fine. It’s convenient, reliable, and cost-effective.

Cable TV

Yet another outdated expense. Cable packages include channels you never even watch. Streaming services are tailored, and you’ll be spoiled with options. Almost all major channels are also moving to the other side. Case in point: HBO Max.

Concert Tickets

After a point, you’re too old for the bustle of concerts. Plus, the prices? They’ve surged over 50% in the last decade. Most of the concerts are live-streamed, so just watch those. Skip the overpriced VIP sections.

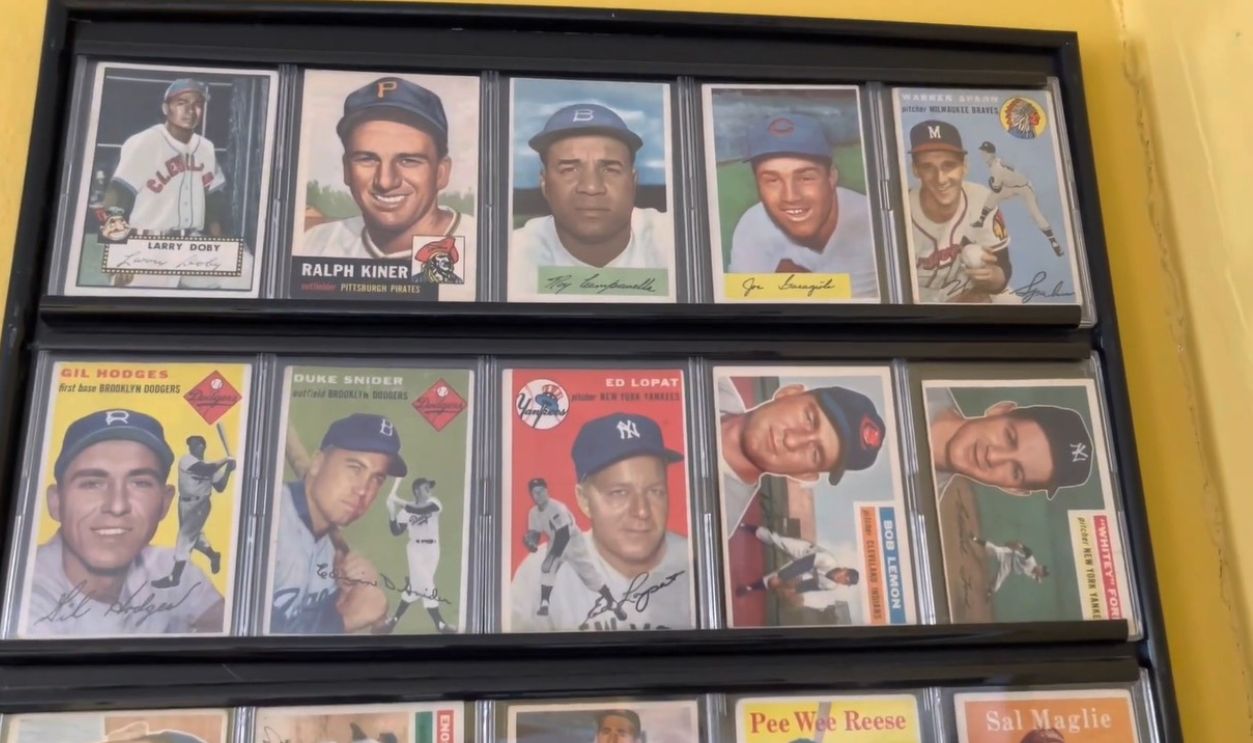

Sports Memorabilia

Collecting memories, not objects, is key in retirement. Autographed items or rare collectibles can cost thousands. Instead, capture the spirit of the game by attending events or watching from home.

ONE OF THE MOST EPIC SPORTS MEMORABILIA COLLECTIONS YOU WILL EVER SEE!!!⚾️🥊 by Joezeppi1

ONE OF THE MOST EPIC SPORTS MEMORABILIA COLLECTIONS YOU WILL EVER SEE!!!⚾️🥊 by Joezeppi1

Private Jets

Owning a private jet is the hallmark of excess. Maintenance alone can cost millions annually. Opt for first-class tickets or flight-sharing programs for the occasional splurge. The same comfort at a fraction of the cost. Be more mindful of your money and the environment.

Boats

Boats also fall in the same category. They are notorious money pits. Maintenance, docking, insurance, equipment, operating costs, fuel—all of these add thousands to the initial cost. Doesn’t renting boats for a day sound like a better option?

Expensive Baby Clothes

Now, this is just a stupid thing to spend insane amounts of money on. Babies grow faster than you think. Spending hundreds on designer onesies is impractical when thrift stores or hand-me-downs bring you equally adorable options. They’re gonna drool all over it, even if it’s Gucci.

Exotic Pets

Exotic pets require specialized care, enclosures, and very specific diets. Over time, people find these demands stressful rather than fulfilling. Better yet, adopt from local shelters; companionship doesn’t have to come with extravagant expenses.

Technology Gadgets

You don’t need every gadget released on earth. That VR? AI binoculars? AI-Powered Cat Flap? You don’t need them. Buy things that meet your actual needs rather than chasing trends. Tech should simplify life, not complicate finances.

New iPhone Every Year

Wait until upgrades are truly significant to replace your device. Upgrading annually for marginal improvements is wasteful, and older models usually remain functional for years. Save your dollars for meaningful upgrades.

Haircuts

Why go to high-end salons each month if local stylists can do the same thing for less? And you know what’s even better? Learn how to cut your own hair. Saves so much money over time; it’s insane.

Comfortable Living Over Luxurious Living

Ultimately, it’s not about lavish expenses—it’s about freedom and security. Cutting unnecessary costs keeps your savings intact, so you can focus on experiences and people that truly enrich your life. Choose comfort and joy over fleeting luxury.