The Purchases That Raise Quiet Questions

Nobody plans for emotional gaps to show up as receipts. Still, they do. A change in how he spends often says plenty—especially when his spouse isn’t in on it.

Buying Lavish Gifts For Another Woman

When a spouse begins purchasing lavish gifts for another woman in secret, it sets off a destructive chain reaction. This financial infidelity immediately breaches trust, and this pattern of deceptive spending creates escalating arguments about money.

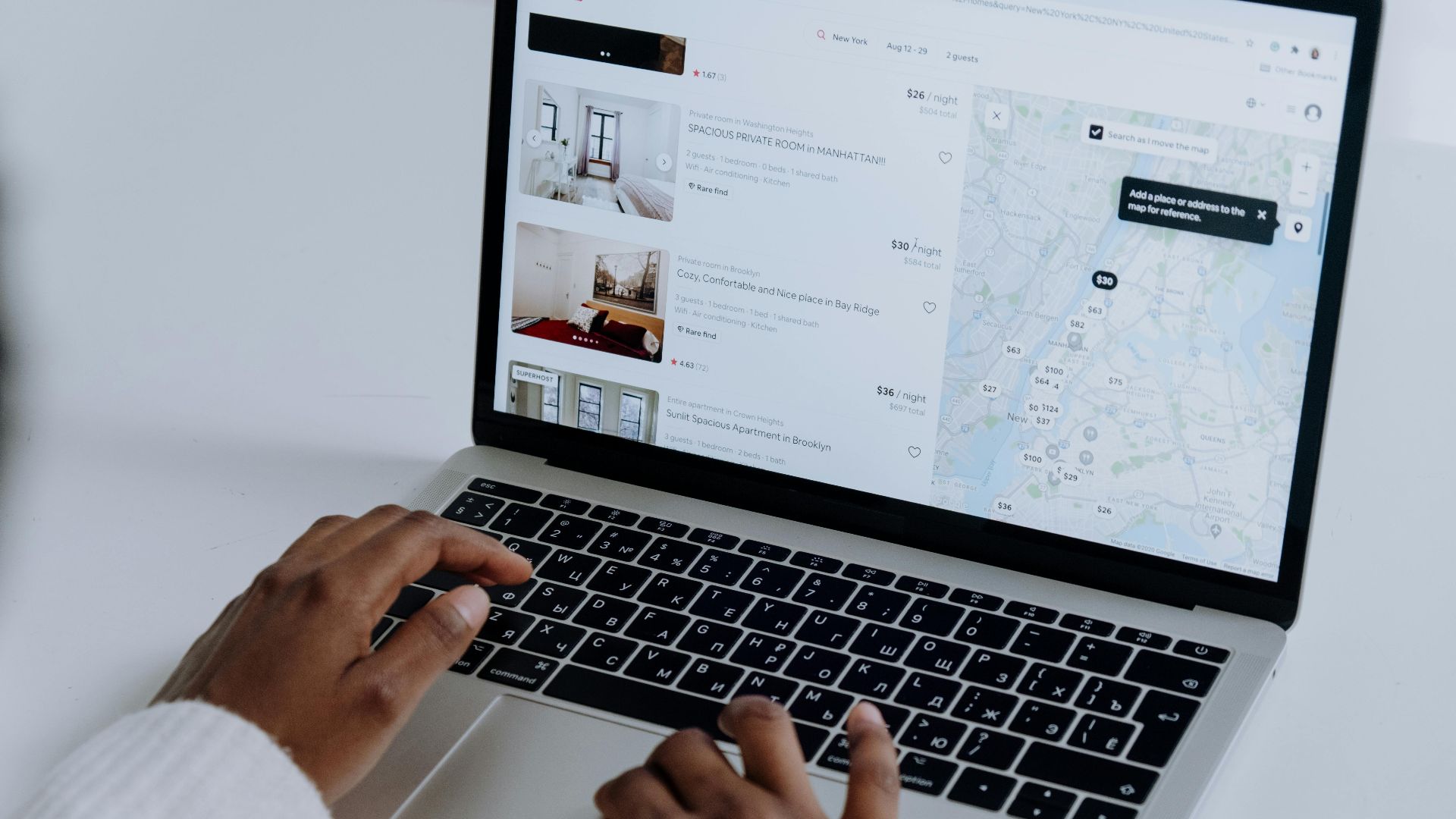

Booking Hotels Secretly

In our culture of casual deception, secret hotel bookings initiate a devastating spiral where the concealment breeds financial infidelity, which corrodes marital trust. This self-perpetuating cycle of monetary duplicity ultimately proves more destructive than conventional relationship challenges.

Having Private Bank Accounts

The erosion of marital trust can begin with simple avoidance of financial conversations. These fissures deepen when partners establish secret bank accounts, which ultimately threaten the entire relationship by escalating stress and eroding trust between spouses.

Getting Escort Services Or Paid Companionship

The clandestine pursuit of escort services sets in motion a corrosive cycle. When this web of monetary deceit is in play, it breeds emotional estrangement and shattered trust. It ultimately positions both financial infidelity and marital unfaithfulness as twin forces that propel countless couples toward divorce.

Having Online Dating Subscriptions

When a married man starts paying for dating apps or keeping secret accounts, that’s distance (and disrespect). Hidden subscriptions turn emotional drift into financial betrayal. What looks like a few quiet charges often signals a deeper problem his partner wasn’t meant to find.

Exploring Sudden Cosmetic Surgery Or Image Overhauls

Behind dramatic appearance transformations, especially out of the blue, lies a deeper psychological narrative: one of emotional withdrawal and marital disconnection. When a spouse secretly channels funds into cosmetic surgeries or radical image overhauls, they may be manifesting inner turbulence through financially destructive behaviors.

Hiring A Divorce Coach

Like a trail of breadcrumbs leading back to deeper wounds, the engagement of a divorce coach often reveals a pattern of concealed preparations and unspoken plans. This financial investment signals the intersection of monetary conflicts and emotional distress, with financial disagreements proving as destructive to marriages as infidelity.

Buying A Condo Without Spouse’s Knowledge

Financial experts increasingly encounter cases where spouses covertly purchase condos, marking a troubling trend in marital financial infidelity. Beyond straining household budgets, these unauthorized real estate acquisitions create complex legal entanglements and emotional rifts.

Renting A Second Apartment

A secret lease speaks volumes. Why? Because maintaining another residence divides attention, resources, and loyalty. The expense quickly turns into emotional debt, and it leaves the primary home feeling like a convenience rather than a commitment.

Secretly Funding Another Woman’s Venture

When a husband starts secretly funding another woman's venture, it represents a serious breach of financial loyalty. Such a deceptive financial behavior typically triggers immediate resentment between partners, destabilizing the relationship's core dynamics.

Going For Frequent Solo Travel Without Informing Their Partner

Healthy marriages thrive on open dialogue about travel plans and spending, yet frequent solo getaways shrouded in secrecy often mask deeper relationship troubles. When unexplained trips drain shared finances and create mounting debt, couples must address both the emotional distance and financial strain.

Having Anonymous Messaging Apps

Technology promises to bring couples closer, but when anonymous messaging apps come into the picture, it often drives them apart. What's marketed as casual communication becomes a vehicle for hidden conversations and concealed spending—a digital-age betrayal that extends beyond the financial.

Owning Secret SIM Cards Or Burner Phones

In an era where financial transparency forms the bedrock of marital trust, the emergence of tech-enabled deception tools marks a troubling evolution in relationship dishonesty. The acquisition of secret SIM cards and burner phones represents a calculated step beyond mere financial concealment, enabling both emotional and financial cheating.

Booking High-End Dating Coaches

In healthy marriages, partners openly discuss relationship challenges and jointly seek guidance when needed. However, the covert engagement of high-end dating coaches while married reveals a troubling pattern of emotional withdrawal and financial infidelity. This secretive spending basically erodes foundational trust and contributes to relationship strain.

Subscribing To Adult Entertainment Platforms

When a man pays for adult platforms in secret, emotional distance has already set in. Hidden subscriptions create quiet barriers, and they turn intimacy into isolation. Financial secrecy around pleasure is rarely about curiosity—it’s about disconnection that slowly replaces honesty in the relationship.

Secretly Gambling Or Betting

Wagering on games or races may begin casually and turn costly fast. Gambling introduces secrecy, missing funds, and escalating tension. When a man’s entertainment budget turns into unpredictable losses, financial strain and emotional withdrawal usually follow close behind.

Sudden Obsession With Expensive Wardrobe

A dramatic shift in appearance can mark changing priorities. New suits, designer sneakers, or luxury accessories could hint at reinvention. There is nothing wrong with a simple upgrade, but a style spending spike overnight? That could be more about attention directed somewhere beyond the marriage.

