When you think of the word "entrepreneur," you probably envision a single person, perhaps in a garage or basement, getting everything done on their own. Sure, it may start off that way, but at some point, other people will need to be brought into the mix; especially once the business starts to grow. New entrepreneurs often tend to think they can do it all by themselves, but the reality is that no business can flourish without effective collaboration.

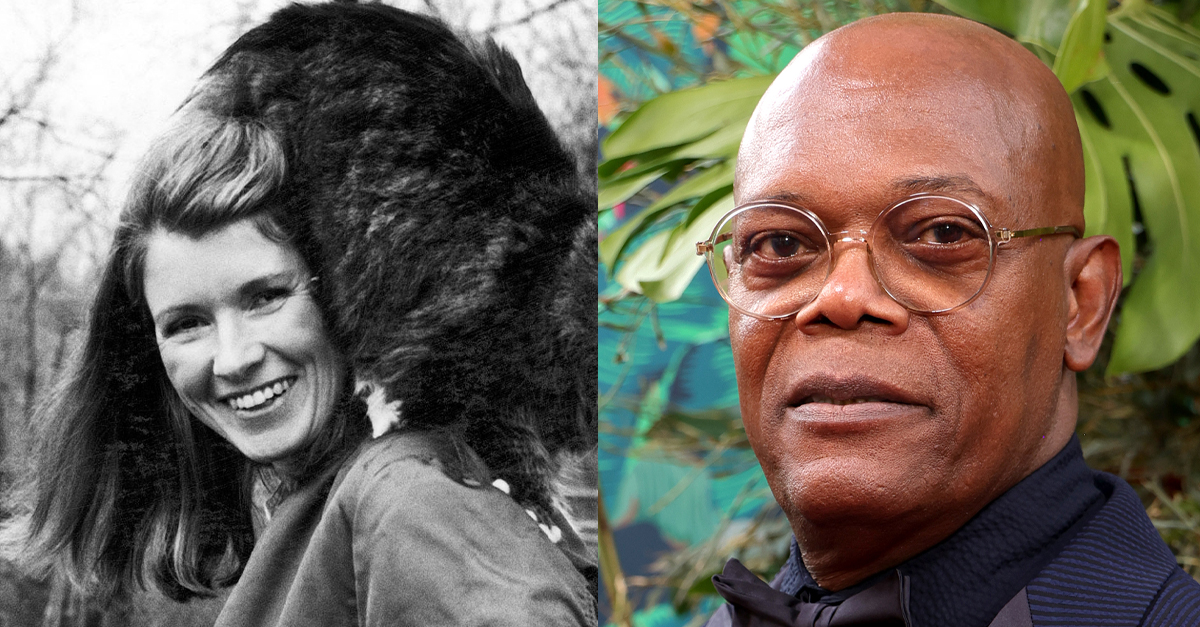

Take it from Natasha Bowes, the CEO of Biotiful, the wickedly successful dairy company. In 2012, Bowes left her sixteen-year career in financial services behind to start her business and she hasn't looked back since. Her company sells a product called Kefir, a fermented milk beverage that she grew up drinking as a child in Russia. In the early stages of her enterprise, she targeted the UK and Western Europe markets in hopes that they would embrace the drink in the same way that she did.

Today, Biotiful sells as much as 300,000 bottles of Kefir a week, with health food enthusiasts representing her biggest customers. Yet, despite how successful her business is now, Bowes still has one regret—not hiring staff earlier on. In a recent interview with BBC, she said that her company would have probably grown even faster if she didn't spend the first two and a half years trying to run the company on her own.

"If I had taken on staff earlier, I could have got to the £1 million sales mark in half the time," she said.

Kefir is unique in that it contains over 40 strains of probiotic bacteria, so initially, Natasha had to import all of the cultures from Russia, then learn how to make the actual drink. It took her nine months to get the process down, and then another four months to trial the production and develop new flavor variations.

Eventually, high-end organic food shops such as Fortnum and Masons, Harrods, and Selfridges began to sell her product, and she spent much of her time in the stores giving out samples and getting customer feedback. The only problem with that was, she was also juggling the other aspects of her business at the same time, including the management of production, sales, marketing, operations, and finance.

She did not feel comfortable taking on staff until her company made a steady profit. But looking back at her journey now, she realizes that her reluctance to do so cost her a lot of valuable time which she could have used to really get her business off the ground.

"My biggest regret is hesitating to hire people. I felt I could only justify taking on staff when I sure the business was profitable," Bowes said. "But then again, not taking people on sooner definitely holds up the growth of our business."

So then, when is a good time to start hiring employees? Bowes thinks the earlier the better, even if the company isn't necessarily making a profit yet.

"I believe one should seriously consider starting to take on staff into the business when you know, as an entrepreneur, that you have a viable proposition and when you have established your early sales," Bowes says.

"The business doesn't have to be making a profit yet. You just have to be sure that it is on course to [do so]. Because you cannot really deliver on the big mission, the ambition of building the brand of the business, without support."