Finance Tips for Young Adults

The world of finance is vast and confusing. And to be fair, we don’t learn much about this in school, so it’s no wonder that young adults today are struggling more than ever before.

If you don’t know where to start, you’re in the right place. From saving for retirement to saving on groceries, here are 20 finance tips that can help send you in the right direction.

Understands Needs vs. Wants

In order to properly budget, you must first understand the difference between needs and wants. Needs should be things within your day-to-day life that directly impact your quality of life.

Examples include transportation and housing. Most others should be considered “wants”.

Start Budgeting

Making a budget, and sticking to it, can help prevent you from living paycheck to paycheck. For most people these days our expenses are fairly close to our income, which can make budgeting difficult.

But there are almost always sneaky expenses that we don’t even realize we are wasting money on. Whether it’s unnecessary coffee runs, or paying for premium subscriptions, find out where you cash is going and then adjust things accordingly.

Manage Your Debt

Paying off debt is not something that can be ignored. Unpaid debts that go to collections will end up hurting you in the long run.

If you’re struggling with your debt, ask your lender about a payment plan or a hardship program.

Use Cash Instead of Credit

While credit has its benefits, for many young adults, it can have the opposite effect.

Using cash can help you avoid spending money on things you cannot afford. It also avoids interest accrued when you miss paying off the balance each month.

Build an Emergency Fund

An emergency fund exists to cover unexpected expenses. These could include medical bills, car repairs, or even job loss.

To avoid a stressful surprise, put a little money aside from each paycheck to help avoid financial hassles later.

Deemerwha studio, Shutterstock

Deemerwha studio, Shutterstock

Have Multiple Income Streams

Having multiple income streams will increase your earning potential and help you receive financial freedom faster.

Passive income is a great way to make money while also working your usual full-time job—doubling your income without doubling the work.

Buy Health Insurance

If the pandemic taught us anything at all, let it be how important health insurance is. If your job doesn’t provide medical insurance, it would benefit you to explore your options.

Having a comprehensive insurance policy will save you thousands of dollars in the case of a medical emergency.

Summit Art Creations, Shutterstock

Summit Art Creations, Shutterstock

Build Your Credit

Having a credit card can be dangerous for some young folk, but in order to build credit you have to have—and use—credit in the first place.

Having a credit card and paying it off will boost your credit score. This can also be done with various loans.

Cancel Unused Subscriptions

This is in regard to all those “free trials” we set up just to watch one movie or TV series. Most often these free trials become paid subscriptions and we don’t notice until we’re a few month deep into payments.

Keep track of your free trials, and all the extra channels you may be paying for and not watching.

Learn About Money

Good financial planning requires learning. In order to effectively manage your money, you need to understand it first.

Book an appointment with a financial advisor, or do a simple google search for terms you don’t understand.

Tinnakorn jorruang, Shutterstock

Tinnakorn jorruang, Shutterstock

Save for Retirement

This is becoming more and more important as the financial health of the world changes. Everyone is urged to start saving for retirement now. No matter how young you are, plan for your retirement.

Look into company-sponsored retirement plans, or talk to your financial advisor about retirement savings plans.

Set Goals

Set life goals, big and small, both financial and lifestyle. Once you know what you want, you can create a realistic budget that will motivate you to save.

Learn How Taxes Work

Whether you’re financially successful or not, there’s one expense that you will always pay for—taxes. Understanding your tax bracket will help leverage retirement savings accounts and minimum your tax burden.