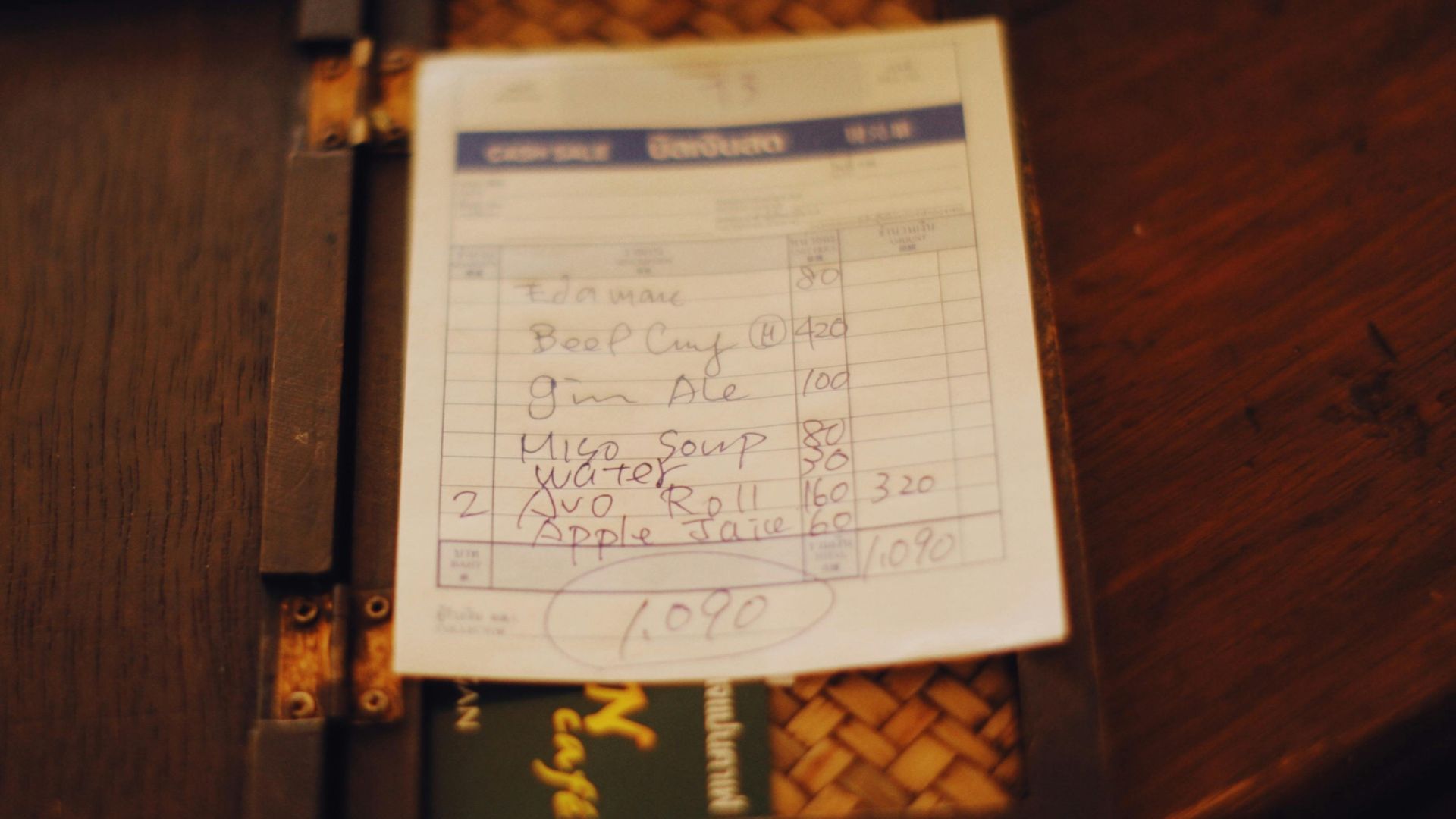

Hiding Restaurant Bills

Restaurant receipts can reveal what words won’t. These repeated unexplained meals indicate hidden company or quiet escapes that corrode transparency. The result? They leave one partner guessing and the other avoiding accountability.

Hiring A Private Investigator On Their Spouse

Spending money on surveillance signals broken communication. A man who hires an investigator has already lost trust. That choice replaces conversation with suspicion, and it creates emotional fallout that costs far more than the invoice itself.

Going For Frequent “Boys” Trips

Constant group trips can mask avoidance when travel with friends becomes routine and unshared. This marks a turning point. Prioritizing escape over connection gradually erodes partnership, and it leaves laughter abroad and tension at home.

Secret Cash Withdrawals

The account had a certain amount by Monday, but by Friday, a chunk of it is gone! When he is asked, he’s shady about it or gives a vague reason. Such unaccounted cash signals hidden activity. Money disappearing quietly leaves emotional damage behind, because trust rarely survives once financial honesty disappears.

Centre for Ageing Better, Pexels

Centre for Ageing Better, Pexels

Having Secret Storage Units

Unless it’s hiding a surprise gift, a secret storage unit rarely means something good. These spaces often hold concealed purchases or traces of a separate life. Paying monthly for privacy usually mirrors a growing distance that’s already reshaping the marriage itself.

Having Membership In Exclusive Social Clubs Without Spouse’s Knowledge

Exclusive clubs cost more than fees. Whenever a man joins without telling his spouse, it signals separation in interests and intent. Private memberships create boundaries that exclude, reinforcing emotional detachment while draining shared resources.

Avoiding Financial Conversations

Refusing to discuss money locks out communication entirely. A man who dodges questions about finances replaces teamwork with tension. Avoidance builds walls, and that silence often becomes the most explicit warning a marriage can give.

Hiring Legal Consultations Secretly

In a typical divorce case, secret legal consultations often mark the final stage of fading trust. Concealed attorney meetings and hidden expenses signal quiet preparation for separation, creating toxic financial secrecy that breeds anxiety, emotional exhaustion, and deep resentment between partners.