These Banks Were Given The Biggest Corporate Fines In History

Many companies have broken the law in the past—usually to get ahead of their competition in some way, or to increase their own profiteering capabilities, regardless of the consequences for the environment, economy, or the lives of everyday people. But these companies were caught—and handed the biggest corporate fines in judicial history.

HSBC's Non-AML Program

AML stands for "anti-money laundering", a series of expectations for banks to uphold practices and procedures that don't encourage or support financial crimes. In 2012, the Department of Justice found that Britain-based HSBC (operating under HSBC USA) had looked the other way when its major clients conducted money laundering operations. It was charged under four different pieces of legislation, to the tune of $1.2 billion.

Alexandros Michailidis, Shutterstock

Alexandros Michailidis, Shutterstock

Poor MANS Trading Oversight

Trading oversight is a poor man's game, or so MANS (one of the world's largest trading companies dating back to 1873) thought. Even after going bankrupt in 2011, MANS was still under investigation for poor trading regulations. The CFTC fined MANS Trading $1.21 billion and banned its CEO from trading markets for life.

SAC's Insider Trading Debacle

SAC Capital was a trading company that was found guilty of insider trading by the Securities And Exchange Commission (SEC)—insider trading is when a company or individual gets inside information about publicly traded stocks, giving them an unfair advantage. Along with a whopping $1.8 billion, several individual traders for SAC Capital were given lengthy prison sentences.

Credit Suisse's Tax Fraud

Credit Suisse made one mistake in a huge tax fraud scandal that rocked the bank. They'd illegally aided US customers in misrepresenting their income taxes. After years of scandalous behavior, Credit Suisse was ordered to pay $1.8 billion.

LIBOR Fixes Prices

Over six years, major multinational banks Citicorp, JP Morgan Chase, The Royal Bank of Scotland, Barclays, and UBS AG pleaded guilty to various charges. They called themselves "The Cartel" and even initiated private chat rooms to influence stock prices. For this cartel-like behavior, they were fined $2.5 billion.

The Wells Fargo Accounts That Weren't

When Wells Fargo began opening up banking and credit accounts using real customers' information without their consent, nobody except the customers paid attention. This was done in order to meet the bank's high sales quotas that they demanded of their employees. This incredible scheme by the bank affected some 16 million customer accounts and they were fined $3 billion by the Department of Justice.

Wells Fargo (Again)

Man, Wells Fargo can't seem to stop committing financial crimes! This time, Wells Fargo incorrectly applied customer payments for things like mortgages and car payments. Customers were also hit with incorrect interest charges. Several customers lost their homes or cars as a result of the bank's error. The Consumer Financial Protection Bureau fined Wells Fargo $3.7 billion and an additional $1.7 billion civil penalty, as well as $2 billion in customer restitution.

alexgo.photography, Shutterstock

alexgo.photography, Shutterstock

Binance Cryptocurrency

The Binance cryptocurrency exchange company violated American sanctions by willingly facilitating transactions from sanctioned groups, including ransomware, terrorist organizations, North Korea, and Iran. After being under investigation for several months, Binance pleaded guilty to violations and was fined $4.3 billion dollars—the largest fine ever issued by the Treasury Department.

Offloading Toxic Assets Is Illegal, Credit Suisse

One of the results of the subprime mortgage crisis was that big banks like Credit Suisse couldn't escape financial punishment for profiteering off the misery of Americans. In their case, Credit Suisse conducted poor business practices that directly resulted in the subprime mortgage crisis. They settled for $5.3 billion, for selling toxic debt to their customers.

Goldman Sachs Pinches From Malaysian Coffers

Those "Malaysian coffers" were the public funds of the Malaysian people and Goldman Sachs, along with local government officials, was accused of helping to steal money from the public purse. Goldman-Sachs agreed to pay $5.4 billion in restitution to various global investigative agencies. Moral of the story: Don't steal from the government.

Another Toxic Asset Offload For A European Bank

The Germany-based Deutsche Bank also attempted to offload assets that were destined to fail, ahead of the housing market crash in 2008. It took eight years for investigators in the United States (and Europe) to find Deutsche Bank guilty and slap them with a $7.2 billion fine.

BNP Paribas' Terrorist Ties

You might think that it's relatively simple to not support a terrorist entity with money from your bank. After all, countries listed as terrorist organizations are easily found and legislation outlining that financial support for these organizations is illegal is readily available. But that didn't stop BNP Paribas, a France-based bank who funneled money to terrorist organizations in Sudan, Iran, and Cuba. The punishment was an $8.8 billion fine from the Department of Justice.

Korawat photo shoot, Shutterstock

Korawat photo shoot, Shutterstock

JP Morgan Chase & The Subprime Morgan Crisis

JP Morgan Chase passed out subprime mortgages like they were Halloween candy in the run-up to the financial crash of 2008. For purposely misleading customers into purchasing subprime mortgages—knowing they were destined to fail—JP Morgan Chase was fined $13 billion by the Department of Justice.

Bank Of America & The Subprime Mortgage Crisis

Sure, JP Morgan Chase was fined $13 billion, but the Bank of America was absolutely clobbered by investigators with fines. The Bank of America was fined three separate times over the subprime mortgage crisis: an $11 billion settlement, followed by a $10.3 billion payment to the US Government in 2013, then, in 2014, a $9.3 billion payment to the Federal Housing Finance Agency.

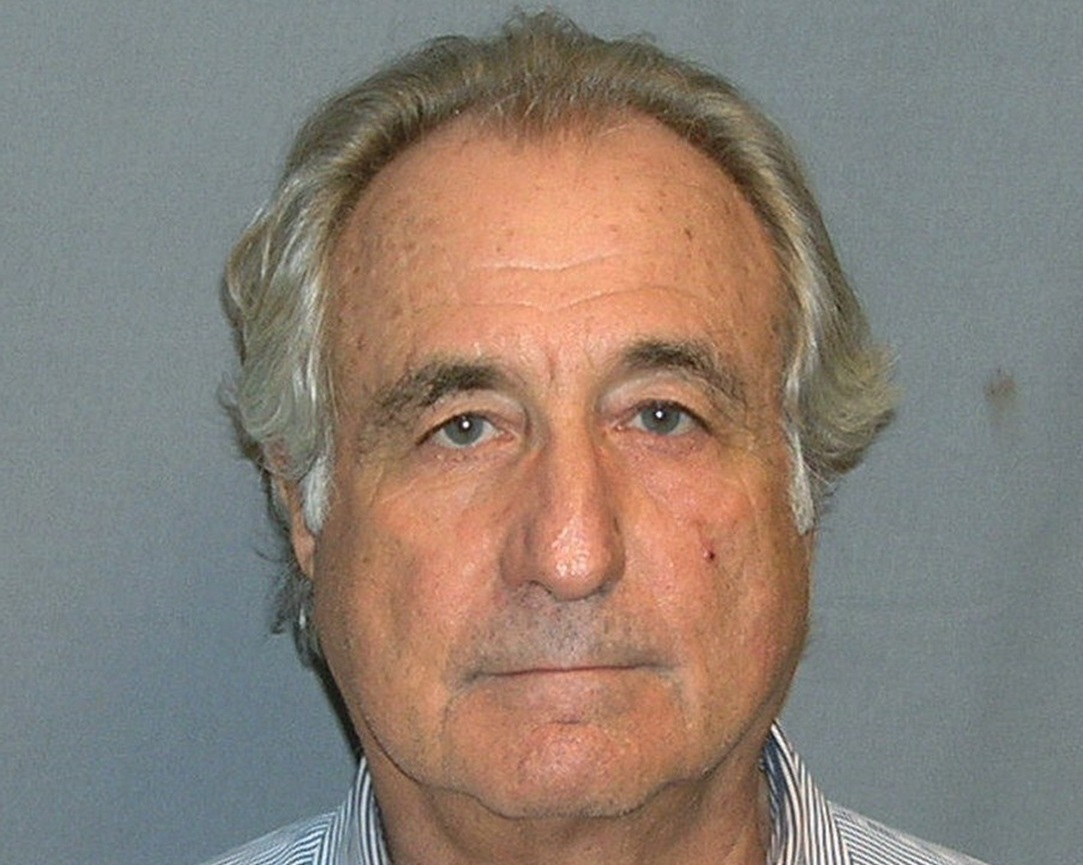

The Largest Ponzi Scheme In History

We're speaking, of course, of one Bernie Madoff—one of history's greatest financial fraudsters. He defrauded his customers of more than $65 billion, over several decades. He was found guilty of fraud and sentenced to 150 years in prison. His company, JP Morgan Chase, agreed to pay $1.7 billion to Madoff's customers to avoid prosecution.

U.S. Department of Justice, Wikimedia Commons

U.S. Department of Justice, Wikimedia Commons