Deemerwha studio, Shutterstock

Deemerwha studio, Shutterstock

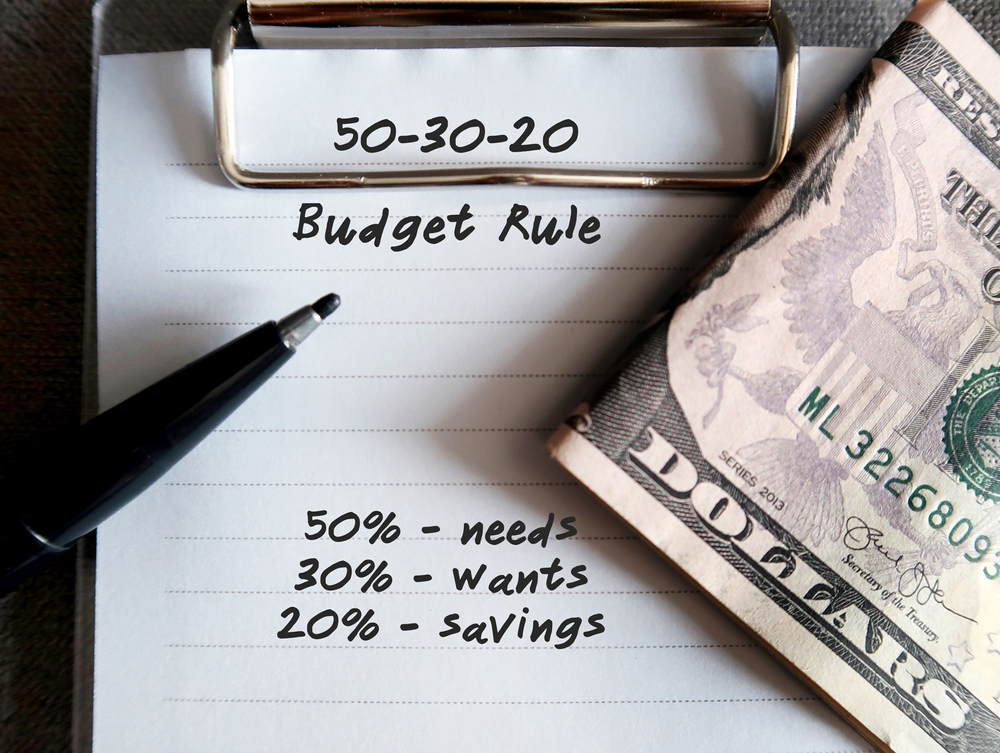

Use the 50/30/20 Rule

There are a few adaptions to this rule, but one that works best for most people is the 50/30/20 rule. It basically means allocating 50% of your income to your needs, 30% to your wants, and 20% to your savings.

This helps pay your expenses and secure your savings while still fulfilling your wants.

Automate Your Bills

The best way to avoid late payment fees is to set up direct withdrawal for your bills. Companies frequently charge late fees if they don’t receive payment on time.

Automate Your Savings

Another way to save more and spend less is to set up automated savings payments. This means, you can have a portion of your paycheck go directly into a savings account as soon as you get paid.

You can set a small amount, or a larger amount, depending on what your budget allows.

Put a Spending Limit on Your Card

Setting a limit on your credit or debit cards is a great tip for saving money fast. We often don’t realize how much we spend until it’s already gone.

Having a limit encourages you to reassess your spending habits before they actually happen.

Save on Groceries

One of the best ways to save on groceries is to meal plan.

Before you head to the store, plan your meals for an entire week, including the ingredients needed for each meal.

This will ensure you only buy what you will need, avoiding unnecessary spending.

Cut Back on Utilities

Paying attention to your energy consumption can save you money.

Lower the temperature in your home and put on a sweater. Only use as much lighting as needed, and swap for LED bulbs. Ensure your windows and doors are sealed well.

Negotiate Your Bills

Most utility companies can work with you to lower your bills, but you have to ask. Call the loyalty department for your cell phone company and request a deal for being a loyal customer for x-years. You may find an instant savings.

Cable companies can also make adjustments to services to cut the costs.

TuiPhotoEngineer, Shutterstock

TuiPhotoEngineer, Shutterstock

Final Thoughts

Saving money can be challenging if you don’t know where to start. The best place to begin is education. Learning about your financial responsibilities and how to navigate them is the best way to ensure financial freedom later on.

Remember, it is never too early to start saving.

Jantanee Runpranomkorn, Shutterstock

Jantanee Runpranomkorn, Shutterstock