A Billionaire No More: The Sudden Fall Of Larry Chen

A Billionaire No More: The Sudden Fall Of Larry Chen

It only took six months for Larry Chen to lose his billionaire status. The Chinese businessman, who was formerly among the world's richest with a net worth of $10.2 billion, took a financial hit as China began cracking down on private education. His company Gaotu Techedu Inc., which provides an online tutoring service, plummeted by almost two-thirds in the New York Stock Exchange (NYSE), making it now worth just $336 million according to Bloomberg's Billionaires Index.

China has implemented new regulations that prohibit companies like Chen's to make profits, raise capital, or go public. The move is in line with growing criticism for the country's private education sector—many of China's for-profit educational businesses operate on excessive workloads and prohibitive expenses that make it difficult for Chinese families to rely on their services.

Under the new regulations, online tutoring services will no longer be approved to teach China's school syllabus and those who wish to do so will need to apply for licenses and undergo review. In fact, some citizens have even claimed that the high cost of education is the main reason why they are not having more children. Such is counterproductive to China's recent authorization of three kids per family for this year, which was rolled out in order to boost the country's numbers amid an ongoing population decline.

"The after-school tutoring industry has been severely hijacked by capital," said the Ministry of Education in a recent statement. "[This] runs against the nature of education as welfare, and harms the normal education ecosystem."

Shutterstock

Shutterstock

The recent changes have added to Gaotu's mounting financial struggles—since late January of this year, the company has lost over $15 billion due to poor stock performance. Despite these setbacks, Chen said on Weibo, a Chinese version of Twitter, that Gaotu "will comply with the regulations and fulfill social responsibilities."

Some of Chen's contemporaries have also taken the blow from China's latest updates. Zhang Bangxin, the CEO of TAL Education Group, experienced a $2.5 billion drop in wealth after his company's shares tanked 71 percent in the NYSE. Luckily for him, the drop wasn't substantial enough to lose his billionaire status, and he is still worth $1.4 billion today.

On the other hand, Yu Minhong, the chairman of New Oriental Education & Technology Group Inc., lost his billionaire status as Chen did after losing $685 million from a 54 percent drop. His company is now only worth $579 million after the substantial losses.

Like Gaotu, TAL and New Oriental have also pledged to abide by the new regulations as well as seek government assistance.

READ MORE

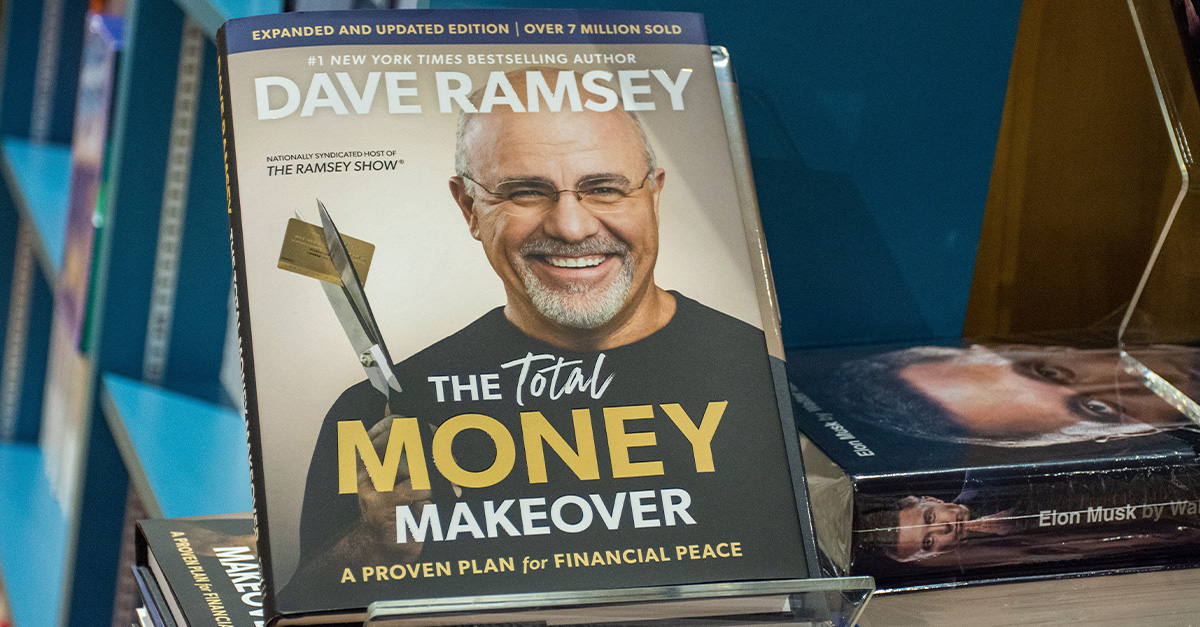

Podcaster and financial guru Dave Ramsey went from a millionaire—to broke in his twenties—and then re-gained his financial status in his thirties. Find out how he did it and how it could work for you by adopting some of Dave's best financial advice.

If you are selling your house, or thinking about selling your house—these are some of the simple (and often for very inexpensive) things you can do to increase the value of your home and help get the highest offers and the most money you can out of it.

Wealth often brings freedom, but for some, it fuels mind-bending indulgences that defy all logic. Since they don’t worry about the price tag, why wouldn’t rich folks buy whatever they crave, no matter how ridiculous?

Apart from business deals, bank accounts, and monitoring the stock market, some billionaires have hobbies that are surprisingly down-to-earth—or outright unexpected. So, what are the richest people’s favorite hobbies?

Stuck in a credit rut? A low credit score can feel like a roadblock but, hey, it’s not unsalvageable. There are things you can do that’ll boost your score and your confidence pronto.

Discover the 15 most dangerous jobs in the world, and how much they pay. Learn about danger pay, PPE, and the risks associated with each job.

Disclaimer

The information on MoneyMade.com is intended to support financial literacy and should not be considered tax or legal advice. It is not meant to serve as a forecast, research report, or investment recommendation, nor should it be taken as an offer or solicitation to buy or sell any securities or adopt any particular investment strategy. All financial, tax, and legal decisions should be made with the help of a qualified professional. We do not guarantee the accuracy, timeliness, or outcomes associated with the use of this content.

Dear reader,

It’s true what they say: money makes the world go round. In order to succeed in this life, you need to have a good grasp of key financial concepts. That’s where Moneymade comes in. Our mission is to provide you with the best financial advice and information to help you navigate this ever-changing world. Sometimes, generating wealth just requires common sense. Don’t max out your credit card if you can’t afford the interest payments. Don’t overspend on Christmas shopping. When ordering gifts on Amazon, make sure you factor in taxes and shipping costs. If you need a new car, consider a model that’s easy to repair instead of an expensive BMW or Mercedes. Sometimes you dream vacation to Hawaii or the Bahamas just isn’t in the budget, but there may be more affordable all-inclusive hotels if you know where to look.

Looking for a new home? Make sure you get a mortgage rate that works for you. That means understanding the difference between fixed and variable interest rates. Whether you’re looking to learn how to make money, save money, or invest your money, our well-researched and insightful content will set you on the path to financial success. Passionate about mortgage rates, real estate, investing, saving, or anything money-related? Looking to learn how to generate wealth? Improve your life today with Moneymade. If you have any feedback for the MoneyMade team, please reach out to [email protected]. Thanks for your help!

Warmest regards,

The Moneymade team