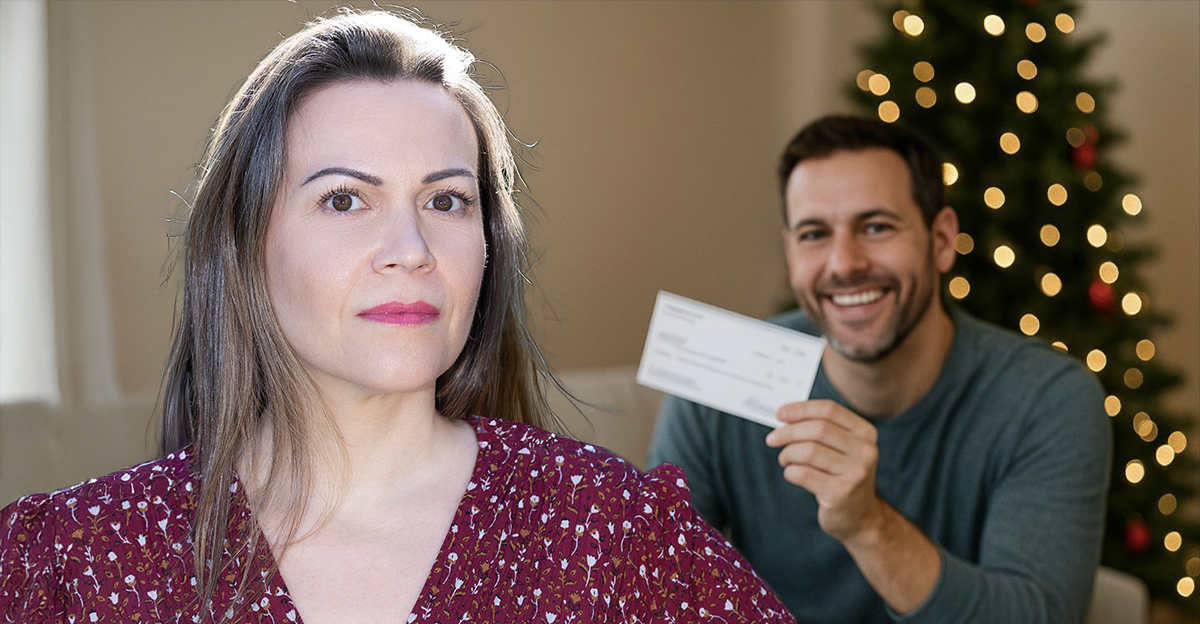

A Bonus Sparks A Financial Battle

Your husband’s Christmas bonus just came in, and instead of a sense of relief, you’re feeling stressed out even more. You want to tackle your credit card debt that’s ballooning out of control, but he’s insisting you splurge and “treat yourselves” to some well-earned luxuries over the holidays. It’s a familiar refrain: one partner wants security while the other wants to throw caution to the wind and celebrate. So what can you do now?

Why Bonuses Create Tension

A bonus tends to feel like extra, unexpected money. That’s why many people see it as a reward to just spend right away. But debt doesn’t go on holidays; the interest keeps growing. When couples disagree on their financial priorities, decisions about what to do with a bonus get emotional, tied to self-worth, fairness, and the desire to feel joy after a long year of hard work and stress.

Debt Doesn’t Take Time Off For Christmas

Credit card interest compounds fast. Using bonus money to pay it down gives you an immediate financial return that is better than most investments. Every dollar you put toward high-interest debt frees up future income. Choosing fun over financial relief might feel good right now, but it can prolong the cycle of anxiety long after you’ve taken the Christmas tree down.

Treating Yourself Can Mean Stability

A “treat” doesn’t necessarily have to be material. Peace of mind is a gift as well. Remind your husband that becoming debt-free means you’ll have more flexibility next year. You can still celebrate, but scaling things back a bit protects your future. The bonus should help you both feel a sense of security at a financially challenging time of the year. It shouldn’t be a source of new problems you’ll regret when January rolls around.

What Does “Treating Ourselves” Mean

What does he want emotionally? Relaxation? Recognition? Status? A family memory? Getting to the bottom of his motivation will make it easier to find a compromise. Maybe a small celebration along with a big debt payment could meet both goals. Instead of saying “no,” offer him an option that acknowledges his feelings without throwing away your financial progress.

Recognize His Hard Work

Sometimes partners want to spend the bonus because it validates their efforts. Be sure to express appreciation for that fact before you shift the conversation. If he feels respected, he might be more open to your reasoning. Praise goes a lot farther than pressure; you’re supposed to be a team, not opponents.

Show The Math Clearly And Calmly

Try not to argue in general terms. Compare two scenarios: spending the bonus vs. paying debt. Show exactly how much interest you’ll save and how much faster you’ll be out from under those credit card balances. When the long-term impact is laid out in black and white, responsible choices begin to look a lot more rewarding.

Create A Plan Together

A shared debt payoff strategy builds a sense of teamwork. Agree on which debts you need to attack first, how much to allocate monthly, and what role bonuses should play in that plan. When decisions come from a plan, not stress and panic, everyone feels a lot more in control.

Set Aside A Celebration Amount

Compromise doesn’t mean you lose. Set aside maybe ten to twenty percent of the bonus as a well-deserved treat you both enjoy: a special dinner, a night away, or meaningful gifts. This keeps the joy alive while you still make big financial progress. Win-win decisions like this are what strengthen relationships.

No Last-Minute Shopping Pressure

The holidays can push us to spend emotionally, especially on family. Make decisions before advertising and social pressure push you too far. Commit to a limit now; and once that budget is set, stick to it. Don’t make any impulse purchases under the excuse of generosity.

Discuss Future Dreams, Not Just Bills

Turn the focus of the conversation from sacrifice to opportunity. What could you afford next year if you were to reduce your debt now? Perhaps a vacation without guilt? Or maybe a new car paid for in cash? A home improvement project? Shared goals like these make financial discipline feel exciting, and not like a millstone around your neck.

Know The Psychology Of Spending

Shopping unleashes dopamine and temporarily numbs stress. Financial wins, on the other hand, feel slower and less flashy. But they keep paying dividends long after the moment recedes. Recognizing this brain chemistry will better enable you to make choices based on values instead of momentary impulses.

Consider Automatic Debt Payments

If you’re lucky enough to receive bonuses annually, make a rule that a percentage must always go to debt. When expectations are clear and consistent, you won’t have to go through the same rigmarole of arguments every Christmas.

Get Professional Support If Needed

If money talks only seem to escalate into conflict, a financial counselor or planner can help mediate between the two of you. A neutral party reinforces the logic of tackling high-interest debt first, without emotional baggage getting in the way. Ultimately, it’s your husband’s money, but it probably couldn’t hurt to at least try to get some mediation of this type.

Focus On The Larger Relationship Pattern

This argument may be about a lot more than just money. Do you the two of you share similar spending habits and goals? Do you trust each other to make smart financial decisions? Getting to the root of the disagreement will help prevent repeating this battle like a broken record every December.

Don’t Shame Or Issue Ultimatums

No one responds well to feeling like they are being controlled or judged. Keep the conversation focused on the real problem of credit card debt, and not the person. You’re both working toward a shared future, and respect is the two-way street that must guide the process if you want sustainable change.

Long-Term Relief Vs Short-Term Euphoria

Ask your husband how he wants to feel in January. Proud? Prepared? Unburdened? The bonus should be an improvement to your lives that lasts beyond Christmas morning. When emotions settle down and the bills appear in the mailbox, the smart choice will be obvious: paying off debt is the gift that keeps giving.

Vodafone x Rankin everyone.connected, Pexels

Vodafone x Rankin everyone.connected, Pexels

Build In Smaller Rewards Through The Year

Maybe your husband wants to feel like he can enjoy money sometimes. Schedule future mini-splurges once financial milestones are reached. Celebrate debt reduction the same way you would celebrate a promotion or other work achievement.

Shared Financial Identity

Couples thrive when they share a story: “We’re responsible.” “We’re planning for our future.” “We’re building something together.” Take this moment to reinforce your partnership, not divide it. The bonus is temporary, but your shared bond should last.

Protect The Future You Both Deserve

Wanting a fun Christmas doesn’t make him careless, and wanting financial relief doesn’t make you a joyless scold. With teamwork and compassion, you can honor both priorities: enjoy the season while you build a foundation of security. The best holiday gift is to know you have a bright future ahead of you, one in which you’re not floundering under a mountain of debt.

You May Also Like: