Millionaire Spending (And Not Spending)

Just because you have millions of dollars in the bank doesn't mean you have to spend millions of dollars. In fact, for many millionaires, the way they got those millions in the bank was by not spending, and being super frugal with their finances.

You want to be a millionaire—well, why not start by saving like one?

Hotel Vanity Kits

Bernadette Joy is a first-generation Filipina-American who was $300,000 in debt in 2016. Today, she is a millionaire—and it is all thanks to the strict, frugal habits she employed over the last many years...

Like saving the vanity kits often provided for free by hotels: "The items in these kits can come handy in unexpected situations".

Lay Off The Luxury Cars

Stop letting your car define you—because if all you're doing is trying to impress other people, you could quickly wind up "car poor". Look at Mark Zuckerberg. Sure, has a few cars, but they aren't all super luxury vehicles. In fact, just last year it was reported that one of Zuck's main rides was an entry-level Acura TSX, valued at about $30,000 (and that's couch cushion money for this guy).

Lord of the Wings© from Toronto, Canada, Wikimedia Commons

Lord of the Wings© from Toronto, Canada, Wikimedia Commons

Subscriptions

Have you ever looked into how many things you're subscribed to? From multiple streaming services to upgrades in apps, newsletters, clubs, etc—some of you will probably be shocked by how much you're paying every month (and more shocked by how much you're paying for things you barely (or never) use).

Subscriptions

First off—cancel all the recurring-payment subscriptions to the things you don't use. Next look at what you do use and see if there is a way to spend less on those also. This could mean downgrading the membership (sometimes we don't really need, or take advantage of, the upgraded features).

And when it comes to the streaming services...

Streaming Subscriptions

Netflix, Hulu, Paramount+, Disney+, Apple TV+, HBO Max—do you actually watch stuff on all of the services you have? And even if you do, you probably aren't watching them all at the same time.

Which means you can cancel a few, do your binging on one, or two—then cancel those, sign up for another one or two, and get through those shows. You'd be surprised how much you could save by cycling your streaming services.

Gym Membership?

We all need to exercise and take care of ourselves physically—and yes, a gym membership is a great way to do that. But there is one huge thing about a gym membership...you have to go to the gym. Having the membership won't get you into shape. You have to actually go there multiple times per week and exercise.

If you do that, then it's worth the money. If you don't use it, then stop paying for it, save the hundreds of dollars every year—and go for more walks and exercise at home.

Savings, Savings, Savings

In other words—living below your means. Maybe you have an extra $1,000 a month after paying all your bills and buying groceries. Well, for most of us that means time to spend $1,000. For millionaires and wannabe millionaires, it means $1,000 (or at least a portion of it) more to put into savings.

Savings First

Taking the whole savings thing to the next level—there are many rich people whose first piece of advice to those that want to be wealthy is: pay yourself first. Meaning think about your savings as a salary for your future and make that the priority.

Think of it this way...

Savings First

Rather than making calculations and determining you have an extra $1,000 a month to put into savings—decide how much you want to put into savings and adjust your current lifestyle and spending to fit that number.

Don't Chase Consumerism

We're not saying you have to be like Zuckerberg or Steve Jobs, who wear the same basic clothing and style every day—but chasing labels and high-end brands is kind of like needing luxury cars to make sure everyone else knows you're rich.

You could do that, or you could spend less on consumerism and actually be rich.

Employee Benefits

Does your employer offer to match your 401(k) contributions, and provide health insurance and health savings accounts? Take advantage of it all. It's part of your compensation package so use it to its full potential.

Cash

These days, it's so easy to tap with your phone or your watch, that most of us don't even take out our wallets when we pay for things anymore. But one thing the wealthy do is—not only do they take out their wallets, they take out cold, hard cash. Which means...

Put Your Cards Away

We all love the buy-now-pay-later convenience of credit cards, but that also allows us to spend beyond our means. If you pay for something with cash, then you obviously have the cash to buy it. And with that in mind...

Make A Budget

Set a budget with your income and expenses in mind, then use only the cash designated in the budget. It sounds annoying—but it really is the best way to hold yourself accountable and truly grow your wealth.

Taking In Take-Out Containers

Why spend money on Tupperware containers when you can clean and reuse the containers that come with your take-out food? It's also better for the environment than throwing them out.

Coupons

Yes, it's true. Not only have many millionaires used coupons to save money and build up their bank account—but there are those who continue to "clip" those coupons even once they've reached wealthy heights.

Casper1774 Studio, Shutterstock

Casper1774 Studio, Shutterstock

Divide The Plys

This one is a little extreme, but there are those who take frugality to the level of pulling apart multi-ply toilet paper in order to make each roll go farther (honestly, we're not sure we can get on board with this one, but we wanted to put it out there and let you decide).

Every Last Drop

Not only does Bernadette Joy reuse take-out containers, but she also uses every last drop of her various beauty products, toothpastes, and such. And she's very serious about it too: "I recently saw a friend throw theirs out too soon and I nearly passed out".

Invest

You don't have to become a day trader buying low and selling high in front of multiple screens every day. But investing in some long term funds or something you can hold on to and watch grow over years and years could mean lots of extra cash in the end. A good financial advisor that you trust is key (if you don't know what you're doing).

Invest

Honestly, even a simple high-yield savings account that gives you a few percentage points growth is better than keeping everything in your checking account where it is all too easily spent.

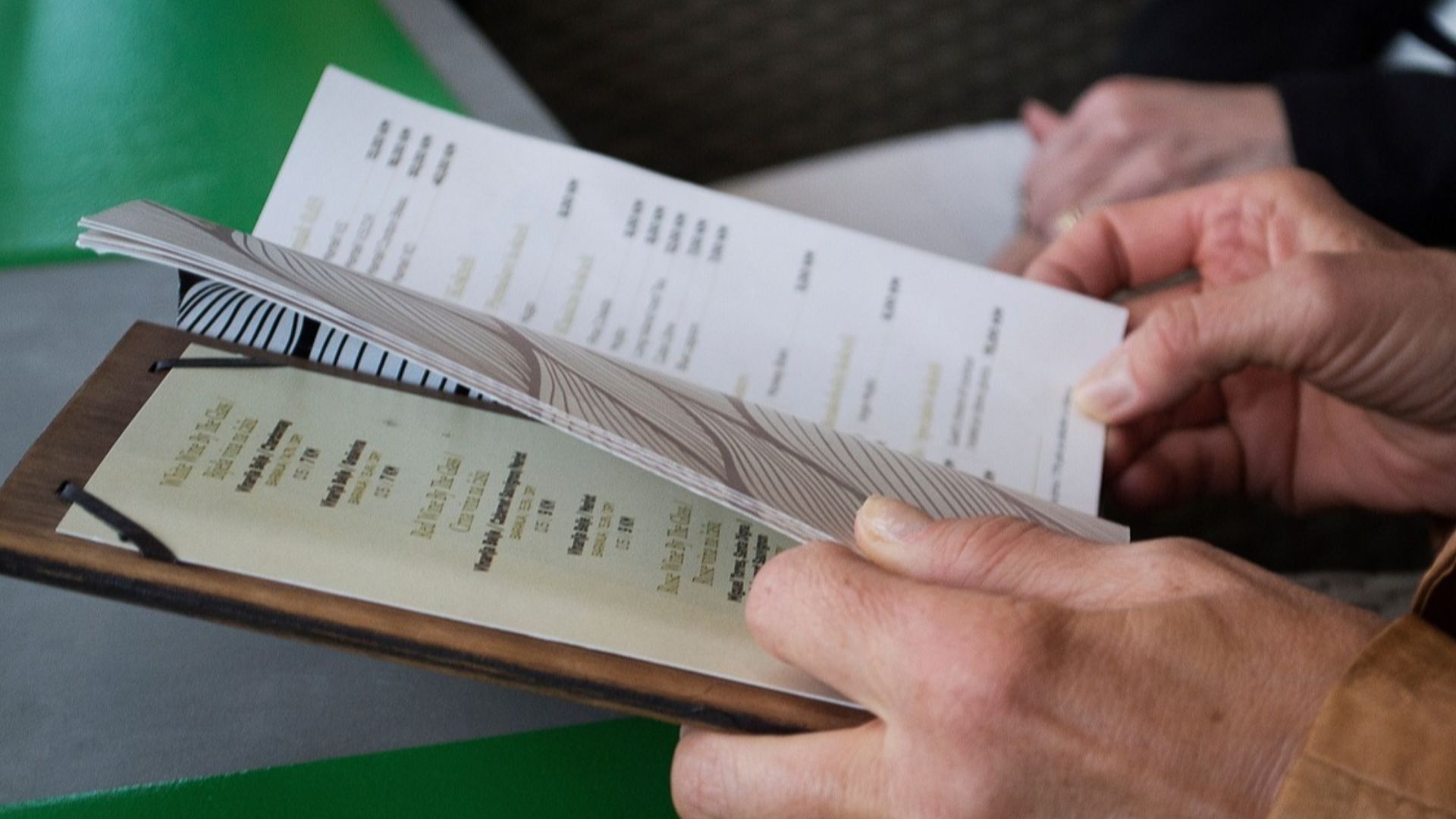

Menu Prices

While there are millionaires so frugal they won't even go out for dinner, others—like the aforementioned Bernadette Joy—allow themselves to eat out, but are still (even after crossing the millionaire mark) looking at the prices. Joy even caught onto the psychology of menu creation:

"I’ve noticed that many restaurants strategically place higher-price items at the beginning of the menu to catch your attention. So what I do is start at the end. By reading in reverse, I’ll usually spot the more affordable options first".

And speaking of going out for dinner...

Save Half Your Dinner

There are many frugal millionaires who will save half of their dinner at a restaurant for lunch the next day. And, let's be honest with each other here—this one is good for your wallet and your diet.

Pablo Merchán Montes, Unsplash

Pablo Merchán Montes, Unsplash

Just Say "NO" To Debt

No, you don't have to buy a house with cash or pay for college up front. Those are things many how-to-get-rich folks will tell you are "good" debt. But most debt is bad. Because all it is doing is pushing money you have to pay from now until later—and with interest rates which, depending on the type of debt, often means paying more later than you would've paid today (which is even worse).

Cheapest Cuts Of Meat

Okay, one more from Bernadette Joy: "Yes, I’m the woman who’s blocking the chicken section, looking for the cheapest pack of chicken thighs to save an extra 23 cents...I absolutely love eating Korean barbecue. Beef short-ribs can be expensive. At my local international grocery store in Charlotte, North Carolina, the traditional cut is $11.99 per pound, but I buy the end-cuts that are only $7.99 per pound".

A Frugal Mind

It truly is a mindset.

We are so used to spending and getting what we want when we want it—or not thinking that a few extra dollars here or there really matter in the long run...but they do. And when you realize that and actually start seeing that bank account rise, it will become so much more important than the instant gratification of another consumer purchase (you probably don't really need it anyway).

You Might Also Like:

25 People Who Went From Extreme Poverty To Unimaginable Wealth