When A Missed Payment Feels Like A Trap

You might assume that banks want customers to always make their loan or credit card payments on time. In reality, a lot of lending models quietly generate more profit when borrowers struggle just a bit. Late fees, penalty interest, and compounding balances can turn your temporary financial squeeze into the bank's steady revenue stream. In light of this, it’s hard not to wonder whether the system is working against you.

michaelheim, Adobe Stock; Factinate

michaelheim, Adobe Stock; Factinate

Banks Make Money From Debt

Banks earn their money through interest, fees, and penalties tied to borrowing. While timely payments generate a predictable amount of interest revenue, late payments unlock higher rates, extra charges, and longer repayment periods. These are the mechanisms the banks implement that can significantly increase the total amount a borrower pays without the bank taking on any additional lending risk.

Minimum Payments Are Encouraged

Minimum payments are designed to look manageable, but not necessarily to eliminate debt quickly. Paying the minimum amount keeps balances high and interest accruing. From the point of view of bank profit, slow repayment generates a lot more revenue than fast payoff, especially when rates climb after you’ve missed or made late payments.

Late Fees Are No Accident

Late payment fees are intentionally structured to be punitive but common. Grace periods are short, the bank’s reminders are generally not too intrusive, and the fees apply immediately after deadlines. These charges generate reliable income for lenders and disproportionately affect borrowers who are already struggling to keep up.

Penalty Interest Rates Increase Profits

A lot of credit agreements include penalty interest rates that kick in after a missed payment. These rates can jump dramatically and apply retroactively. Once these new penalty rates are triggered, they can stay in place for months, significantly increasing how much you owe even if you get back to making regular payments quickly.

Banks Rarely Offer Proactive Help

Banks generally wait for signs of distress before they reach out to offer assistance. Proactively lowering rates or restructuring loans immediately reduces their profit. Many hardship programs exist, but these are often reactive and they require that you take the initiate to contact them after financial damage has already occurred.

Automated Lending Systems

Modern lending relies heavily on algorithms, not human judgment. These systems are mathematically calibrated to maximize profitability across millions of accounts. Borrowers who are constantly “in the soup” financially but manage not to default are often the most profitable segment. This generates a perverse structure of incentives within the system.

Debt Becomes A Long Term Asset

From a bank’s point of view, revolving debt is an asset that pays over a long time period. As long as you continue making some payment, even if it’s late, the account stays active and profitable. Fully repaying the loan totally eliminates that income stream for them.

Default Is Different From Struggle

Banks definitely don’t want you to default completely. Default stops payments altogether and triggers costly and time-consuming collection processes. The ideal scenario for lenders is for you to struggle, where you stay engaged, worry about making payments, pay penalty fees, and carry a balance without going over the edge and into the abyss of total nonpayment.

Credit Scores Reinforce The Cycle

Missed payments damage your credit score, which raises your future borrowing costs. Higher rates mean you pay more interest over time. This feedback loop makes it harder and harder to get back to solid ground financially while increasing lender revenue from the same underlying debt.

Overdrafts Operate On The Same Logic

Overdraft programs follow a similar model. Small mistakes trigger disproportionately high fees. Instead of preventing transactions, banks often allow overdrafts knowing that the fees will follow. Customers who live paycheck to paycheck with zero balances generate consistent fee income in this way.

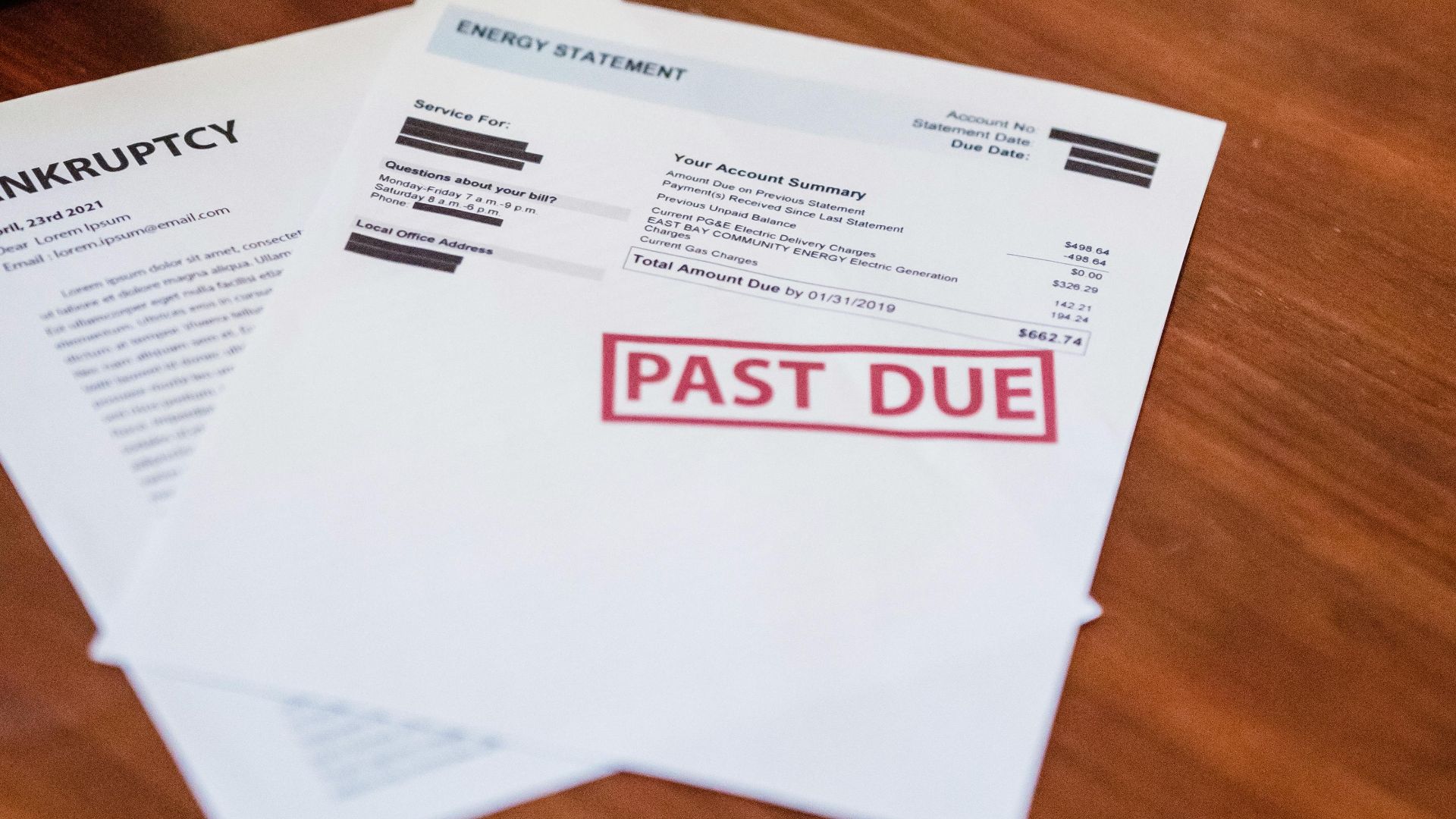

Karolina Grabowska www.kaboompics.com, Pexels

Karolina Grabowska www.kaboompics.com, Pexels

Transparency Is Limited

Banks disclose their fee structures legally, but rarely clearly. Complex language, long contracts, and scattered disclosures make it difficult for many regular people like you and I to understand the real cost of borrowing. The benefits of this confusion go to the institution, not the customer, especially if the customer’s finances are showing signs of strain.

Recognize Predatory Features

Watch for high penalty rates, vague hardship terms, and low minimum payment requirements. These kinds of features signal financial products that are designed to profit from extended debt. Getting an understanding of these signals will allow you to avoid or exit financial arrangements that thrive on your stress.

If You’re Already Struggling

If you’re currently in a situation where you’re missing payments, contact lenders early. Ask them about hardship programs, temporary rate reductions, or alternative payment plans. While there’s no guarantee you’ll qualify, earlier engagement gives you some better leverage and reduces long term damage compared to silent delinquency.

Pay Strategically

Always prioritize your debts with the highest penalty rates and fees. Small changes in payment timing and allocation can prevent these costly triggers. Strategy and awareness of timing is often more important than the total payment size that you hand over when resources are limited.

Automation Isn’t Your Ally

Automated billing systems don’t account for your real-life circumstances. Missing one deadline can snowball into months of higher costs. Manual reminders, calendar alerts, and autopay safeguards can help you counter systems that are designed for the bank’s profit under the banner of convenience.

When To Consider Outside Help

Credit counseling organizations and nonprofit advisors can help you negotiate or reorganize debt that is becoming unmanageable. Independent guidance can give you some perspective that lenders won’t provide. In some cases, structured debt plans can lower fees and stabilize finances faster.

Emotional Fallout From Financial Punishment

Financial stress isn’t just a number on a balance sheet. Constant penalties generate guilt, doubt, fear, and decision paralysis. Recognizing that the system is structured to be harsh can help you separate your own self-worth from financial outcomes and encourage proactive problem solving rather than avoidance.

Why Awareness Changes Outcomes

Understanding how banks profit during borrower struggles gives you power. Awareness helps you to avoid traps, question terms, and act earlier. Knowledge doesn’t eliminate hardship, but it prevents financial pain from ballooning out of control.

The Bottom Line On Banks And Missed Payments

Banks don’t want customers to fail entirely, but there’s no doubt they profit when customers struggle. Late fees, penalty rates, and extended balances generate revenue from hardship. By understanding these dynamics, you can make better-informed choices that protect your finances and reduce unnecessary losses.

Karolina Grabowska www.kaboompics.com, Pexels

Karolina Grabowska www.kaboompics.com, Pexels

You May Also Like: