The Oil Age Is Evolving

Countries built on barrels of crude are investing in wind turbines, solar farms and hydrogen plants. Why is that? Because oil wealth isn’t guaranteed to last. With changing demand, climate treaty commitments, and volatile prices, the oil‑rich nations are stepping up their green investment not just because of obligations, but necessity.

The Resource Trap That Caught Many Nations

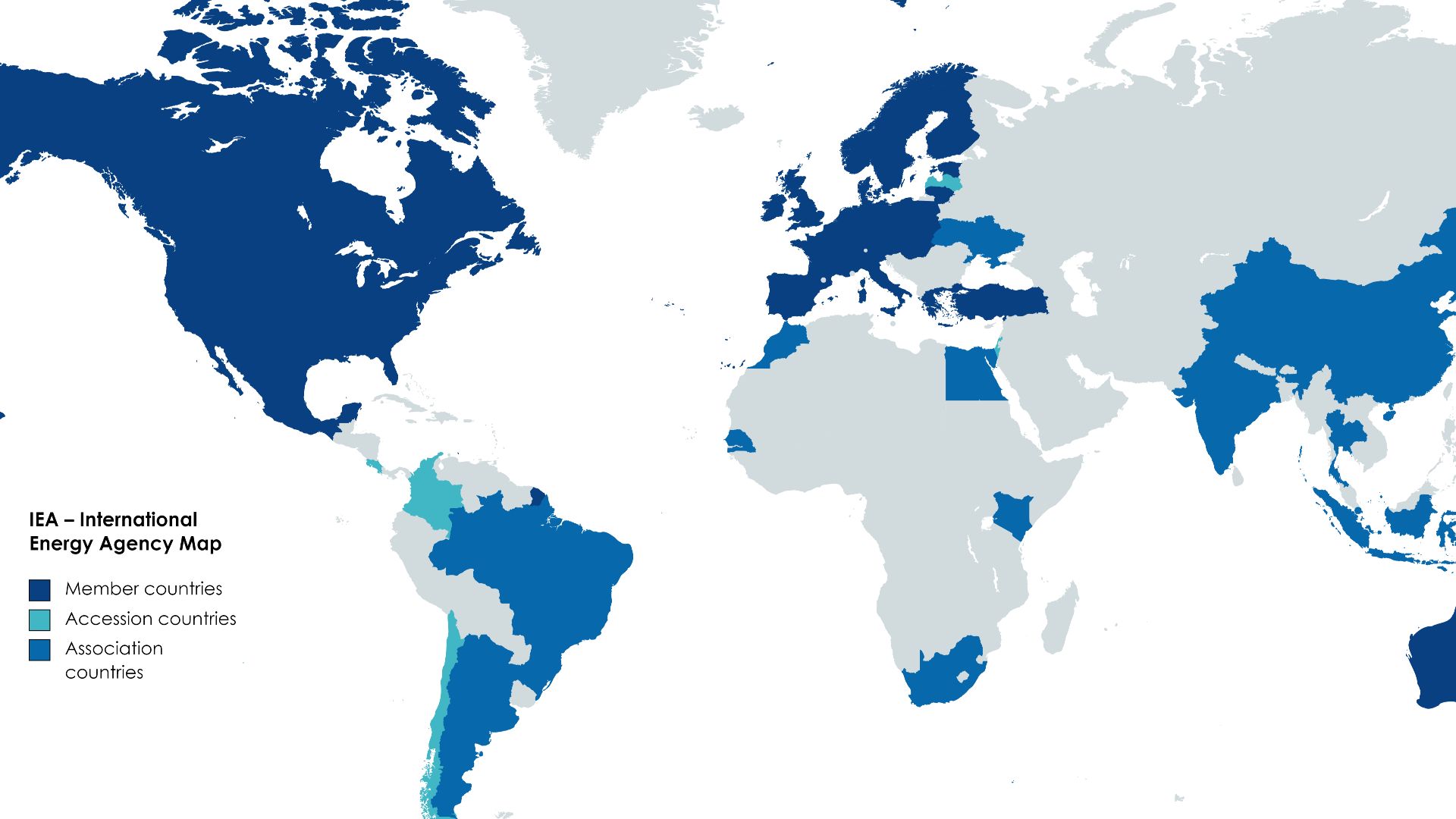

The “resource curse” is when countries rich in oil can actually stagnate when they get too reliant on one commodity. International Energy Agency (IEA) data notes that oil and gas producers still make up a large share of overall energy revenue, but their return on capital is getting less and less stable over the years.

Bourenane Chahine, Wikimedia Commons

Bourenane Chahine, Wikimedia Commons

Volatile Oil Prices: An Urgent Wake‑Up Call

When oil prices plunge, as they have several times in the past decade, governments funded by oil are always hit hard. In those circumstances, building alternative industries is no longer an option and becomes a lot more urgent. Many oil‑rich states are acknowledging that diversion of risk isn’t something that can go on forever.

