When The Past Returns At The Worst Time

Few moments sting like seeing a promising job interview unravel in a matter of seconds. You answered truthfully about the time you got fired, but honesty doesn’t always play out the way you hope. The key now isn’t to get lost in regrets and what ifs; it’s in learning how to recover, reframe, and rebuild your confidence for the next step in your career trajectory.

Understand The Question’s Real Purpose

When interviewers ask if you’ve ever been fired, they’re not looking for perfection. They’re testing your sense of accountability, growth, and honesty under pressure. How you explain difficult incidents in your past matters a lot more than what actually happened.

Why Honesty Is Important

You may be tempted to blur the truth, but background checks and references can usually expose these kinds of omissions. Employers respect self-awareness more than denials of responsibility. Framing your story as a learning experience can turn that setback into a strength.

Reflect Before You Reapply

Before you rush into your next application, take some time to unpack what really led to your firing. Was it performance, culture fit, or something purely circumstantial like layoffs? Understanding the root causes will help you prevent repeat patterns and show that you’ve grown from the experience.

Rewrite The Narrative

Don’t bluntly state, “I was fired.” Say something like, “I was let go after a change in direction that taught me how to adapt.” The descriptive language you use matters. The same event can sound like a failure, or a turning point, but it depends entirely on how you describe it.

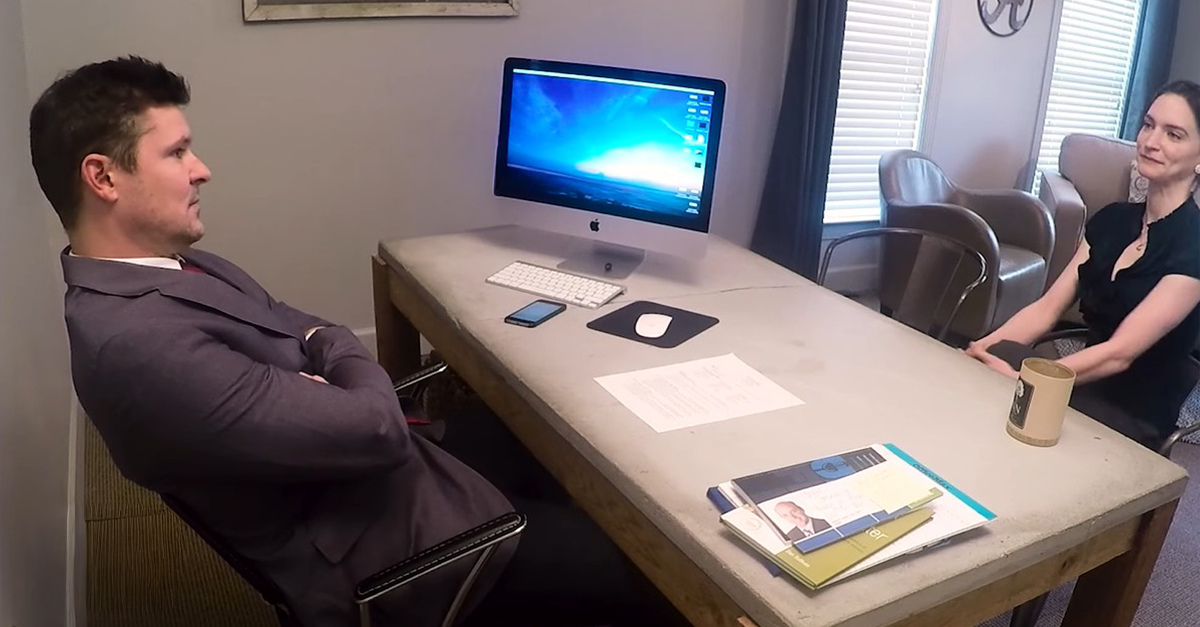

Amtec Photos, Wikimedia Commons

Amtec Photos, Wikimedia Commons

Focus On What You’ve Learned

When asked about the firing, be honest, but pivot quickly to the lessons gained. Maybe you improved your communication skills or discovered the type of work environment where you really thrive. Every tough experience can be reframed as professional development.

Avoid Oversharing Or Defensiveness

Stick to the facts and avoid emotional explanations about unfair treatment or office politics. Defensiveness signals some unresolved issues that may carry over into your next position, while calm acknowledgment demonstrates maturity. Keep your tone factual, not apologetic.

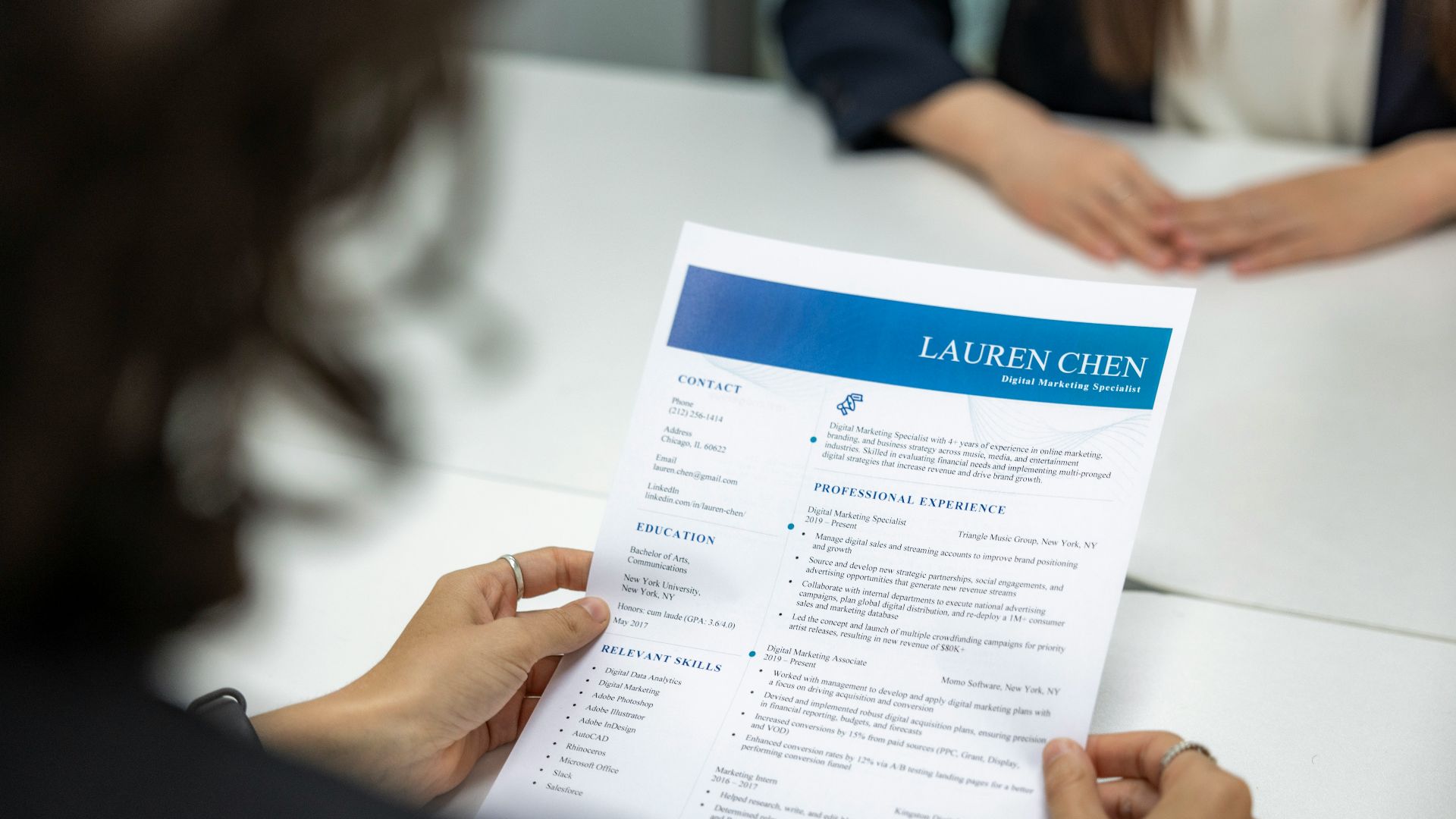

Rebuild Your Resume Story

Make sure your resume puts emphasis on your accomplishments before and after the firing. Use metrics and action verbs to show that your value didn’t change with one employer’s decision. Recruiters are interested in your overall career trajectory, not a single stumble.

Gather Strong References

If one job ended badly, find other employers who can vouch for your work ethic and integrity. A positive reference from a respected professional can offset negative assumptions about what you have to offer. Ask former colleagues or clients who can speak credibly about your skills.

Practice Your Explanation

Write out your firing explanation as a three-sentence story: what happened, what you learned, and how you’ve grown. Rehearse the new version of the story until it feels natural and confident. A practiced calm demeanor of purely and simply recounting the facts will always be better than nervous over-explaining.

Highlight Continuous Learning

Show that you turned your downtime into progress. Enrolling in professional courses, certifications, or volunteer work shows that you are determined to take the initiative. Employers love candidates who use setbacks as opportunities to grow.

Protect Your Finances While Job Searching

A job loss can quickly turn into a financial crisis if you rely on savings too long. Trim unnecessary expenses and put any large purchases on hold. Focus on liquidity, and keep cash available until you see the return of a stable income.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Review Your Unemployment Eligibility

If you were fired for performance, you may still qualify for unemployment benefits depending on state laws. File as soon as possible and give accurate documentation. Don’t assume you’re disqualified without checking.

Revisit Health And Retirement Coverage

If your benefits ended with your job, consider COBRA, Affordable Care Act options, or a spouse’s plan. For retirement accounts, try as hard as you can to avoid cashing them out. You can roll over your 401(k) into an IRA to safeguard growth and avoid penalties.

Make A Short-Term Budget

Base your budget strictly on essential needs, like housing, food, insurance, and job-search costs. Postpone vacations and large purchases. The goal is sustainability while you reset professionally.

Keep Your Credit Intact

If severance or unemployment turns out not to be enough to get you through, communicate with creditors early. Many organizations offer hardship deferrals or interest reductions. Protecting your credit score now will make your eventual financial recovery a lot easier.

Network Without Shame

Don’t hide from your professional network just because of one negative experience. Reconnect with mentors and peers; a lot of professionals have faced the same situation. Vulnerability along with professionalism often leads to unexpected job leads.

Prepare For Future Interviews

Rehearse your story until it sounds like a growth chapter in your career saga, not damage control. Keep your tone composed and forward-looking. When you take ownership of your narrative with confidence, interviewers see resilience instead of red flags.

Move Forward With Perspective

Being fired once doesn’t define your worth or career; many people have been fired and went on to further success elsewhere. Treat it as one chapter, not the entire story. The ability to recover, learn, and move forward gracefully will make a better impression than an unblemished record ever could.

You May Also Like:

People Share How They Answered A Tough Job Interview Question

"My interview was going great, but I froze when they asked me who my favorite Teletubby was!”