You Released Estate Funds Before Probate Closed

You thought you were trying to help. Your brother claimed he had a financial emergency and asked for his share of the inheritance from your dad’s estate before probate was finalized. You agreed to do this, but unfortunately, he wired the entire amount to a woman he met online who has since taken off and disappeared. Now the estate owes taxes, and you’re left wondering how to fix this costly mistake.

Executors Have a Fiduciary Duty

As executor, you’re legally obligated to act in the best interests of the estate and its heirs. Disbursing funds before debts, taxes, and expenses are settled can violate that duty. Courts are expecting you to manage the estate responsibly, which means that personal decisions, even made with good intentions, can create liability.

Why Early Distributions Are Risky

Even when heirs start putting pressure on you, early distributions from the estate are dangerous. Until probate closes, the estate may still owe various and sundry taxes, legal fees, or unexpected debts. If funds have already been handed out and spent, you may be held personally responsible for covering those obligations out of your own pocket.

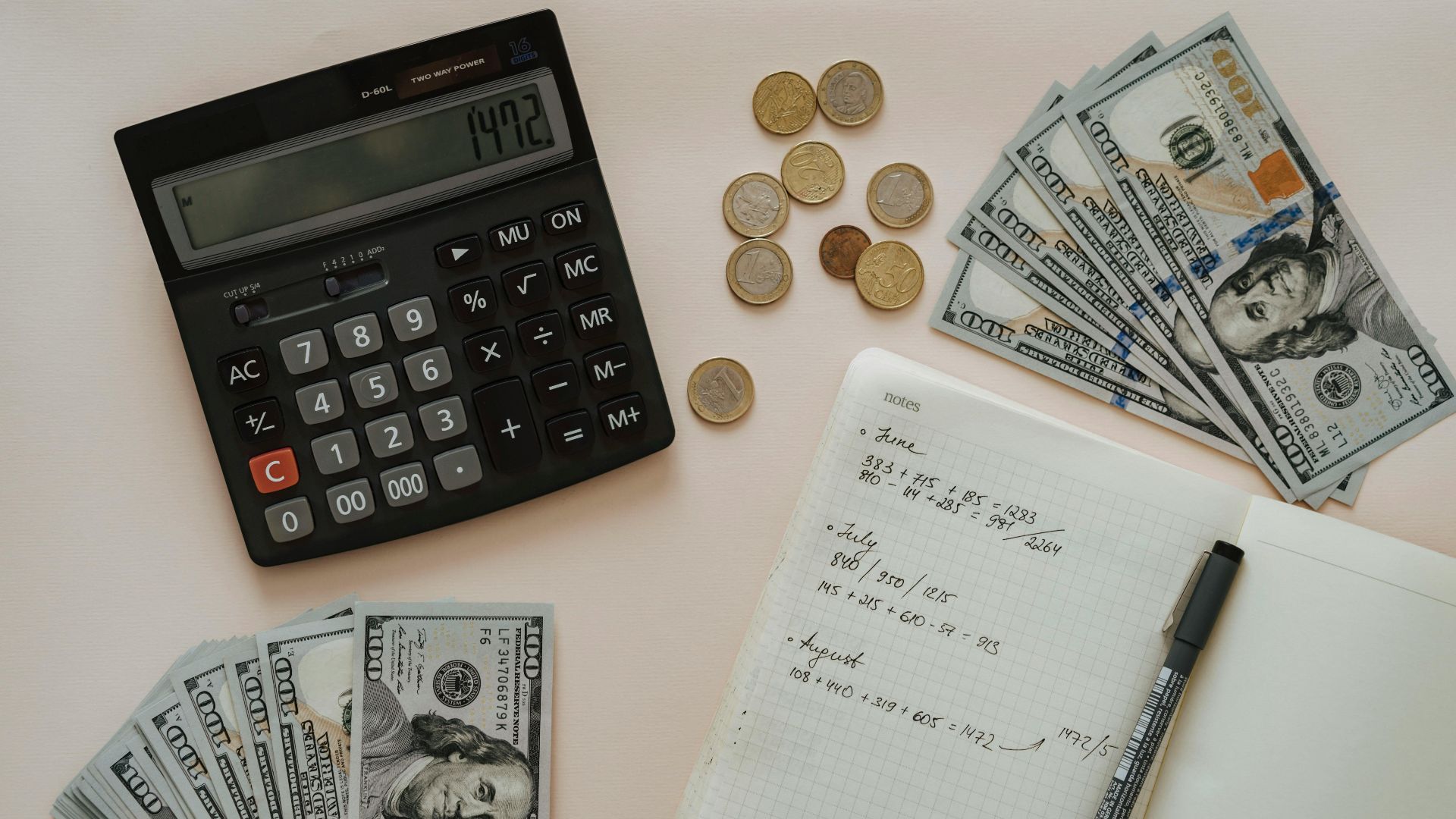

Determine The Exact Tax Liability

Before we start getting excited, let’s take a deep breath and calculate the total tax burden. Work with the estate’s accountant or probate attorney to file the necessary returns and determine how much exactly the estate owes. You need clarity before deciding whether repayment is possible through other estate assets, or whether you personally are on the hook for the difference.

Talk To The Probate Attorney Immediately

This is not a situation you want to try to handle alone. Contact the estate’s attorney and tell him/her exactly what happened. Being transparent, and not hiding the early payout, gives you the best chance of negotiating with the court or tax authorities to minimize penalties or personal exposure.

Notify The Probate Court Of The Mistake

Probate courts understand that mistakes happen, but they also expect you to give them prompt updates. File an amended accounting or affidavit explaining in detail that an early distribution was made in error, and include as many details as you can about the lost funds. Not properly reporting this shortfall can worsen your liability and damage your credibility.

Get Court Authorization To Recover Funds

If your brother still has any assets, or if the wire transfer can be traced, the court may permit you to pursue recovery. Even if the money is gone for good, documenting your efforts shows good faith. If the woman he sent the funds to was part of a scam, you must file a police report and let the bank’s fraud department know what’s going on.

Protect Yourself By Documenting Everything

Maintain detailed records, including emails, bank transfers, receipts, and communications with your brother. If any questions come up later, this paper trail will show that you acted in good faith, even if your decision was made prematurely. Documentation can be make-or-break evidence if the court reviews your fiduciary conduct.

Hold A Family Meeting To Explain The Situation

Transparency will help prevent resentment among other family members. Gather all heirs and explain what occurred, including how you plan to address the shortfall. Open and honest communication can help maintain family trust and show that you’re taking responsibility to protect the estate’s interests.

Understand That The Brother’s Actions Don’t Excuse Yours

Even though your brother’s irresponsible decision was the cause of this loss, the court will still hold you accountable because you released the funds prematurely. Executors can’t shift the blame to beneficiaries when distributions are made without approval or before final accounting. The buck stops with you.

Explore Repayment Options With Your Brother

Ask your brother to sign a written repayment agreement acknowledging the early distribution and his personal obligation to pay back the estate. Even if he can’t pay now, this establishes legal recognition of the debt. It gives you grounds to collect later if his financial circumstances improve.

Consider A Surcharge Proceeding

If your brother refuses to pay back the estate, the court may issue a surcharge order against him, holding him liable for the loss. While collecting on it may be difficult, this process shows that you took reasonable steps to get the estate’s funds back and limit your exposure.

Pay Taxes Before Any More Money Goes Out

Going forward, the estate’s tax and debt obligations must be your top priority. Hold the remaining funds in a separate estate account, and don’t release another penny of it until the court approves a final distribution order confirming all liabilities have been paid. Don’t give in to the screaming and moaning of the other heirs; it’s your job to handle the estate’s money according to the law and to the best of your ability.

File The Estate’s Tax Returns On Time

Late filings can lead to penalties and interest that amplify the financial strain. Even if you have to pay some taxes from your own funds temporarily, on-time compliance lowers the risk. Keep your receipts to document any personal outlays so you can recover it later from estate assets.

Strengthen Oversight With Professional Help

Consider hiring a CPA or licensed fiduciary to assist with financial oversight. These professionals can ensure compliance, manage future accounting, and reassure the court that you’re taking corrective steps to carry out your duties properly.

Report The Scam To Authorities

Get your brother to file a report with the FBI’s Internet Crime Complaint Center (IC3) or local law enforcement. While it’s unlikely you’ll get the money back, filing creates a record that could help in restitution claims or demonstrate that the loss stemmed from fraud, not malice.

Prepare To Get An Earful

Other heirs may start hurling accusations against you of favoritism or negligence. Stay calm, share documents, and continue to point out that your actions were well-intentioned but mistaken. Showing that you’re cooperative and remorseful often persuades heirs not to undertake costly litigation.

Learn From The Mistake And Follow Procedure

This experience shows you why probate procedures are in place. Never issue early distributions again, no matter what pressure people bring to bear. Wait for court authorization, confirm that taxes are settled, and release funds only after final accounting and closing approval.

Future Executors Can Avoid This Pitfall

If you ever serve as executor again, or advise others, insist on a formal process. Estate funds belong to the estate until probate is finished. Using escrow accounts, professional accountants, and legal oversight ensures that you can do your fiduciary duties without personal exposure.

Protect Yourself And Rebuild Trust

You made a costly but common mistake. With transparency, legal guidance, and by taking responsible steps, you can protect your personal assets and your father’s estate’s best interests. Probate law rewards diligence: use that lesson to rebuild and maintain trust and ensure proper closure.

You May Also Like: