The Rise and Fall Of Powerhouse Brands

Big business once meant household names and logos etched into memory. But dominance doesn’t guarantee survival. The marketplace turned, and these corporate giants stayed still.

Blockbuster Video

No video chain symbolized American weekend culture quite like Blockbuster. At its peak, it operated more than 9,000 stores. But leadership missteps, including rejecting a Netflix acquisition, doomed the brand. As digital streaming exploded, Blockbuster’s failure to adjust turned its empire into a relic. Bankruptcy followed, with only one store surviving.

File:BlockbusterMoncton.JPG: Stu pendousmat (talk) derivative work: Georgfotoart, Wikimedia Commons

File:BlockbusterMoncton.JPG: Stu pendousmat (talk) derivative work: Georgfotoart, Wikimedia Commons

Zenith Electronics

Zenith helped shape American television culture by introducing innovations like the remote control and pushing early color TV adoption. Despite its engineering strength, it couldn’t compete with cheaper Asian imports and changing consumer preferences. By the late 1990s, the company was acquired by LG, and the Zenith name faded from relevance.

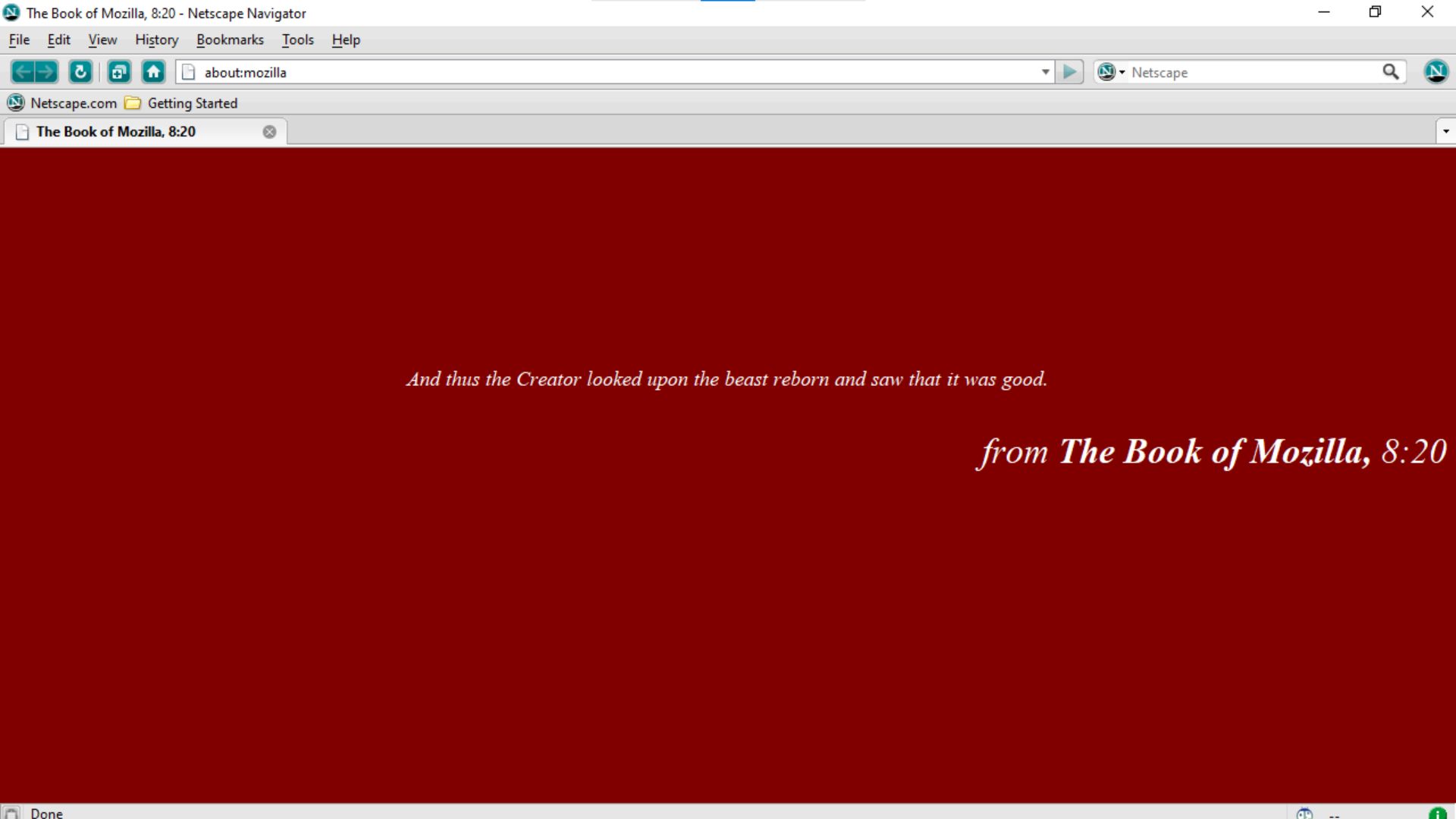

Netscape

As one of the earliest web browsers, Netscape Navigator shaped how millions first experienced the internet. Its influence peaked in the mid-1990s before Microsoft’s Internet Explorer overwhelmed it via bundling tactics. Acquired by AOL in 1999, the brand gradually dissolved, though its legacy continues through Mozilla’s open-source development roots.

Netscape Communication Corporation, Wikimedia Commons

Netscape Communication Corporation, Wikimedia Commons

JCPenney (Pre-2020)

Familiar to generations of middle-class shoppers, JCPenney became a cautionary tale of retail stagnation. Misguided rebrands and neglect of e-commerce left it vulnerable. Though technically still operating under new ownership, the chain’s cultural and financial relevance vanished with its 2020 bankruptcy filing and store closures.

Kirk Allen, CC BY 3.0, Wikimedia Commons

Kirk Allen, CC BY 3.0, Wikimedia Commons

Dominion Textile

Dominion was a Canadian textile titan with deep roots in North America’s industrial economy. It thrived through most of the 20th century, but cheaper global manufacturing and changing demand forced contraction. Acquired by Polymer Group in 1998, it disappeared quietly—one of many legacy manufacturers undone by a shifting world.

Compagnie aerienne franco-canadienne, Wikimedia Commons

Compagnie aerienne franco-canadienne, Wikimedia Commons

MGM (Old Structure)

Decades before content streaming reshaped entertainment, MGM reigned as the world’s most glamorous film studio. Its famous lion's roar accompanied countless classics. Yet, internal shakeups and media consolidation sealed its legacy. By 2022, what remained was absorbed by Amazon, ending the studio’s identity as a cinematic powerhouse.

Alexander Migl, CC BY-SA 4.0, Wikimedia Commons

Alexander Migl, CC BY-SA 4.0, Wikimedia Commons

Woolworth’s (US)

As a trailblazer in discount retail, Woolworth’s shaped America’s consumer habits for generations. It introduced fixed prices and an accessible shopping experience. But big-box competitors and changing locations weakened its hold. By 1997, its last US store closed. It was the end of an era for downtown retail.

Steve Morgan, CC BY-SA 3.0, Wikimedia Commons

Steve Morgan, CC BY-SA 3.0, Wikimedia Commons

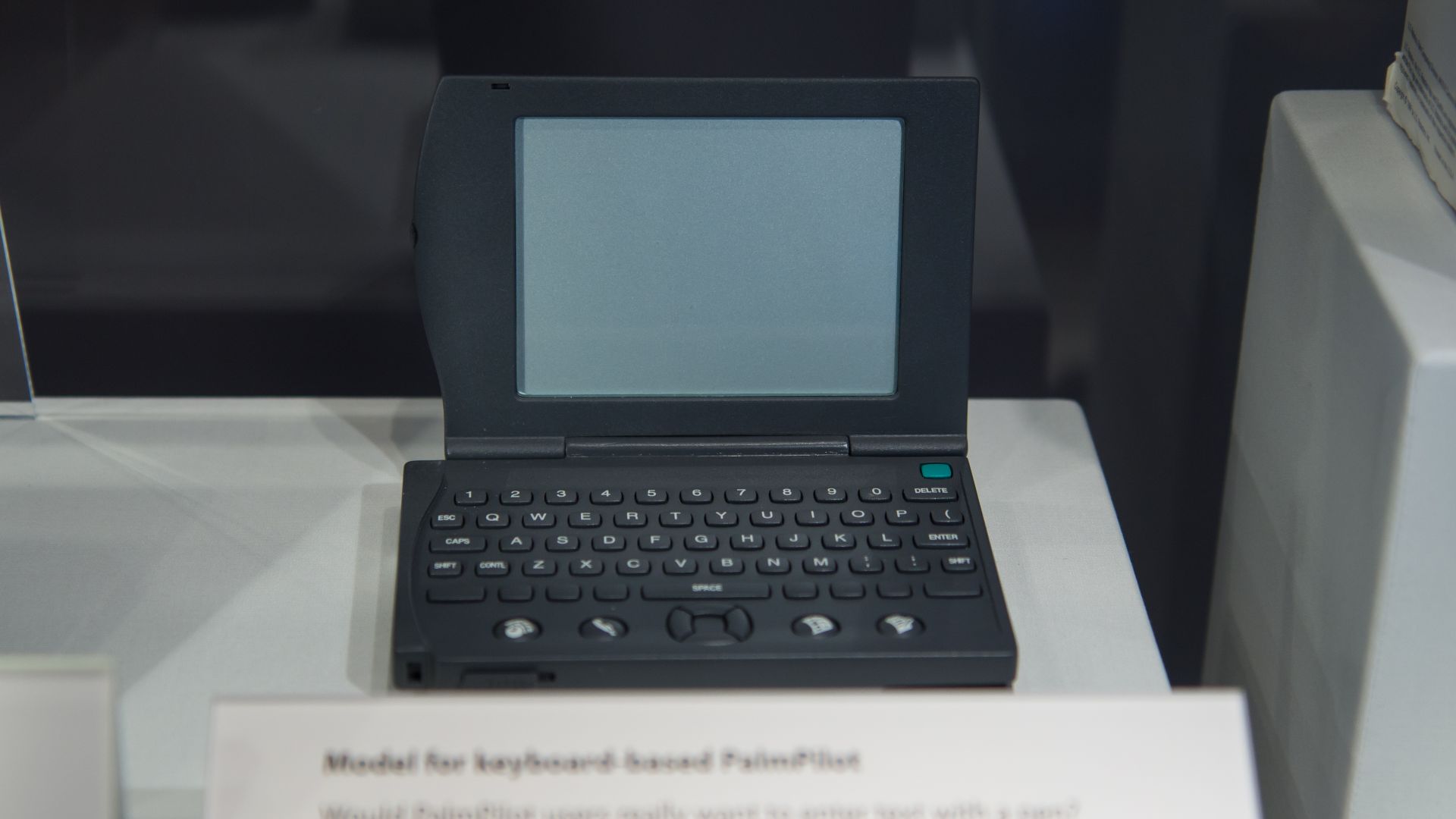

Palm, Inc

Before smartphones dominated pockets, Palm handhelds defined digital convenience. Its Palm Pilot became a must-have for professionals in the late 1990s. But failure to transition effectively into smartphones, alongside tough rivals like Apple and BlackBerry, led to its decline. HP acquired and later shelved the brand after a brief WebOS experiment.

Atomic Taco from Seattle, WA, USA, Wikimedia Commons

Atomic Taco from Seattle, WA, USA, Wikimedia Commons

RKO Pictures

Among the original Hollywood giants, RKO blended art and innovation. Responsible for King Kong and Citizen Kane, the studio shaped film history. However, profit instability and a rocky post-war industry climate pushed RKO out of production by 1957. Today, it exists more in film textbooks than on any screen.

Frank Ross productions Ltd. Rko Radio Pictures, Wikimedia Commons

Frank Ross productions Ltd. Rko Radio Pictures, Wikimedia Commons

Montgomery Ward

Through its iconic mail-order catalogs, Montgomery Ward brought modern goods to isolated American homes long before the internet. Its innovation faded as malls grew and digital shopping took root. Despite relaunch attempts, Ward’s retail presence ended in 2001. It left behind a legacy buried beneath 20th-century consumer transformation.

Ian Poellet (User:Werewombat), CC BY-SA 3.0, Wikimedia Commons

Ian Poellet (User:Werewombat), CC BY-SA 3.0, Wikimedia Commons

Texaco (Independent)

Texaco, known for its star emblem and long-running gas station network, once rivaled Exxon in US oil. A massive legal judgment and lagging international performance weakened the brand. Acquired by Chevron in 2001, the Texaco name persists on signs, but its strategic autonomy ended with the merger.

The U.S. National Archives, Wikimedia Commons

The U.S. National Archives, Wikimedia Commons

Carolco Pictures

Founded to produce high-octane blockbusters, Carolco thrived on 1980s hits like Rambo and Total Recall. Its aggressive expansion, however, lacked caution. The spectacular failure of Cutthroat Island drained finances and investor faith. Bankruptcy followed in 1995 to cement Carolco’s story as a cautionary tale of overreach in Hollywood filmmaking.

United Artists (Original)

Creative control was the cornerstone of United Artists when Chaplin, Pickford, Fairbanks, and Griffith launched it in 1919. For decades, it empowered filmmakers over studios. But a disastrous production of Heaven’s Gate in 1980 collapsed its finances. MGM’s acquisition soon followed and dissolved its once-independent identity in corporate hands.

Unknown photographer, Wikimedia Commons

Unknown photographer, Wikimedia Commons

Zayre

Zayre’s bold signage and bargain pricing made it a recognizable force in discount retail throughout the 1960s and 1970s. However, inconsistent quality and fierce competition chipped away at performance. By the late 1980s, the chain was sold, and its name disappeared—though its corporate descendant lives on as TJX.

Joe Archie, CC BY 2.0, Wikimedia Commons

Joe Archie, CC BY 2.0, Wikimedia Commons

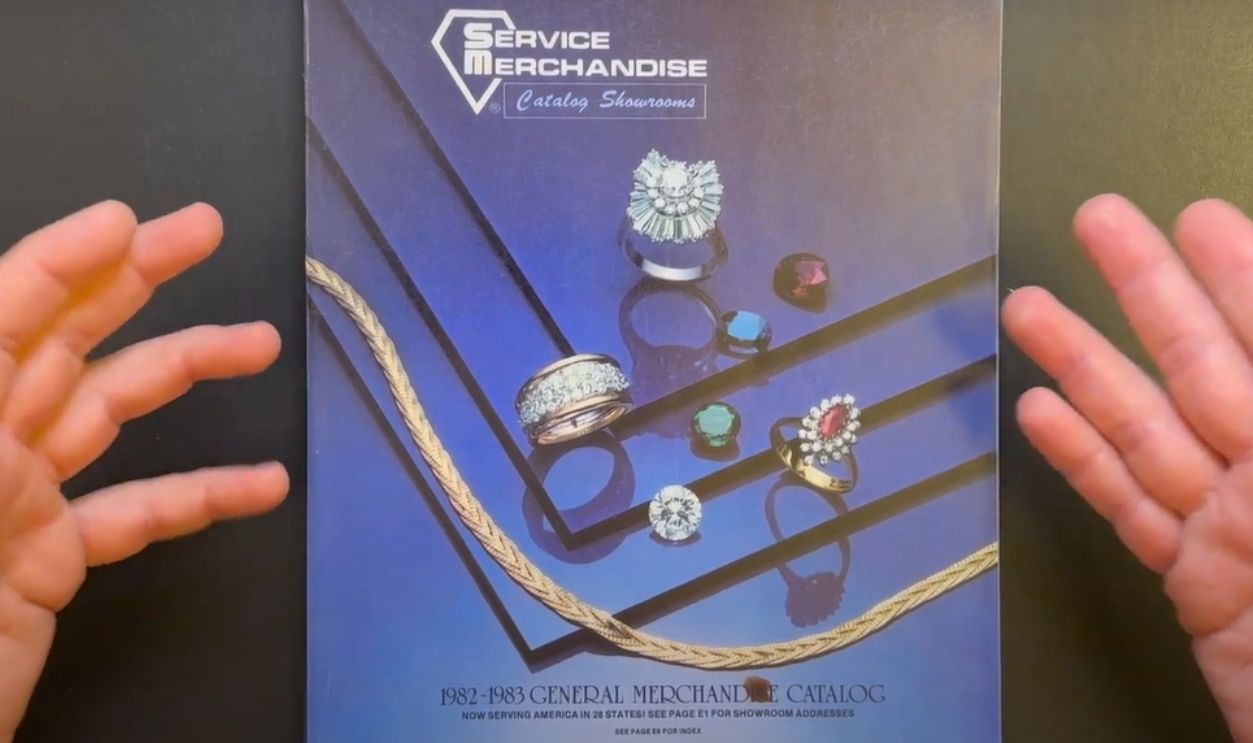

Service Merchandise

Hybridizing catalogs with showrooms, Service Merchandise gave 20th-century shoppers a unique retail experience. Over the years, the rise of self-service stores and online shopping made its model feel outdated. A series of restructuring efforts failed to reverse the decline. In 2002, the company shuttered entirely after years of falling sales and debt.

Service Merchandise Catalog 1982-1983 by The Atomic Comic Pile

Service Merchandise Catalog 1982-1983 by The Atomic Comic Pile

Standard Oil Of Indiana (Amoco)

Amoco traced its roots to the Standard Oil breakup and became a top-tier fuel brand by mid-century. Innovation in refining and marketing made it a household name. Global consolidation in the 1990s led to a $48 billion merger with BP. The Amoco brand was phased out in many markets shortly after the deal.

Eden, Janine and Jim, CC BY 2.0, Wikimedia Commons

Eden, Janine and Jim, CC BY 2.0, Wikimedia Commons

Orion Pictures

Unlike other studios, Orion’s prestige came quickly with five Best Picture nominees in one decade. Still, critical acclaim couldn’t balance poor business decisions. Financial losses mounted through the early 1990s, ending in bankruptcy by 1991. Though the brand reemerged later, its core operation never regained the momentum it once held.

Orion Pictures in 3D by SLN! Media Group

Orion Pictures in 3D by SLN! Media Group

Sears, Roebuck & Co

Once the ultimate retail destination, Sears delivered everything from homes to hammers. It led the charge into suburban malls during the mid-20th century. But years of mismanagement and debt with digital misfires drained its strength. Bankruptcy proceedings began in 2018, closing the chapter on America’s most recognized department store brand.

Tdorante10, CC BY-SA 4.0, Wikimedia Commons

Tdorante10, CC BY-SA 4.0, Wikimedia Commons

Circuit City

This former electronics retail giant once outpaced Best Buy in sales and innovation. Poor inventory systems and a failed entry into digital sales hastened its downfall. The 2008 financial crisis sealed its fate. By 2009, Circuit City had liquidated, leaving a void in mid-tier tech retail.

Terry Ross, CC BY-SA 2.0, Wikimedia Commons

Terry Ross, CC BY-SA 2.0, Wikimedia Commons

American Motors Corporation (AMC)

Known for practical compacts like the Rambler and quirky cult cars like the Gremlin, AMC was a bold underdog in a Big Three world. Its acquisition of Jeep kept it competitive, but ongoing losses forced a Chrysler buyout in 1987. AMC’s brand identity was retired shortly after the merger.

dave_7, CC BY-SA 2.0, Wikimedia Commons

dave_7, CC BY-SA 2.0, Wikimedia Commons

Polaroid (Original)

Instant photography was revolutionized by Polaroid, whose iconic cameras defined decades of snapshots. Yet its refusal to embrace digital photography proved fatal. Sales plummeted, and the original company filed for bankruptcy in 2001. Later revivals borrowed the name, but the groundbreaking business model that once wowed the world disappeared entirely.

Andrew Butitta, CC BY-SA 2.0, Wikimedia Commons

Andrew Butitta, CC BY-SA 2.0, Wikimedia Commons

RadioShack

Long before online tech stores, RadioShack was the neighborhood go-to for gadgets and DIY parts. Misaligned branding and failure to engage the digital generation undermined its relevance. After years of decline, the company filed for bankruptcy in 2015 with only fragments of its vast retail footprint left behind.

RickObst, CC BY-SA 4.0, Wikimedia Commons

RickObst, CC BY-SA 4.0, Wikimedia Commons

Borders

Borders grew from a single Ann Arbor bookstore into a national chain with thousands of employees. Its downfall came from slow digital adoption and overreliance on CDs and DVDs. Moreover, a costly deal with Amazon sealed the end. By 2011, Borders declared bankruptcy and allowed competitors like Barnes & Noble and Amazon to dominate unchallenged.

Mervyn’s

This regional department store thrived for decades in suburban California and the Southwest by offering affordable apparel for families. Private equity buyouts and increased competition from Target and Kohl’s undermined its survival. Mervyn’s filed for bankruptcy in 2008 and exited the retail stage.

Amin Eshaiker, CC BY-SA 3.0, Wikimedia Commons

Amin Eshaiker, CC BY-SA 3.0, Wikimedia Commons

Packard

For decades, Packard represented American automotive luxury and refinement. Its slogan—“Ask the Man Who Owns One”—became iconic. Unfortunately, mismanagement and poor mergers during the 1950s proved damaging. Production ceased in 1958, and Packard joined the list of premium brands that couldn’t weather industry consolidation.

Michael Rivera, CC BY-SA 4.0, Wikimedia Commons

Michael Rivera, CC BY-SA 4.0, Wikimedia Commons

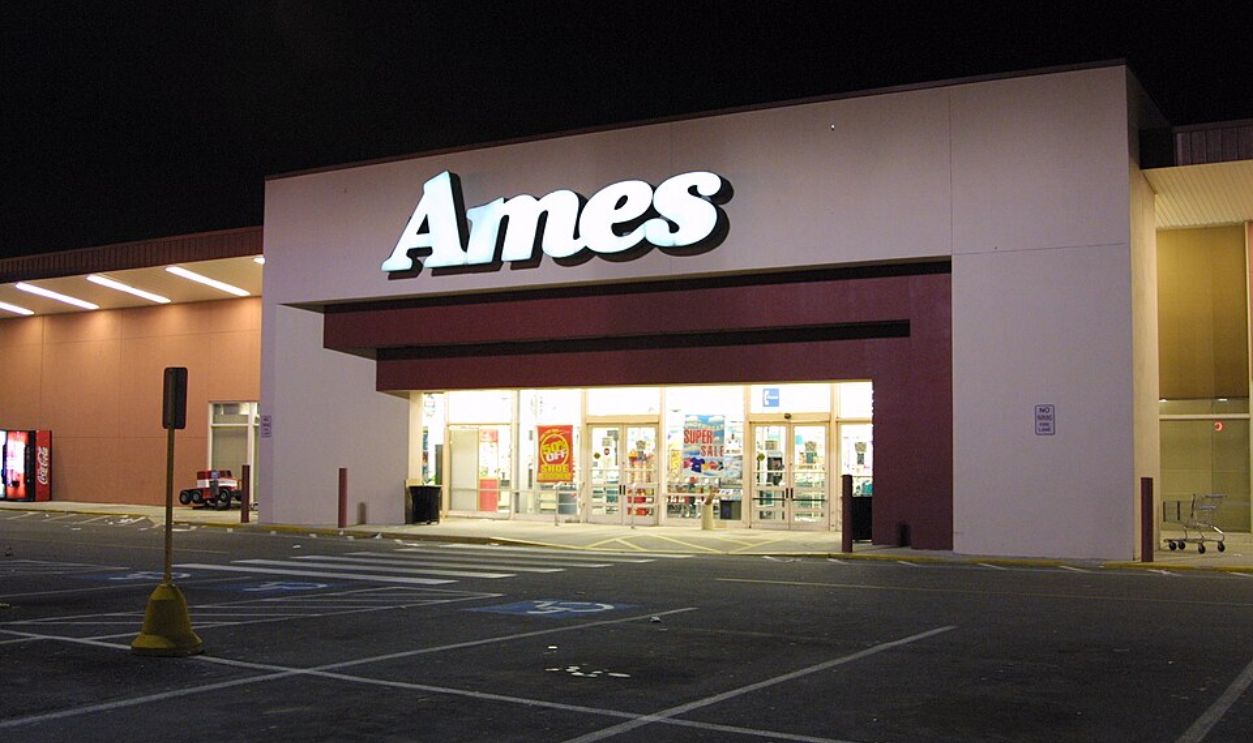

Ames Department Stores

In the 1980s, Ames operated over 700 locations across small-town America, specializing in affordable goods and local convenience. Yet rapid expansion through shaky acquisitions and weak margins led to financial instability. Its second bankruptcy in 2001 was fatal, and the chain folded in 2002 after nearly 45 years in operation.

Anthony92931, CC BY-SA 3.0, Wikimedia Commons

Anthony92931, CC BY-SA 3.0, Wikimedia Commons

Douglas Aircraft Co

Douglas revolutionized commercial aviation with its DC series, especially the DC-3, which helped launch modern air travel. Merged with McDonnell in 1967, the company faded as Boeing captured market share. The Douglas name vanished by the 1990s, and its legacy was absorbed into broader aerospace history rather than surviving independently.

Ken Fielding, CC BY-SA 3.0, Wikimedia Commons

Ken Fielding, CC BY-SA 3.0, Wikimedia Commons

Korvette’s

Often considered a pioneer in discount department stores, Korvette’s soared in the 1950s and 1960s by offering everything from records to furniture. Poor real estate choices and pressure from growing competitors caused its decline. By 1980, Korvette’s closed all stores, unable to adjust to retail’s changing demands.

Bradlees

Known for its clean stores and regional popularity in the Northeast, Bradlees served value-seeking families for decades. After spinning off from Stop & Shop, it struggled as competition from Walmart and Target intensified. Financial losses mounted, and by 2001, the chain folded and took hundreds of suburban shopping anchors with it.

Richjenkins (talk) (Uploads), Wikimedia Commons

Richjenkins (talk) (Uploads), Wikimedia Commons

Digital Equipment Corporation (DEC)

DEC helped revolutionize computing with its PDP and VAX minicomputers, challenging IBM's dominance throughout the 1970s and 1980s. However, the shift toward personal computers caught DEC off guard. Compaq acquired it in 1998, and its identity disappeared as the industry moved toward smaller, consumer-oriented technology platforms and software-based ecosystems.

stiefkind, CC0, Wikimedia Commons

stiefkind, CC0, Wikimedia Commons

Unocal Corporation

As a mid-century petroleum power, Unocal played a strategic role in US oil supply and global ventures. Environmental concerns and takeover attempts weakened its standing. In 2005, it was acquired by Chevron, ending its independent operations and highlighting how energy geopolitics can swallow once-mighty players.

The Bushranger, CC BY-SA 4.0, Wikimedia Commons

The Bushranger, CC BY-SA 4.0, Wikimedia Commons

Compaq

Founded in 1982, Compaq quickly disrupted the personal computing world by producing IBM-compatible PCs at lower prices. It became a Fortune 500 staple but struggled with competition and internal complexity. Acquired by Hewlett-Packard in 2002, the brand was eventually phased out, but it left behind a legacy of early PC accessibility.

Uscleo, CC BY-SA 4.0, Wikimedia Commons

Uscleo, CC BY-SA 4.0, Wikimedia Commons

Gold Circle

Gold Circle once offered discount retail with a polished twist, attracting shoppers looking for savings without sacrificing aesthetics. A division of Federated Department Stores, it couldn’t keep pace with aggressive competitors. By 1988, the brand was absorbed into Hills and eventually faded, marking the end of its brief retail impact.

DeLorean Motor Company

Stainless steel and gull-wing doors made the DeLorean DMC-12 unforgettable, especially after its Back to the Future fame. Yet behind the scenes, financial missteps and legal trouble plagued the company. It lasted just a few years before folding in 1982 and left behind a stylish yet unsustainable legacy.

MercurySable99, CC BY-SA 4.0, Wikimedia Commons

MercurySable99, CC BY-SA 4.0, Wikimedia Commons

Silicon Graphics (SGI)

Special effects in films like Terminator 2 and Jurassic Park owed their magic to SGI’s powerful workstations. For years, it led the 3D graphics industry. But mass-market hardware and shrinking software compatibility pushed it toward irrelevance. After multiple bankruptcies, SGI was sold in 2009 and faded from tech relevance entirely.

Dennis van Zuijlekom, CC BY-SA 2.0, Wikimedia Commons

Dennis van Zuijlekom, CC BY-SA 2.0, Wikimedia Commons

Atari (Original Corp)

Atari didn’t just sell video games—it created the home console industry. From Pong to Asteroids, its impact was monumental. However, poor quality control and executive missteps during the 1980s led to its crash. The brand lives on in licensing, but the original business collapsed decades ago.

Jason Scott, CC BY 2.0, Wikimedia Commons

Jason Scott, CC BY 2.0, Wikimedia Commons

Studebaker

Founded in the 1850s as a wagon maker, Studebaker transitioned into a respected automaker known for distinctive design and solid engineering. Postwar production issues and high costs led to mounting losses. By 1966, the last Studebaker rolled off the line and ended more than a century of operations.

Berthold Werner, CC BY-SA 3.0, Wikimedia Commons

Berthold Werner, CC BY-SA 3.0, Wikimedia Commons

Bethlehem Steel

For much of the 20th century, Bethlehem Steel helped build America by supplying beams for bridges, skyscrapers, hotels, and warships. Global steel competition and labor costs exposed its outdated infrastructure. The company filed for bankruptcy in 2001 after decades of decline, ending its role as a symbol of American industrial dominance.

W T Grant Co

W T Grant’s credit-based business model fueled rapid growth during the mid-20th century. Lax credit controls and overexpansion proved disastrous. In 1976, it filed one of the largest US retail bankruptcies of the time. The chain disappeared, but it served as a business school case study in avoidable financial collapse.

Courtaulds

Once a pillar of the UK’s textile and chemical industries, Courtaulds was instrumental in developing synthetic fibers like rayon. Globalization and rising competition eroded its market share. The company was broken up in the 1990s, with its assets absorbed by larger chemical conglomerates to end over a century of innovation.

Alan Longbottom,CC BY-SA 2.0, Wikimedia Commons

Alan Longbottom,CC BY-SA 2.0, Wikimedia Commons

Toys "R" Us

For decades, Toys "R" Us was every kid’s dream stop and every parent’s shopping mission. With Geoffrey the Giraffe leading the charge, it dominated the toy industry through the 1980s and 1990s. But debt-heavy ownership and online competition took their toll. In 2017, the brand filed for bankruptcy, closing hundreds of stores.

Raysonho @ Open Grid Scheduler / Grid Engine, Wikimedia Commons

Raysonho @ Open Grid Scheduler / Grid Engine, Wikimedia Commons

Jay Jacobs

Once a staple in suburban malls, Jay Jacobs sold trendy, affordable fashion aimed at teens and college-age shoppers. It thrived before fast fashion and bigger chains controlled the market. Struggling with relevance and expansion missteps, the brand filed for bankruptcy in 1994 and closed more than 100 stores. In 1999, another bankruptcy led to liquidation.

Today’s Man

Specializing in discount men’s suits, Today’s Man carved out a niche in the 1980s for young professionals seeking sharp looks on tight budgets. Due to changing shopping habits and rising competition, the chain filed for bankruptcy in 1996, but another one in 2005 made it disappear from strip malls and commercial centers.

Hudson Motor Car Company

Hudson earned respect for engineering prowess and sleek design, particularly in postwar America. Its "step-down" chassis offered superior handling, and its models were early favorites on racetracks. But limited capital and rising pressure from Detroit’s Big Three pushed Hudson into a 1954 merger with Nash to form AMC. The Hudson name was phased out by 1957.