Gulf States: From Oil Empires To Energy Innovators

Once defined by vast oil reserves and a flood of petro-dollars, the Gulf states are positioning themselves as leaders in the global clean-energy transition. Nations like Saudi Arabia and the UAE are investing heavily in solar, wind, and green hydrogen. They’re not abandoning oil by any means, but they’ve set about redefining what energy dominance means in the twenty-first century.

SpLoT, Sudopeople, Wikimedia Commons

SpLoT, Sudopeople, Wikimedia Commons

Norway: A Model

Government Pension Fund of Norway AKA "The Oil Fund” invested surplus oil revenues and has increasingly got into renewables while divesting from fossil energy exploration. Its strategy emphasizes what oil‑rich nations aim for: using today’s wealth to prepare for tomorrow’s energy future.

Middle East Funds Start To Shift Too

Sovereign wealth funds in oil‑rich states like Saudi Arabia are now investing in solar, wind, green hydrogen and other non‑oil sectors. According to Reuters, even the oil‑rich funds are allocating billions toward renewables.

Why Diversification Is Economic As Well As Ethical

Beyond the optics of cutting emissions, diversification is smart risk‑management. The IEA points out that oil and gas returns have gotten less consistent, while investment gaps in clean energy pose risks in the long term.

Job Creation And Local Value: A Big Driver

Oil‑rich nations know extraction jobs won’t last forever. Building green industries, including solar manufacturing, wind farm operations, and hydrogen plants, can provide new employment and local supply chains. It’s a strategic move for their economies.

Green Hydrogen: The New Export Commodity?

Some oil nations are looking at exporting green hydrogen or renewable‑based fuels, replacing some of their existing oil export structure. The advantage is through the use of existing infrastructure, capital, and government backing. This could have a big impact on new global energy trade flows.

Oil Wealth + Infrastructure = Competitive Edge In Green

Many oil‑rich states already have roads, ports, pipelines, grid infrastructure, and capital already in place. Availing themselves of those assets to build renewable industries gives them a head start. But the smooth implementation of that will be important as they transition from drilling wells to building turbines and factories.

Risk Of Stranded Assets Is Real

As demand for oil declines, reserves could become “stranded”, i.e., worthless, once uneconomical. Diversifying into renewables can give a hedge against asset‑write‑downs and shows sound long‑term thinking rather than short‑term reactivity to the boom-and bust cycle.

Challenges: Governance, Capacity And Technology

Though the money is still flowing in, oil‑rich nations still face many hurdles: managing new industries, developing skills, regulating clean sectors, and avoiding another repeat of the “resource curse.” Data from a recent study show that GCC (Gulf Cooperation Council) countries still face challenges while diversifying.

U.S. Department of State, Wikimedia Commons

U.S. Department of State, Wikimedia Commons

Case Study: Kazakhstan’s Renewable Push

Kazakhstan, long heavily dependent on oil and gas, is now leveraging its wind and solar potential and exploring green hydrogen to diversify. It’s not a Gulf state, but it’s a good example of the broader pattern of oil‑rich countries looking onward from hydrocarbons.

Borrowing Against Oil? Nations Taking Debt To Build Green

Countries like Kuwait are now borrowing money to finance infrastructure and green projects because oil revenue alone may not be enough to support future budgets. Their strategy is to invest now to create long term revenue streams that don’t rely on oil.

What It Means For Investors

If oil‑rich nations successfully transition to green energy, it creates investment opportunities far beyond oil, including infrastructure, manufacturing, technology, and export‑renewables. Investors should keep an eye on sovereign strategies, fund flows, and policy changes in these nations.

Dependency Breeds Instability

Countries diversifying successfully into green energy may generate long‑term growth, making their bonds or equities more appealing to investors. Conversely, nations stuck in oil dependency risk instability, which scares off investment.

What It Means For Citizens Of These Countries

If revenues shift from oil to green industries, public finances could get a big boost. That means more sustainable budgets, less volatility and potentially higher living standards for the people living in these countries.

How Developed‑Market Investors Get Exposure

You don’t have to live in the Middle East or Kazakhstan to benefit. Look at funds that focus on global renewables, sovereign‑wealth strategies, and companies expanding into non‑oil sectors in oil‑rich states.

Stay Aware Of Greenwashing Risks

Some oil states talk a lot about green but continue expanding their fossil fuel output. For example, Saudi Arabia plans major solar/hydrogen projects but still regularly raises their oil‑production targets. Investors and savers should watch for substance behind the headlines.

Diversifying Isn’t Optional

Oil‑rich nations aren’t going green simply out of the goodness of their hearts; they’re doing so because their futures depend on it. The transition from crude to batteries, from wells to wind farms, is already underway. By adapting early, these countries can provide a roadmap from resource dependency to sustainable growth. For global citizens and investors, it’s a shift worth watching.

You May Also Like:

Best Strategies For Saving Money On Gas

I paid $15K for solar panels and they barely work. Is there any financial upside left?