The Dimensions Of The Dilemma

You’ve just inherited enough money to pay off your $320,000 mortgage, which carries an interest rate of 6.4%. You now have a life-changing decision to make; one that forces you to weigh the peace of mind of being debt-free against the potential gains from investing. Both options carry major long-term consequences.

The Appealing Thought Of Being Debt-Free

There’s no denying the satisfaction of owning your home outright. With no monthly mortgage payment, your budget opens up, and financial stress goes down by a lot. Many people take this route just for the emotional relief alone. There’s comfort in knowing that the bank can never take your home.

The Pure Math Of Interest Rates

At 6.4%, your mortgage rate is higher than average historical returns from conservative investments like bonds or high-yield savings accounts. This means that if your expected investment return is less than 6.4% after taxes, paying off the mortgage might be the more prudent financial move.

Compare To Average Market Returns

If you’re willing to invest in the stock market, the historical average annual return of the S&P 500 has been around 7% after inflation. That slightly surpasses your mortgage interest rate, but keep in mind that market returns aren’t guaranteed, whereas mortgage interest is.

Weigh The Tax Deduction

Mortgage interest used to be a more powerful tax deduction, but the 2017 tax law changes mean that fewer homeowners itemize now than they used to. If you don’t claim the mortgage interest deduction, your after-tax cost of 6.4% interest is effectively the full rate.

The Safety Of A Guaranteed Return

If you pay off your mortgage, you’ll effectively be getting a “guaranteed” return equal to your interest rate. No market swings, no volatility, just steady savings. Think of this as earning a risk-free 6.4% yield, which is hard to beat without taking on significant investment risk.

The Flexibility Of Keeping Cash

On the other hand, investing or holding the inheritance gives you liquidity. Once you pay off the mortgage, that cash is locked into your home’s equity, and is harder to access unless you sell the home or refinance. If you value having flexibility, full payoff might not be the best way to go.

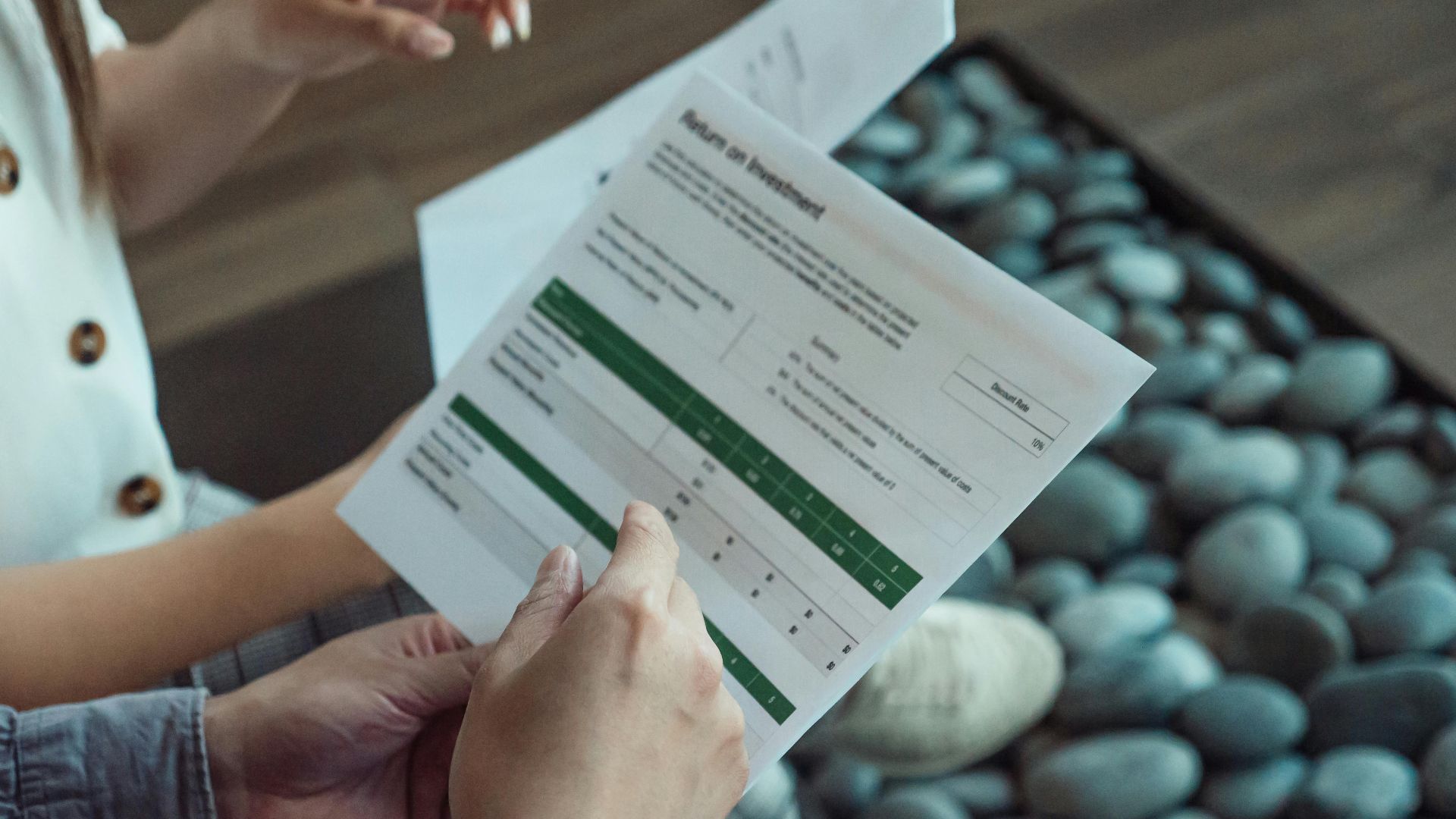

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Partial Payoff Compromise

There is another way to go that doesn’t compel you to go “all in” on one strategy. Many homeowners split the difference using part of the inheritance to reduce the mortgage balance, lowering their monthly payments and interest costs, while still investing the remainder for growth.

How Much Is In Your Emergency Fund?

Before you pay off your mortgage, make sure you’ve got enough emergency savings. This typically means about three to six months of expenses. Paying off your home but draining your liquid reserves can leave you at risk if you experience sudden big-ticket cost or job loss.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Age And Retirement Goals

The decision you make will also depend in large part on your age and what stage of life you’re in. If you’re approaching retirement, getting rid of a major monthly expense gives you stability and security. But if you’re younger with decades of earning potential ahead of you, investing the money may give you better long-term returns.

The Peace Of Mind Factor

It’s tough to put a price on peace of mind. Financial decisions aren’t always strictly a matter of dollars and cents. Some people sleep better at night knowing they’re mortgage-free, while other people may prefer to see their money grow in the market. Emotional comfort plays a big role here.

Inflation Is Also A Factor On Mortgage Debt

Inflation can greatly reduce the “real” value of your long-term debt over time. Paying your mortgage with future dollars, which may be worth less, can actually be advantageous. It’s a bit abstract to think of it this way, but the financial advantage is real. Investing allows you to leverage inflation instead of extinguishing that debt immediately.

Vodafone x Rankin everyone.connected, Pexels

Vodafone x Rankin everyone.connected, Pexels

Your Risk Tolerance

If you’re risk-averse and can’t stomach volatility, paying off the mortgage may make the most sense. But if you can handle the market’s roller coaster ride and have a diversified portfolio, the potential upside of investing the money could outweigh the guaranteed savings of debt repayment.

Time Horizon For Investment

How long are you prepared to leave the money invested? If your investment horizon is 10 years or longer, the odds of outperforming a 6.4% mortgage improve by a lot. Shorter time frames, however, favor paying down debt, since markets can be unpredictable.

Psychological Anchors And Regret

Regret aversion is real. If you invest the money and markets go down, you’ll maybe wish you’d paid off your house. On the other hand, if you pay off the mortgage and the markets soar, you’ll be upset by missing out on gains. A balanced approach would reduce both these types of regret.

Home Equity Isn’t Liquid Wealth

Remember that home equity doesn’t pay your bills. Paying off your mortgage may increase your net worth, but it won’t do anything to help your immediate cash flow unless you’re planning to downsize or take out a home equity line of credit later. Liquidity matters.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Inflation And Rising Home Values

Real estate tends to appreciate long term, but your home’s growth potential doesn’t change whether you owe money or not. Paying off the mortgage won’t make your property worth more, but it will shift the equity mix between you and your lender.

Run The Numbers With A Financial Advisor

A financial advisor can model both scenarios, factoring in investment returns, tax impacts, and your risk tolerance. They’ll help you visualize outcomes and align your decision with your overall financial plan.

Possible Hybrid Strategy

If you’re still undecided, it may be that the dual strategy is best: you could pay off part of the mortgage to drop your balance down to a very manageable amount, say $100,000; and then you can invest the rest. This gives you a win-win: lower monthly payments, reduced interest over time, and exposure to long-term market growth.

Final Takeaway

There’s no universal cut-and-dried answer here. If financial security and freedom from debt appeal to you most, then pay off the mortgage. If you value flexibility and long-term growth potential, invest. As with all financial matters, your choice depends on your comfort with risk, liquidity needs, and life goals.

You May Also Like: