Warren Buffett's Secrets To Financial Success

American financial mogul Warren Buffett has a long history of financial success, from his time at the Wharton School at the University of Pennsylvania to starting Buffett Partnership Ltd in 1956 and acquiring the famed Berkshire-Hathaway textile company, which he's led as Chairman since 1970. Widely regarded as one of the world's foremost financial moguls, let's examine some of the "Oracle of Omaha's" secrets to financial success.

Change Your Investments If They're Failing

One key thing Buffett says is, "Should you find yourself on a sinking ship, your time is better spent finding a new vessel than patching holes". If your investments fail, it's time to change your approach, or sell those stocks and re-purchase better options. Change is the only constant in the market and you should embrace it.

Following The Crowd Isn't Always A Good Idea

Buffett's next piece of advice: "Beware the investment activity that produces applause, great moves are usually greeted by yawns". What he means is that following the crowd on what seems like a good investment could mean that in a few months, you'll be left with very little. Sometimes, it's better to wait for the market to calm and then make your moves.

Invest In Stocks That Have Value

As Buffett says: "Price is what you pay, value is what you get". While the price of your stocks may change depending on which way the wind is blowing, focusing on their overall value (by doing your homework on which stocks hold the most long-term value) is a way to not get caught up in panic-selling based on the price.

Never Invest In A Business You Don't Understand

If you don't understand how a business works, or what the product it sells does, it's not a good idea to put your money into it. You want to ensure you invest in things you understand because that will inform your investment strategies throughout the life of the business.

Look For Passive Investment Options

Passive income has taken a huge leap in the last 10 or 15 years—it's no wonder, when financially successful people like Warren Buffett tout it. "If returns are going to be seven or eight percent and you're paying 1% in fees, that's an enormous difference in how much money you're going to have for retirement". Finding low-fee stocks that have high returns is a great way to passively make money without really noticing the outgoing costs every month.

Buffett's Four M's Of Investing

Buffett pioneered this strategy when he was coming up in the investment world—now, the Investment King himself has largely abided by the Four M's of investment throughout his business career: Meaning, Moat, Management, and Margin of safety.

Meaning

You'll always want to investment in something that not only has meaning to you, but that you know the ins-and-outs of. This can take up your time, but becoming an expert on a potential investment option—increasing the meaning of option (because now you understand more about a particular investment, putting your money into it holds more personal value to you)—is always good practice before you put your hard-earned money into something.

Moat

A company's moat refers to the ability of a business to maintain its competitive edge. Understanding how a business will stand up to its competitors—and make changes where necessary to continue to make money—is a great way to ensure that your investments will go farther.

Management

Before you invest in a company, look at the management. Is the company well run? Does it have a continued plan for success and growth? Is the managerial team easy to work with? How a company is run will tell you a lot about its growth potential.

Margin Of Safety

Buffett's practice of increasing your margin of safety, or searching for the safest way to invest (remembering his First Rule: Don't lose money), is one of his important pieces of advice. Don't try and make the easy, get-rich-quick investment—instead, wait for a safer investment to come along. "Don't try and drive a 9,800-pound truck over a 10,000-pound capacity bridge, instead travel down the road a little further and find the 15,000-pound capacity bridge".

Buying A Wonderful Company At A Fair Price

One of Buffett's most memorable quotes is: "It's far better to buy a wonderful company at a fair price, rather than a fair company at a wonderful price". Unlike most investors of his era, Buffett bought many companies with good management, competitive edges, better ethics, and better business models for success than his competitors—who were more interested in paying the lowest-possible price for a mediocre investment.

Patience Is A Virtue Until The Proof Is In The Pudding

Have a little faith in your investments. If you've done your homework, followed the Four M's, and are confident that the company you're backing is worth the investment, then have patience. If the business does well, the stock will eventually follow.

Warren Buffett's Long-Term Investment Advice

There's a reason why Warren Buffett is the world's eighth-richest man, and has been the Chairman of Berkshire-Hathaway since 1970—it's his ability to invest in a product or company and see its long-term potential (and be right about it) and continuously make money. He has some great advice for those looking to make passive-income via long-term investments.

USA White House, Wikimedia Commons

USA White House, Wikimedia Commons

Invest In What You're Happy To Hold On To

Choose your investments wisely—if the market shut down tomorrow for a decade, would you be happy to hold onto these investments? If so, then they're generally a good buy, if not, then maybe it's time to look elsewhere. Plan for the worst, hope for the best.

Pick Good Stocks At Good Times With Good Companies

Buffett's salient advice about timing: "All there is to investing is picking good stocks at good times with good companies", may seem obvious, but bad timing is one of the primary reasons your investments will fail. Knowing the market and knowing your chosen investments well will guide you as to when you invest.

"If You Couldn't Own A Stock For 10 Years, Don't Own It For 10 Minutes"

Buffett's advice here is all about long-term investments. Investing is all about putting your money away in a stock for a certain period of time, with the end goal of making a lot more money than you initially put in. Sometimes, that process can take a year, two years, five years, even decades. Don't put your money into a company unless you're comfortable not seeing it for 10 years.

Act As Though You Only Have 20 Investments To Make In Your Life

"An investor should act as though he had a lifetime decision card with just 20 punches on it". Buffett's advice here is to be careful with your money and invest wisely. Spend your time researching which are likely to be your most profitable investment options over time and put your money in like you only have 20 investments to make in your entire life.

Think Four Or Five Years Ahead

While it can be easy to fall into the trap of checking on your investments and growth annually, when investing money, think four or five years ahead—as that is likely when your investment will begin to bear fruit. Don't bother checking on your investment after the first year—consider checking on it again in only four or five years. This is why it's important to only invest what you can afford to forget about.

Only Invest In Wonderful Companies

Investing in companies that you're proud to put your money into, with a profitable future ahead of them, will pay dividends in the end—as the company ages like fine wine and its value increases, you make more money. Being selective with your investments will make you richer in the long-term.

Keep It Simple

Despite attending one of the world's foremost business schools, Buffett's best advice is to keep things simple. "The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective". Buffett's investments throughout the course of his career have focused on a simplified investment process. There's no need to overcomplicate your investment calculations unnecessarily: remember the Four Ms.

Don't Rely On Forecasting Too Much

Buffett says, "Forecasts tell you a lot about the forecaster; they tell you nothing about the future". In general, the advice here is to rely on yourself to make decisions about your investments. Use your own intuition to tell you when you should invest in something—forecasters aren't often right.

Carlos Delgado, CC BY-SA 3.0, Wikimedia Commons

Carlos Delgado, CC BY-SA 3.0, Wikimedia Commons

Buy A Stock The Way You'd Buy A House

Buffett uses a great analogy of buying a stock in the same way you'd buy a house. You wouldn't buy a house sight unseen, would you? No—hopefully not, anyway. You'd do your research into how old the house was, where it was located, what was the asking price, amenity accessibility, etc. The same should be true of your stock investments. Understand as much as you can about what you're investing in. It will allow you to make better financial decisions.

Circles Of Competence

We all have our "circles of competence"—the things that we know a lot about. Buffett's advice is to only invest in companies within this circle. And, while the size of the circle is unimportant, knowing where its boundaries lie is. Investing outside of your circle of competence is a recipe for disaster and breaking Rule 1: Don't lose money.

Diversification Is Unnecessary

This may seem counterintuitive, but Buffett's answer to whether he's diversified is always "No". His thinking is that if you're a great investor, you're very knowledgeable in your particular investments, to the point where you don't need to diversify. You can simply keep investing in the same company and because if you know what you're doing, you'll keep making money.

Carpe Diem

"Seize the Day" has many applications, but Buffett's advice on carpe diem is: "Opportunities come infrequently. When it rains, put out the bucket, not the thimble". Work as hard as you can when the stock market is doing well and take advantage of the best opportunities as they come along.

Fear Can Be Your Friend

While fear in the stock market is generally considered a bad thing, it can be your friend as an investor. As stocks fall, people may sell "wonderful companies" for a pittance, allowing you to capitalize and, when the market comes back up, you'll have made the money that your fellow investors failed to.

Don't Buy What's Popular

Another tip from Mr Buffett about not following the crowd. Just because something is popular with your fellow investors, doesn't necessarily mean it's a salient choice. Check out what's not popular during your market research and see which of those investments have the potential for long-term success.

Avoiding Bad Investments Is Sometimes More Important Than Finding Good Ones

Problems don't become problems unless you let them, right? Avoiding bad investment decisions—and all the headaches they produce—is sometimes more important than finding a great investment. If all you've got in front of you is a series of bad investment decisions and just a few good ones, opt to not choose investments rather than buying the handful of good ones. Your waiting may pay off when the market resets.

Don't Take The Easy Way Out

If you're interested in investing in a company but they might have some unresolved issues, or their stocks are speculative at best, it's a good idea to wait for a better investment, rather than take the easy way out and risk your money on an investment with an uncertain future.

If An Investment Sounds Too Good To Be True, It Probably Is

One of life's great old adages about things being too good to be true is one that Warren holds near and dear. Run, don't walk away from people who are promising you the moon when asking for your invest in their company or product.

Being Productive Isn't The Be-All/End-All

When it comes to investing, being productive isn't necessarily the be-all/end-all. Society puts so much emphasis on productivity, but if your productivity isn't getting you anywhere with your investment, why spend your energy, financial and mental capital? Rather, wait for the right investment to come along, then get as busy as possible.

The Past Doesn't Really Tell You Anything

When you're making investments initially, the past can be a useful tool—but it's not a great predictor of the future. As Warren says, "What we learn from history is that people don't learn from history".

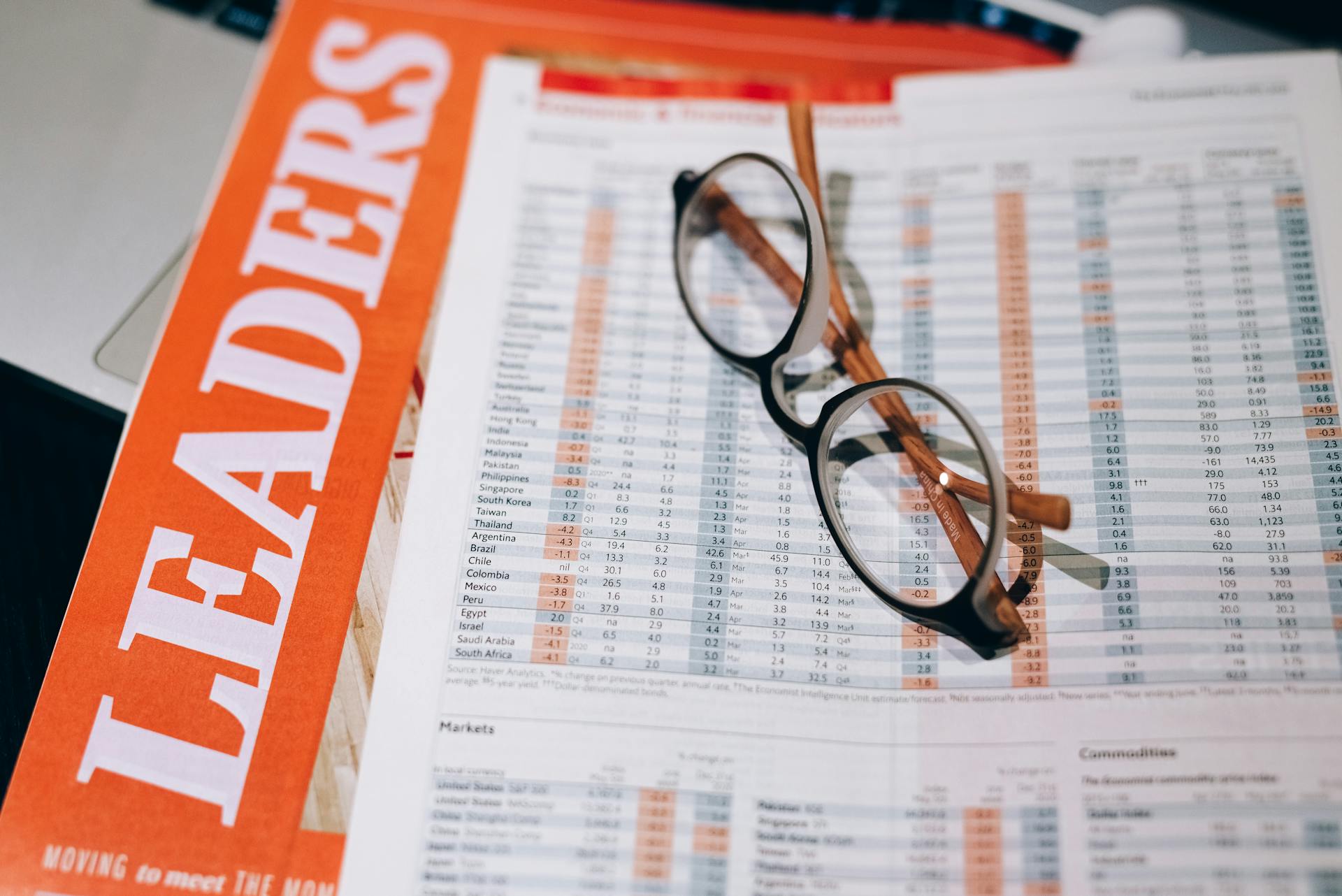

SevenStorm Jushaszimrus, Pexels

SevenStorm Jushaszimrus, Pexels

Greed Never Pays Out In The End

Being greedy is not only a cardinal sin, it's also not a good look for an investor. It's obvious when you're just in it for the money and other investors like Buffett don't like it. They'll use it against you: "We simply attempt to be fearful when others are greedy and greedy when others are fearful".

Your Cash Is Burning A Hole In Your Pocket

That $1,000 in cash that you have sitting in an envelope in your emergency hiding place is doing nothing for you and is only depreciating in value. You can't buy as much today with $1,000 as you could last week, but you can make that $1,000 into $10,000 in 10 years by investing it wisely.

Be As Prepared As You Can For Anything

Anything can happen in the stock market, so you should be as prepared as you can for that. Investing wisely and knowing when to divest is critical to this ready-for-anything motto: "Predicting rain doesn't count, building the ark does". If you have favorite companies that you're not yet invested in, market downturns can be a great time to buy those stocks for cheap.

Hang Around The Right People

If you want to be financially successful, surround yourself with people who have made themselves financially successful. Good, decent people, obviously, but you'll slowly start to drift in the direction of those with financial smarts and make better financial decisions yourself.

Henri Mathieu-Saint-Laurent, Pexels

Henri Mathieu-Saint-Laurent, Pexels

Maintain Your Public Image And Reputation

How often have you seen a single company completely fall apart due to the actions of its ownership? Maintaining a good public reputation by behaving admirably and not making silly mistakes that could cost you everything is a key part of continuous financial success. The public will react if you're a jerk.

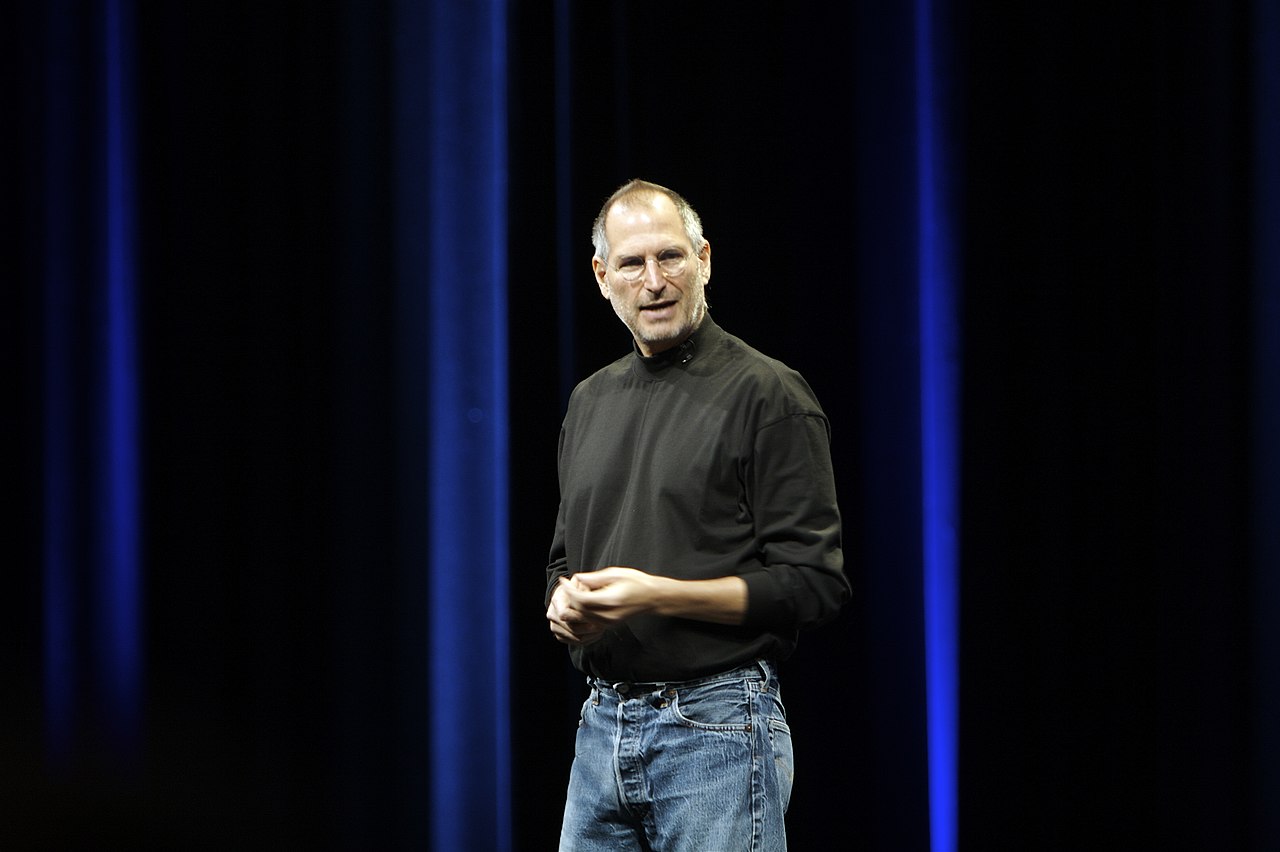

Ben Stanfield, CC BY-SA 2.0, Wikimedia Commons

Ben Stanfield, CC BY-SA 2.0, Wikimedia Commons

Doing Good Is More Important Than Being Rich

As Buffett says, "If you get to my age in life and nobody thinks well of you, I don't care how big your bank account is, your life is a disaster". Do good for those around you and you'll be rewarded in ways that money can't buy.

When You Make It, Lift Others Up

When you've achieved whatever your metric of financial success is, use your capital to lift others up and don't be haughty about being a millionaire. Remember that no matter how much you have, your grave will be the same size as the man on the street—be kind, always.

Do you agree with Buffett's financial advice? If you've ever used his advice, how did it help you? Let us know in the comments below!