Build Wealth Using These Retirement Investment Choices

Consistent growth and peace of mind rarely go hand in hand in investing. Yet some options manage to strike that perfect balance. Today’s financial environment offers lesser-known options capable of delivering impressive gains without keeping investors up at night.

Vanguard Dividend Appreciation ETF (VIG)

This fund focuses on large, established companies with a track record of consistently raising dividends. It offers reliable income and relative stability, which makes it a strong core holding for retirement portfolios. With low fees and broad diversification, VIG suits investors seeking dependable growth without taking on excessive equity risk.

Schwab US Dividend Equity ETF (SCHD)

Targeting high-quality US companies with strong balance sheets and durable cash flows, SCHD delivers competitive yields and attractive total returns. Its strict screening criteria emphasize financial health and dividend sustainability. This ETF is popular among income-focused investors who want exposure to blue-chip equities while preserving long-term capital.

iShares MSCI USA Min Vol Factor ETF (USMV)

Designed to reduce market volatility, USMV selects stocks that historically fluctuate less than the broader market. It aims for smoother performance during downturns without sacrificing much upside. Investors favor this ETF for dampening portfolio risk while still participating in equity growth. It’s ideal for conservative retirement strategies.

Vanguard Wellington Fund (VWELX)

One of the oldest balanced funds in the United States, Vanguard Wellington maintains a classic mix of stocks and high-quality bonds. The strategy seeks long-term capital appreciation alongside steady income. Its disciplined approach and seasoned management team turn this actively managed fund into a favorite among traditional, risk-aware investors.

Fidelity Strategic Income Fund (FSICX)

This diversified income fund allocates across US government securities, high-yield corporate bonds, emerging-market debt, and floating-rate loans. By blending asset classes, it enhances yields while moderating risk. FSICX appeals to those who need reliable income streams without overexposure to any single segment of the bond market.

Series I Savings Bonds (I-Bonds)

Issued by the US Treasury, I-Bonds protect purchasing power by combining a fixed rate with a semiannual inflation adjustment. Interest compounds tax-deferred until redemption. With government backing and zero default risk, these bonds suit individuals seeking a safe hedge against rising prices while earning respectable long-term, real returns.

United States Department of the Treasury, Wikimedia Commons

United States Department of the Treasury, Wikimedia Commons

Treasury Inflation-Protected Securities (TIPS)

TIPS adjust their principal based on changes in the Consumer Price Index, ensuring payments reflect inflation. Backed by the US government, they offer a reliable way to maintain purchasing power. Payouts rise with inflation, and this makes them a strong retirement anchor for investors concerned about the eroding impact of rising costs.

Short-Term US Treasury Bills

These bills mature in one year or less and are among the safest investments globally, backed by the full faith and credit of the US government. While returns are modest, their liquidity and principal stability make them a strategic tool for risk-averse investors prioritizing capital preservation and flexible cash management.

Floating-Rate Treasury Notes

Unlike fixed-rate treasuries, these notes adjust their coupon payments every quarter based on short-term interest rates. This feature makes them particularly attractive when rates are rising. Backed by the US Treasury, they combine security with income that moves alongside monetary policy to protect from fluctuating rate environments.

US Federal Gov't / Myself, Wikimedia Commons

US Federal Gov't / Myself, Wikimedia Commons

Ginnie Mae Bonds (GNMA Securities)

Government National Mortgage Association securities are supported by pools of federally insured mortgages. The US government guarantee virtually eliminates credit risk. Monthly payments include interest and principal for a steady cash flow. Investors value GNMAs for reliable income and strong protection, especially during periods of economic turbulence or equity volatility.

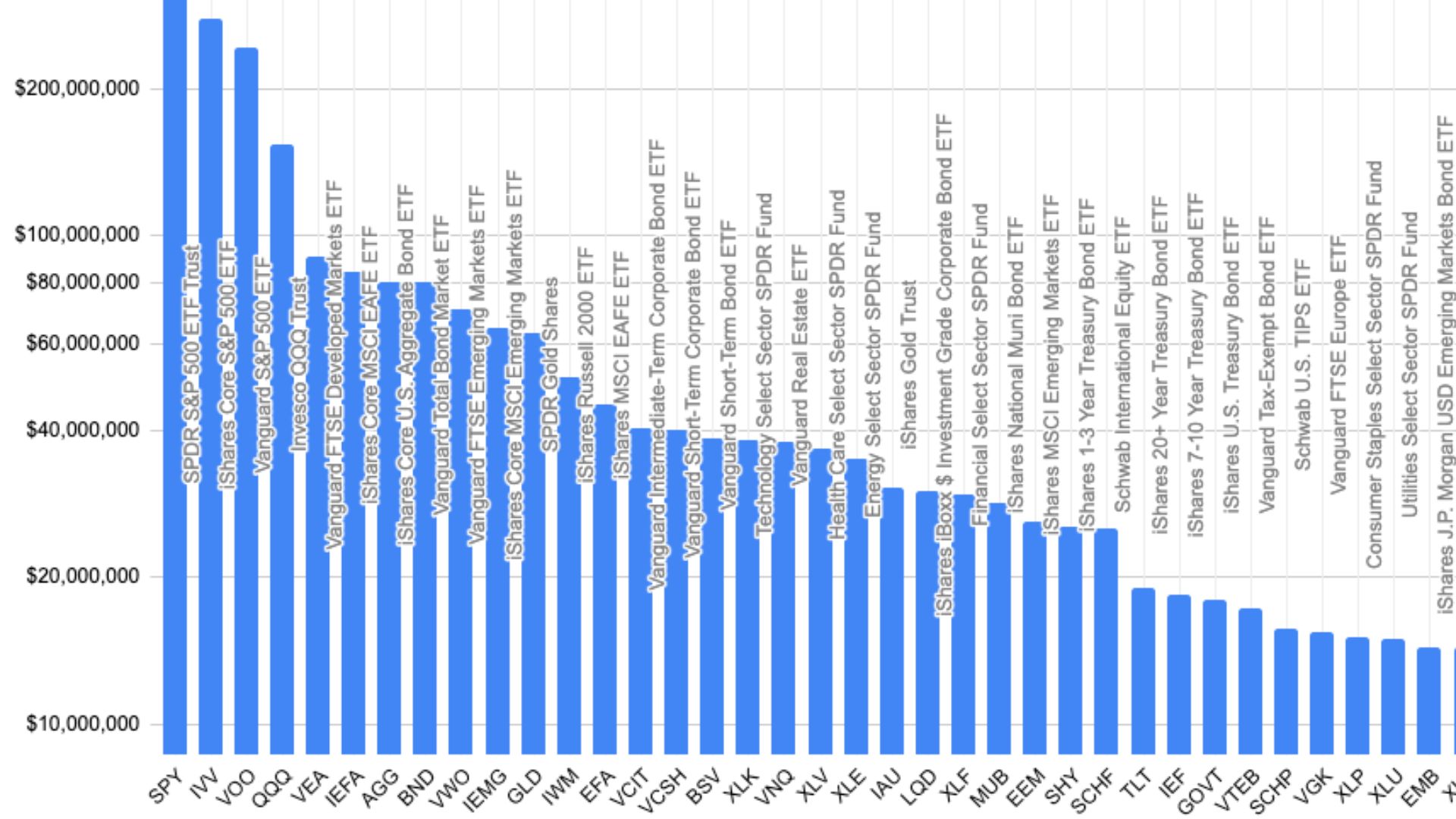

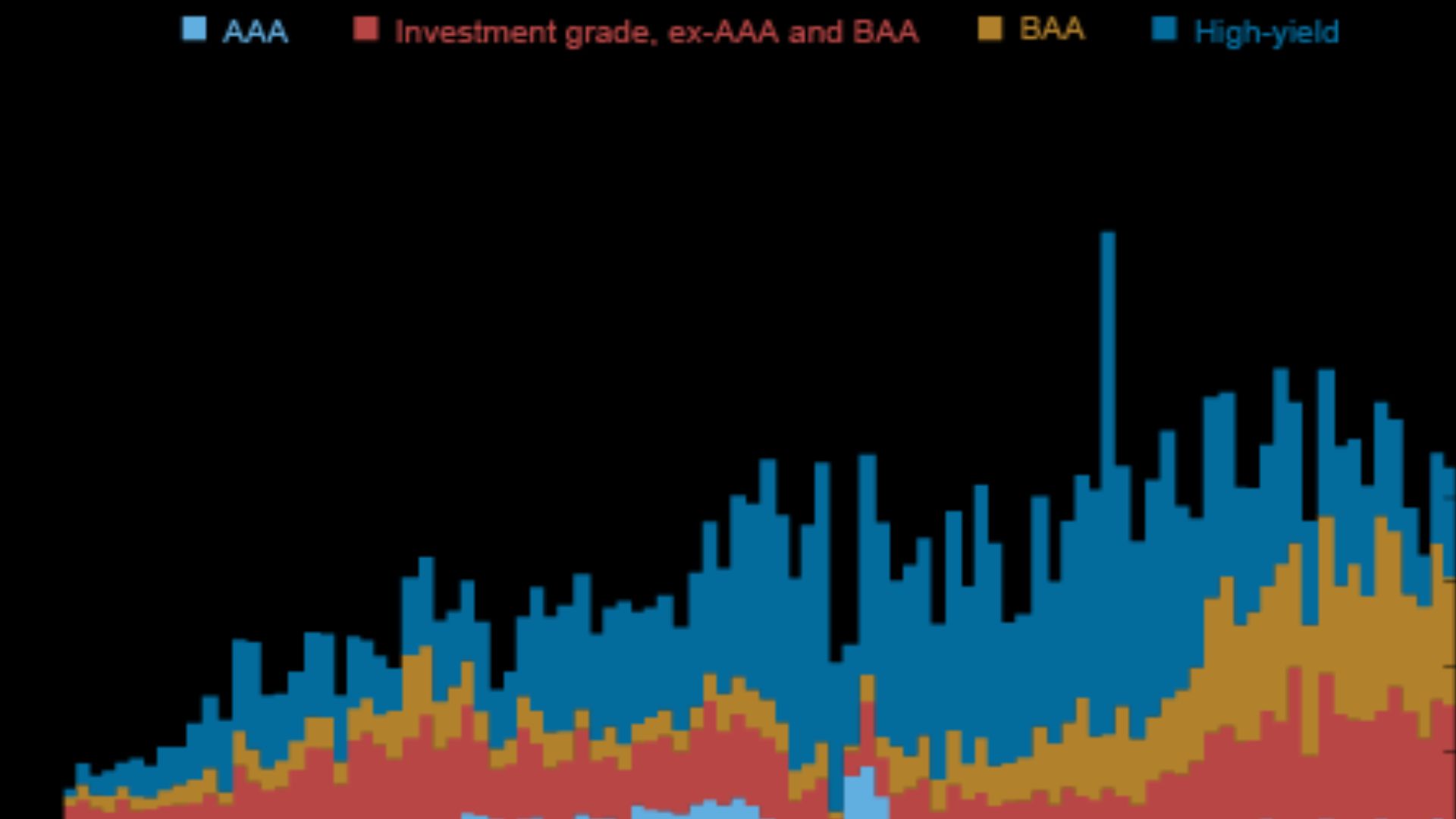

Investment-Grade Corporate Bond ETFs

Funds like LQD invest in high-credit-quality corporate debt issued by financially sound companies. They provide higher yields than Treasuries while maintaining relatively low credit risk. Investors seeking predictable income without excessive exposure to stock market swings often include investment-grade bond ETFs as a cornerstone of diversified retirement portfolios.

Federal Reserve Bank of New York, Wikimedia Commons

Federal Reserve Bank of New York, Wikimedia Commons

Short-Term Corporate Bond Funds

Focused on bonds maturing in one to five years, funds such as VCSH reduce interest-rate sensitivity while still providing higher yields than government securities. With holdings in stable, established corporations, they offer a compromise between safety and return. They appeal to investors who want dependable income with limited exposure to rate volatility.

Preferred Stock ETFs

Preferred shares offer hybrid characteristics of stocks and bonds, typically delivering fixed dividends with priority over common stock. ETFs like PFF provide diversified exposure to this asset class across sectors. These are useful tools for a stable retirement cash flow as investors appreciate their high income potential and lower volatility.

Stable Value Funds

Usually available through employer-sponsored retirement plans, stable value funds invest in high-quality bonds wrapped in insurance to protect principal. They deliver yields higher than money market funds with minimal risk. With steady returns and daily liquidity, these funds are viewed as conservative building blocks for retirement savings.

Publicly Traded Equity REITs

Real Estate Investment Trusts own and operate income-producing properties such as apartments, offices, and warehouses. Traded like stocks, REITs like VNQ distribute most of their earnings as dividends. They offer diversification away from traditional assets and a hedge against inflation to attract investors seeking passive income and long-term growth.

Mortgage REITs Preferred Shares

Preferred shares of mortgage REITs provide higher, fixed dividends while sitting above common equity in the capital structure. Though tied to real estate markets, securities like NLY-G offer strong income with less volatility than common REIT shares. They serve income-focused investors willing to trade moderate risk for elevated yields.

Real Estate Crowdfunding Portfolios

Platforms aggregate capital from investors to purchase diversified real estate projects. These portfolios typically focus on residential and commercial developments, distributing income through dividends. Though less liquid than public REITs, Fundrise Core Portfolio and similar tools provide access to institutional-quality properties and attractive long-term returns.

Healthcare And Infrastructure REITs

Concentrating on essential real estate like hospitals, clinics, data centers, and utility infrastructure, these REITs create durable income streams while these sectors benefit from steady demand. Companies such as Realty Income are prized for monthly dividends and stable performance, which makes them compelling defensive plays in retirement portfolios.

High-Yield Savings Accounts

Offered by credit unions and online banks, these accounts earn substantially higher interest than traditional savings while remaining FDIC insured. They provide immediate liquidity and zero exposure to market risk. Attractive to conservative investors, they can serve as a cash reserve option that keeps pace more effectively with inflation.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Money Market Mutual Funds

These financial tools invest in highly liquid, short-term debt such as Treasury bills. The goal is to preserve a stable net asset value while delivering dependable, low-risk returns. Favored for capital preservation and accessibility, they are ideal holdings for retirees who prioritize stability over growth.

Certificates Of Deposit

Issued by banks and purchased through brokerages, brokered CDs offer higher fixed interest rates in exchange for locking in funds over predetermined periods. FDIC insurance protects principal up to statutory limits. They are suitable for retirees seeking secure returns and willing to structure laddered maturities for liquidity.

National Museum of American History , Wikimedia Commons

National Museum of American History , Wikimedia Commons

Fixed Indexed Annuities

Insurance products offering principal protection with returns linked to the S&P 500, or a similar market index, and how it performs. Gains are capped, but losses are eliminated, providing upside participation without market downside. These annuities appeal to retirement investors seeking growth potential combined with long-term income certainty.

Multi-Year Guaranteed Annuities

MYGAs are similar to fixed-rate CDs but are issued by insurance companies, offering guaranteed interest for a specific term. They provide predictable returns and tax-deferred growth until payout. With principal safety and higher yields than many bank products, MYGAs attract savers wanting assured accumulation without volatility.

Low-Beta Equity Funds

These funds select stocks with historically lower volatility, providing equity exposure while minimizing sharp price swings. By focusing on steadier companies, S&P 500 Low Volatility ETFs aim to reduce downside risk without abandoning growth potential. Investors seeking long-term accumulation with controlled risk consider low-beta funds a prudent retirement portfolio component.

Covered Call ETFs

Covered call strategies generate income by selling call options on underlying index holdings. QYLD and JEPI ETFs deliver high monthly yields and reduced volatility at the cost of capped upside. Designed for income generation in sideways markets, they appeal to retirees looking for cash flow without taking on excessive equity exposure.

Global Infrastructure Funds

Investing in essential services such as roads, utilities, airports, and pipelines, these funds offer steady dividends from long-lived assets. Infrastructure revenues are often inflation-linked for a natural hedge. Their stability and defensive nature make them attractive to risk-conscious investors seeking global diversification and dependable income streams.

Baird Core Plus Bond Fund

BCOIX blends investment-grade bonds with selective exposure to higher-yielding sectors for enhanced returns. Active management allows tactical shifts to manage risk in changing rate environments. The fund’s record of smooth performance and reliable income makes it attractive for conservative investors looking to preserve capital while earning a steady yield.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Capital Preservation Hedge Funds / Risk-Parity Funds

These sophisticated funds use a blend of asset classes and leverage to achieve steady returns across market environments. AQRIX and similar tools follow a risk-parity strategy to balance exposure and guarantee smoother performance. Investors include them to diversify traditional portfolios and enhance resilience without sacrificing return potential.

Vanguard Total Bond Market ETF

Offering exposure to the entire US investment-grade bond market, BND blends Treasury, mortgage-backed, and high-quality corporate debt in one low-cost fund. It provides stable, long-term income with minimal credit risk. Broad diversification and low volatility make this ETF a logical core fixed-income holding for conservative retirement portfolios.

iShares 1–5 Year Investment Grade Corporate Bond ETF

IGSB is a short-term bond ETF that focuses on high-quality corporate debt with maturities between one and five years. The strategy reduces sensitivity to interest-rate swings while still offering higher yields than Treasuries. Investors seeking dependable income with relatively low price fluctuation often use IGSB to stabilize retirement-focused portfolios.

