The Reality Is Sinking In

You’ve been trying to tackle your credit card debt by paying the minimum amount each month. But when you used a debt calculator and saw “23 years to pay off,” it hit hard. The reason for this is very simple: minimum payments mainly go toward paying the interest, while barely making a dent in the principal.

How Credit Card Interest Works Against You

Credit cards often carry interest rates between 18% and 30%. If you only pay the minimum amount on your monthly bill, most of that payment covers interest charges, not your balance. Doing this for too long will pull you into a vicious cycle where you’re paying hundreds or even thousands of dollars just to borrow the same $10,000 year after year.

Understanding The Minimum Payment Trap

Credit card companies calculate minimum payments as a small percentage of your balance, usually around 2% or thereabouts. That number is calculated to keep you in debt longer. It’ll seem like you’re staying “current” on your payments, but it barely moves the needle on your debt, allowing lenders to profit from long-term interest.

Check Your Statements For Interest Disclosures

Federal law requires issuers to show how long payoff takes with minimum payments. If you take a moment to look at your monthly statement, it often includes a box stating, “If you make only the minimum payment, you will pay off this balance in X years.” That timeline isn’t theoretical, it’s real math.

Build A Realistic Debt Payoff Strategy

To break free from this rut, you’ll need a structured plan. Two common debt repayment strategies are the debt avalanche and debt snowball. The avalanche focuses on paying off the highest-interest balance first, while the snowball tackles the smallest debt for faster motivation. Whichever of these two approaches you take, they both beat paying only the minimum.

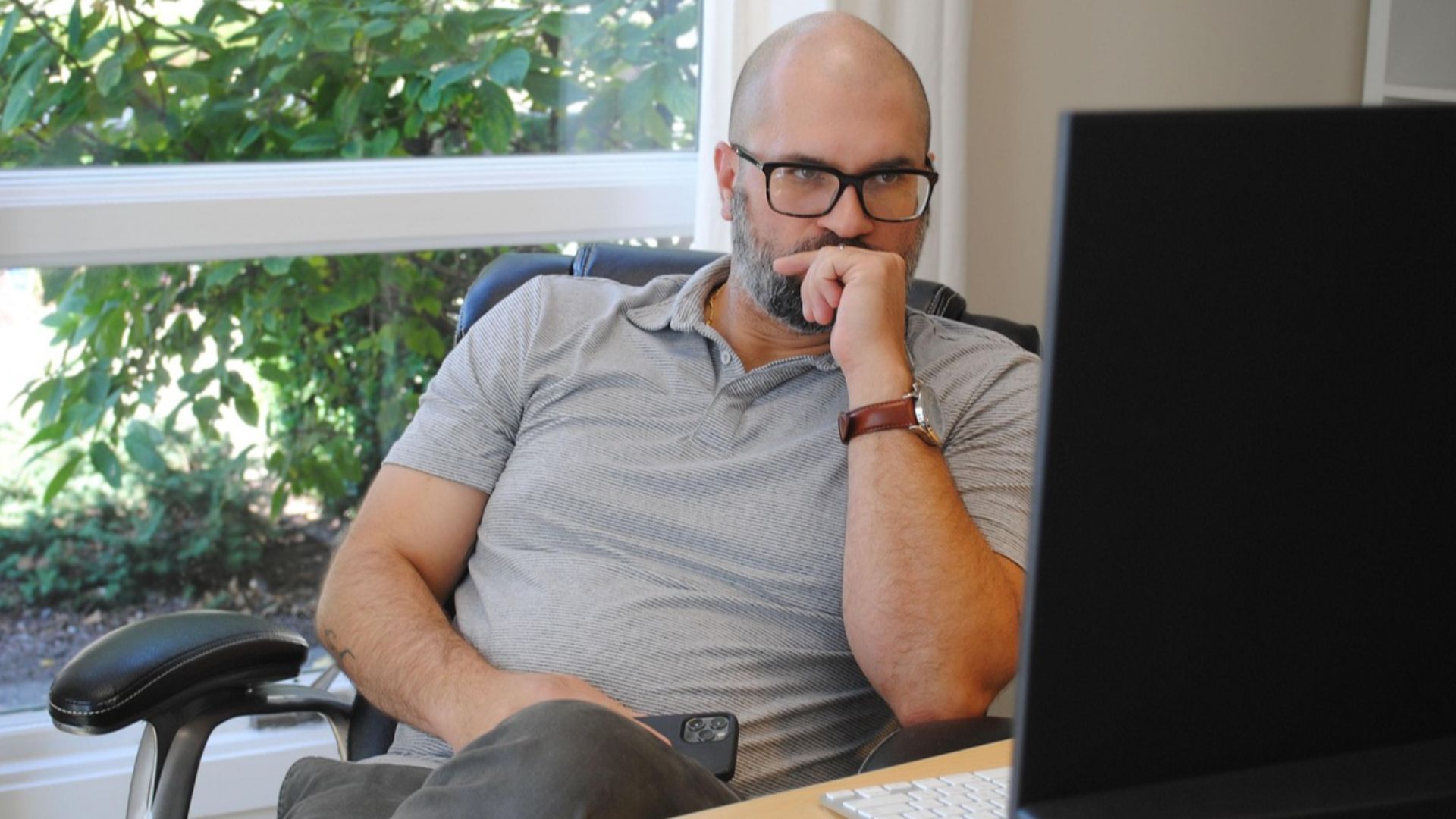

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Consider Consolidating Your Balances

If you’ve maxed out several credit cards, a balance transfer credit card or personal loan could help. Look for 0% introductory APR offers or lower fixed-rate loans to reduce interest. The problem here is that you can’t under any circumstances use new credit to fund old habits; you also have to pay off the transferred balance before promotional rates expire, or you’ll be right back in the same situation.

Boost Your Monthly Payment Amounts

Even small increases in your monthly payment can make a big difference. For example, if you pay $300 instead of $200 monthly, you’ll dramatically speed up payoff time and save thousands of dollars in interest. Treat your debt like a non-negotiable monthly bill and round up payments whenever you have extra money to do so.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Track Spending So You Don’t Add More Debt

You can’t get out of a hole if you’re still digging. Review your bank and credit card statements frequently for discretionary spending. Cancel any unused subscriptions, limit dining out, and stay away from impulse buys. The goal is to keep the balance from growing while you focus on repayment.

Christian Velitchkov, Unsplash

Christian Velitchkov, Unsplash

Look At Getting A Side Hustle

Extra income can also accelerate debt payoff. Consider freelancing, selling unused items, or taking on part-time work. Even an additional $200 a month put directly toward your principal can cut your repayment timeline in half.

Talk To Your Credit Card Company

Some lenders offer hardship programs or lower interest rates if you level with them about your situation. Call them and let them know your situation; they may temporarily reduce your APR or set up a structured payment plan for you. Be polite but firm in requesting better terms to help you get rid of your debt faster.

Understand The Role Of Credit Counseling

If you feel overwhelmed by all this, a nonprofit credit counseling agency can create a debt management plan (DMP) for you. These programs consolidate your payments and may be able to negotiate reduced interest rates on your behalf. You’ll end up having to make one payment to the agency, which then distributes funds to your creditors.

Stay Away From Debt Settlement Companies

Be wary of for-profit companies promising “pennies on the dollar” settlements or similar pie-in-the-sky promises. They often charge high fees, advise you to stop payments, and can ruin your credit score. Many creditors refuse to work with these debt settlement companies, and any forgiven debt could activate unfavorable tax consequences.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Don’t Close Your Accounts Too Quickly

If you pay off a card, don’t close the account immediately. Keeping older accounts open maintains your credit utilization ratio and average account age, both of which help your credit score. Just make sure the card doesn’t charge annual fees.

Keep An Eye On Your Credit Utilization

Your credit utilization, or the percentage of available credit you’re using, should ideally stay below 30%. Paying down balances improves this ratio and can also raise your credit score, which could qualify you for better rates on future consolidation loans.

Set Milestones And Celebrate Progress

Remember that debt repayment is a marathon, not a sprint. Celebrate the small victories, like cutting your balance by $1,000 or paying off one card entirely. These milestones keep you motivated, and help you stay consistent over the long term.

Build An Emergency Fund

Unexpected expenses are the leading cause of credit card relapse. Even while you continue paying off debt, set aside a small emergency fund $500 to $1,000 to handle car repairs or medical bills without having to rely on credit again.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Automate Payments To Stay On Track

Set up automatic transfers from your checking account. This means you’ll never miss a payment date, while avoiding late fees and credit hits. Automating extra payments also keeps you committed to your plan.

Review Your Budget Every Month

Debt repayment demands flexibility. Review your spending on a monthly basis and adjust as income or expenses change. Reallocate small amounts from entertainment or dining out, and you’ll become debt free faster without impacting your lifestyle.

A Learning Experience

Treat this as a financial life turning point. Once you’re debt-free, make a commitment to stay there. Build your savings, invest strategically, and avoid depending on credit for everyday expenses. Use what you’ve learned to maintain long-term financial stability.

Visualize Life After Debt

Picture the relief of opening a credit card statement that shows a zero balance. Freedom from interest payments means moving on with your life. It also comes with more money for travel, retirement, or home ownership. Every extra dollar you pay back now brings that future a little bit closer.

You May Also Like: