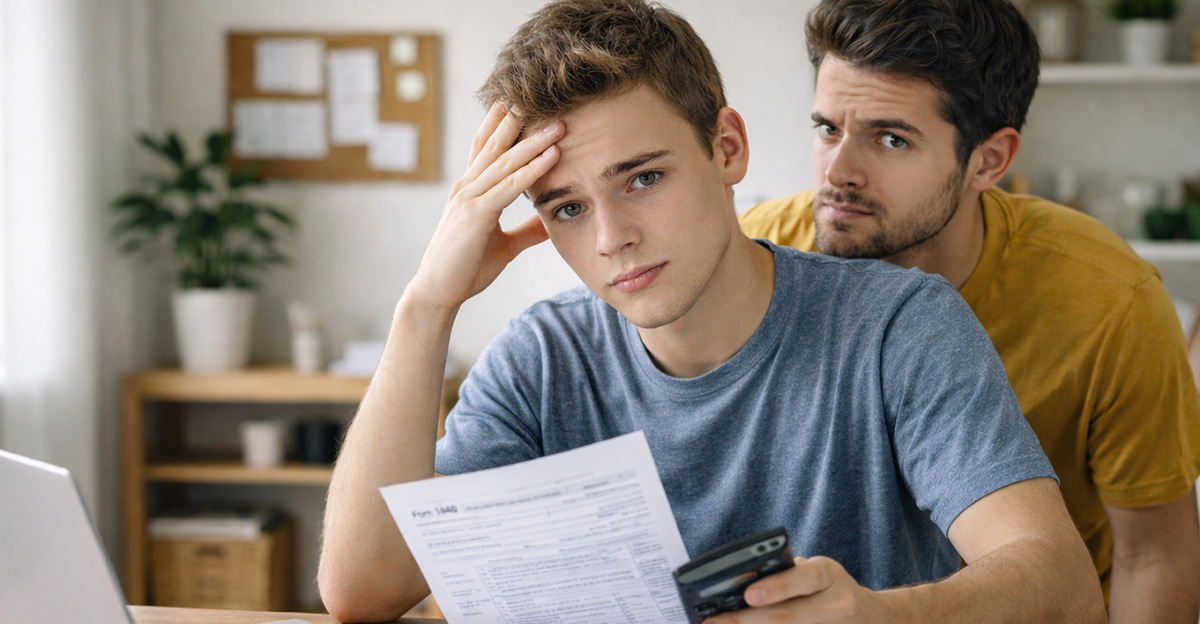

Welcome To Your First Tax Season

Turning 18 comes with new freedoms—and new paperwork. Filing income tax for the first time can feel intimidating, especially when someone confidently says you shouldn’t bother. Before you take advice from the group chat philosopher of record, let’s break down what taxes are, what the law requires, and what actually happens if you ignore them.

The Claim: “Taxation Is Theft”

“Taxation is theft” is a punchy phrase, usually delivered with a knowing nod. It suggests the government forcibly takes your money without consent. It’s emotionally satisfying, sounds rebellious, and fits neatly on a meme. But catchy slogans aren’t the same thing as practical, legal guidance for your first job.

Where That Idea Comes From

The phrase comes from a strain of libertarian philosophy that prioritizes minimal government and maximal individual choice. Think thinkers like Robert Nozick, not the IRS. Philosophical arguments can be interesting and even thoughtful—but they don’t override laws currently in force where you live.

Libertarian Review, Wikimedia Commons

Libertarian Review, Wikimedia Commons

What The Law Actually Says

In plain terms: if you earn income above certain thresholds, you are legally required to file a tax return and pay what you owe. This isn’t a suggestion or a vibe. It’s written into law, enforced by penalties, and backed by courts. Philosophical disagreement doesn’t equal legal exemption.

Taxes Aren’t Optional

You don’t get to opt out of income tax the way you opt out of a streaming subscription. Choosing not to pay isn’t a statement—it’s noncompliance. And the government has centuries of experience collecting taxes from people who really, really didn’t want to pay them.

What Happens If You Don’t Pay

Skipping taxes can trigger late fees, interest, audits, wage garnishment, and damaged credit. In extreme cases, it can even involve criminal charges. For an 18-year-old just starting out, that’s a spectacularly bad trade: a temporary feeling of rebellion for long-term financial headaches.

Income Tax 101

Income tax is based on how much you earn, not how old you are. Wages, tips, and many side hustles count. The system is progressive, meaning higher earners pay higher rates on additional income. Most teens and young adults fall into the lowest brackets, if they owe anything at all.

Why Governments Collect Taxes

Taxes fund things we all use: roads, schools, hospitals, courts, national defense, and emergency services. Even if you don’t personally love every line item, the system runs on shared contributions. No taxes means no infrastructure—and definitely no smooth drive to your favorite fast-food spot.

The Roads-And-Schools Reality Check

If you’ve ever attended a public school, driven on paved roads, used a public library, or relied on police or firefighters, you’ve benefited from taxes. Paying into that system is how it keeps working. You don’t have to cheer for it—but it’s not exactly a mystery where the money goes.

Paying Taxes Vs. Liking Taxes

Here’s an important distinction: you can dislike taxes and still pay them. Plenty of adults complain loudly every April, then file on time. Paying taxes isn’t an endorsement of every government decision—it’s compliance with the rules of the society you live in.

Consent And The Social Contract

You didn’t sign a form agreeing to taxes at birth, true. But modern societies operate on a “social contract”: you follow the laws, and in return you get protections and services. Courts have consistently ruled that this framework makes taxation legal, not theft.

Freedom, Rights, And Responsibilities

Freedom isn’t just about what you can avoid—it’s also about what you contribute. Voting, working, and paying taxes are all part of adult civic life. Taxes are one of the costs of living in a structured society instead of, say, a very exciting but short-lived anarchy.

Your Employer Is Already Involved

If you have a regular job, your employer likely withholds taxes from each paycheck. That money goes straight to the government before you even see it. So “not paying taxes” would require ignoring paperwork, not filing returns, and hoping no one notices. Spoiler: they notice.

Withholding: The Sneaky Middleman

Withholding often means you’ve already paid most—or all—of your tax bill throughout the year. Filing your return is how you square up, not how you hand over a sack of cash. For many young workers, filing actually means getting money back.

Filing A Return Isn’t Paying Extra

A common first-time fear is that filing triggers a bill. Often, it’s the opposite. If too much was withheld, you get a refund. Filing is how you prove what you owe—or don’t—and close the loop. Skipping it can delay refunds you’re entitled to.

Deductions, Credits, And Refunds

The tax system includes deductions and credits that reduce what you owe. Education credits, low-income credits, and standard deductions can wipe out a small tax bill entirely. Translation: paying attention and filing properly can save you money, not cost you more.

How Much Will An 18-Year-Old Owe

If you worked part-time or earned modest wages, your federal tax bill may be tiny or zero. State taxes vary, but many are also minimal at low income levels. This is not a situation where you’re funding a yacht for a senator with your summer job money.

When You Might Not Owe Anything

If your income is below the filing threshold or covered by deductions, you might owe nothing—and still be required to file. Filing documents that fact. It’s the difference between “I don’t owe” and “I didn’t bother,” which matter a lot to tax authorities.

What About Cash Jobs And Side Hustles

Babysitting, freelancing, or online gigs still count as income. Cash doesn’t make earnings invisible. Many first-time filers get tripped up here, not out of malice but confusion. Learning this early saves stress later, when amounts—and scrutiny—get bigger.

Protest Isn’t The Same As Nonpayment

If you oppose taxes on principle, there are lawful ways to express that: voting, advocacy, campaigning, or supporting reform. Simply not paying isn’t protest; it’s paperwork avoidance with consequences. History shows the IRS is not swayed by philosophical footnotes.

Legal Ways To Lower Your Taxes

Want to keep more of your money? Great! Use legal strategies: claim deductions, track expenses, contribute to tax-advantaged accounts when eligible. That’s how financially savvy people reduce taxes—by playing within the rules, not pretending the rules don’t exist.

What Smart Adults Actually Do

Most adults grumble, file, and move on. They budget for taxes, learn enough to avoid overpaying, and don’t take legal advice from their sister’s boyfriend. Maturity isn’t about loving the system—it’s about navigating it without blowing up your future.

Listening To Internet Hot Takes

Confident opinions spread fast online, especially edgy ones. But taxes are a legal and financial reality, not a debate club topic. Before following advice that could cost you money or peace of mind, check whether the person offering it bears any consequences if it goes wrong.

Talking To Your Sister’s Boyfriend

You don’t need to win the argument. A simple “I’m going to follow the law and file” is enough. You can disagree politely and still do the smart thing. Family gatherings go better when you’re not debating political philosophy over dessert anyway.

Your First Filing Game Plan

Gather your forms, use reputable tax software or a free filing program, and ask questions if you’re unsure. Filing your first return is a milestone—one that builds confidence and financial literacy. You’ll likely be surprised by how straightforward it actually is.

The Big Picture On Taxes

Taxes aren’t theft, but they are a shared cost. They fund imperfect systems that keep society functioning. You’re not wrong to question how money is used—but opting out unilaterally isn’t how change happens. Participation gives you standing, not silence.

So… Is He Right?

No. “Taxation is theft” is a philosophical opinion, not a legal defense. As an 18-year-old, your best move is to file honestly, learn the basics, and move forward clean. Paying your first taxes isn’t selling out—it’s stepping into adulthood with your eyes open.

You May Also Like:

Gen X Doesn't Want To Work—And Their Reasons Actually Make Sense

We bought a vacation home that now needs $40K in septic work. Can we back out?