I just got offered the job of my dreams. I opened the offer letter and learned it pays $32,000 less than what I make now. Should I take the risk?

I just got offered the job of my dreams. I opened the offer letter and learned it pays $32,000 less than what I make now. Should I take the risk?

You finally get the call, and your dream job is yours. The role fits your skills, the mission excites you, and you can almost picture your first day. Then you see the salary offer—$32,000 less than what you make now—and your stomach drops. Is passion worth a pay cut?

Before you decide, let’s unpack what truly matters and see whether saying “yes” will move you forward or set you back.

Evaluate What the Offer Really Means

Many professionals face the dilemma of receiving an offer that’s financially lower but emotionally higher-stakes. Candidates in this position often find themselves torn between the promise of personal fulfillment and the comfort of financial stability.

But here’s the thing: a salary dip doesn’t automatically make a job a poor choice, but it does signal the need for a hard look at your numbers. So, start by assessing whether you can maintain your current lifestyle, save for the future, and stay on track with debt payments.

Once you know what’s financially sustainable, you can better weigh the emotional and career rewards that may come with the role.

Vitaly Gariev, Unsplash

Vitaly Gariev, Unsplash

Think Beyond The Base Salary

A paycheck rarely tells the whole story. Career experts emphasize that the full compensation package—bonuses, healthcare, stock options, time off, and remote flexibility—can easily shift the balance. A lower base may still make sense if the role offers advancement opportunities or benefits that boost your long-term financial stability.

For instance, a position that invests in your education or provides equity could make up the difference within a few years. On the flip side, if the offer lacks these incentives, the lower salary may quickly feel restrictive.

Vitaly Gariev, Unsplash

Vitaly Gariev, Unsplash

Ask the Right Questions Before Accepting

Before signing anything, take a moment to evaluate the offer through a practical lens:

What’s the minimum salary you need to live comfortably right now?

How will the change affect your savings, retirement, or debt payoff?

Are bonuses, perks, or flexibility enough to close the financial gap?

What’s the timeline for potential raises or promotions?

Could the role open doors that raise your income later?

Each question helps separate emotion from calculation. The goal isn’t just to follow your heart—it’s to make sure your finances can follow, too.

At The End Of The Day

Taking a job that pays less can sometimes be the right move. It can open new doors and align your work with your values. But it only works if the trade-off improves your quality of life or your long-term earning power. If you’re on the fence, have a financial advisor review the numbers to confirm what’s realistic. Passion may fuel your purpose, but thoughtful planning keeps your future secure.

Vitaly Gariev, Unsplash

Vitaly Gariev, Unsplash

READ MORE

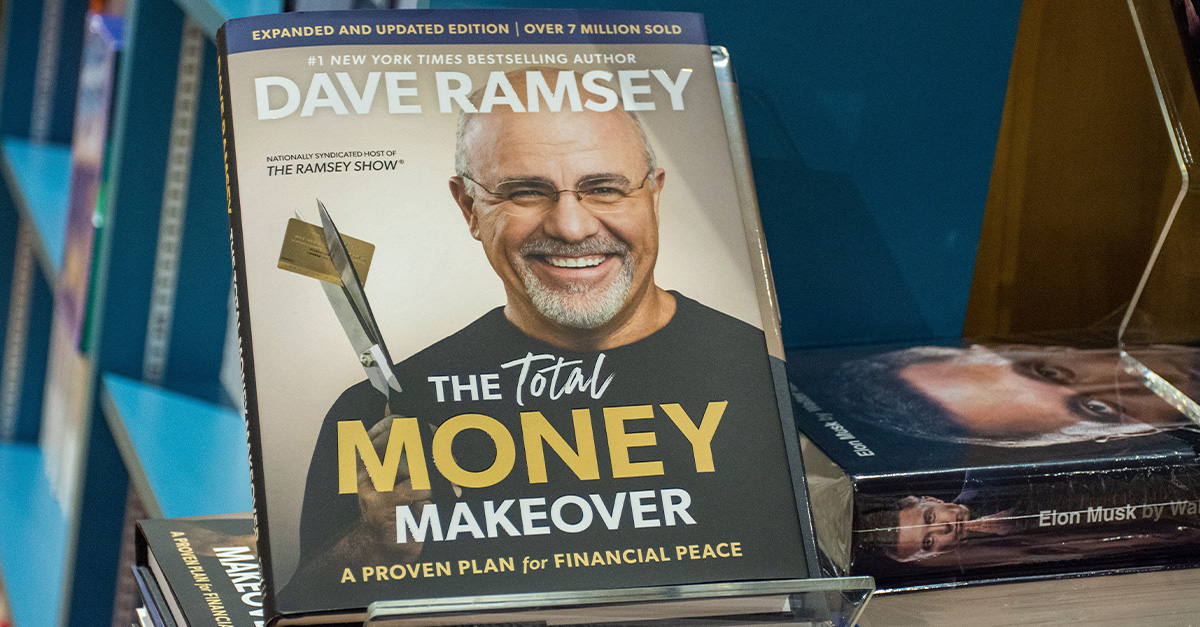

Podcaster and financial guru Dave Ramsey went from a millionaire—to broke in his twenties—and then re-gained his financial status in his thirties. Find out how he did it and how it could work for you by adopting some of Dave's best financial advice.

If you are selling your house, or thinking about selling your house—these are some of the simple (and often for very inexpensive) things you can do to increase the value of your home and help get the highest offers and the most money you can out of it.

Wealth often brings freedom, but for some, it fuels mind-bending indulgences that defy all logic. Since they don’t worry about the price tag, why wouldn’t rich folks buy whatever they crave, no matter how ridiculous?

Utility costs have surged for millions of U.S. households over the last decade. Surprisingly, much of the increase stems from neglecting simple energy-saving practices and poor planning—issues that are easy to fix with a little effort.

Apart from business deals, bank accounts, and monitoring the stock market, some billionaires have hobbies that are surprisingly down-to-earth—or outright unexpected. So, what are the richest people’s favorite hobbies?

Stuck in a credit rut? A low credit score can feel like a roadblock but, hey, it’s not unsalvageable. There are things you can do that’ll boost your score and your confidence pronto.

Disclaimer

The information on MoneyMade.com is intended to support financial literacy and should not be considered tax or legal advice. It is not meant to serve as a forecast, research report, or investment recommendation, nor should it be taken as an offer or solicitation to buy or sell any securities or adopt any particular investment strategy. All financial, tax, and legal decisions should be made with the help of a qualified professional. We do not guarantee the accuracy, timeliness, or outcomes associated with the use of this content.

Dear reader,

It’s true what they say: money makes the world go round. In order to succeed in this life, you need to have a good grasp of key financial concepts. That’s where Moneymade comes in. Our mission is to provide you with the best financial advice and information to help you navigate this ever-changing world. Sometimes, generating wealth just requires common sense. Don’t max out your credit card if you can’t afford the interest payments. Don’t overspend on Christmas shopping. When ordering gifts on Amazon, make sure you factor in taxes and shipping costs. If you need a new car, consider a model that’s easy to repair instead of an expensive BMW or Mercedes. Sometimes you dream vacation to Hawaii or the Bahamas just isn’t in the budget, but there may be more affordable all-inclusive hotels if you know where to look.

Looking for a new home? Make sure you get a mortgage rate that works for you. That means understanding the difference between fixed and variable interest rates. Whether you’re looking to learn how to make money, save money, or invest your money, our well-researched and insightful content will set you on the path to financial success. Passionate about mortgage rates, real estate, investing, saving, or anything money-related? Looking to learn how to generate wealth? Improve your life today with Moneymade. If you have any feedback for the MoneyMade team, please reach out to [email protected]. Thanks for your help!

Warmest regards,

The Moneymade team