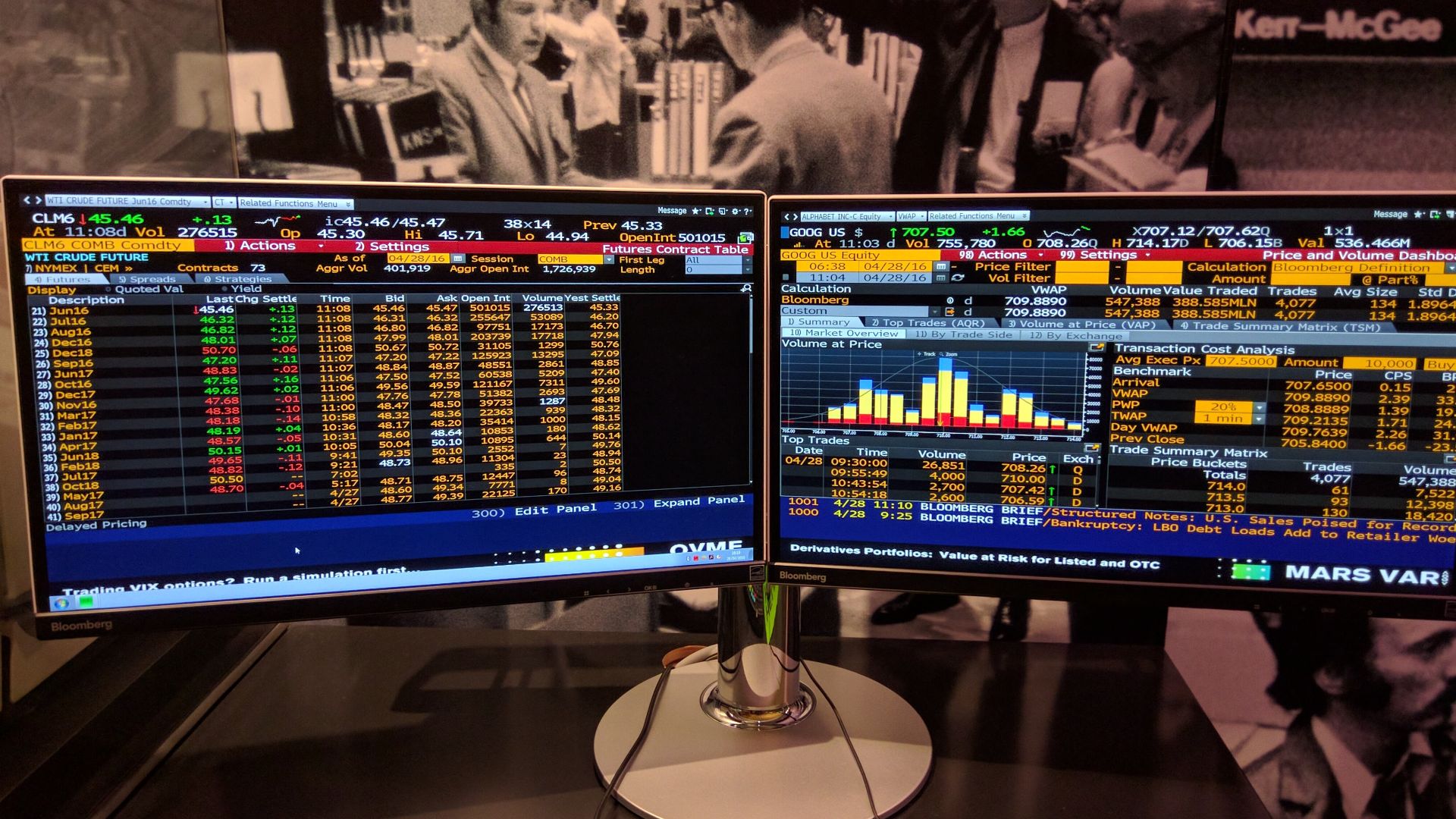

Fidelity US Bond Index Fund

Tracking the Bloomberg US Aggregate Bond Index, FXNAX delivers broad-based exposure to investment-grade government and corporate bonds. With an ultra-low expense ratio, it provides steady income and diversification across fixed-income sectors. It appeals to those looking to build a core bond position while minimizing fees and long-term portfolio risk.

Travis Wise, Wikimedia Commons

Travis Wise, Wikimedia Commons

BlackRock Multi-Asset Income Fund

BAICX takes a diversified approach, blending dividend stocks, bonds, preferred shares, and global income-producing assets. The goal is to generate a consistent yield while managing volatility. Its flexible allocation strategy allows the managers to adapt to market conditions. It suits retirees seeking sustained payouts and stability.

Jim.henderson, Wikimedia Commons

Jim.henderson, Wikimedia Commons

T Rowe Price Capital Appreciation Fund

This actively managed fund combines quality equities with a sizable bond allocation to protect downside risk. Its long-term track record shows resilience during market declines while still capturing growth over time. Investors favor PRWCX for its cautious yet opportunistic strategy aimed at long-term wealth preservation and retirement growth.

Vanguard High-Dividend Yield ETF

Targeting companies with above-average dividend payments, VYM focuses on financially strong large-cap stocks. Consistent payouts, lower volatility, and a diversified mix of sectors make it a popular vehicle for retirement income. Its low-fee structure and blue-chip holdings appeal to investors prioritizing cash flow and capital security.

SPDR Portfolio S&P 500 High Dividend ETF

SPYD holds an equal-weighted basket of the highest-yielding companies in the S&P 500. It offers elevated dividend income while preserving sector balance to manage risk. Investors appreciate its focus on dependable blue-chip payers and low-cost structure, positioning SPYD as a reliable tool for boosting income within retirement portfolios.

Schwab Target Income Fund

Engineered specifically for retirees drawing income, SWLRX maintains a conservative allocation dominated by high-quality bonds and dividend equities. The strategy seeks to reduce volatility while providing regular distributions. Its simplicity, low cost, and careful asset mix appeal to investors prioritizing steady retirement income over capital appreciation.

JPMorgan Equity Premium Income ETF

JEPI combines a curated portfolio of large-cap stocks with an options-based strategy designed to generate high monthly income. By selling covered calls, it seeks to dampen volatility while delivering attractive yields. This approach makes JEPI popular among retirees wanting exposure to equities without excessive market swings.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

TIAA Traditional Annuity

Available within certain retirement plans, this annuity guarantees principal protection and credits interest at a rate set by TIAA. Returns are not tied to the market, helping shield retirees from volatility. Its dependable, contractually backed growth and lifetime income options make it a conservative choice for long-term retirement security.

Invesco Preferred ETF

PGX invests in preferred securities issued by high-quality banks and financial institutions. These hybrid instruments offer fixed dividend payments and rank above common stock in payouts. With historically stable income and lower volatility than equities, PGX serves income-oriented investors seeking higher yields without assuming excessive credit risk.

USAA Income Fund

Focused primarily on investment-grade bonds with selective exposure to high-yield credit, USAIX aims for steady income while guarding capital. Active management positions the fund to handle interest-rate cycles and market stress. Its historically smooth performance appeals to risk-averse investors seeking reliable income throughout retirement.

Fidelity Strategic Dividend & Income Fund

This multi-asset fund strategically combines dividend-paying stocks, preferred securities, REITs, and convertibles to build a durable income stream. Diversification across asset classes helps reduce volatility without sacrificing returns. FSDIX is popular with retirees who want a balance between dependable cash flow and long-term growth potential.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Tax-Exempt Municipal Bond Funds

Municipal bond funds invest in debt issued by state and local governments, offering income that is typically free from federal taxes. Backed by high-credit municipalities, these funds are considered relatively safe while providing attractive after-tax yields. VMITX and similar financial tools appeal to investors seeking steady income, particularly those in higher tax brackets.

Vanguard LifeStrategy Income Fund

Holding a fixed mix of roughly 80% bonds and 20% global stocks, VASIX provides turnkey diversification for conservative savers. The focus is on stability and modest growth, delivered through low-cost index building blocks. It is suited for retirees prioritizing principal preservation and predictable, low-stress returns.

Vanguard Ultra-Short Bond ETF

Designed as a step above a money market fund, VUSB holds ultra-short-term, high-quality bonds. It aims to provide slightly higher yields without materially increasing interest-rate risk. With strong liquidity and minimal price fluctuation, the fund functions well as a conservative income-generating option for retirement portfolios.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels