Are Travel Agencies On The Way Out?

Are Travel Agencies On The Way Out?

Do you really need a travel agent?

Recently, I read an article about why we still need travel agencies. I’m sure it was written by a travel agent, but I considered the arguments in good faith and easily dismissed every one. Here they are:

- They provide additional perks, like chef’s dinners and a better seat on the plane. Guess what? Those perks are there for the taking, and you can access them without paying an agency commission.

- They can save you time and money. This argument assumes that someone traveling for leisure doesn’t have time to spend five minutes booking a flight online. And these days, a Google search will tell you the cheapest hotel option in 0.002745567783 seconds.

- They’re there for you if things go south. Listen up, fellow snowflakes: if we can’t get ourselves on another flight after missing the last one, the whole generation is doomed, just like the boomers predicted.

- They provide a human touch. Here’s my favorite part: “Travel agents are more than itinerary-fillers, they're people who care about what you want and how you feel.” Anyone who’s worked in customer service knows this is patently untrue, and anyway, no one cares about my solo vacation to Honolulu more than me, Karen; no one.

Photo by Joshua Earle on Unsplash

Photo by Joshua Earle on Unsplash

Leaving on a private jet plane

While the industry is undeniably narrowing, there is still one aspect in which travel agencies find themselves useful, and that’s luxury travel. Access to exclusive hotels, cruises, and vacation packages allow agents to offer top-of-the-line trips when money is no issue. This is backed up by the latest industry trends, which suggest that while people are spending more on travel ($307 billion so far in 2019), the actual number of businesses is steadily shrinking.

So while cookie-cutter vacation pushers like Thomas Cook may be facing the end of an era, there’s still room for boutique agencies catering to those who want a streamlined travel planning experience. For most of us, however - the other 84% - the appeal of travel booking is in figuring it out on our own.

Pixabay

Pixabay

READ MORE

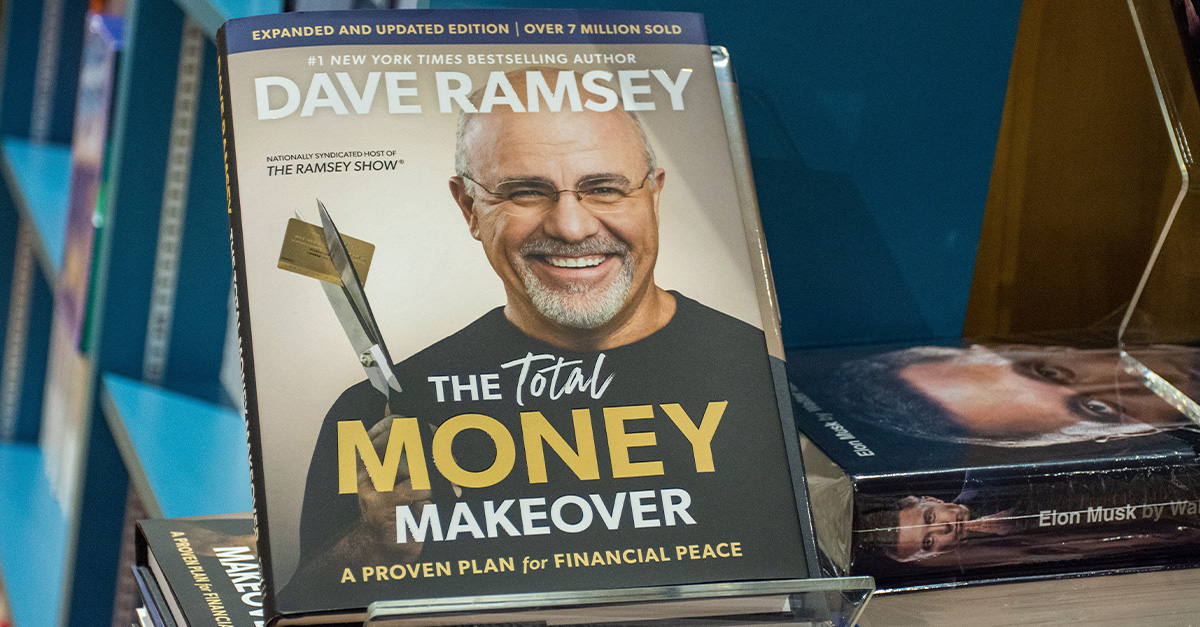

Podcaster and financial guru Dave Ramsey went from a millionaire—to broke in his twenties—and then re-gained his financial status in his thirties. Find out how he did it and how it could work for you by adopting some of Dave's best financial advice.

If you are selling your house, or thinking about selling your house—these are some of the simple (and often for very inexpensive) things you can do to increase the value of your home and help get the highest offers and the most money you can out of it.

Wealth often brings freedom, but for some, it fuels mind-bending indulgences that defy all logic. Since they don’t worry about the price tag, why wouldn’t rich folks buy whatever they crave, no matter how ridiculous?

Apart from business deals, bank accounts, and monitoring the stock market, some billionaires have hobbies that are surprisingly down-to-earth—or outright unexpected. So, what are the richest people’s favorite hobbies?

Stuck in a credit rut? A low credit score can feel like a roadblock but, hey, it’s not unsalvageable. There are things you can do that’ll boost your score and your confidence pronto.

Discover the 15 most dangerous jobs in the world, and how much they pay. Learn about danger pay, PPE, and the risks associated with each job.

Disclaimer

The information on MoneyMade.com is intended to support financial literacy and should not be considered tax or legal advice. It is not meant to serve as a forecast, research report, or investment recommendation, nor should it be taken as an offer or solicitation to buy or sell any securities or adopt any particular investment strategy. All financial, tax, and legal decisions should be made with the help of a qualified professional. We do not guarantee the accuracy, timeliness, or outcomes associated with the use of this content.

Dear reader,

It’s true what they say: money makes the world go round. In order to succeed in this life, you need to have a good grasp of key financial concepts. That’s where Moneymade comes in. Our mission is to provide you with the best financial advice and information to help you navigate this ever-changing world. Sometimes, generating wealth just requires common sense. Don’t max out your credit card if you can’t afford the interest payments. Don’t overspend on Christmas shopping. When ordering gifts on Amazon, make sure you factor in taxes and shipping costs. If you need a new car, consider a model that’s easy to repair instead of an expensive BMW or Mercedes. Sometimes you dream vacation to Hawaii or the Bahamas just isn’t in the budget, but there may be more affordable all-inclusive hotels if you know where to look.

Looking for a new home? Make sure you get a mortgage rate that works for you. That means understanding the difference between fixed and variable interest rates. Whether you’re looking to learn how to make money, save money, or invest your money, our well-researched and insightful content will set you on the path to financial success. Passionate about mortgage rates, real estate, investing, saving, or anything money-related? Looking to learn how to generate wealth? Improve your life today with Moneymade. If you have any feedback for the MoneyMade team, please reach out to [email protected]. Thanks for your help!

Warmest regards,

The Moneymade team

Photo by Joshua Earle on Unsplash

Photo by Joshua Earle on Unsplash Pixabay

Pixabay