A Promise That Sounded Too Good To Ignore

For years, Corinthian Colleges marketed itself as a fast track to a better life. Its ads promised short programs, flexible schedules, and—most importantly—careers that paid well right after graduation. For students who couldn’t afford to wait four years for a traditional degree, it sounded like the perfect solution. Enroll now, graduate quickly, and start earning real money. Hundreds of thousands of people believed that promise. Many would later wish they hadn’t.

Job Placement Was the Hook

Above all else, Corinthian sold results. Recruiters cited job placement rates that often exceeded 90%. Prospective students were told employers valued Corinthian graduates and that career services would guide them straight into the workforce. For many, those assurances made the decision feel safe.

Who Corinthian Was Targeting

Corinthian’s schools—including Everest, Heald, and WyoTech—focused heavily on low-income students, working adults, veterans, and first-generation college students. Many recruits were told this was their chance to escape financial instability. Recruiters often stressed urgency, warning that waiting too long could mean missing out on limited opportunities.

Marketing Was the Engine

Corinthian spent aggressively on advertising. TV commercials, online ads, and billboards pushed the same message everywhere. Recruiters were trained to emphasize outcomes over academics. Internal materials later showed staff were coached to redirect concerns about cost or debt back to future earning potential.

Tuition Was High—But Downplayed

Programs often cost far more than similar options at community colleges. Most students relied almost entirely on loans. Recruiters frequently minimized the risk, suggesting future salaries would make repayment manageable. As one former student later recalled, “They made it sound like the debt wouldn’t matter.”

Graduation Didn’t Match Expectations

Once programs ended, many graduates felt stranded. Job leads were limited or nonexistent. Some were told to search job boards on their own. Others were encouraged to apply for entry-level work unrelated to their field. The promised transition from classroom to career never arrived.

Placement Numbers Raised Questions

Graduates eventually learned how “employment” was defined. Temporary jobs, unrelated work, and even short-term positions arranged by the school sometimes counted. In some cases, working for just one day qualified a graduate as “placed.” The impressive statistics began to unravel.

What Internal Records Revealed

Investigators later uncovered emails and testimony suggesting placement data had been manipulated. Former employees said they were pressured to meet numerical targets, even if that meant stretching definitions. One whistleblower described the process as focused on appearances, not actual outcomes.

Debt Kept Piling Up

Loan payments arrived whether graduates had jobs or not. Many worked low-wage positions while carrying tens of thousands of dollars in debt. Defaults rose. Credit scores dropped. For students who enrolled hoping for stability, the situation felt increasingly inescapable.

Students Compared Notes

Online forums and social media groups filled with similar stories. Different campuses. Different programs. Same results. Graduates began to realize their struggles weren’t isolated incidents. What once felt like personal failure started to look systemic.

Regulators Took Interest

Complaints reached state attorneys general and federal agencies. The Consumer Financial Protection Bureau accused Corinthian of predatory lending and deceptive practices. Investigations expanded to include recruiting scripts, placement data, and internal training materials.

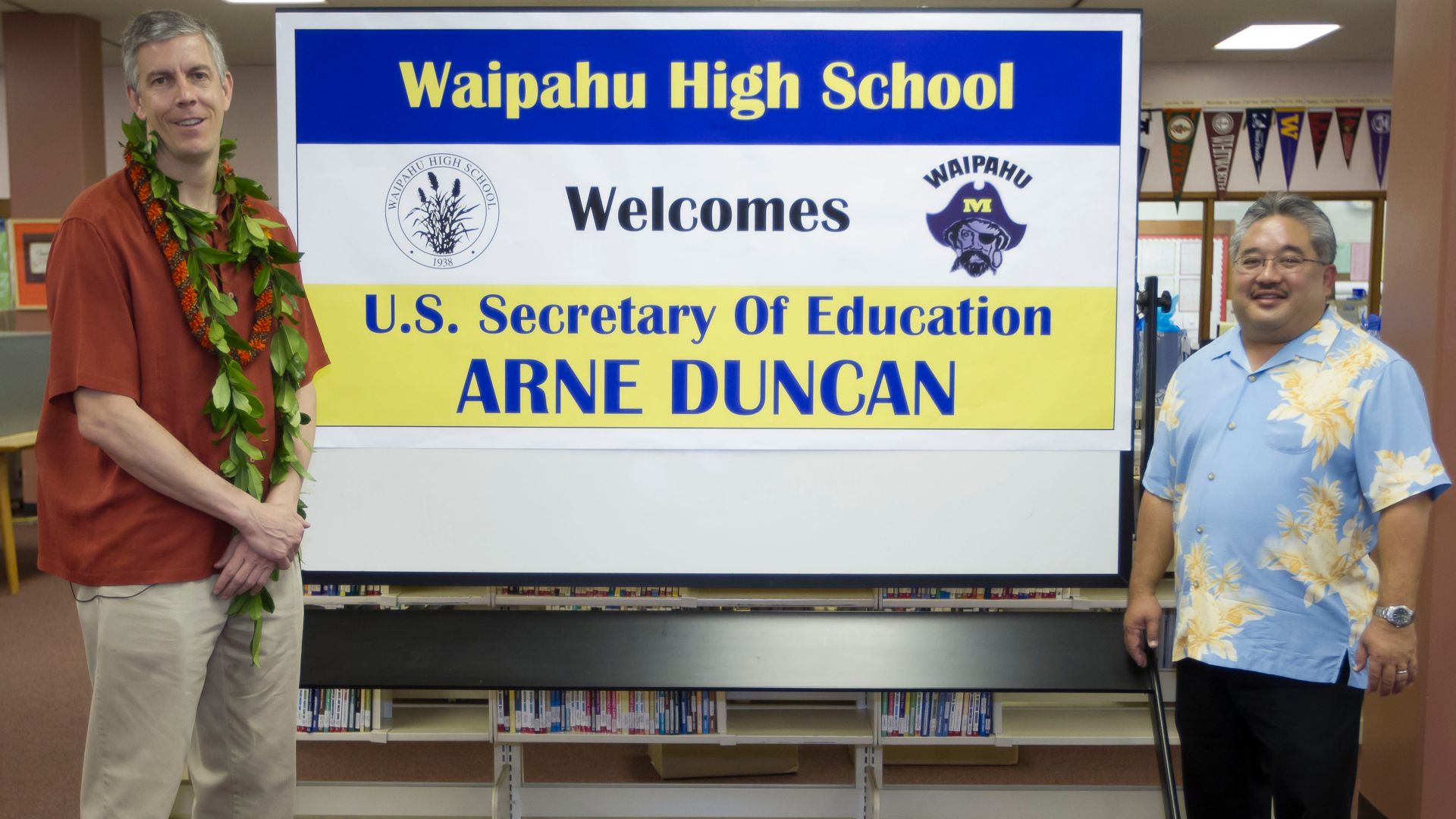

G. Edward Johnson, Wikimedia Commons

G. Edward Johnson, Wikimedia Commons

“A House of Cards”

In 2014, U.S. Secretary of Education Arne Duncan publicly described Corinthian as a “house of cards.” Federal officials questioned whether the company deserved continued access to student aid funds. The scrutiny accelerated Corinthian’s financial decline.

US Department of Education, Wikimedia Commons

US Department of Education, Wikimedia Commons

Lawsuits Followed

Former students filed lawsuits alleging fraud and misrepresentation. They argued they enrolled—and borrowed heavily—based on promises that weren’t true. The legal pressure compounded Corinthian’s regulatory troubles and intensified public attention.

The Collapse Came Quickly

Enrollment dropped. Campuses closed. Federal funding was restricted. In 2015, Corinthian Colleges filed for bankruptcy. Thousands of students were left mid-program, unsure whether their credits would transfer, while loan balances remained.

Bankruptcy Didn’t End the Fallout

Legal action continued after the collapse. State and federal lawsuits moved forward. Executives faced civil penalties. Corinthian became a central example in broader investigations into the for-profit education industry.

Relief Finally Arrived

Years later, former Corinthian students qualified for loan forgiveness under borrower defense programs. Ultimately, billions of dollars in federal student loans tied to Corinthian were discharged. For many borrowers, it was the first meaningful financial relief they’d experienced.

A Rare Admission

In announcing relief efforts, the Department of Education acknowledged students had been harmed by “widespread misrepresentations” about job outcomes. That acknowledgment shifted responsibility away from borrowers and onto the institution that recruited them.

Maryland GovPics, CC BY 2.0, Wikimedia Commons

Maryland GovPics, CC BY 2.0, Wikimedia Commons

Rules Began to Change

Corinthian’s collapse helped prompt stricter regulations around advertising, job placement claims, and outcome reporting. Schools were forced to be clearer about employment data. Inflated or vague promises became much harder to defend.

Why This Case Mattered

Students sue schools all the time and usually lose. What made Corinthian different was scale—and evidence. Internal documents, whistleblowers, and consistent student testimony painted a clear picture of systemic deception.

The Ripple Effects

Corinthian didn’t just disappear. It changed how regulators, accreditors, and students viewed career-focused education. Scrutiny increased across the industry, and skepticism toward glossy placement statistics became the norm.

The Students Who Forced Accountability

Most of the students who sued never wanted to be plaintiffs. They wanted jobs. By speaking up and pushing legal action, they forced accountability—and protections—that didn’t exist before.

Why the Story Still Matters

Corinthian Colleges is gone, but its impact remains. Schools still market outcomes, but with far more caution. For students today, the lesson is simple: ask how promises are measured—and what happens if they fall apart.

You Might Also Like:

You Can Get These High-Paying Jobs With Just A Certificate

The Opportunity And The Pitfalls Of Taking On A Restaurant Franchise in 2026