Understanding The Infamous Collapse

The Enron scandal remains one of the most infamous examples of corporate fraud in American history. What was once known as a highly respected energy company collapsed into a heap of accounting tricks, greed, and deception. It’s the story of how wrongdoing, weak oversight, and megalomaniac personalities tore down a corporate giant.

Fast Ascent

Enron was formed in 1985 through the merger of Houston Natural Gas and InterNorth. It grew quickly into one of the biggest energy companies on the planet. Marketing itself as an innovator, Enron aggressively promoted itself as a forward-thinking energy trader and a model of corporate success.

A Reputation Built On Illusion

Enron’s leadership promoted an image of themselves as industry revolutionaries. They claimed to have created a whole new blueprint for energy trading that practically guaranteed dazzling profits. Investors and analysts were transfixed by the company’s rapid growth, but behind the scenes, a lot of the numbers were smoke and mirrors.

The Role Of Accounting Tricks

Enron relied heavily on mark-to-market accounting. Without getting too technical, this accounting practice allowed them to record projected future profits as if they were real today, which sounds a bit like counting chickens before they’re hatched. The system gave overblown earnings projections and concealed losses, making the company seem a lot more profitable than it was in reality.

Special Purpose Entities

Another tool Enron used was the special purpose entities (SPEs). These off-balance-sheet partnerships were designed to hide debt. Shockingly, this bit of legerdemain allowed Enron to keep billions of dollars in liabilities off its books, leaving investors and regulators none the wiser.

Key Executive: Kenneth Lay

Kenneth Lay, Enron’s founder and CEO, was pivotal to the company’s rise and fall. He cultivated close political ties and advanced himself as a highly respectable business leader. But he ignored mounting red flags and made money for himself while employees and shareholders lost everything.

Key Executive: Jeffrey Skilling

Jeffrey Skilling, who became CEO in 2001, was the mastermind of many of Enron’s underhanded practices. He aggressively pushed mark-to-market accounting and encouraged a culture of over-the-top risk-taking. Skilling’s vision built short-term illusions on a foundation of sand at the cost of long-term stability.

Key Executive: Andrew Fastow

Chief Financial Officer Andrew Fastow orchestrated many of the SPEs. He engineered convoluted financial structures that concealed debt but directed money toward him personally. Fastow made a tidy profit while misleading shareholders; he ultimately pled guilty to fraud and ended up serving prison time.

A Credulous Wall Street

Wall Street analysts frequently repeated Enron’s claims without much scrutiny. The company’s financial statements were so dauntingly complex, they discouraged deep investigation. With the analyst crowd rubber-stamping everything Enron said, investors saw little reason not to trust Enron’s glowing reputation, unaware that profits were largely fictional. The unfounded analyst enthusiasm kept the stock price artificially inflated.

Alex Proimos from Sydney, Australia, Wikimedia Commons

Alex Proimos from Sydney, Australia, Wikimedia Commons

Employees As Victims

Thousands of employees had invested their retirement savings in Enron stock at the encouragement of management. When the scandal unravelled, they not only lost their jobs but their life savings as well. Meanwhile, the executives cashed out millions in stock options. The imbalance between leadership and workers couldn’t have been more stark.

The Whistleblowers

Sherron Watkins, an Enron vice president, played a pivotal role as a whistleblower. She warned executives about the unethical practices going on and she would later give testimony before Congress. Her courage helped reveal Enron’s misconduct, though there had been many other employees’ warnings ignored over the years.

Regina Kühne , Wikimedia Commons

Regina Kühne , Wikimedia Commons

The Collapse Of Enron

By late 2001, journalists and analysts were finally starting to ask serious questions about Enron’s finances. Confidence in the beleaguered energy giant began to go up in smoke, and the stock plunged from over $90 to under $1 in weeks. Enron filed for bankruptcy in December 2001, the biggest US corporate bankruptcy up to that point.

The Role Of Arthur Andersen

Arthur Andersen, one of the “Big Five” national accounting firms, was Enron’s auditor. The firm failed to properly scrutinize financial statements and actually shredded documents while investigations were ongoing. Its involvement led to the firm’s collapse and cast a shadow over the entire accounting industry.

Congressional Investigations

Congress got busy and launched hearings into the Enron fiasco. Executives testified, thought they often invoked the Fifth Amendment. The scandal laid bare the gaps in corporate governance, oversight, and accounting standards, undermining public trust in big business.

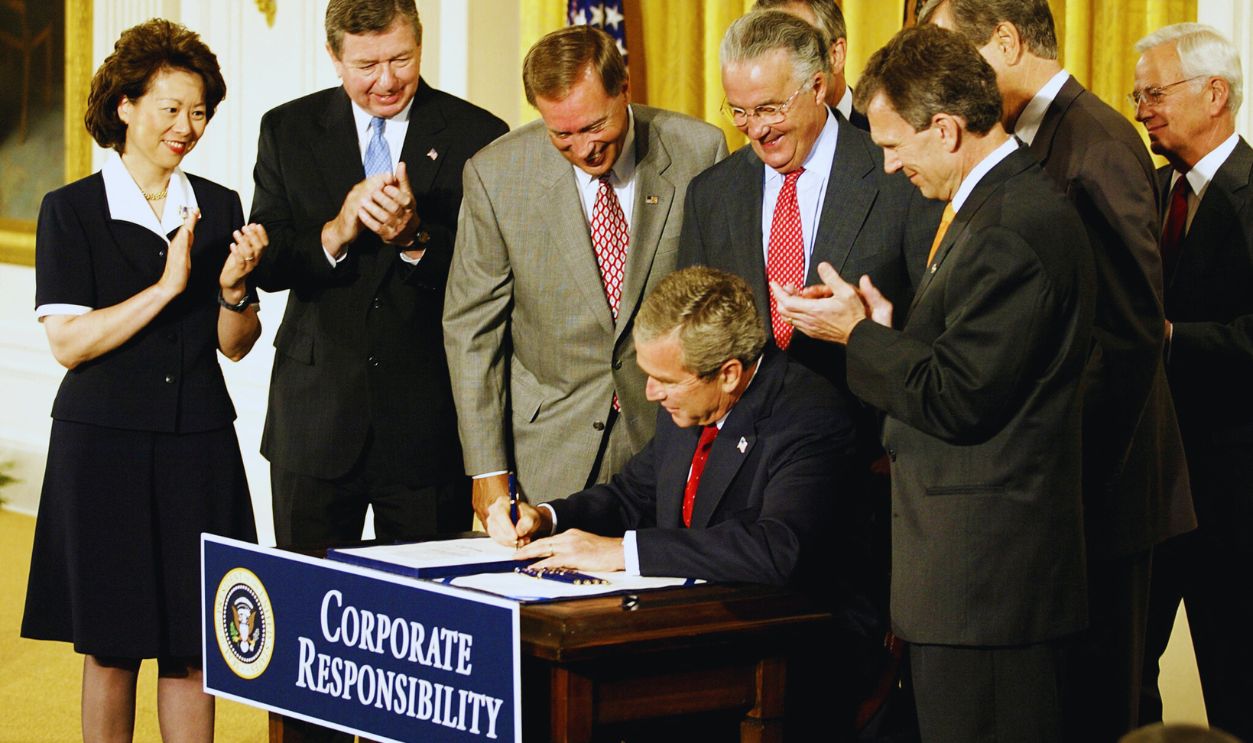

Reforms: Sarbanes-Oxley Act

In 2002, Congress passed the Sarbanes-Oxley Act in response to Enron and other corporate scandals, including the WorldCom collapse. The law demanded much stricter auditing requirements, executive oversight, and internal controls. It was a long-overdue reform that aimed to restore investor confidence in publicly-traded companies.

The Long-Term Industry Impact

Enron’s collapse made energy markets and corporate America rethink transparency. It showed the obvious need for better oversight of complex financial instruments. The scandal brought changes to accounting practices and new set of expectations for corporate governance.

Cultural Fallout

Beyond the immediate world of finance, Enron became a symbol of greed and hubris. The scandal was the inspiration for a whole slew of documentaries, books, and courses in ethics. These various works all retold the cautionary tale of the dangers of unchecked ambition and the danger of ignoring ethics.

The Takeaway For Investors

The Enron scandal reiterated the importance of skepticism. Investors were reminded to always scrutinize financial statements, question claims about earnings, and understand the risks of herd mentality. It wasn’t the first time that blind trust in reputation turned out to be a disaster for shareholders.

It’s Still More Relevant Than Ever

More than two decades have passed, but Enron is still relevant as new corporate scandals erupt onto the public stage. Each case further reinforces the need for accountability, transparency, and responsible leadership. Enron is still one of the best examples showing that systemic fraud can undermine even the most prestigious corporations.

Reflecting On Enron’s Legacy

The Enron story is ultimately about broken trust. Executives made themselves rich while destroying other people’s lives. Its legacy continues to shape laws, markets, and corporate culture. Keeping the Enron fiasco in the back of our minds will help ensure that future generations maintain their vigilance against corruption.

You May Also Like:

The Biggest Stock Market Crashes In History

Not A Gamble: Basics To Know About The Stock Market

Benjamin Graham, Warren Buffett, And The Intelligent Investor